Expanding your business is exciting, but it can leave you feeling nervous, especially if you’re unsure how to do it. Your immediate question is, “Can an LLC own another LLC?”

The answer is yes, but that alone won’t help you. For example, you might be ready to bring a new line of products or services to your niche. Or perhaps you naturally progress into another lucrative market. Both scenarios require a different approach.

We’ll explore your options and the recommended paths you could take to expand your business depending on your goals and present stage. You could start another LLC, run multiple DBAs and other options at hand. All come with additional legal requirements and effort (like paperwork, filing fees, tax calculations, running costs, etc.).

So, with those in mind, let’s answer this question, “How can an LLC own another business, and should it?”

Different Ways to Expand Your Business

Before we look at how you can expand your business, think about why you’re expanding your business. Your answer could determine which option you choose, such as starting multiple LLCs, multiple DBAs, or multiple businesses under one LLC.

For example:

- Do you want to increase revenue by adding a new range of products or services in your current niche that doesn’t fall under your present LLC offerings?

- Have you identified a natural progression into another niche that requires a new branding and marketing approach?

- Or are you ready to try something new in a different market but don’t want to risk your present LLC?

Once you have your answer, you’ve got 3 options to expand your business:

- You can own a single LLC and operate multiple DBAs.

- Start multiple LLCs under one LLC.

- Or create a Series LLC with several subsidiaries LLCs.

Each option has pros and cons, such as helping to mitigate potential liability concerns, ease of formation, and cost. So, let’s begin with registering multiple DBAs.

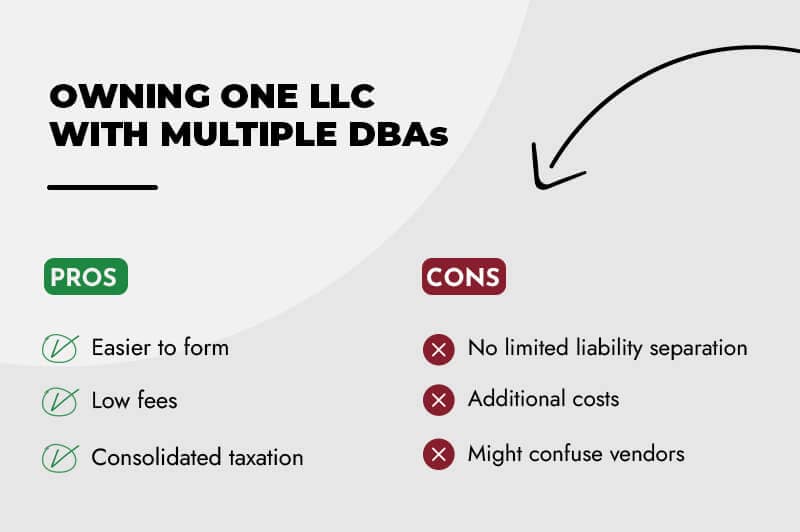

Owning One LLC with Multiple DBAs

Your current LLC can expand to meet demand by forming multiple DBAs (Doing Business As) rather than creating additional LLCs. A DBA allows your LLC to do business using a different name. This would enable you to enter other marketplaces, use alternative branding strategies, and sell products/services that deviate from your original LLC.

Depending on your state, DBAs are also known as assumed names, trade names, or fictitious names. Still, all allow you to run another brand under your original LLC structure. Owning multiple DBA comes with pros and cons; let’s find out what they are next:

Multiple DBA pros

Easier to form

As a DBA isn’t a separate legal structure from your LLC, it simplifies your business compliance requirements. For instance, you don’t have to file an Article of Organization for each DBA you own, and you only need one EIN.

Low fees

Using one LLC to run multiple DBAs reduces your administrative setup fees and running costs.

Consolidated taxation

Filing taxes is also less complex as you can report your multiple DBA profits and losses on your original LLC’s tax return.

How many DBAs can an LLC have?

Most states and counties have no restrictions on the number of multiple DBAs an LLC can have.

Multiple DBA cons

No limited liability separation

Any multiple DBA you own will gain the limited liability protection of your LLC, meaning you can do business with confidence.

