Small Business Grants: Where and How to Find Them

Small business grants offer free money to help you when starting a business. There are many types available, such as small business grants for women, minority groups, veterans, start-ups, and existing businesses. They are further broken down by local, state, and federal levels, each with specific application requirements.

Finding an eligible grant for your business is crucial because you can begin the application process and get that much needed startup or growth funding. We’ll look at where to find the right small business grant for your business and how to apply.

Types of Business Grants

These grants come in many forms, but all serve the same purpose: to help small businesses succeed. When you apply and receive a grant, it’s usually free money you don’t need to pay back. However, you may have to pay taxes depending on your situation. You will also likely have reporting requirements or compliance audits and may have restricted use of the funds or, in some cases, have to match some of the funding amount.

You can use grants for various purposes, such as starting a new business, expanding existing business ideas, purchasing equipment, or providing employee training. The key to getting accepted is applying for the appropriate grant. And while there are many types, grants fall into four categories.

The four types of business grants are:

Local grants

Local business grants are financial awards provided by government agencies, non-profit organizations, and other entities to small businesses operating within a specific geographic area to improve the local community.

Grants are awarded based on your business plan, financial need, and the potential for job creation or the economic impact you bring to your community.

State grants

State governments also offer small business grants available through state agencies like the Department of Economic Development, the Small Business Administration, and the Department of Commerce.

The competition for state grants is often less intense than federal because of fewer applicants.

Federal grants

Small businesses in the United States can get federal business grants to help spur the economy and create jobs. In practice, however, most federal grants are limited to research-driven businesses, nonprofits, or programs administered through local and state organizations.

Federal grants are competitive and have more stringent requirements than state or local grants because government agencies provide them with larger budgets and more resources.

Resources for federal grants include the U.S. Small Business Administration (SBA), the National Science Foundation (NSF), the National Institutes of Health (NIH), the Department of Agriculture (USDA), and the Department of Energy (DOE).

Corporate grants

Corporations provide grants through corporate social responsibility initiatives, charitable foundations, or to spur innovation and development in their industries.

You’ll find examples of corporate grants in technology, retail, and financial institutions. Businesses that win these grants align with the corporation’s mission, values, and charitable causes that the companies support.

How to Know if You’re Eligible

Local, state, federal, and corporations award grants based on the applicant’s business plan, financial need, and potential for job creation or economic impact within the community.

The eligibility requirements vary depending on the specific grant program and the local, state, or federal government agency (or corporation) that administers it.

However, government agencies and private businesses provide grants because they want others to succeed. You stand a good chance of receiving one as long as you’re eligible and can convince them of your business’s mission and benefit to society.

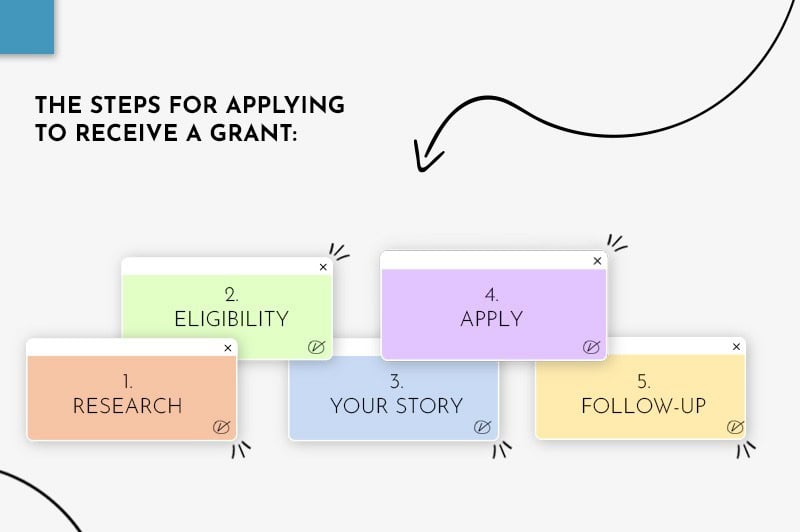

The Steps For Applying to Receive a Grant

The steps to apply for a business grant can vary depending on the specific program and the organization administering it. However, the process typically includes the following steps:

Research

Begin by researching grant opportunities that align with your business goals and objectives from government agencies, non-profit organizations, and corporations.

