Pennsylvania was the keystone for our nation’s revolutionary democracy, supporting the country in times of change.

And it could do the same for your business.

Look at the statistics:

- Ranks 4th on the Forbes “Best States to Start a Business”

- 19th largest global economy

- 83.3% of start-ups survive year one, the nation’s 4th highest

What’s impressive, though, is Pennsylvania’s small business funding of $27.7 million, doubling the national average!

Add the many tax incentives and a low flat income tax rate of 3.07%, and it’s easy to see why starting a business in Pennsylvania is a brilliant choice for entrepreneurs.

Step# 1. Fine-tune your business idea

You don’t choose a business idea like Storage Wars, invest, and hope for the best.

There’s too much time and money at stake. You need a dead cert. And that’s why you must develop a business idea that’s viable and sustainable.

How to develop a business idea:

Many successful business ideas are born from necessity, while others derive from more traditional ways, like:

- Identify a problem: Find problems in a niche and create a product or service that provides a solution.

- Play to your strengths: Combine your experience, skills, and interests to start a business.

- Serve your community: Meet local demand and provide a product or service already popular in Pennsylvania.

Popular Pennsylvania business ideas:

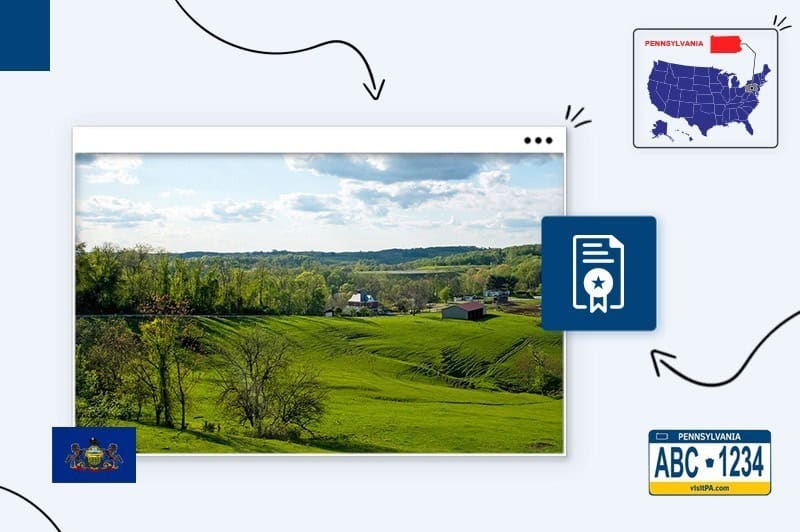

Pennsylvania has many business opportunities because of its four seasons, national parks, lakes, and ski resorts.

Entrepreneurs in the recreation business can serve one demographic during the summer and another in winter.

Your idea could be a restaurant, microbrewery, Boutique hotel, B&B, campground, or one that serves them. There’s an abundance of ideas for your business in Pennsylvania, including:

- Farm-to-table and locally sourced products

- Food truck or food delivery service

- Outdoor adventure and Ecotourism

- Fitness studio or personal training services

- Historical and cultural tourism

- Event planning or wedding services

- Landscaping company

- General handyman

Once you have an idea, you must validate it.

Validate your business idea:

Validation means confirming a large enough market for your business idea, assessing the competition, identifying your target audience, and determining what people will pay for your service or products.

And that’s where your business plan comes into play.

Step #2: Create a business plan

A business plan helps turn your idea into a reality by plotting your route from start-up to success.

It’s what validates your idea, where you set your goals, create completion timelines, and convince investors to provide the funding.

The three key parts of a business plan confirm the market need for your idea, how much money you’ll require, and how you’ll sell to your target audience.

Market research

Before starting your business, conducting thorough market research is crucial for identifying your potential customers, understanding their needs, and analyzing your competition.

By understanding your market, you ensure your business idea caters to your customer’s demands and stands out from your rivals.

Key questions to ask during your market research:

- Is there a demand for my business idea?

- Who is my target market, and will it sustain my business?

- Who are my major competitors, and can I compete?

- What sets my business apart from the competition? What unique value or advantage do I bring to the table?

Your market research determines how much money you’ll need and where you’ll spend it.

Financial plan

Your financial plan contains the expenses involved in launching your business and ongoing costs like rent, utilities, and supplies to ensure you have sufficient funds until it becomes profitable.

For funding, a financial plan must include a sales forecast and a budget to estimate your expected revenue, expenses, and projected profit.

Your financial plan should include the following:

- Start-up costs: Every dollar you’ll spend on opening the doors of your business.

- Operating budget: Your daily fixed and variable business expenses.

