Stay compliant with a registered agent service

We’ll assign a dedicated registered agent for your LLC to receive your legal documents, ensuring nothing slips through the cracks and your business stays on track.

Over 100K businesses have been formed with Tailor Brands

What is a registered agent?

Every LLC and corporation is required by law to have a registered agent.

The registered agent acts as the official point of contact between the state and your business.

They receive and manage all legal and government documents on your behalf.

They ensure you don’t miss critical notices or important state notices.

Every LLC and corporation is required by law to have a registered agent.

The registered agent acts as the official point of contact between the state and your business.

They receive and manage all legal and government documents on your behalf.

They ensure you don’t miss critical notices or important state notices.

How does our registered agent service work?

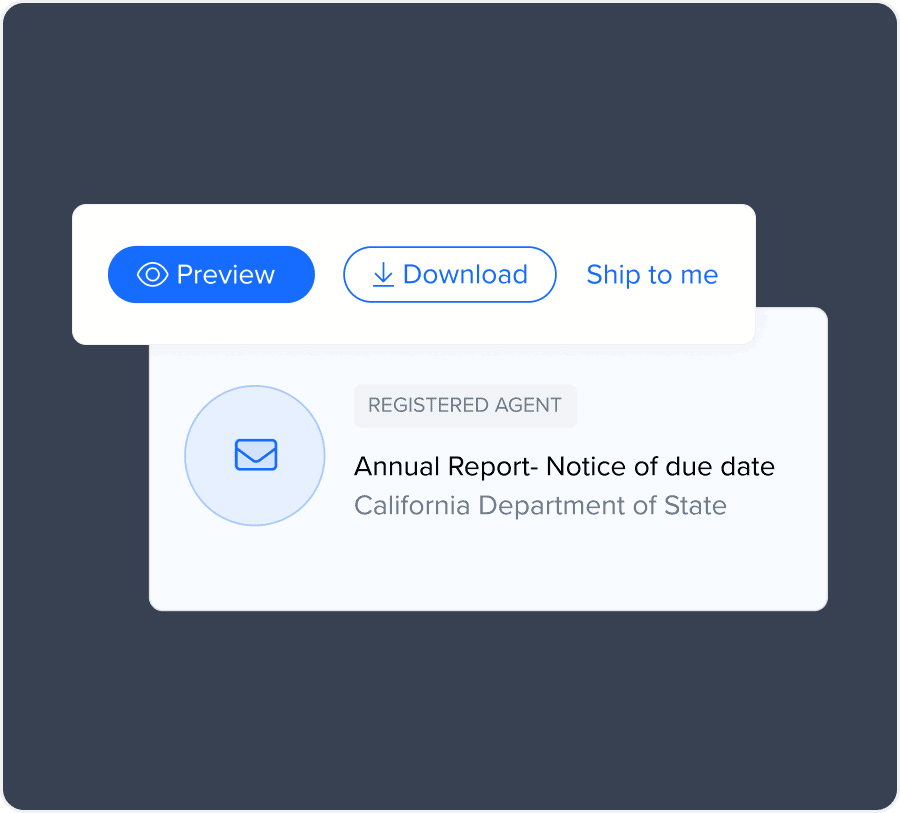

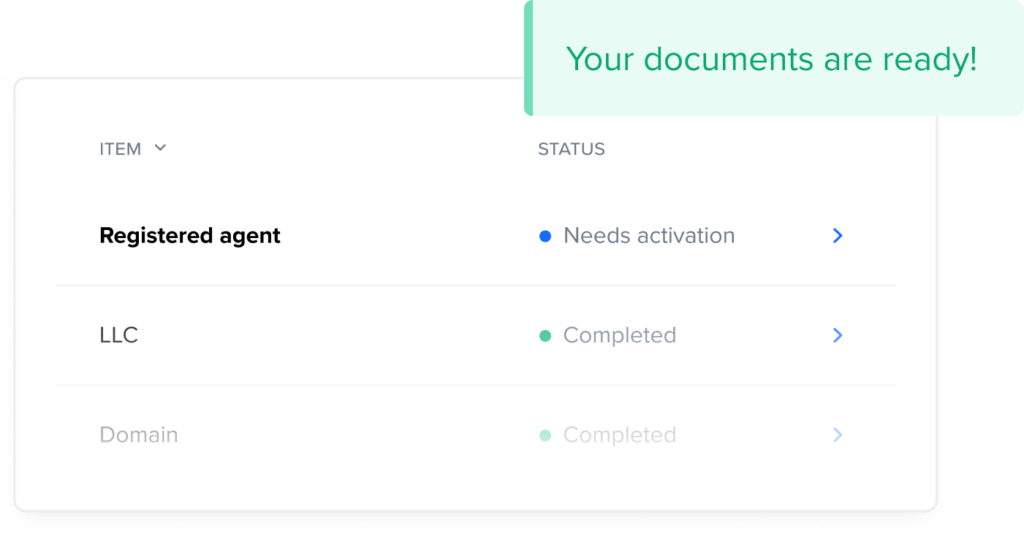

Your official documents arrive

As your registered agent, we’ll receive official documents on behalf of your LLC.