Eligibility

Check the eligibility requirements for each grant program to ensure that your business qualifies. Conditions can include location, industry, size, and financial need.

Prepare and develop your story

Gather all the documents and information required for the grant application, such as your business plan, financial statements, and tax returns.

Create your story before you apply because many grant providers want to know the “why” behind your application. Here’s where you infuse your pitch with emotion and explain how your business will make a real difference should they approve your application.

Your story is your “show me the money” moment!

Apply

Grant applications are often arduous, and you shouldn’t rush when filling them out. One mistake on your application could lose you the grant, so take it slow and fill out the forms correctly.

Before submitting, include all required documents, information, and a business plan.

You may also need to have the following:

- Employer Identification Number (EIN)

- Your SAM.gov registration and UEI

- Revenue history

- Bank statements

- Tax returns

- Location(s) information

- Contact information

Ensure you follow the instructions and meet the application deadlines.

Follow-up

Once you submit your application, follow up with the grant-making organization to ensure they received it.

Wait for a decision

Grant-making organizations take several weeks or months to evaluate and notify the applicants of their decision. So, be patient.

Compliance

If you receive a grant, comply with the terms and conditions and the reporting requirements. Remember that applying for a business grant can be time-consuming and competitive, so it’s essential to be well-prepared and submit a robust application.

How to improve your chances

The U.S. SBA serves to help small businesses like yours get funding from eligible lenders that meet their strict requirements. SBA-approved loans suit start-ups and small to medium businesses that have yet to build a strong credit rating and require capital to grow.

Keeping it local

The larger the grant (federal/state), the longer the process and the steeper the competition. That’s why going local and applying for a small contribution can sometimes be the smart choice.

Begin by looking for small grants your town/city provides to encourage local employment and development. Once you get one, you can branch out to state or federal options.

Learn from successful applicants

Once you find a grant you’re applying for, check out previous winners to find similarities between your businesses. Previous winners suit the grant providers’ credentials. If you’re similar or could implement changes to mirror their style, you might increase your chances of approval.

Hire a professional grant writer

Yes, there is such a person as a professional grant writer. It’ll cost you a few bucks, but it could be a wise investment as grant writers know the language style grant providers look for and how to make your application stand out from the crowd. However, if you don’t have the spare cash, consider a free grant writing course.

The takeaway

Before you apply for a grant, ensure you prepare and are eligible, cover the legal requirements, develop an emotional brand background story, and complete your application correctly.

Lists of Available Grants

Government agencies are the leading distributors of business grants. Still, corporate, state, local, start-up, and specialized grants are available depending on your circumstances.

Let’s begin with federal:

Federal small business grants

Applying for a federal grant can often intimidate small business owners. Still, the grant opportunities and what they can do for your business can make it worthwhile.

Before we look at the different available federal grants, it helps to know that the U.S. Small Business Administration (SBA) provides lots of helpful information and support to business owners when applying for grants.

Note that SBA grants are typically nonprofits, educational institutions and resource partners. For-profit businesses can use the SBA for loans, guarantees and SBIR/STTR for tech and research startups.

Other resources to find grants and federal agencies that offer them include:

Grants.gov

Grants.gov is a government database of federal grant agencies and is a great place to start your search.

You’ll find information on thousands of different grant programs and their application instructions. Once you register, multiple grant opportunities are available.

The only negative with the Grant.gov database is the extensive number of grants, making it difficult to navigate. It will take some work to find those specifically for small businesses as most are intended for research, public programs and nonprofit or government grants.

U.S. Economic Development Administration (EDA)

The EDA, part of the U.S. Department of Commerce, is another excellent resource for entrepreneurs looking for state business grants. The EDA works directly with local communities to encourage entrepreneurship, innovation, and economic development in the U.S. You typically do not apply directly to the EDA but through the local governments and economic development organizations they fund.

