Most business entities formed or registered in Illinois, such as a corporation or limited liability company (LLC), must designate an individual or business to serve as its registered agent. An Illinois registered agent’s job is to receive service of process and official correspondence on behalf of a company. You may act as your own registered agent, or you can hire a registered agent service. Using a service offers numerous benefits. For starters, you can be sure that you will never miss important documents, such as a lawsuit against your business or a notice from the state government. This post will cover what you need to know about registered agents for Illinois LLCs.

When you file articles of organization to create an LLC in Illinois, you must designate a registered agent and a registered office for your business. You must do the same if you are registering an out-of-state LLC with the Illinois Secretary of State. The registered agent for your business serves an important function. They must meet several eligibility criteria set by state law. Choose carefully when deciding whom to appoint as your LLC’s registered agent.

The primary purpose of a registered agent is to receive certain types of documents on behalf of your LLC. The documents will go to the location designated as the registered address. The registered agent must promptly notify you that they have received important documents, such as the following:

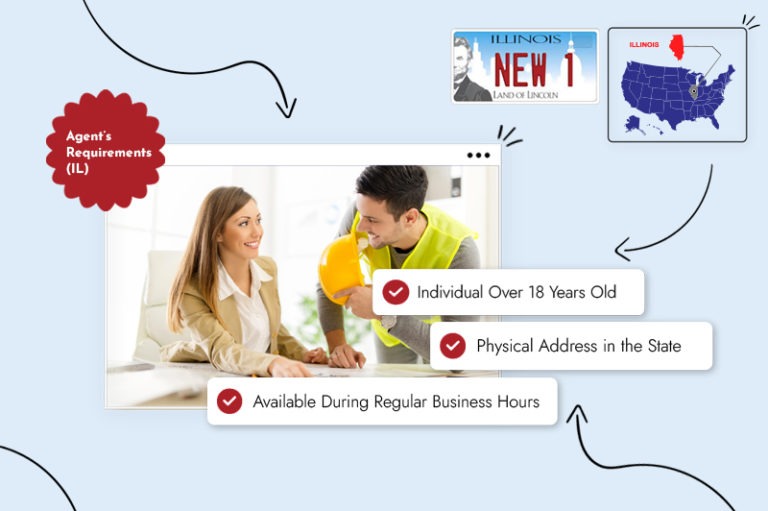

An individual or business entity may serve as the registered agent for an Illinois LLC if they meet the following criteria:

Any individual who meets the qualifications described above — including you — may serve as the registered agent for your LLC. Your home address or the LLC’s primary business address can also be the registered address as long as it is not a P.O. box. While this might seem like the simplest course of action, serving as your LLC’s registered agent has some significant drawbacks.

Using a registered agent service costs money, although not a lot of money. It offers advantages over serving as your own registered agent that you should consider carefully. We discuss the advantages of using a service like Tailor Brands in greater detail below.

You must appoint a registered agent and identify a registered office address when you file the articles of organization to create your LLC.

The individual or company that you are appointing as your registered agent must meet the legal criteria, and they must be willing and able to fulfill the role. Illinois does not require the registered agent to sign a form indicating their consent. By signing and submitting the paperwork to form the LLC, you are representing to the state that your registered agent has agreed to serve in that capacity.

You can file Articles of Organization to create an LLC and appoint a registered agent online in most cases using the Illinois Secretary of State’s online portal. The filing fee is $150, and the processing time is typically 10 business days. If you are forming a series LLC, meaning that the company can form its own subsidiaries, the filing fee is $400. You can pay a $100 expedited service fee to cut the processing time down to 24 hours, weekends and holidays excepted.

Payment must be by credit card (Visa, MasterCard, Discover, or American Express). Payment by debit card is possible, but not recommended. All transactions are subject to a payment processor fee.

You may prefer to submit paper forms by mail using Form LLC-5.5. You may need to use this form if your LLC needs to do either of the following:

You must submit an original signed Form LLC-5.5 and one copy, as well as a certified check, cashier’s check, or money order payable to the Illinois Secretary of State. You may send these materials to the following address:

Illinois Secretary of State

Limited Liability Division

501 S. Second St., Rm. 351

Springfield, IL 62756

Their office is open from 8:00 a.m. to 4:30 p.m., Central Time, Monday through Friday. You may contact them at 312-793-3380.

