The articles of organization provide the Secretary of State’s office with the information it needs for the process of starting an LLC in Illinois for you. It is the most important document in the LLC formation process. Without it, you cannot create a business entity.

Every state requires articles of organization to create an LLC, although the exact name of the document may vary based on the state. The information provided in the articles of organization enables the state to confirm that you have met all of the legal requirements to set up a business entity.

When you file your articles of organization, you must pay a $150 fee to the Illinois Secretary of State. If you have already formed an LLC in another state, you may register it to do business in Illinois by filing an Application for Admission to Transact Business, which also requires payment of a $150 fee. If your LLC has the ability to create a series of affiliated LLCs, the filing fee for either document is $400.

You may pay an additional $100 with either filing for expedited service. This fee shortens the processing time to one business day.

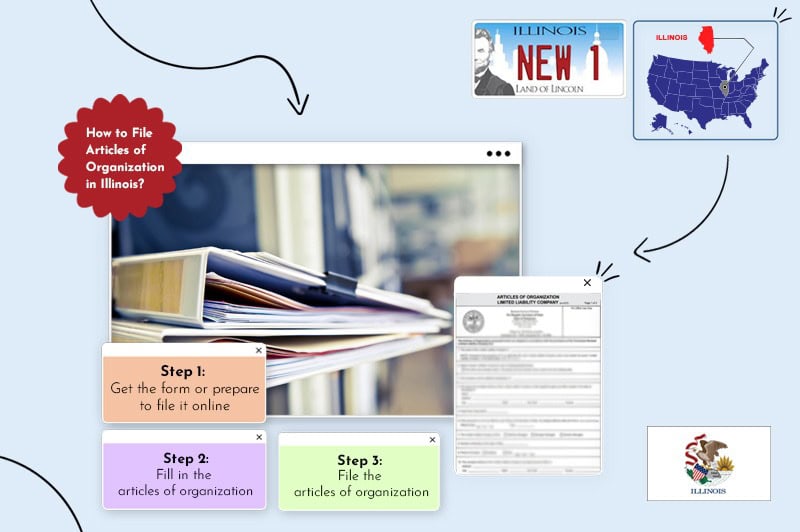

The following steps can help you prepare to file Articles of Organization to start an LLC in Illinois.

1. Get the form or prepare to file it online

You can file Articles of Organization online in most cases, or you can file a paper form by mail. You may be required to file by mail in some situations. To prepare for filing, you can do one of the following:

- Sign up for an account at the Illinois Secretary of State’s online portal

- Download Form LLC-5.5 and any other forms you need from the Secretary of State’s website

Most LLCs file online, but you may be required to file by mail if you need to state a specific business purpose or include custom provisions in your Articles.

2. Fill in the required information in the articles of organization

Next, you should gather the information that you will need for the Articles of Organization.

Your LLC name

Your LLC’s name must be distinct from all other business entities registered with the Secretary of State. You may need to do an Illinois entity search at the Secretary of State’s website to see if the name you want is available.

Illinois law requires that LLC names only consist of letters in the English alphabet, Arabic or Roman numerals, and a limited set of symbols. It requires LLC names to include one of the following terms, separate from any other word:

- Limited Liability Company

- L.L.C.

- LLC

If you want to name your business “John’s General Store,” acceptable names to put on the Articles of Organization include the following:

- John’s General Store, Limited Liability Company

- John’s General Store, a Limited Liability Company

- John’s General Store, L.L.C.

- John’s General Store, LLC

The LLC’s name may not contain any of the following terms:

- Corporation

- Corp.

- Incorporated

- Inc.

- Ltd.

- Co.

- Limited Partnership

- LP

Additional restrictions include the following:

- Nothing in the name may state or suggest that the purpose of the business involves assurance, banking, or insurance.

- The name may not include the terms “trust,” “trustee,” or “fiduciary” unless the LLC meets additional legal requirements.

- The name may not include the words “bank,” “banker,” or “banking” unless the LLC has received approval from the Department of Financial and Professional Regulation.