Small Business Technology Transfer and Small Business Innovation Research

Small businesses can get grants from the SBIR and STTR to help with research and development. These grants are competitive R&D grants and are often focused on tech and research startups.

U.S. Department of Agriculture (USDA)

USDA provides grants to local and state governments and non-profit and private organizations to assist small businesses in rural areas. These might include roadside stand businesses, farmer’s markets, and low-interest government loans to family and newly owned farms.

Program for Investors in Micro-entrepreneurs

The SBA Program for Investors in Micro-entrepreneurs (PRIME) offers federal grants that help private, nonprofit microenterprise development organizations to provide capital, training, and support to underserved small businesses.

U.S. Department of Energy (DOE)

The DOE works with the SBIR and STTR programs to help fund energy research and development for small businesses. This might include energy use and production, environmental management, and fundamental energy sciences.

Businesses must meet specific needs, but grants are available if you qualify for these categories.

U.S. Environmental Protection Agency (EPA)

Businesses in the green or environmental sector can apply for grants from the EPA. These grants go to non-profits, research institutions, and government agencies working to prevent pollution and improve air quality.

National Institutes of Health

The NIH also works with the SBIR and STTR programs to fund small businesses in biomedical research that engage in research to help improve the nation’s health.

It’s a complicated application process, but with billions of dollars available annually to fund medical research, securing a grant is worth your effort.

U.S. Chamber of Commerce Dream Big Awards

The Dream Big Awards isn’t an upfront grant. It recognizes small businesses for their economic contributions. It’s awarded to those deemed to have made a positive impact with grants of up to $25,000. The award structure, amounts and categories do change from year to year.

To qualify, you must be in business for a minimum of one year.

Corporate small-business grants

Many large companies and corporations provide grants to non-profit and for-profit enterprises working in (and sometimes outside) their sectors to encourage growth and innovation.

The qualification and application process varies with each grant provider, as does how much they offer.

But all are worth looking at:

Lenovo Evolve Small Grant

Lenovo’s Evolve Small Grant initiative supports small businesses by providing technology donations and grants throughout Canada and the U.S. You must own a small business with 100 employees or fewer to qualify.

FedEx Small Business Grant Contest

As of now, FedEx has not announced dates for an upcoming Small Business Grant Contest. The most recent program ran in 2024, with applications open from March 1 to April 1 and winners announced in mid-May. There is currently no confirmation that the contest will run again in 2026, and applications are not open at this time.

Historically, when the contest does run, FedEx tends to open applications in late winter or early spring, so any future announcement would most likely appear in Q1 of the year. The best way to stay up to date is to monitor the official FedEx Small Business Grant Contest page or sign up for FedEx small business email updates, as new contests are posted there first.

Visa Everywhere Initiative

The Visa Everywhere Initiative is a startup competition providing grant funding to tech start-ups around the globe.

To win the competition, you must prove how you’ve developed an innovative product with the help of Visa’s products. To be eligible your business would typically have to be involved in Fintech or be venture capital backed.

The winner of the initiative gets a $100,000 business grant. Other grants also go to the 2nd and 3rd-placed competitors, local and regional winners, and the audience’s favorite.

Venmo Small Business Grant

The Venmo Small Business Grant aims to help small businesses achieve big things. Each year the program changes but it last awarded $10,000 to 20 small businesses, plus free promotions on their and PayPal’s websites and social media platforms.

You typically need a U.S. Venmo account, a valid profile, $50,000 in annual sales, and 10 employees or fewer to qualify, but this does change from year to year.

Don’t worry if your small business isn’t eligible for corporate or federal small business grants because the following options could also be the perfect fit:

State and regional small business grants

State and regional governments provide small business grants to entrepreneurs who need support. There’s often less competition for these grants than federal ones because of fewer applicants. You can apply through state agencies in your locality.

