Fees for industries and localities that require licenses vary widely. Therefore, some North Carolina small businesses won’t have any licensing fees at all, and others may find that licenses run into the hundreds or even thousands of dollars.

What follows is a discussion of what North Carolina licenses a business might require, what your North Carolina business license cost might be, and how to determine which specific licenses your business will have to obtain.

Do you need a business license in North Carolina?

In the narrowest sense, the answer to this question is “no.” There is no statewide business license in North Carolina, and there may indeed be some businesses that won’t be required to acquire any licenses at all.

However, almost all professional services require licenses specific to the trade. The manufacture and sale of certain kinds of goods requires state licenses. Whatever work you do, there’s a decent chance that you’re going to need some kind of license.

Also, if you sell anything that’s subject to sales tax, you will need a Certificate of Registration with the North Carolina Department of Revenue. There’s no fee for it, but you may not make sales unless you have one.

How much does a business license cost in North Carolina?

If you’re starting up a small business North Carolina, one of your first questions is likely to be, how much is a business license in North Carolina? In one sense, the answer is that there is no cost, because North Carolina does not require or issue a general statewide business license.

However, many entrepreneurs will find that they do face licensing fees. If they provide professional services or manufacture or sell goods that are regulated by a state agency, they may have to obtain a license from an agency. Some of these are as low as $10, and most are no more than a few hundred. However, there are some licenses that run into the thousands of dollars.

Also, some municipalities may have licensing requirements. Most often, these are not general business licenses but are required to conduct certain activities in the locality, such as selling alcohol or providing entertainment. In many cases, these are less than $100.

In summary, it’s impossible to pin down business license costs without knowing your industry and location. Licensing is just one part of the bigger picture when launching a company, so it helps to understand the broader steps in starting a small business. Fortunately, the state provides resources, whether online, by phone, or by email—that can guide you through your specific licensing requirements and fees.

Which business licenses do I need in North Carolina?

In North Carolina, there are more than 700 licenses and permits issued by the state. In addition, many cities and counties have a handful of permits that they may require for some business activities. And if that’s not enough, some federal agencies require licenses for businesses that fall under their purview.

Fortunately, you don’t have to sit and wonder which licenses you need to apply for. North Carolina provides a facility to field questions about which license or permit your business needs. You can work with the Economic Development Partnership of North Carolina by calling 1-800-228-8443 or by filling in their contact form.

There are also databases that you can use to learn about your licensing requirements.

Industry licenses

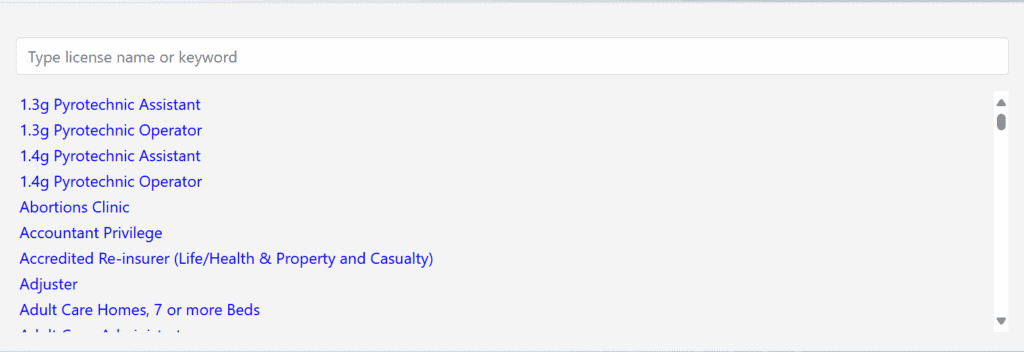

To find out which state industry licenses are required for your line of business, you can search the North Carolina Business & Occupational License Database. The first page will display a list of industries to choose from:

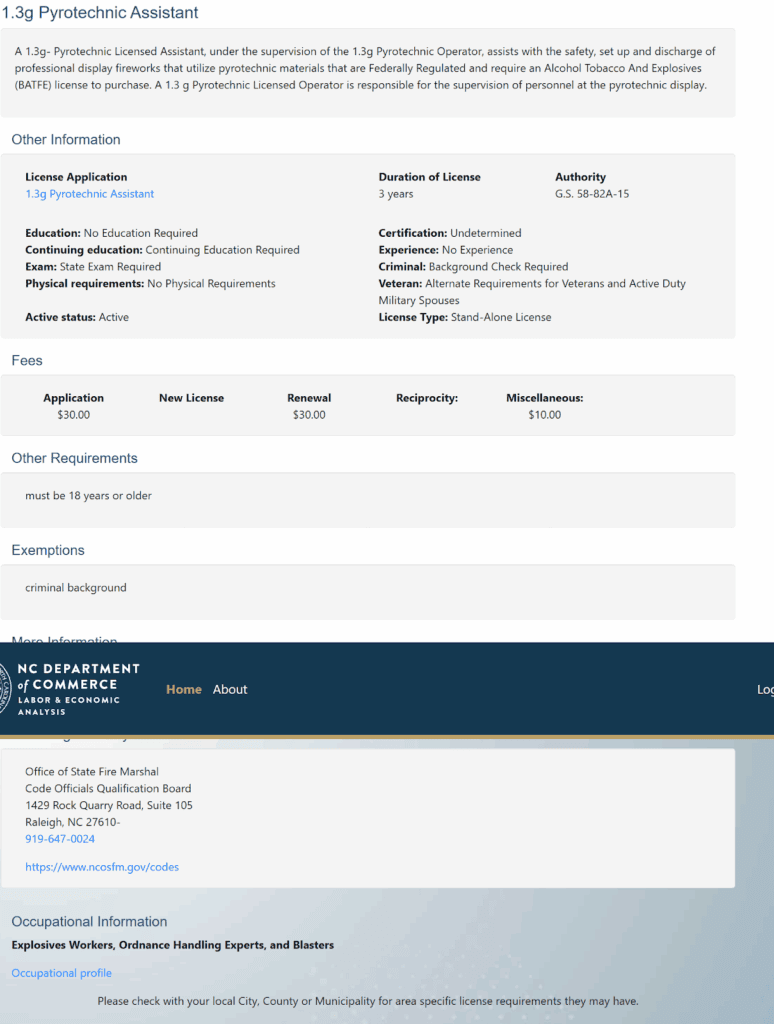

When you select one of these and click its link, you will be shown additional information about the business activity in question. For example:

As you can see, this screen will show you the application fee, the renewal fee, and the duration of the license before it needs renewal. It lists any business license requirements North Carolina has, including education, exams, certification, experience, and background checks. There may be answers to FAQs.