- Revenue generation strategy: How and where you’ll sell your products or services, ensuring a steady income stream.

Marketing plan

Here’s where your market research and competitor analysis determine how people shop for your products or services and discover your competition’s marketing strategies.

Once you have that information, you can create a marketing strategy that promotes your brand where your target audience sees it, driving sales.

Choose a location

Pennsylvania State has convenient access to New York City, Baltimore, Washington, D.C., and Cleveland, so it’s perfect for businesses that work out of state.

But small businesses relying on local foot traffic, like food and retail, need a location that suits their target audience with convenient public transport, road access, and parking.

Some Keystone State locations are more suited to different business ideas, for example:

- Philadelphia: A diverse economy, ideal for various industries like healthcare, education, technology, and tourism.

- Pittsburgh: A thriving center for innovation and technology with a powerful presence in advanced manufacturing, robotics, healthcare, and finance.

- Harrisburg: Is a capital city with opportunities in government services, consulting, and legal services.

- Lancaster: Charming downtown area, perfect for boutique shops, restaurants, and tourism-related businesses.

- Bethlehem: Hub for arts, culture, and entertainment, attracting businesses in the creative industries.

For help finding the perfect location for your business, visit the Commonwealth of Pennsylvania website.

Pennsylvania zoning laws and regulations:

Municipal governments and local authorities issue permits that allow specific businesses to operate in certain locations.

To see what applies to your new business, check the PA Business One-Stop Shop website and the search tool relative to all municipalities and towns.

Decide if you’re an online-only business

What’s the nature of your business?

Will it be online, a physical store, or a combination?

You can start with one option and expand later, so consider that a possibility.

If you’re launching an online business, here are the essential elements you’ll need:

- A website: Your business website should be visually attractive, informative, provide valuable details, and include an email opt-in. I’ll tell you why later in the post.

- Social media presence: Here, you’ll connect with your target audience, engage your customers, and raise brand awareness.

- Supply and distribution plan: Anyone selling products needs a supply and distribution plan to stay in stock and fulfill consumer orders.

- Specific taxes: Online businesses that sell products must remit and pay sales tax, and those with a physical presence in Pennsylvania (including stock in a warehouse like Amazon) pay Nexus tax.

- Online business regulations: Pennsylvania has consumer protection laws, privacy and data security requirements, and advertising and marketing regulations, follow them.

Brick-and-mortar store owners should also create a Google My Business listing to promote their business, display reviews, and show their location.

Step# 3. Choose a business name

Your business name must project the right impression to get the right emotional response from your target audience.

The best business names are simple, memorable, leave a lasting impression, and are easy to find online.

Ideally, your business name will match your website domain and social media accounts to establish a powerful online presence.

To come up with a business name, you must also consider the following:

Pennsylvania naming requirements:

The Keystone State’s rules to register a business name are:

- Uniqueness: You can’t use a previously registered name.

- Entity Identifiers: An LLC’s name must include the words “limited liability company,” limited company, or one of its abbreviations, like LLC, L.L.C., or LTD

- Restricted Words: Certain words or terms are prohibited, such as Bank, Inc., Incorporated, Insurance company, Insurer, Trust, Trustee, and Corporation. Or words that might confuse your business with a government agency (State Department, FBI, Treasury).

How to register your business name in Pennsylvania:

- Ensure your chosen name is available using the PA searchable database of existing business names.

- Business entities like LLCs and Limited Partnerships register their name with the Pennsylvania Secretary of State when filing their Articles of Organization.

- You can reserve your chosen name for 120 days with the Pennsylvania DOS by filing a Name Reservation/Transfer of Reservation.

Using a DBA in Pennsylvania:

A DBA (Doing Business As), also known as a fictitious name, allows sole proprietors and partnerships to trade using a more professional-sounding business name.

LLCs can also use a DBA to run multiple businesses under one structure or use a catchy brand name relative to their niche.

Step# 4. Choose a business structure

Before you start your business in Pennsylvania, you must choose a business structure.

Choosing the right business structure is essential because it determines your start-up and running costs, tax obligations, and level of liability protection.

The common business structures

Sole proprietorship:

A sole proprietorship is a non-separate legal entity; you and your business are one, there’s no liability protection, and your personal assets are at risk.

General Partnership:

Like a sole proprietorship, but with 2 or more people.

Limited Liability Partnership (LLP):

An LLP is a separate business structure that protects partners from personal liability regarding the company’s debts or legal matters.

Limited Liability Company (LLC):

LLCs come in 8 variations, combining a corporation’s liability protection with a partnership’s simplicity.