State Business Incentives Database

The State Business Incentives Database is not a grant provider but a U.S. map listing incentive programs throughout the country. Its database provides invaluable information for small business owners. The only drawback is that you must be a C2ER member, which costs $380 annually (as of January 2026).

Small Business Development Centers

You’ll find Small Business Development Centers (SBDCs) that support aspiring entrepreneurs throughout the U.S. These centers can help connect small business owners with grants available in the region and other business financing solutions.

You can use their state map to find one near you.

State Trade Expansion Program

The State Trade Expansion Program, funded by the SBA, provides financial awards to territory and state governments to help small businesses expand abroad with export development.

Eligibility requirements vary from state to state.

Local Chamber of Commerce

Your local chamber of commerce is often the first place to look for and find business grants available in your area. Contact yours and ask if they can connect you with grants suitable for your business situation.

The following list of small business grants is for entrepreneurs of a specific demographic in our society. If that’s you, chances are, help could be at hand!

Specialty Small Business Grants

To help entrepreneurs from all walks of life and situations, certain organizations fund specific groups and communities who face unfavorable odds and unique challenges. This includes veterans, minority groups, and women. I hope you find what you need in the list below.

Small business grants for women

To help tackle workplace inequality, many small business grants are now available for women of all ages, cultures, origins, and domestic situations.

Let’s start there:

Live Your Dream Award

The Live Your Dream Foundation helps women who have suffered and survived traumatic events and sexual violence. With annual grants of $2.1 million on behalf of Soroptimist International, the foundation offers educational programs to help women overcome these situations and build their confidence and careers. Grants range from $1,000 to $10,000, and international finalist winners can receive up to $16,000.

Cartier Women’s Initiative Award

Sustainable and eco-friendly women business owners can avail of the Cartier Women’s Initiative Award.

Cartier offers 3 types of funding: Science and technology pioneer awards, diversity, equity, and inclusion awards, and regional awards.

American Association of University Women

The American Association of University Women (AAUW) offers research and academic and career development grants for women wishing to reenter the workforce or change careers.

The AAUW also provides grants to fund projects encouraging young girls to seek careers in technical fields.

Stacy’s Rise Project

The Stacy’s Rise Project helps women in the food and beverage industry by offering funding and mentorship to help grow their businesses and create community and global networking opportunities. Since 2017, the project has provided almost $1 million in funding and connected thousands of female entrepreneurs.

Tory Burch Foundation Fellowship Grant

The Tory Burch fellows program offers grants, free education, and mentorship to women entrepreneurs from all walks of life to support them in starting and growing their businesses.

Amber Grant for Women

WomensNet exists to help women entrepreneurs achieve their business dreams. Since 1998, they have provided two $10,000 grants monthly and two $25,000 annually. They named the grants after Amber Wigdahl, who tragically died at 19 before she could fulfill her business dreams.

To qualify for a grant only takes a single application, and all women-owned businesses are eligible.

Small business grants for minority groups

According to the US Senate Committee on Small Business and Entrepreneurship, racial minority-owned businesses account for almost half of all small businesses in the last decade, creating nearly 5 million jobs and generating $700 billion in revenue. However, significant disparities in access to start-up capital still exist!

To tackle this problem, many organizations offer small business grants for minority groups.

Minority Business Development Agency (MBDA)

The Minority Business Development Agency provides numerous resources to help minority-owned businesses prosper. Resources include mentoring, technical assistance, counseling, funding, and growth support.

The MBDA can also help you secure contracts and access capital to compete in your marketplace. Also, they can help you apply for local, state, and federal business grants and debt-based financing.

You can find the MBDA’s latest grant programs and updates on their contest website.

Sephora Accelerate

Entrepreneurs entering the beauty industry can apply for a grant from the Sephora Accelerate program that supports minority business leaders. Though grants aren’t monetary, winners get free access to a 6-month beauty industry boot camp and can launch their products with Sephora.

National Minority Supplier Development Council (NMSDC)

The National Minority Supplier Development Council offers networking opportunities and business services that enable entrepreneurs to connect with investors. We know the NMSDC for the quality of its community of business advisors and mentors, making it an invaluable resource for all budding minority entrepreneurs.

