Sole proprietors who don’t file excise tax returns have a Keogh retirement, or Solo 401 (k) pension plan, or employees don’t need an EIN.

Instead, they’d use their Social Security Number for their taxpayer identification number and file Form 1040 Schedule C to report their income and expenses.

However, there are certain circumstances when you need a sole proprietorship EIN, such as:

- Filing returns for selling alcohol, tobacco, or firearms

- Withholding taxes on income paid to non-residents

- Filing for chapter 7 (liquidation) or chapter 11 (reorganization) bankruptcy

- When you inherit or buy a business, you operate as a sole proprietorship

- Working with farmers’ cooperatives, nonprofits, or plan administrators

- Changing your sole proprietorship to an LLC

You can check out the IRS questionnaire for further information to see if you need a sole proprietorship EIN. But chances are unless you fall within the IRS’s “certain circumstances” you won’t. However, there are several benefits to getting one.

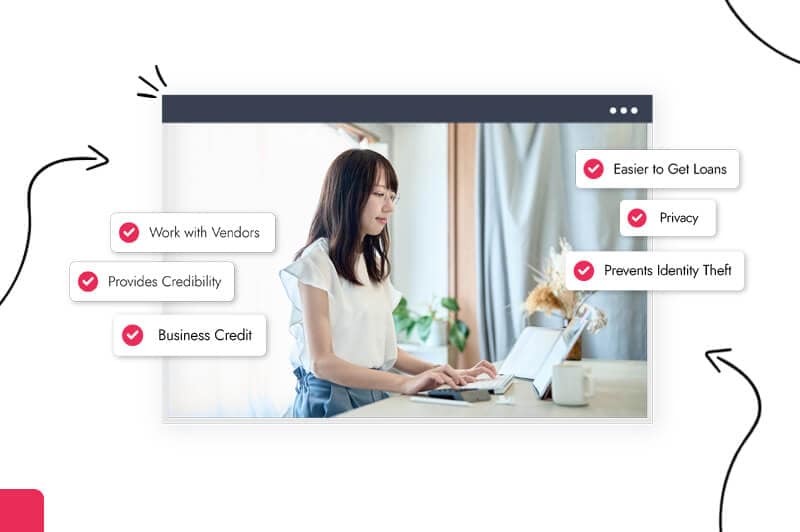

Benefits of Getting an EIN

Many sole proprietors choose to get an EIN to be ready for whatever the future holds. For example, you might need to scale your business and take on employees. Having an EIN enables you to act quickly.

There are several other reasons you should get an EIN for your sole proprietorship, the first being professionalism.

Professionalism and credibility

An EIN conveys professionalism, establishing your sole proprietorship as a credible business, not just a side gig.

For instance, sole proprietor freelancers and independent contractors must provide clients with an SSN or an EIN to receive a 1099 tax form. Many clients are more comfortable doing business with sole proprietors with an EIN because they know they’re legit.

In addition, having a sole proprietorship EIN shows clients you’re an independent contractor, not an employee, making you more attractive to businesses looking to hire.

Helps you open a business bank account

Opening a business bank account helps avoid commingling funds by separating business and personal finances. Identifying and tracking business transactions from personal ones simplifies your accounting and bookkeeping.

Both help you avoid incorrect or late filing fees, making your life easier and reducing stress.

While an EIN isn’t mandatory sometimes, you might find that most banks require one to open a business account.

Establishes business credit

Business credit is often the lifeblood of many small businesses, and an EIN is crucial to establishing it.

A business credit report is a commercial summary that evaluates your sole proprietorship’s history of credit accounts, payments to vendors, and other bill payments.

Each time you use your EIN to apply for credit, your account appears on your business credit report. When you’re in good financial standing, your business credit gets a boost, increasing your chances of getting a lower-interest loan and better prices from suppliers.

Speeds up business loan applications

You can get a business loan without an EIN if you are a legal business. But there’s a catch as most lenders require you to have a business bank account with a credit history, so you’ll often need an EIN.

Reduces the chances of identity theft

Using your Social Security Number for your business increases the chances of identity theft and fraudulent tax returns. An EIN reduces that chance by separating your personal and business finances and keeping your SSN private.

Builds trust with vendors

Small businesses often rely on suppliers, vendors, and other partners to succeed, but they’re picky with who they’ll do business.

Vendors and wholesale distributors often run an EIN check before doing business with a small business/retailer. Having an EIN and a credit report shows them you pay your bills and are trustworthy.

You can hire employees when you need them

Many sole proprietors are lone wolves, but you could need employees to help grow your business as you become more successful. Having an EIN today ensures you’re ready to take on extra help and file the proper payroll taxes tomorrow.

Helps avoid tax penalties and claim tax reductions

An EIN helps simplify bookkeeping and accounting but can also help you with tax reductions and avoid late payment penalties.

Many sole proprietors work from home and claim tax deductions on a percentage of their home office space and utilities. However, tax deductions often lead to audits; having an EIN and a business bank account helps ensure you’re ready if the IRS comes knocking.

And any business that requires an EIN on tax day but doesn’t have one risks their tax return being rejected and incurring late filing fees.

Those are the benefits of having an EIN; now let’s look at how you can get one for your business.

How to Get an EIN

You can get your EIN online using the IRS website or by calling the IRS at 800-829-4933 from 7:00 a.m. to 10:00 p.m. local time. You can also complete Form SS-4 and mail/fax it to the IRS at:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

By Fax: (855) 6416935

Alternatively, you can apply using our EIN application service, which removes the hassle of navigating the IRS website or filling out government forms.

Conclusion

I hope I’ve answered all your questions regarding sole proprietorship and EINs.

Remember that having an EIN for your sole proprietorship gives you the freedom to scale and establish your business. It’s simple to get and you’ll save time down the line when your hands are full.

So, why wait?

Yes. A TIN is a broad term for several tax ID numbers (including EINs and SSNs), while an EIN specifically identifies a business entity for federal tax purposes.

No. EIN and FEIN refer to the same federal tax ID number, though some states informally use “EIN” to describe a state-level tax ID.

Not always—sole proprietors can usually use their SSN. However, certain IRS conditions require an EIN, and many owners choose one for privacy and business credibility.

A sole proprietor can only have one EIN unless they change their business name or structure.

You can find your EIN on IRS notices, past tax returns, bank records, or by calling the IRS Business & Specialty Tax Line.

Using an EIN helps protect your SSN, open bank accounts, build business credit, and prepares your business for growth and hiring.