However, suppose one of your multiple DBAs makes a mistake and incurs legal action such as litigation or debts. In that case, your original LLC could be at risk for all liabilities.

Additional costs per DBA

Owning one LLC with multiple DBAs is cheaper than owning multiple LLCs; however, there are additional costs.

Each DBA has a filing fee; you must place a notice of DBA registration in a local publication and, depending on your state, renew your DBA after a set period.

Some state examples of renewal are:

- DBA Texas renewal is every 10 years

- DBA Florida renewal is every 5 years

- But in some states, like for a New York DBA, you only register once

Harder to sell

A DBA isn’t a separate entity from your original LLC, so it could be harder to sell. It also doesn’t give you rights to the DBA name, so another LLC could use it unless you register it as a trademark.

But what if you want the option to sell or require separate liability protection? Here’s where option 2 can help:

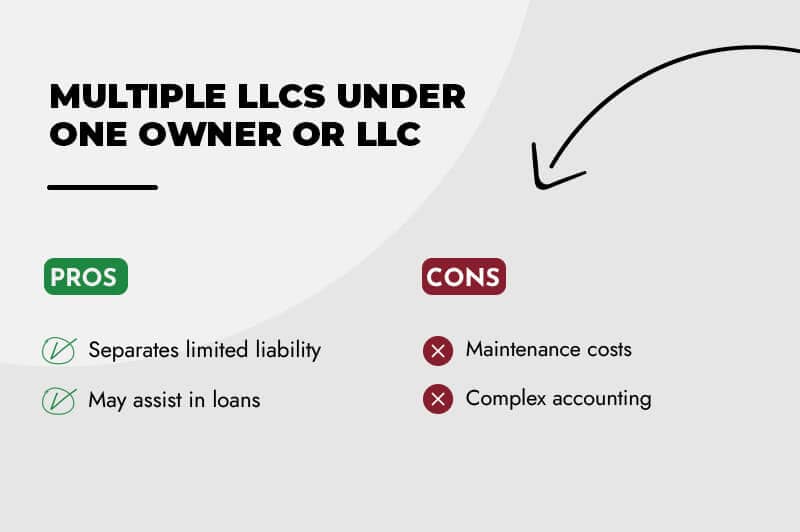

Multiple LLCs Under One Owner or LLC

Your next option is to create an LLC for each business you start and place them under one parent LLC, known as a holding company.

Holding companies are like silent partners: They don’t really do anything except own another company to control how it’s run.

A holding company acts as a parent (also known as an umbrella) LLC that owns assets relative to the multiple LLCs (known as subsidiaries). In contrast, the subsidiaries take care of all management duties.

Multiple LLC pros

Separates limited liability of each business

The most attractive element of owning multiple LLCs under one holding company is the separate limited liability it offers. As each LLC is a separate legal entity, if one should tank, your parent LLC is safe from any fallout, such as lawsuits and debts.

Possible tax perks

Any subsidiary owned 100% by a holding company could avoid paying tax on profits as revenue flows through to the holding LLC. Profits then become tax-free dividends which can stay in business until owners choose to use them.

May assist in loans and banking needs

Banks and other financial lending institutions rarely grant loans to new businesses because they like a safe investment. When you own a parent LLC with a solid financial background and reputation, it could help you get a loan for another LLC.

Easier to sell a subsidiary LLC

Any LLC you create using the “multiple businesses under one LLC” structure is a separate entity, making it easier to sell to another business.

Multiple LLC cons

The “multiple businesses under one LLC” option also comes with disadvantages, including cost and complex accounting. I advise you to consult an attorney or tax accountant before starting multiple LLCs.

Forming and maintenance costs

Forming and maintaining multiple LLCs can be costly and time-consuming as you must register and run each as a separate entity.

Some costs include:

- LLC formation fees (filing articles of organization for each LLC)

- Annual renewal charges (depending on your state)

- Registered agent fees (you can use one agent for multiple LLCs, but they’ll charge for each entity)

Administrative duties could include:

- Creating separate LLC operating agreements

- Opening multiple business bank accounts

- Maintaining different financial records

Complex accounting

Depending on your holding company’s ownership structure, running multiple LLCs makes for complex accounting. You might have to track and report each LLC’s debits and credits (expenditure and income) to the IRS on separate schedules (tax forms). This increases your tax filing forms, bookkeeping duties, and accountancy fees.

