Summary of costs to form an LLC in Georgia

Are you looking for a quick summary of your LLC start-up registration costs? Below are the most common fees you can expect to pay:

| LLC filing fee | $105 |

| Business licenses & permits | Vary by municipality, but fees for a business license range from $10 to $1,000 |

| Filing a DBA (optional) | $25 per assumed name |

| Franchise tax | Exempt if business net worth is under $100,000; maximum of $5,000 |

| Annual report/Statement of information | $50 |

| Operating agreement (optional) | Up to $1,000 if you hire an attorney or a service |

| Registered agent service (optional) | $199 to $400 |

| Reserve business name (optional) | $25 |

Starting a Limited Liability Company (LLC) in Georgia is exciting, but it can also be overwhelming and costly. You can reduce your stress significantly by researching all steps involved or using an LLC formation service to take you through each step. This guide presents basic start-up costs when doing your Georgia LLC registration.

General steps and costs when forming a Georgia LLC

Keep in mind that costs can vary significantly by county and it may be necessary for administrators to occasionally increase prices to cover processing fees. Even so, the estimates below will help you plan your administrative start-up costs.

Naming your Georgia LLC

The Peach State allows new LLC owners to conduct a Georgia entity search at no cost. You also have the option of reserving a business name for $25 while you are still in the process of launching your LLC. You may wish to do this if you have your heart set on a certain business name and have concerns it may not be available when you are ready to claim it.

A common practice among LLC owners in Georgia is to register a single business name and then operate several branches of the company under different names. You need to file “Doing Business As” (DBA) paperwork to reserve additional names. The filing fee is $25 per Georgia DBA you request.

Filing articles of organization and annual reports in Georgia

Georgia requires all new LLC owners to file articles of organization before officially recognizing the company’s status. The current fee to do so is $105. You may see this referred to as an LLC filing fee.

The Secretary of State also requires LLC members to file an annual report outlining the status of the business and whether leadership has made any significant changes in the past year. Annual fees are $50, which you pay between January and April. This is required even when your LLC has not made any changes.

Appointing a registered agent

In Georgia, all LLCs are required to designate a registered agent Georgia that businesses can depend on to receive legal correspondence on behalf of the company. This person must be available during regular business hours and receive mail at a street address rather than a post office box. You do not have to pay a fee if you choose to be your own registered agent or appoint someone to the task.

Many LLC owners opt to use a registered agent service to keep their addresses private and free themselves from having to be available during regular business hours. The registered agent service receives and logs all official communication for the LLC. Fees for such services range from $199 to over $400 per year.

Creating an operating agreement

Georgia does not require LLC members to create an operating agreement, but doing so is highly beneficial. An operating agreement outlines such things as the names of members and their roles, the initial investments, and the formal process to follow when a member decides to leave the LLC.

You and your business partners do not need to file an operating agreement with the state if you choose to create one. You also do not need to pay anything to create the agreement if you decide to prepare it yourselves. Expenses can add up to over $1,000 if you seek help from an attorney.

Other annual and additional Georgia LLC costs

The above are some basic business costs you should expect to incur, while the fees below do not always apply to every situation.

Franchise tax

Georgia is one of several states that impose a franchise tax on most LLCs, partnerships, and corporations. Be careful not to confuse franchise taxes with income taxes, as they are not the same thing. The state government does not base franchise taxes on business income as the federal government does on income tax.

Despite its name, you do not pay a franchise tax for operating a franchise business in Georgia. The Secretary of State assesses the tax for the privilege of owning a corporate franchise or doing business within Georgia’s state lines. You do not have to pay franchise taxes if the net worth of your business is less than $100,000.

Georgia calculates the franchise tax amount based on a company’s net worth. The maximum amount assessed is $5,000 for a net worth that exceeds $22 million. You might want to consider hiring an accountant or tax advisor to help determine if you are liable for paying this tax.

Business licenses & permits

State, county, or local governments may require your business to obtain certain licenses and permits before you can officially begin serving customers. Licenses grant you permission to perform certain actions, while the purpose of a permit is to ensure your business follows established safety guidelines.

You do not need to obtain a business license at the state level when you operate an LLC in Georgia. However, you do need to apply for a business license if you plan to launch your LLC in any of these cities:

- Atlanta

- Columbus

- Macon

- Sandy Springs

- Savannah

Certain types of businesses require special business licenses. Common examples include bars, massage therapists, and pool halls. Here are some examples of other types of licenses or permits you may need to obtain in Georgia:

- Building and zoning, if constructing a new business

- Business tax number, if selling taxable goods or services

- Home occupation permit for home-based businesses

- Professional license for certain careers, such as accountant or interior designer

- Signage permit

Due to the large number of potential permits or licenses you may need to obtain, and the varying cost for each, your best bet is to contact the Georgia Secretary of State directly.

