Pennsylvania LLC costs summary

The following table is a summary of the costs associated with the formation of your Pennsylvania LLC.

Some of these costs vary from municipality to municipality. Certain municipalities require you to obtain licensing for certain activities, but won’t charge for them. Depending on the business activity, others may not require a license or permit.

| LLC filing fee (certificate of organization)x | 125$ |

| Registered agent service (optional) | 199$-400$ |

| Reserve a business name (optional) | 70$ |

| File a DBA (optional) | 70$ |

| Operating agreement (optional) | 0-1,000$ |

| Decennial report | 70$ |

| Business license | Varies by municipality, around 125$ |

The cost of setting up an LLC depends on the manner in which you go about forming your company. Forming an LLC in PA isn’t difficult, nor is it expensive. If you’re doing the paperwork on your own, the only costs you incur are the filing fees and contracting with a registered office for its services. Costs go up, but not significantly if you retain an LLC formation service to handle the paperwork on your behalf.

There’s no getting around the fact that you need to spend money when forming an LLC, especially if you want to get it done right and avoid mistakes. Here’s a look at what you need to know about costs, what you’ll encounter during your formation process, and why it may be worth paying for a service.

General steps and costs when forming a Pennsylvania LLC

You’ll have to follow a set of steps when forming your Pennsylvania LLC, and you have to make sure you’ve completed each step before moving on to the next one. Here’s a look at what’s involved in forming an LLC in Pennsylvania and related costs.

Naming your Pennsylvania LLC

No duplications are allowed when naming your Pennsylvania LLC, and you’re required to use a unique name for your LLC in Pennsylvania. That means you have to perform a Pennsylvania entity search in the corporate database on the Department of State’s (DOS) website to find out if the name is already in use. In the event the name you’ve chosen is unique, you can lay claim to it as part of your certificate of organization.

In the event you’re not ready to form your LLC, but you want to reserve the name, you can do so by paying $70 for the name reservation/registration service.

If you’re filing for doing business as (DBA), known as a fictitious name in Pennsylvania, you’ll have to pay a $70 fee and submit it to the DOS with the appropriate form. Before starting the process, it’s a good idea to review the requirements for a DBA Pennsylvania to ensure your filing meets state guidelines.

Filing certificate of organization

The fee for filing your certificate of organization is $125. There are no other charges associated with this filing.

Appointing a registered agent

You’re required to appoint a PA registered agent, known in this state as a “registered office,” or a corporate registered office provider (CROP) as part of your formation and operation of a Pennsylvania LLC. You can act as your own registered office or appoint a friend or family member, but that can be problematic as you’re required to be available during business hours from Monday through Friday. However, there’s no cost to you or your appointed registered agent if you go this route.

Don’t want to deal with the registered office requirements? You can use Tailor Brands’ CROP service to take over the role.

Creating an operating agreement

The state doesn’t require an operating agreement as part of forming your Pennsylvania LLC, but it is highly recommended that one be created as you put your LLC together. The operating agreement lays out the duties and responsibilities of all members and is something that can be enforced in court if there’s a dispute or someone fails to perform their duties.

In the event a member of the LLC decides to take on someone else’s work or doesn’t feel they’re obligated to perform, you can use the operating agreement to remind them of their responsibilities. If the non-performing member disagrees, you can take the matter to civil court and ask a judge to enforce the agreement or come to a resolution.

The cost of creating the operating agreement ranges anywhere from no cost if you do it on your own, and all the way to $1,000 if you use a lawyer.

You may wish to use Tailor Brands’ operating agreement service or retain a lawyer to draw up the document. Utilizing a professional service for the creation of an operating agreement results in a document that’s strong and can hold up to court challenges.

Other annual and additional Pennsylvania LLC costs

After you’ve formed your Pennsylvania LLC, you may need to pay for licenses and permits to run your business. These costs vary greatly and the need to obtain them depends on the local laws of the municipality. You can check the website for your town’s requirements, call the city clerk, or visit city hall in person to find out what you’ll need to operate your business in compliance with local regulations.

Franchise tax

The state of Pennsylvania does not levy a franchise tax.

Business licenses & permits

The state of Pennsylvania does not have a general business license, but many municipalities require a business to obtain a business license to operate. In addition, some businesses require additional licenses and permits to legally operate in the state of Pennsylvania. Which ones you need is dependent on the type of business you operate. Some of the more common licenses and permits you may need include:

- Sales tax number: Free in the state of Pennsylvania

- Business license: Free to $550 depending on municipality and industry

- Commercial activity license: Usually free

- Industry-specific licenses: Depends on the industry

- Commercial occupancy fee: $450

- Construction permits: $5 per $1,000 of construction value

More information can be found on the PA Business One-Stop Shop website. You can search for the required licenses, registrations, permits, and zoning that are required by your local government on this site.

