What is an annual report?

The annual report is a document that the state of North Carolina requires from all LLCs doing business in the state. The information listed in the annual report is mostly technical information about your business.

The purpose of the annual report is to ensure that information about your LLC in North Carolina, which the Secretary of State makes available to the public on its website, is accurate and current.

Your LLC cost in NC includes an annual report fee of $203 if you file online or $200 if you file on paper via mail or in person.

North Carolina LLC annual report requirements

Your annual report must contain the following information:

- LLC business name, which is the LLC’s official name as you entered it on your Articles of Incorporation

- Primary business address (also called the “principal office address”), which must include a physical street address and a valid mailing address (which can be the same as the street address)

- Members’ and/or managers’ names, titles, and business addresses

- Brief description of the nature of your business

- Registered agent contact information, registered office street address, and registered office mailing address if its different from the street address

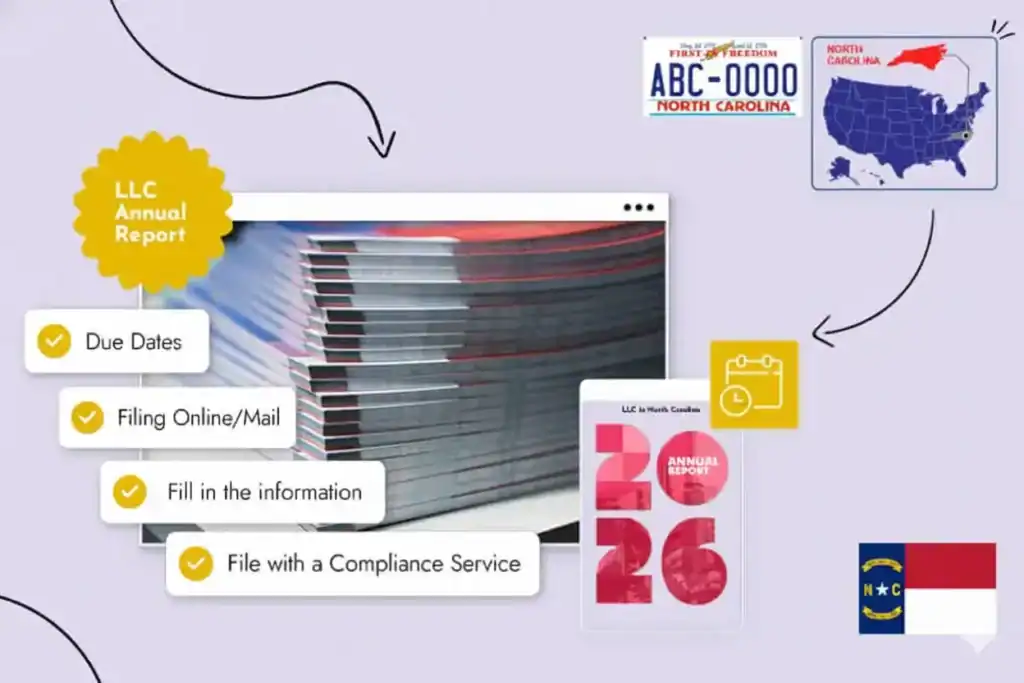

How to file an annual report in North Carolina

You can file your annual report online, by mail, or in person. Filing online is the fastest.

Due dates

Your first annual report is due on or before April 15 in the year following the year that you formed your LLC. For example, if you formed your LLC any time in 2022, your first annual report would be due on or before April 15, 2023. After that, you will continue to file annual reports every year on or before April 15.

File online

If you file your North Carolina LLC annual report online, it will be filed with the Secretary of State’s office the same day you submit it and will be visible online right away. If you file on paper, you may have to wait as long as 12 weeks for the report to be processed and the information posted online.

Start the online filing process at the North Carolina Secretary of State’s main annual reports page. Click the “Get Started” button that’s under “Begin Online Annual Report Process.” In the search box, type in the name of your company, but don’t include the “LLC” designation at the end.

Find your company in the list, and in the “Actions” column, click on the icon that looks like a computer monitor. You’ll get a list of all your past annual report filings. If this is your first annual report, you’ll see a document listed called the “Creation Filing.”

Click on “File Most Recent Annual Report.” You’ll see the name and address of your LLC as they appear in the Secretary of State’s records. Click on the checkboxes to certify that what’s listed is the correct company and that you are authorized to file the annual report.

From there, the online filing program will walk you through the input process. Your registered agent’s name, as you entered it on your Articles of Organization, will already be filled in. You’ll have the opportunity to change your agent at this point if you want.