If you need to change your LLC’s registered agent and/or registered office, you may do so online at the Illinois Secretary of State’s website. This might be necessary, for example, if you have been serving as your LLC’s registered agent and now you want a registered agent service to take over.

The filing fee for routine processing of a request to change the registered agent and/or address is $25, payable by credit card with a payment processor fee. You may pay an additional $50 for a total of $75 for expedited processing within 24 hours, not counting weekends or holidays.

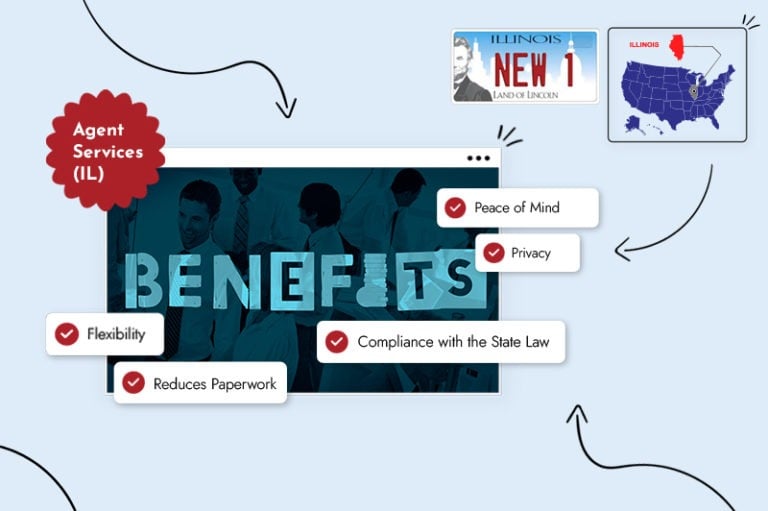

A registered agent service can offer many benefits for your Illinois LLC.

A registered agent service takes on some of your duties as a small business owner. You can focus on running your business while the service remains on the lookout for important correspondence.

Using a service can also help you and your business avoid embarrassment. If someone sues your LLC, a process server will deliver the papers to the registered agent service at their office. The service will receive the papers and let you know. Most importantly, they will let you know quietly. The process server will not come to your office to serve you in front of your employees or customers.

Registered addresses are part of the public record. When you use a registered agent service, anyone looking for your business will find the service’s address instead of your address. That can be helpful when the person looking for the registered address intends to sue your company.

Registered agent services have extensive experience with every possible kind of official correspondence, government notice, and lawsuit. They know about deadlines for responses. They will send you reminders to make sure you know about your legal obligations well in advance.

When you use a registered agent service, the service’s office is your LLC’s registered office. You can leave the office early or go on vacation knowing that someone will always be there during business hours to receive papers for you.

Receiving critically important documents is one of the main parts of a registered agent service’s business. You can be assured that any document received on behalf of your LLC will remain safe and secure until the service hands it over to you. When you use your own address as the LLC’s registered office, official notices could become mixed up with regular mail. Using a service means you never risk losing an important notice amid piles of mail. A registered agent service will make sure that the documents you need get to you.

Owning and running an LLC brings many responsibilities. Luckily, you do not have to shoulder all of them on your own. Designating a registered agent service lightens your load and lets you focus on the actual business, not the mundane details of official correspondence and legal notices. Let us help you do what you would rather be doing.

This portion of our website is for informational purposes only. Tailor Brands is not a law firm, and none of the information on this website constitutes or is intended to convey legal advice. All statements, opinions, recommendations, and conclusions are solely the expression of the author and provided on an as-is basis. Accordingly, Tailor Brands is not responsible for the information and/or its accuracy or completeness. It also does not indicate any affiliation between Tailor Brands and any other brands, services or logos.

Products

Resources

@2024 Copyright Tailor Brands