Basics of LLC Dissolution

LLC dissolution is more than just taking down a website, closing all email accounts, and moving on. It is the official act of dissolving your business in your registered state.

LLC dissolution is the final step in removing the legal status of your business, either voluntarily or involuntarily, with the Mississippi Secretary of State.

Before its finalization and acceptance, however, you will need to take several actions such as sending notice to all creditors and applicable government agencies (both federal and local), taking care of any existing debts, and attending to any taxes that may be outstanding.

All steps and dissolution procedures must be followed in order to dissolve the LLC and protect you from any future liabilities.

Types of LLC Dissolution

Dissolving your LLC can happen in three distinct ways: administrative, judicial, or voluntary dissolution. Each type has its own procedures, so knowing how they differ is imperative.

Administrative Dissolution

Administrative dissolution is initiated by the State and removes all rights, authority, and powers of the LLC due to a lack of compliance with its obligations.

Administrative dissolution can result from any of the following:

- Failing to submit the State-required annual report

- Failing to maintain a registered agent on file with the Mississippi Secretary of State

- Ignoring any requirements to pay a state franchise tax within an allotted timeframe

Judicial Dissolution

In a Judicial dissolution, a court, through a legal process, orders the dissolving of the limited liability company.

Examples of when and why a court may initiate a Judicial dissolution include:

- Breaches of fiduciary duties by the LLC owner or member

- Fraud or mismanagement by a manager or member

- Internal disputes or disagreements among LLC members

- Inability of a member to fulfill LLC responsibilities, often due to death or a mental condition.

Voluntary Dissolution

For a voluntary dissolution to occur, members of the LLC must vote to cease doing business. Such an action usually requires majority consent.

There are two distinct ways that a voluntary dissolution can happen. These include:

- Dissolution triggers, such as the departure or death of a member, as listed in the LLC operating agreement; or

- A vote by members to dissolve the LLC due to financial issues or internal disputes.

Dissolving Your LLC in Mississippi

To conduct a voluntary dissolution for your Mississippi LLC, you will need to take the following steps.

Step 1: Vote to Dissolve the LLC

LLC members will need to come together to discuss and approve a dissolution decision.

This vote in favor of dissolution requires the consent of all its members or a lesser amount if provided for in the operating agreement (or its formation documents).

All votes and decisions will need to be recorded in the meeting minutes.

In some cases, an agreed to dissolution trigger (e.g., a member’s death) in the Mississippi LLC operating agreement will initiate the voluntary dissolution instead of a majority vote.

Should there not be an agreement or a dissolution clause in place, all LLCs will need to follow the provisions set forth in the Mississippi Limited Liability Company Act.

Single vs multi member LLC dissolution

The distinct difference between single-member and multi-member LLC dissolution is that multi-member LLCs will need to come together and obtain a majority vote in favor of business dissolution.

Dissolution rules in your LLC operating agreement

The LLC operating agreement is a comprehensive guide for how to run and, if necessary, dissolve the business.

Understanding the dissolution clause in the LLC’s operating agreement is crucial at this point in time. This type of clause will govern what you do next; that is, the process your business must follow to dissolve the business. It may include such rules and matters as:

- How many members (or what percentage) must vote for dissolution

- Guidelines for how the LLC will attend to any outstanding debts and other liabilities

- Procedures for settling then closing all LLC activities

- Methods for canceling contracts, handling outstanding debts, and dividing assets

Mississippi-Specific Rules for Voting to Dissolve Your LLC

LLC members will need to come together to discuss and approve a dissolution decision. In Mississippi, this vote in favor of dissolution requires either the consent of all members or a lesser amount if provided for in the operating agreement or its certificate of formation.

Step 2: Wind up all business affairs and handle any other business matters

Once a dissolution decision is officially made, steps to wind up all business affairs and handle any other business matters must occur. This “winding up” often includes:

- Notifying the registered agent

- Contacting customers and suppliers of the LLC’s closing

- Canceling any business permits or licenses

- Defending and/or prosecuting any lawsuits (administrative, civil, or criminal)

- Attending to any employee matters

- Closing bank accounts for the business

- Disposing of the LLC’s property

Step 3: Notify creditors and claimants about your LLC’s dissolution, settle existing debts, and distribute remaining assets

Essential steps in the dissolution process include the following:

- Notifying creditors and any claimants about the dissolution.