The program will prompt you to enter or verify all the information listed in the “North Carolina LLC Annual Report Requirements” section above. The program will pull up some of the information from what you already submitted on your Articles of Incorporation. It will also ask for additional information that was not part of the Articles, including a brief description of your business, a principal office telephone number, and a principal office street address.

You can also enter a principal office email and an email where you want to receive a receipt for the annual report, but those are both optional and will not show on the public-facing website. You’ll then enter or, if necessary, edit the names and addresses of all the LLC’s officials.

Finally, you’ll have to indicate who is certifying and signing the report with an electronic signature.

Pay the $203 filing fee with a credit card or ACH debit (electronic check). The credit card doesn’t necessarily have to be for your business but could be your personal credit card. If you want to do a debit, the ACH process will be faster if you already have your ACH information set up on your Secretary of State account, and you’re logged into that account.

Your report will be officially filed as soon as your payment information is accepted, and you’ll get a receipt on the next screen.

File by mail or in person

The Secretary of State’s office prefers that you file online. If you file a paper copy through the mail or in person, it will take much longer to process (up to 12 weeks instead of instantly).

You’ll need to print out a PDF of the annual report form. To find and download the PDF that’s been personalized for your business, look for your business name using a NC business search on the Secretary of State’s business registration search page and click on the “Annual Report” button next to your LLC’s name.

You will see that some fields in the annual report form have already been filled in with information from your Articles of Incorporation or your previous annual reports if this is not your first one.

After you complete, sign, and date the form, mail it to P.O. Box 29525, Raleigh, NC 27626-0525 with a filing fee of $200. Or, you can file it in person at the Secretary of State’s office Monday through Friday 8:00 a.m. to 5:00 p.m. (except for state holidays) at 2 South Salisbury Street in Raleigh.

Fill in the form with the above information requirements

Follow the online program’s prompts and the instructions in the “File Online” section above to fill out the form online. To fill out a paper form, check the information that has been automatically filled out on the form to ensure that it’s correct, and enter information in all the blank fields. There’s one exception: If you don’t have any new officials since the last time you filed the report (or since the Articles of Incorporation if this is your first annual report), you can leave that box blank.

File with a compliance service

Many small business owners prefer to have a company take care of filing their annual reports for them. At Tailor Brands, we offer an annual report service that will give you the peace of mind of knowing that you’ll never miss or be late for an annual report deadline.

We make sure that all the details are handled correctly, file your annual report for you, and ensure that you are following all the necessary state requirements. We’d be glad to take care of it so that you can focus your time and energy on the core missions of your business.

What happens if I failed to file on time? (or at all?)

If you fall behind on your annual reports, the state will send you a notice that your LLC will be dissolved if you don’t file the missing report(s) within 60 days.

Late fees, fines, and penalties

If the state dissolves your LLC, you will have to pay a $100 fee, in addition to the annual fees that you still owe, to reinstate it. If you have a foreign LLC that is revoked, you must requalify and pay a $250 application fee.

Dissolution

If you fail to file your annual report, the state will send your North Carolina registered agent a postcard form called “Notice of Grounds for Administrative Dissolution or Revocation.” Once you get the notice, you only have 60 days to file the missing report(s). If you don’t file by then, the state will go ahead and dissolve your LLC.

If your LLC has been administratively dissolved, all you can do is wind up the affairs of your business.

Conclusion

As the owner of an LLC, filing your annual report on time is an important task that you must do to comply with state law. Tailor Brands offers an annual report compliance service that will reduce your stress by taking care of all the details for you and making sure that your filing is completed correctly and on time every year.

FAQ

A North Carolina LLC annual report is a mandatory filing that updates the Secretary of State with key business details, such as your LLC’s name, address, members or managers, and registered agent information. It ensures the state has accurate records and keeps your business in good standing.

The annual report fee is $203 if filed online or $200 if filed by mail or in person. Filing online is faster and allows for immediate processing and confirmation.

Your first annual report is due by April 15 of the year following the formation of your LLC. After that, you must file by April 15 each year to remain compliant and avoid penalties or dissolution.

If you fail to file your annual report, your LLC may be administratively dissolved by the state. You will receive a 60-day warning notice, and if you still do not comply, your LLC will lose its active status. Reinstating a dissolved LLC costs $100, plus the outstanding annual fees.

Yes, many business owners choose to use a compliance service to file annual reports. Tailor Brands offers an annual report filing service to ensure your LLC stays in good standing and deadlines aren’t missed, so you can focus on running your business.