Annual report

PA currently requires all businesses to file a Pennsylvania decennial report, or once every 10 years, as opposed to every year or two years in other states. It’s important to notice that this requirement may change over time and it’s important to maintain annual compliance and remain in good standing with the state. Its official name is the Decennial Report of Association Continued Existence and tells the state that the business is still extant.

The decennial report must be filed in years ending in 1 (2031, 2041), and all LLCs are required to file the report. You fill out the form for the decennial report and submit it via mail or electronic delivery.

LLC fee

The cost to form your LLC is $125 with no further fees.

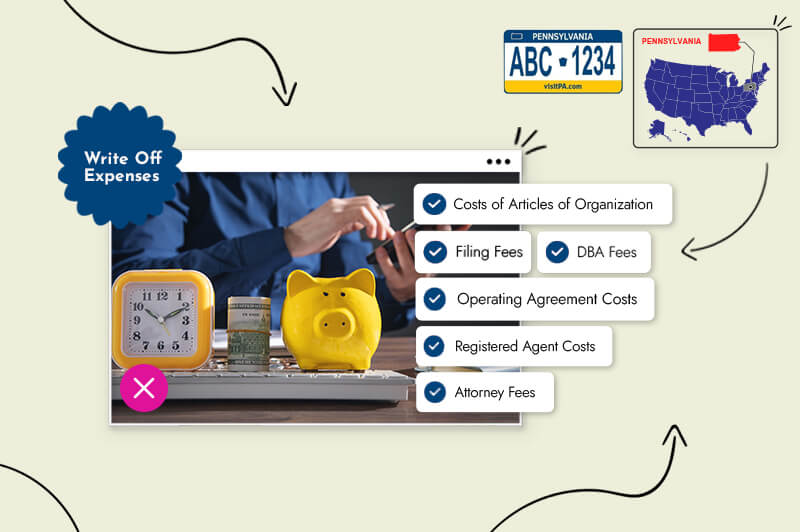

What expenses you can write off

One of the upsides of forming an LLC is the fact that most of the costs of formation are tax-deductible at the federal level. They’re considered operating expenses and are fully deductible. The fact that these costs were paid before the LLC was formed is immaterial. The money you spent to form your business is literally part of the cost of doing business and can be used to lower your overall tax liability.

Deductible costs include:

- Costs incurred for the creation of the certificate of organization

- Filing fee for the certificate of organization

- Filing fee for a DBA

- Cost of creating an operating agreement

- Cost of retaining a registered agent (can be deducted annually after an LLC is formed)

- Attorney fees related to the formation of the LLC

- Accountancy costs related to the formation of the LLC

Pennsylvania LLC state fees

The following fees are taken from the Commonwealth of Pennsylvania site:

| Fee type | Fee cost |

| Domestic LLCs: | |

| Certificate of Organization | $125 |

| Each ancillary transaction | $70 |

| Certificate of Merger, Consolidation or Division | $150 |

| Additional fee for each association that is a party to a merger or consolidation | $40 |

| Additional fee for each new association resulting from a division | $125 |

| Annual Registration (restricted professional companies only) | at least $500 |

| Statement of Validation | $75 plus amount of attached filing |

| Annual Report | $7 |

| Foreign LLCs: | |

| Registration | $250 |

| Amended Registration | $250 |

| Domestication of Foreign Limited Liability Company | $125 |

| Each ancillary transaction | $250 |

| Annual Registration (Partnership) | at least $340 |

| Annual Registration (Company) | at least $500 |

| Annual Report | $7 |

Conclusion

There’s no getting around the fact that you’re going to need to spend some money upfront to form your Pennsylvania LLC. The good news is a majority of the associated fees are fixed and enable you to get a solid idea of how much you’ll need to get started. You’ll want to have extra cash available to cover unexpected costs, but you’ll find that you can form your LLC without breaking the bank.

Forming an LLC is the first step toward growing your business, and it’s one worth investing in. You have nothing to lose and a lot to gain when it comes to being taken seriously by other business entities and banks. They’re far more likely to extend credit, lend you money, and sell/buy from you in quantity because you’ve taken the time to build a trustworthy foundation in the form of an LLC.

FAQ

It costs $125 to file the Certificate of Organization, the only required state fee.

Yes. Acting as your own is free, while professional services typically cost $199–$400 per year.

No, but it’s strongly recommended. Costs range from free (DIY) to around $1,000 with an attorney.

Optional expenses include $70 to reserve a business name, $70 to file a DBA, and industry-specific licenses or permits.

Not annually. Instead, LLCs must file a decennial report every 10 years for $70.