Operation Hope Small Business Empowerment Program

Operation HOPE provides a team of dedicated business coaches to help you start your business and develop a plan to achieve your goals. The Small Business Empowerment Program offers 8 and 12-week entrepreneurship training programs that include funding opportunities.

Small business grants for Black women

Black women far outpace any other racial group when starting a small business. Yet historically, Black entrepreneurs have historically faced disproportionate barriers to early-stage financing.

Fortunately, times are changing. Below is a list of grants for black businesswomen that can unlock those resources otherwise denied.

Coalition to Back Black Businesses

The Coalition to Back Black Businesses is an initiative of the U.S. Chamber of Commerce Foundation in partnership with organizations and businesses. It aims to provide more than $14 million in grants, resources, and training to support and empower Black-owned small businesses. The program accepts applications for $5,000 grants each fall. Some applicants can also receive $25,000 in enhancement grants the following summer.

Black Founder Startup Grant

The SoGal Foundation’s Black Founder Startup Grant initiative offers grants of up to $10,000 to multiracial, nonbinary, and black women entrepreneurs.

The program is open to women entrepreneurs with registered businesses who need investor financing to scale up and accept applications throughout the year.

Sage Invest in Progress Grant

In partnership with the BOSS Network (a professional online community of entrepreneurial women), Sage runs the Invest in Progress Grant. The program provides Black female entrepreneurs annual grants of $10,000. Winners also receive one year’s membership to the BOSS University, which helps Black women start and grow their businesses.

Amazon’s Black Business Accelerator Program

Black women sellers on Amazon can apply to the Black Business Accelerator Program, which provides financial support, business advice, mentorship, and promotional support to Black entrepreneurs.

Eligible sellers can access cash grant opportunities, money toward start-up costs, free imaging services, and advertising credits.

Kinetic Black Business Support Fund

Kinetic (Network and connectivity solutions provider) offers eligible Black-owned businesses up to $2,500 in financial support and free internet service. Grants are on a first-come, first-served basis. Applicants must be Black, own a business with 25 or fewer employees, and meet other eligibility requirements, which you can find here.

Small business grants for veterans

Thankfully, organizations exist to help veterans receive small business grants and programs to create a secure future.

The Second Service Foundation

Second Service Foundation provides business grants, mentorship, coaching, educational content, and networking events to support and inspire ex-military entrepreneurs.

Over 85,000 people are members of the foundation, which was formerly known as The StreetShares Foundation. It has helped over 5,000 entrepreneurs achieve their business goals to date.

Links to additional grant databases

- https://www.sba.gov/funding-programs/grants

- https://www.grants.gov/learn-grants/grant-making-agencies/small-business-administration.html

- https://www.uschamber.com/co/run/business-financing/government-small-business-grant-programs

- https://www.uschamber.com/co/good-company/americas-top-small-business/americas-top-small-business-guide

- https://www.sba.gov/business-guide/plan-your-business/fund-your-business

- https://www.usa.gov/grants

Conclusion

We often think of free money when we hear the word grant, and who doesn’t want free cash when starting a business? Keep in mind that grants do not come without responsibilities. There are often reporting requirements, restrictions in the use of the funds, and compliance audits that accompany the grant.

But not all offer cash; some provide invaluable resources that can help you take your business idea and turn it into reality.

And once you choose the right one, you could be in business.

I wish you the very best of luck; you deserve it.

FAQ

There are four types of grants: local, state, federal and corporate.

No, the SBA doesn’t give grants to start or expand the average business. However, they provide grants to non-profits, educational organizations that support entrepreneurship, and resource partners to fund counseling and training programs.

There are several ways you can get cash to support your business: grants, self-funding, venture capital from investors, crowdfunding, small business loans, and SBA investment programs.

The best place to start your search for a grant is on Grants.gov. Grants.gov has a database containing over 1,000 government grant programs. Failing that, reread this post and follow the link to the grant provider that suits your business situation.

More on Business Grants