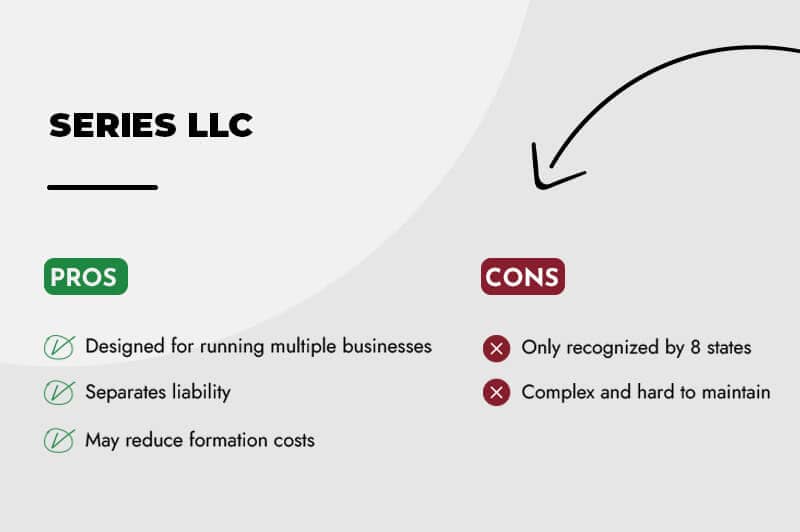

Setting up a Series LLC

At first glance, holding companies and series LLCs look the same. Both have a parent company with subsidiaries beneath them and provide asset protection and tax benefits. However, there are essential differences between them. A series LLC is more cost-effective, and each series is a distinct LLC with a separate name, bank account, and financial history.

You form a series LLC similarly to a regular LLC, except your articles of organization must state the authority to create a series. The original LLC of a series is known as the master, parent, base, or umbrella LLC.

Series LLC Pros

Designed for running multiple businesses

Series LLCs are flexible and those who start one have the freedom to create an operating agreement that applies to all the subsidiaries, avoiding possible disputes.

A master LLC can control its business affairs while also controlling the growth of any series under its umbrella. This makes a series LLC much easier to operate and manage.

Separates limited liability

As with a holding company, each subsidiary of a series LLC benefits from separate limited liability protection, securing the assets belonging to the series LLCs should another go into debt or face litigation.

May reduce formation costs

With series LLCs, you only have to register a master LLC instead of multiple LLCs, saving on formation costs.

Series LLC cons

Relatively new structure

Series LLCs are relatively new, so there’s limited legal precedent regarding conflicts, and the series LLC’s liability protection is yet to be tested in depth. The rules are still open to interpretation, as every state that recognizes the series LLC structure has its regulations.

Not recognized by all states

Series LLCs are not a national norm; it’s down to each state to decide whether to allow them. As of 2022, only 8 states do: Delaware, Illinois, Nevada, Iowa, Oklahoma, Utah, Tennessee, and Texas.

Puerto Rico also recognizes the series LLC structure. Still, as you know, that’s a U.S. territory, and the politics regarding its status remain complicated. Some states like California that don’t allow series LLCs do, however, enable a series LLC from another state to register and do business within their jurisdiction.

Complex and advanced structure to maintain

Maintaining the limited liability protection of each subsidiary and your parent LLC is a complex task. To ensure you do, each subsidiary must run separately from the other. To run each series separately, each will need a business bank account, business name, financial records, documentation of all transactions, and adequate capital.

One series LLC can share duties and costs with another, but all financial records and bank accounts must remain separate to ensure the owner/owners don’t expose themselves to additional liability.

Conclusion

I know there’s a lot to think about when tackling the question of owning more than one LLC. That’s why you should speak with an accountant, tax advisor, and attorney in your location before deciding on multiple DBAs, a holding company, or Series LLC. That said, I wish you outstanding success and admire your entrepreneurial spirit.