- You may not use any word, term, or phrase that “create[s] a connotation that is offensive to good taste and decency.”

Your registered agent information

According to the Illinois registered agent requirements, every business entity organized in the state must have a registered agent and a registered office. Your registered agent is an individual or business that you have designated to receive service of process and official correspondence on the LLC’s behalf. The registered office must be a street address, not a P.O. Box.

You may serve as the registered agent for your LLC. You may also use a registered agent service like Tailor Brands. Since the name of the registered agent and the registered office address are in the public record, using a registered agent service can protect your privacy. Anyone who wants to sue your company will send the lawsuit paperwork to the service’s address, not your address.

The registered agent name and office

You must designate a registered agent and office in the articles of organization. If you have already retained a registered agent service, you may list them. You can change the registered agent or registered office at any time after the Secretary of State approves your LLC.

Principal place of business (if required)

While not always mandatory, some filers also include the LLC’s principal business address. This is often where you keep business records.

Duration of the LLC

The default is perpetual existence, but you can specify an end date if your LLC is intended to be temporary.

Business purpose

Illinois allows most LLCs to list “all lawful business” as the purpose. If you need to provide a specific purpose, you must file by mail.

Management structure

You must indicate whether your LLC will be managed by its members or by one or more managers.

3. File the articles of organization

Once you have all of the necessary information, you have several options for filing the articles of organization. The filing fee is $150 no matter which filing method you use, unless you must pay $400 for a series LLC. The $100 expedited service fee guarantees that the Secretary of State will process your application within 24 hours, not counting weekends and holidays.

File online

You can file articles of organization online, in most cases, at the Secretary of State’s website. The Secretary of State accepts all major credit cards for payment of applicable fees.

File by mail

You must file your articles of organization by mail in two situations:

- You have to state a specific business purpose for your LLC, rather than the default “all lawful business,” in section 5 of Form LLC-5.5.

- You must include additional provisions in section 7 of Form LLC-5.5.

To file by mail, send an original signed Form LLC-5.5 and one copy to the Secretary of State at the following address:

Department of Business Services

Limited Liability Division

501 S. Second St., Rm. 351

Springfield, IL 62756

You may pay the filing fee by certified check, cashier’s check, or money order. You may call the Secretary of State’s office with any questions at 217-524-8008, Monday through Friday from 8:00 a.m. to 4:30 p.m. Central time.

File in person

If you are in or near Springfield, you can file in person at the above address between 8:00 a.m. and 4:30 p.m. Monday through Friday. Bring an original signed Form LLC-5.5, a copy, and payment of the fee by one of the methods mentioned above.

Once the Secretary of State has approved your articles of organization, your LLC officially exists.

Illinois processing times

Processing times depend on how you file and whether you pay for expedited service.

- Online filing: Typically processed within 10 business days. Expedited online filings are processed within 24 hours (excluding weekends and holidays).

- Mail filing: Usually takes 2 to 3 weeks. Expedited service shortens the time to 24 hours once received.

- In-person filing: Similar to online, in-person filings are usually processed in about 10 business days unless you pay for expedited service.

If you’re on a tight schedule to launch your business, the $100 expedited option is often worth it.

Conclusion

When forming an LLC, articles of organization are the most important document you need to get started. The document is not particularly complicated, but you must make sure it complies with state law, so the Secretary of State does not reject it or request revisions. Help is available in this and other parts of the LLC formation process.

FAQ

You can update your Articles of Organization by filing Articles of Amendment with the Secretary of State. You may be able to file online if you are changing the LLC’s name. For any other change, you must file Form LLC-5.25 by mail or in person. The filing fee is $50.

Ownership of your LLC could change if you bring on new members, if existing members depart, or if you sell the entire business. You can file Articles of Amendment to indicate the addition or departure of members. Your next Annual Report may also reflect ownership changes. If you are selling the business outright, you might need to file a Form CBS-1 indicating the transfer of assets.

You may search for business names on the Illinois Secretary of State’s website.