A DBA, short for “doing business as,” is also known as a fictitious name that you can use in lieu of the name of your LLC in PA. This allows you to use an assumed name for your LLC in the event you want to change the company name, branch out into a different type of service, and own a franchise. These are just some of the reasons why you would want to get a DBA, and the process of obtaining one is similar to that of picking out the name for an LLC.

Here’s a look at how to file a DBA in Pennsylvania and what you can expect from the process.

A DBA is an assumed name for a business that wants to use a different name to reflect the current operation. The DBA allows you to change your business name without the hassle of going through the legal process to get it done, and also saves you the effort and expense of creating a new LLC.

You can get a DBA no matter if you’re an LLC, sole proprietor, C, or S-corp. There are no legal protections associated with the DBA, but it can simplify the identification of your LLC to the public at large.

The state of Pennsylvania considers the DBA a fictitious name and allows you to use a fictitious name as part of operating your business. The state feels that people should be able to know who they’re dealing with as a general rule, and it doesn’t take much to find out who’s behind a DBA. However, the state also recognizes the fact that a business owner has the right to use a fictitious name to help customers understand what kind of business they’re engaging with.

You can get a DBA with or without incorporation. That is, if you’re a sole proprietor and you want to protect your personal name, you can register for a DBA and use it for your business name. It also allows you to name your business in accordance with the service you provide. The DBA provides an air of legitimacy to your sole proprietorship and can help you lay claim to the name in the event you want to trademark it when you form an LLC.

Another benefit is that you don’t need to get an employer identification number (EIN) if you’re a sole proprietor or a single-member LLC without employees. However, it’s always a good idea to have an EIN because you can legally use it in place of your Social Security Number. Obtaining a DBA and an EIN provide you with a layer of protection between your personal identity and the public.

The only downside to a DBA is the fact that it’s not a legal entity, and it won’t protect you from liability. The DBA is a fictitious name that enables you to operate your business under a different name only. You can use the DBA for your LLC for organizational and selling purposes, but in the end, it’s just a name for your business.

No, having a DBA in Pennsylvania isn’t required as part of forming an LLC. The purpose of a DBA is to use a name other than the one you chose for your LLC. You can do this for an individual LLC or for other LLCs you form as part of an operating strategy. Using a DBA can help separate each LLC from one another in terms of naming and operation.

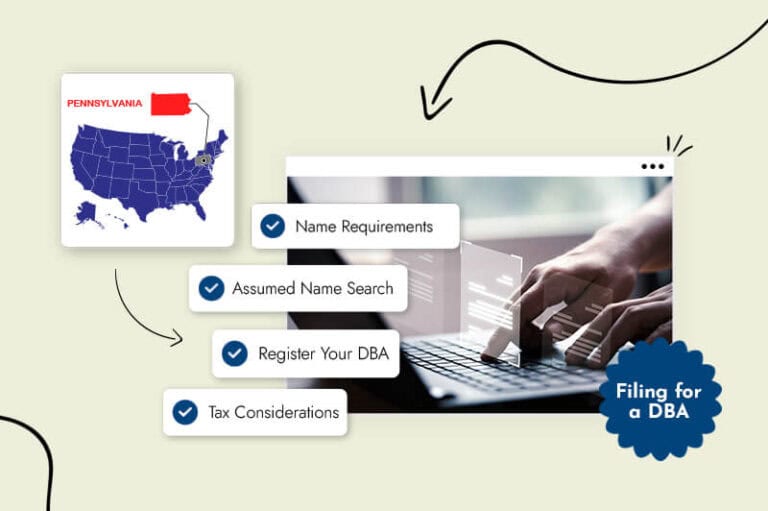

A DBA, or fictitious name, cannot contain a business entity suffix. That includes LLC, Corp, Incorporated, etc. unless the business is actually an LLC or other type of corporation. The name also can’t use terms that are given to financial institutions such as bank, credit union, savings bank, savings and loan, and any similar words.

You can use any words you wish outside of these restrictions as long as no one has claimed the name for their own.

In order to find out if the DBA you want to use is available, you need to search the business entity database. This is the same database that’s used to look for an existing business name for your LLC. If the name you want to use is already taken, you’ll have to alter your name until you can’t find a match.

The address to file your DBA form online is: https://www.corporations.pa.gov/

If you don’t already have an account with the state’s website, go ahead and create one, especially if you haven’t formed an LLC or other corporate entity. You can use the account to upload the form for your DBA and make the payment afterward.

You can file the Registration of Fictitious Name by mail with a check or money order made out for $70 to:

Pennsylvania Department of State

Bureau of Corporations and Charitable Organizations

P.O. Box 8722

Harrisburg, PA 17105-8722

The form comes with an instruction sheet that tells you how to fill it out. Make sure to follow the instructions to ensure that your registration is processed in a timely manner once it’s received by the DOS. Some of the information asked for in the form may not be applicable, especially if you’re a sole proprietor.

Technically, you don’t have to file with the state to use a DBA. However, if you don’t register your name with the Department of State and you use that name for legal purposes, you can’t enforce a contract through the courts. The court is also at liberty to issue a fine of $500 for the lack of registration.

It’s best to register the DBA with the PA DOS and avoid getting into trouble with the court system.

There are no tax benefits or liabilities associated with a DBA as it’s not a legal entity. Your tax business structure remains the same.

A DBA allows all types of corporations and sole proprietors to do business under an assumed or fictitious name. The fictitious name adds a layer of privacy, but it also helps a small business with advertising and attracting customers. Not all businesses need to use a DBA, but it can make it easier for a business to operate.

This portion of our website is for informational purposes only. Tailor Brands is not a law firm, and none of the information on this website constitutes or is intended to convey legal advice. All statements, opinions, recommendations, and conclusions are solely the expression of the author and provided on an as-is basis. Accordingly, Tailor Brands is not responsible for the information and/or its accuracy or completeness. It also does not indicate any affiliation between Tailor Brands and any other brands, services or logos.

Products

Resources

@2024 Copyright Tailor Brands