Annual report

A Georgia LLC annual report is required by the state to update any pertinent information and ensure compliance with all state laws. This report is due by April 1 each year, and the fee to file it is $50.

LLC fee

The initial fee to register an LLC is $100, and the cost is $50 each year thereafter to file the annual report.

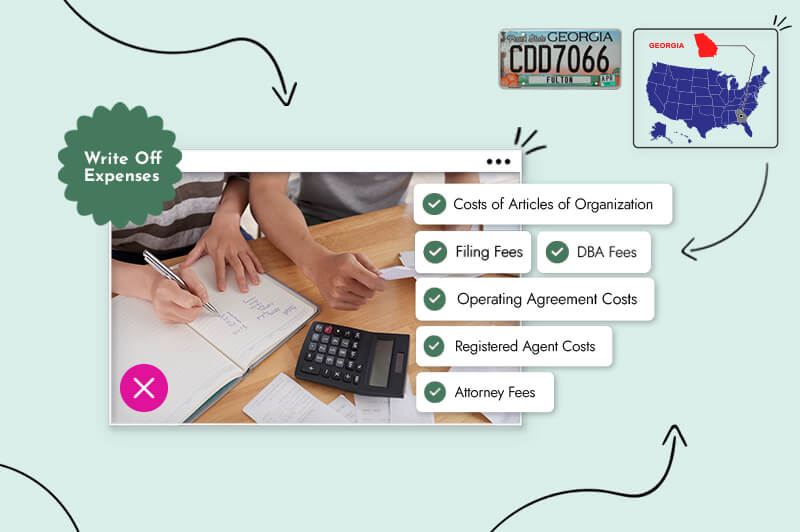

Expenses you can write off

Although you might be feeling overwhelmed at the number of fees you could potentially be responsible for paying to form your LLC, the good news is you can write most of them off on your federal tax return. The following represent the most common examples:

- Articles of organization fees v

- Attorney fees

- Costs associated with preparing an operating agreement

- DBA fees

- General filing fees

- Registered agent service fees

Georgia LLC state fees

Below are the main fees that can be relevant for LLCs in Georgia. Please note that this is the base fee and there’s an additional applicable service charge of $5 for online filings and $10 for paper filings.

| Fee type | Fee cost |

| Articles of Organization (LLC) | $105.00 |

| Annual Registration | $50.00 |

| Certificate of Authority to Transact Business in Georgia (Foreign LLC) | $225.00 |

| Certificate of Authority Late Filing Penalty (Foreign LLC) | $500.00 + fees imposed if registered correctly |

| Amended Certificate of Authority (Foreign LLC) | $20.00 |

| Amended Annual Registration | $20.00 |

| Penalty for Late Filing of Annual Registration | $25.00 |

| Articles of Amendment; Restatement | $20.00 |

| Name Reservation (30-Day) | $25.00 |

| Articles of Merger | $20.00 |

| Certificate of Conversion | $95.00 |

| Statement of Commencement of Winding Up (LLC) | No Fee |

| Certificate of Termination (LLC) | No Fee |

| Application for Withdrawal of Certificate of Authority (Foreign LLC) | No Fee |

| Application for Reinstatement (Domestic LLC) | $250.00 |

| Registered Agent Resignation | No Fee |

| Mass Registered Agent Name Change | (minimum 4 entities; $5.00 per entity) |

| Registered Office Address Change | ($5.00 per entity; minimum fee $20.00) |

Conclusion

Knowing the LLC formation fees you are responsible for paying and remitting the correct amount can be challenging. You can save money by choosing to complete the process yourself, but it may end up costing more in the long run if you miss deadlines or make mistakes. Hiring an LLC formation service can provide you with valuable peace of mind at this exciting yet stressful time.

FAQ

The filing fee for Articles of Organization is $105.

LLCs must file an annual report each year by April 1. The fee is $50.

It depends on your location and business type. Cities like Atlanta and Savannah require licenses, and some industries need special permits.

Yes. Optional expenses include $25 for a DBA, $25 to reserve a name, $199–$400 for registered agent services, and up to $1,000 for an operating agreement.

Yes. Fees such as filing, DBA registration, registered agent services, and attorney costs are generally tax-deductible as business expenses.