S Corporation:

An S corporation provides limited liability protection, allows pass-through taxation, and enables shareholders to sell stocks, making it an appealing choice for entrepreneurs seeking to raise capital.

Tax advantages of each option

- Sole Proprietorship: Sole proprietors are pass-through tax entities, meaning owners report their income or losses on their personal tax returns, avoiding double taxation and business tax returns.

- Partnership: Like sole proprietorships, partners report their income on their tax returns.

- Limited Liability Company (LLC): LLCs are pass-through entities by default, avoid double taxation, and members report their income on their tax returns.

- S Corporation: S corporations can use pass-through taxation, avoid corporation tax, and shareholders can receive tax-free dividends.

You can find LLC, limited partnership, corporation, and fictitious name registration forms on the Pennsylvania Department of State Registration Forms website.

Step# 5. Set up banking, credit cards, & accounting

Sole proprietors, LLCs, and corporations all have things in common. To stay in business, they need efficient bookkeeping and credit lines. And, of course, they must pay taxes.

Business bank accounts, credit cards, certified accountants, and accountancy software are how they achieve it.

Business bank account

Legal entities like LLCs, LPs, and S corporations need separate business accounts to avoid losing liability protection.

Sole proprietors and general partnerships can use them to look more professional to suppliers and clients.

And everyone can use one to simplify their bookkeeping by separating personal and business expenses, which helps reduce accountancy fees come tax time.

Some banks only give business checking accounts to businesses with an EIN, and others require a business license.

Business credit card

Credit cards help manage a business’s cash flow by separating business and personal expenses. They can also improve your credit history, which can help you get lower-interest loans and provide a credit line when you need it.

Business accounting

Most businesses need an accountant to help with federal, state, and city taxes; payroll taxes; quarterly estimated taxes; and annual tax returns.

A Pennsylvanian accountant can help you comply with specific state tax requirements, especially when first starting your business.

Additionally, SMBs can also reduce costs by using accounting software and apps that integrate with your business accounts, enabling you to control your daily business bookkeeping needs.

Step# 6. Get funding for your Pennsylvania business

A U.S. Bank study shows that 82% of businesses fail because of a lack of cash flow and 80.6% fail by year five.

You don’t need a math degree to see the connection!

But only some start-ups can self-fund until they earn a profit. Fortunately, several other options exist

Small Business Administration (SBA)

The SBA helps small businesses by backing financial institutions to provide funding with long repayment terms and lower interest rates than standard commercial bank loans.

Pennsylvania SBA loans include:

- SBA 7(a) Loan in Pennsylvania: Loan amount $5000-$5 million, interest rate 9.25%-11.00%, repayment term 7-25 years

- SBA 504 Loan in Pennsylvania: Loan amount $125,000-$20 million, interest rate 8.25%±1%, repayment term 10-25 years

For further information regarding SBA loans, visit the SBA.gov website.

Pennsylvania credit unions

Credit unions are often a financial lifeline for small businesses offering low-interest variable and fixed business loans, credit cards, and commercial mortgages.

Check out the Pennsylvania Department of Banking and Securities for further information and this list of Keystone State credit unions for one in your area.

Pennsylvania grants and other loan options

Besides loans, other funding options include angel investors, venture capitalists, equity crowdfunding, and government grants.

Here are some key resources to consider:

- Pennsylvania First Program: Provides financial help, including grants and loans, to businesses that create jobs and promote economic development in the state.

- Pennsylvania Industrial Development Authority (PIDA) Loan Program: Offers low-interest loans and lines of credit to eligible businesses for land and building acquisition, construction, renovation, and equipment purchases.

- Keystone Innovation Zone (KIZ) Tax Credits: Provides tax credits to early-stage technology companies in designated zones across Pennsylvania, encouraging innovation and entrepreneurship.

- Community Development Financial Institutions (CDFIs): CDFIs provide financing options to underserved communities and small businesses, such as loans and grants.

For more information on Pennsylvania small business grants, visit USGrants or SBDC Pennsylvania, which helps entrepreneurs start and grow their businesses.

Pennsylvania angel investors and VCs

Angel and venture capital (VC) investors provide alternative funding options for small businesses to secure financial support for a percentage of ownership.

Step #7. Get insured

The insurance policies you need depend on your business type, if you’re an employer and Pennsylvania’s insurance requirements.

Small businesses often need the following insurance coverage:

- General liability insurance: Safeguards your business from potential lawsuits and damages caused by you or your employees to a client’s property and injuries at your premises.

- Professional liability insurance: Provides coverage for your business against claims of negligence, inaccuracies, undelivered work, personal injury, and copyright infringement.