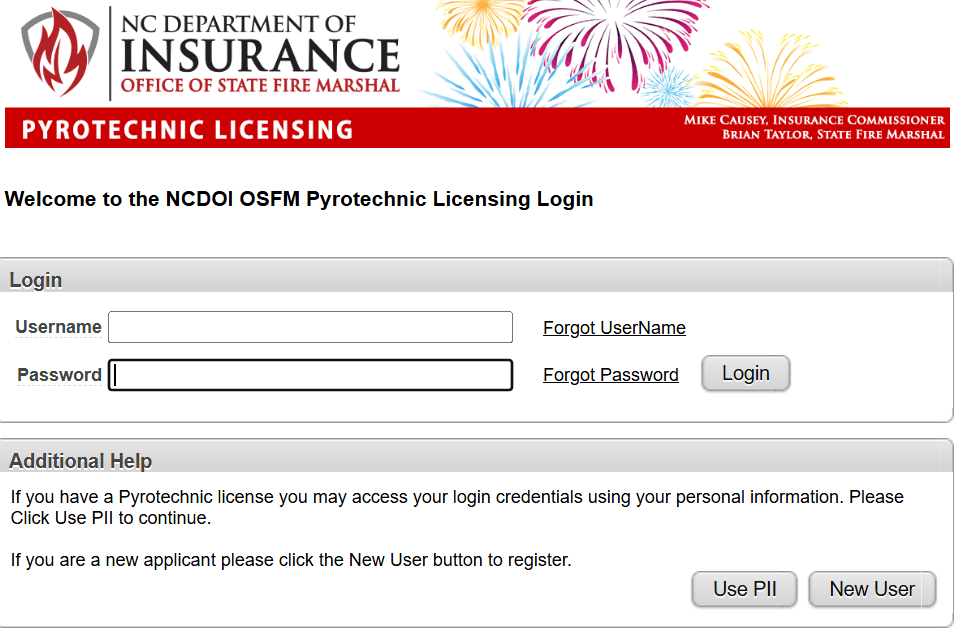

It also shows who the licensing authority is. You can click the license application link to start the actual application process:

Many licensing authorities will require you to register as a user at their database before you can apply online.

Local licenses

Many North Carolina cities, towns, and counties require industry-specific business licenses for activities like selling beer and wine, operating a food truck, or running a day care. There may also be activity-specific licenses for business activities such as erecting signage.

You should check with each municipality where you plan to do business to learn what the requirements are. The state League of Municipalities provides a municipal directory with contact information.

For example, Raleigh does not require a general business license but requires licenses for beer and wine sales and hospitality activities like pushcart vending, street performance, and establishing news racks. Greensboro requires a license for taxicabs and beer and wine sales, and also for peddlers, itinerant merchants, and mobile food vendors.

Many local licenses are free, and very few have significant fees.

Sales and use tax registration

Many states mandate a seller’s license for businesses that are required to collect sales tax. In North Carolina, the required credential is called a Certificate of Registration, and it’s issued by the state’s Department of Revenue. The DOR publishes a list of individuals and businesses that must register. It’s extensive, and it includes not only sellers of physical goods but also many of those who deal in services, rental and leasing, digital sales, entertainment, and service contracts.

There is no fee for a Certificate of Registration, but if you fall under the regulations, you must have one. You can apply either online or by mail with the DOR.

Federal licenses

Some businesses must obtain federal licenses in addition to credentials issued by North Carolina. These are lines of business that are regulated by federal agencies, and they include agriculture, aviation, broadcasting, drilling and mining, firearms, fish and wildlife, liquor licenses, maritime transportation, nuclear energy, transportation and logistics.

If you think that your business activities may be regulated by a federal agency, you can check the Apply for Licenses and Permits page maintained by the Small Business Administration. It contains links to the governing agencies where you can determine whether you are affected and, if so, apply for the licenses.

Renewing your business license in North Carolina

Most North Carolina licenses have a duration, i.e., a period of time for which your license is valid. When that period has elapsed, the license must be renewed. The fees are generally less than they were for the original license.

The North Carolina Business & Occupational License Database, where you applied for your license in the first place, contains all the information about durations and renewal fees. It also provides links to the sites where you can actually submit the application.

There may be an additional processing fee of $25 if the renewal is not received by a month after the renewal date.

Conclusion

While North Carolina has no statewide business license, many businesses face licensing requirements, depending on where they’re located and what business activities they pursue. Fees can vary from under $100 to into the thousands. Fortunately, there is help available, both online and over the phone, to assist with licensing.

There are many challenges when you look at how to start an LLC in North Carolina, and identifying and obtaining licenses is only one of them. You don’t want to fall short with any critical steps, which is why many new businesses engage an online formation service to ramp up businesses such as LLCs. These organizations can not only help apply for licenses but also create start-up documents, register your business with the state, and provide ongoing services like submitting mandated reports. These services are especially useful if you do business in more than one state and have differing requirements to meet.

FAQ

There’s no general business license, but, if you sell taxable goods or services, you will need a free Certificate of Registration from the Department of Revenue.

The easiest way is to use the North Carolina Business & Occupational License Database, which identifies required licenses and provides links to apply for them.

There is no required license specific to LLCs. However, based on your business activity, you need the same industry and local licenses every business structure needs.

If your industry or location requires a license and you don’t procure it, you are in violation of the law. Your business could be shut down. You could possibly be subject to criminal prosecution.

You can call the Economic Development Partnership of North Carolina at 1-800-228-8443, or you can reach them via their contact form.