- Settling any existing debts and financial obligations, such as business loans, credit card debt, and any invoices that remain outstanding

- Distributing to members any remaining assets of the LLC. (This step will require the liquidation of assets and distribution in accordance with Mississippi Code and the LLC operating agreement.)

Step 4: Notify Tax Agencies and settle remaining taxes

Notify tax agencies and file your final tax returns. While Mississippi does not require a tax clearance certificate to approve dissolution, it is essential that you meet all tax obligations as this can help you avoid legal issues down the road.

Step 5: File articles of dissolution with the Secretary of State

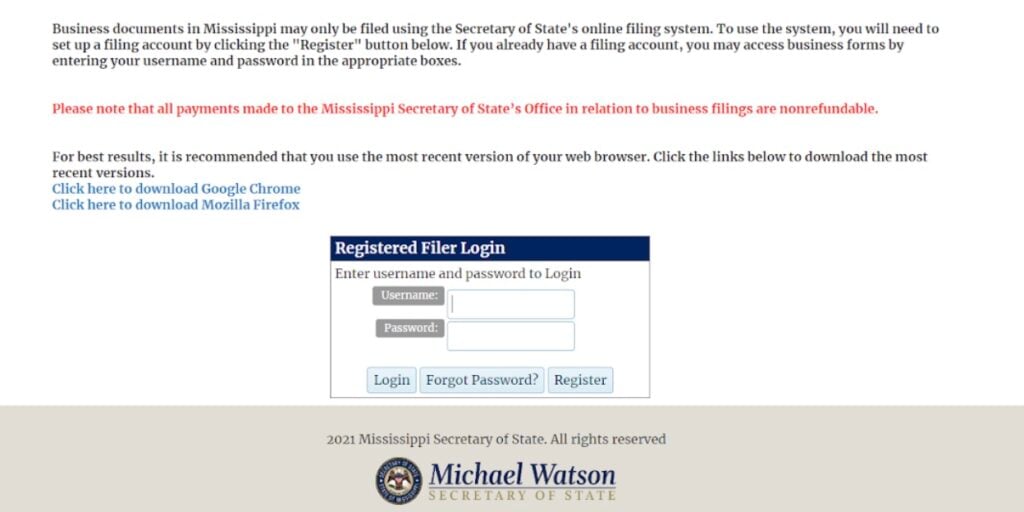

To file Articles of Dissolution in Mississippi, navigate to the Business Services page of the Secretary of State’s website. Once here, you will need to create a corporate filing account or login in with the account you already have.

Next, Click on the “File Articles of Dissolution or Certificate of Withdrawal.” Input your business ID. (If you don’t have this on hand, you can do a search for it on the state business search portal.)

Enter the dissolution effective date, then click on the sign button to enter your name and address.

At this point, you can either continue filing online or print out the Certificate of Dissolution document to mail along with a check made out to the Mississippi Secretary of State.

Whether you file online or by mail, the dissolution filing fee will be $50.

If you file your dissolution documents online, The Mississippi Secretary of State’s office should process them within approximately 24 hours.

If you choose to mail your documents, it can take 2-3 days to process. You can also drop off your documents, but the process time will remain the same.

The state does not offer an expedited processing option.

Conclusion

Dissolving an LLC in Mississippi requires certain steps, particularly if it is a voluntary dissolution. Following these official steps is crucial to acceptance by the state and in limiting any future liabilities for members.

While no one likes to see the end of something they created, dissolving the LLC you formed can also be a new beginning for you in that you can now seek different opportunities for going forward. When you are ready to open your new LLC, consider using our LLC service to help you manage that next challenge.

FAQ

Situations where you should consider dissolving your LLC include: Experiencing financial challenges or undue market competition, inability to keep up with the increasing costs of doing business, or ongoing disagreements or disputes among LLC members

To dissolve an LLC in Mississippi, the Secretary of State’s office requires a $50 filing fee.

In Mississippi, you can complete the entire LLC dissolution online, starting with creating a corporate filing account on the Secretary of State website.

Generally, it will take approximately 24 hours to process the dissolution of your LLC in Mississippi if you file completely online. If you choose to print out the documents and submit via mail or in person, it will take 2-4 days.

Avoiding the process of dissolution in Mississippi means that your company continues to be expected to file annual reports, pay taxes, and conduct all other business activities as usual. It also means that members remain vulnerable to liabilities and claims against the LLC.