- Property insurance: Shields your commercial property, assets, inventory, equipment, and building from losses and damages caused by fire, theft, vandalism, or natural disasters.

- Business interruption insurance: Helps mitigate financial losses by providing coverage for lost income and ongoing expenses when your business operations are interrupted by natural disasters or illness.

- Commercial auto insurance: Offers protection against third-party liability claims, loss or damage to your commercial vehicles, and compensation for any injuries sustained in accidents.

Pennsylvania state-specific insurance regulations

Pennsylvania requires businesses with employees to have workers’ comp insurance to cover loss of earnings and medical expenses due to work-related injuries.

Employers must also contribute to the state’s Unemployment Compensation Program, which benefits-eligible workers who become unemployed through no fault of their own.

For further information on Keystone State insurance requirements, visit the Pennsylvania Insurance Department.

Step #8. Obtain permits & licenses

Illinois doesn’t issue a state business license. However, municipalities may require a local license or permit for your business to operate.

The only Pennsylvania state license is a seller’s permit, also called a tax license.

- You need a seller’s permit when selling taxable goods.

- Local Pennsylvania municipalities require certain businesses, like food and childcare, to get additional permits to ensure compliance.

- To get a business license, visit the Pennsylvania Department of State.

Visit PA One Stop Shop to see which permits or licenses your new business might need.

Federal income tax and Pennsylvania local tax

Business owners pay self-employment and income tax to the IRS. And employers must withhold social security and Medicare taxes, federal income, and federal unemployment Tax.

Visit the IRS website for more information on federal tax.

Many Pennsylvania business owners must also pay state and local taxes.

For example:

- S Corporations shareholders and LLC members pay tax at the 3.07% personal income tax rate and include their income, credit, and loss on their income tax returns.

- Under Act 32, employers within Pennsylvania must hold and remit the Local Services Tax (LST) and the local Earned Income Tax (EIT) from their employee’s paychecks.

- Employers must also withhold and remit federal income, Social Security, and Medicare taxes.

Scroll through the PA One Stop Shop to learn more about Pennsylvania state business taxes.

Pennsylvania-specific regulations

The Keystone State has 67 counties, each with specific regulations. However, one rule applies to all Pennsylvania countries: LLCs have no franchise tax.

Contact your local tax collector or the Philadelphia Dept of Revenue for more information on Pennsylvania-specific regulations.

Step# 9. Find your team

Building a strong team is essential for any business, but when hiring, you must comply with the legal requirements.

Such as:

- Registering employee taxes with the IRS.

- Reporting new hires to the State of Pennsylvania.

- Registering for employer withholding and unemployment compensation.

People are the backbone of the business

Surrounding yourself with the right people is how you grow your business. Hiring the right employees is essential as they’ll run your daily operations.

But many small businesses also need outside help; fortunately, Pennsylvania provides it.

- SCORE, with 16 offices in PA, is a nonprofit that provides free or low-cost education and mentorship to small businesses.

- PA Small Business Development Centers (SBDC) support small businesses, from start-ups to hiring and keeping employees and one-on-one consulting.

Comply with Pennsylvania payroll regulations

Before you hire employees, familiarize yourself with the state’s payroll regulations.

Here are key aspects to consider:

- Minimum Wage: Pennsylvania’s minimum wage is $7.25 per hour.

- Overtime Pay: You must pay employees 1.5 times their regular hourly rate for hours over 40 in a workweek.

- Payroll Taxes: Employers in Pennsylvania must withhold state income taxes from employees’ wages.

- Wage Payment and Frequency: Employers must pay employee wages at least twice monthly on regular paydays.

- Record Keeping: You must maintain accurate payroll records for each employee, including information on wages, hours worked, deductions, and other relevant details for at least three years.

Once you have your team, consider using a payroll service to track working hours and issue paychecks to help simplify your tax compliance.

Hire contractors

Most start-ups lack the resources for full-time employees in every role, and managing everything alone is impractical.

Fortunately, contractors offer a solution.

Hiring independent contractors, like an accountant under a retainer, allows your business to delegate tasks while avoiding legal obligations such as payroll taxes and employee insurance.

Pennsylvania rules on hiring contractors

Correctly categorizing workers as either employees or independent contractors is vital to prevent misclassification problems, which can lead to hefty fines.

Pennsylvania uses the “ABC” test, presuming workers to be employees unless they satisfy the following conditions:

- Contractors have independence and control over their work.

- They provide their services outside the normal scope of your business.

- Contractors work in an independently established trade, profession, or business.

Pro tip:

When hiring contractors, have a written agreement outlining the working relationship, work schedule, payment terms, and other relevant details.