We scan & upload them

We scan your documents and upload them to your business dashboard for easy access.

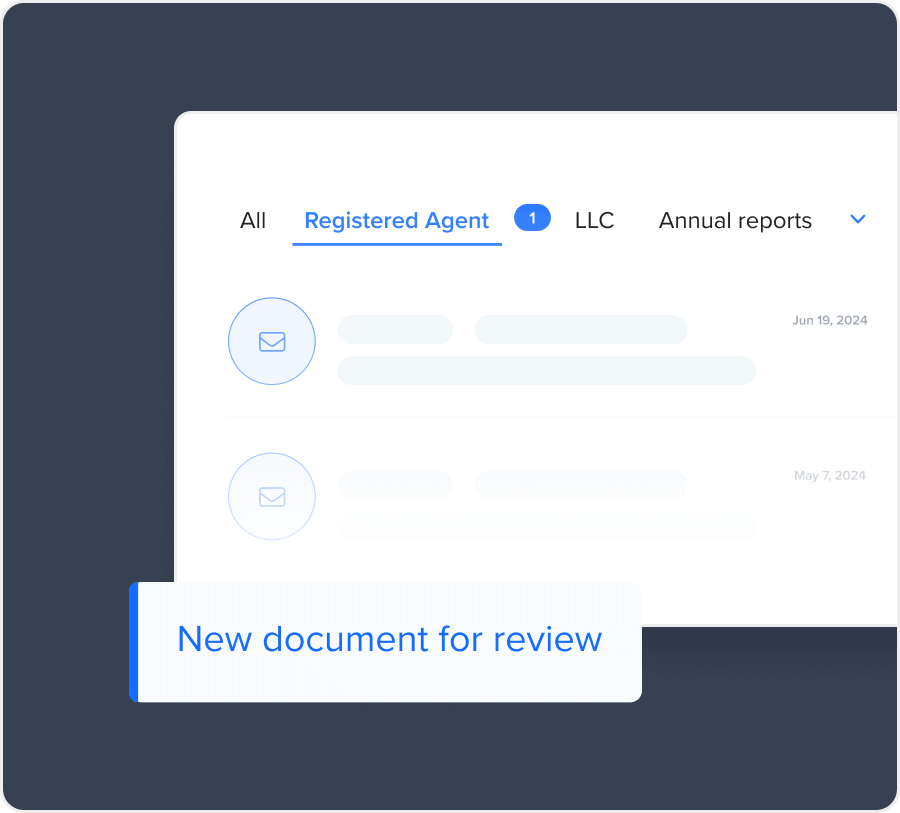

You are notified via text and email

We’ll let you know when a new document is ready for review on your LLC dashboard.

Which documents do they receive on your behalf?

Legal documents such as lawsuits and service of process

Tax forms and notices from the IRS or state agencies

Annual report reminders and compliance deadlines

Licensing and permit renewal paperwork

Important government correspondence and filings

Is it mandatory?

All LLCs and corporations are required by law to have a registered agent.

Why choose Tailor Brands?

Count on a reliable service that ensures all documents are received promptly

Change your address without worrying about missing legal documents and correspondence

Stay informed with regular notifications of important documents

Keep your business looking professional by avoiding awkward deliveries.

FAQ

What is the cost of a registered agent service?

The cost of a registered agent service varies on the provider and the level of service you choose. On average, you can pay anywhere from $50 to $300 per year. Some services offer basic mail forwarding at lower rates, while we include additional features like compliance monitoring, document scanning, and notifications for a higher price.

Who needs to appoint a registered agent?

Any corporation or LLC in the United States of America is legally required to appoint a registered agent.

Can you be your own registered agent?

While it’s possible to act as your own registered agent, many business owners choose not to. You’ll need to be present at your registered address at all times during business hours to physically receive legal documents and official correspondence.

Can you change your registered agent?

Yes, you can change your registered agent by filing a change form with your state’s business agency.

When do you need to appoint a registered agent?

You need to appoint one as soon as you create your LLC or corporation.

Who can serve as a registered agent?

You can appoint yourself, someone else, or a professional service that meets state requirements.

This portion of our website is for informational or educational purposes only. Tailor Brands is not a law firm, and the information on this website does not constitute legal advice. All statements, opinions, recommendations, and conclusions are solely the expression of the author and provided on an as-is basis. Accordingly, Tailor Brands is not responsible for the information and/or its accuracy or completeness. It also does not indicate any affiliation between Tailor Brands and any other brands, services or logos on this page.