Step #10. Market & grow your business

To grow your business in Pennsylvania, you must build a brand your target audience resonates with and then create a marketing strategy that puts it where your target audience sees it.

Here are 6 proven ways to do it:

Invite customers to opt into a mailing list or newsletter

In the marketing world, mailing lists and newsletters are how you engage customers to subscribe and receive emails from your business.

Over time, these subscribers become part of a trusted community familiar with and loyal to your brand.

To entice more subscribers:

- Provide a valuable free resource, like an e-book or exclusive content, to encourage people to share their email addresses.

- Feature a prominent sign-up form on your website and social media channels.

Consider making special offers to attract your first customers

Special offers play a crucial role in enticing potential customers to overcome hesitation and purchase by offering them exclusive opportunities, whether saving money or receiving additional benefits.

Strategies you can use:

- Free shipping and hassle-free returns

- Buy One Get One (BOGO) deals

- Flash sales with limited-time discounts

- Engaging contests and exciting giveaways

- Discounts on products or services

- Customer loyalty programs with rewards

- Holiday promotions to capture the seasonal interest

Look for local businesses or brands to collaborate with

Collaborating with other businesses and engaging in cross-promotion can expand your reach and let you connect with a wider audience.

How to find potential collaborators:

- Attend networking events and join business communities through platforms like MeetUp or local council initiatives.

- Join online forums and communities relevant to your industry to connect with like-minded businesses.

- Use LinkedIn to connect with local business owners and expand your professional network.

Invest in word of mouth (happy customers attract each other)

Word-of-mouth (WOM) marketing is a powerful strategy that leverages satisfied customers to promote your business through positive experiences.

How to get word-of-mouth marketing:

- Encourage user-generated content by requesting happy customers to leave reviews on your website or local business listings.

- Showcase those reviews across all your marketing channels to amplify their impact.

- Implement a referral program or incentives to motivate customers to spread the word about your business.

- Collaborate with industry influencers and seek partnerships that can help amplify your brand’s reach.

Pay attention to online reviews; ask happy customers to review you

Positive customer reviews are how you create credibility, and research shows as few as 10 can influence people’s trust in your brand.

It’s important to respond to unfavorable reviews, demonstrating your dedication to customer satisfaction and transforming a negative experience into a long-term customer relationship.

Create unique, helpful content to showcase your activity

A powerful long-term marketing strategy involves offering valuable content for free to your target audience, such as informative podcasts, captivating images, engaging blogs, and instructional videos.

This approach aims to build trust with your ideal clients before directing them to your sales platforms.

To find the right content strategy:

- Research your competitors’ social media platforms and websites to identify the content that resonates with your audience.

- Establish content goals that align with your consumers’ needs.

- Assess your brand’s online presence to ensure it appeals to your target audience.

- Draw inspiration from industry experts in your field.

Step# 11. Open the doors!

Now you know how to start a business in Pennsylvania. Next, tell the world you’re open.

Plan a successful launch event

Your launch event is a one-time opportunity to leave a lasting impression on your target audience and generate excitement around your brand.

Tips for planning a successful launch event:

- Select a location and date that suits your ideal clients.

- Get any necessary permits and licenses for hosting the event.

- Write a guest list and send invitations to generate interest.

- Plan engaging activities and entertainment that align with your brand’s personality.

- Create a buzz using special promotions or exclusive discounts.

- Use social media and local advertising to promote the event.

- Ensure a photographer or videographer captures memorable moments.

- Follow up with guests to express gratitude and build your community.

Land your first sale

Landing your first sale confirms your business resonates with your target audience, and they want what you sell.

Remember to create introductory offers to entice potential customers to purchase. And enable them to leave a glowing review!

Conclusion

You have a rare opportunity when you start a business in Pennsylvania. The Keystone State wants your business to thrive and provides support on many levels.

Use our steps to guide your journey and contact the agencies in this post because as the African proverb says, “We go fast alone but far together.”

FAQ

The business license fee in Pennsylvania varies depending on the type of license and local requirements.

Since Pennsylvania doesn’t issue a state-level business license, costs vary by individual municipalities and counties.

Contact the regional government offices or visit their websites to determine the price.

To get a business license in Pennsylvania, you must provide a business name, address, contact information, and, in certain situations, a federal employer identification number (EIN).

Forming an LLC in Pennsylvania costs $125.

There’s no cost for a seller’s permit in PA.

Pennsylvania ranks fourth on the Forbes “Best States to Start a Business” list because of its abundant resources and funding opportunities for entrepreneurs.

No, Pennsylvania doesn’t require a state-level “general” business license for sole proprietors.