Georgia is famous for southern hospitality, peaches, abundant sunshine, stunning beaches, and outdoor living.

But the Goober state is also a great place to start a business, ranking 10th in CNBCs (America’s top states for Business) and 21st in US News (Best States Overall).

And the Area Development magazine ranked GA as the No. 1 state for business for the 9th consecutive year.

Pretty impressive.

So, if you’re looking for a state with low living costs, a robust economy, and abundant business opportunities, keep Georgia in mind!

We know starting a business can be a daunting task, so we created this step by step guide especially for you.

- Fine-tune your business idea

- Create a business plan

- Choose a business name

- Choose a business structure

- Set up Banking, Credit Cards, & Accounting

- Get Funding for your Georgia business

- Get Insured

- Obtain Permits & Licenses

- Find your team

- Market & Grow Your Business

- Open the doors!

Step #1: Fine-tune your business idea

Have you ever wondered how successful start-up owners choose their business ideas?

Well, here’s the thing, some are easy, like having a skill you can sell online, providing a service your locality demands, or following your passion and turning a hobby into an income.

But what if you’re stuck on coming up with a business idea?

It happens to most of us; fortunately, there are helpful strategies.

How to develop a business idea:

Hemmingway had an interesting approach to ideas (nope, not alcohol).

Sometimes, when typing away in his Finca Vigía farmhouse overlooking the Havana hills, Hemingway’s inspirational well ran dry (the booze did not). At these times, he’d remind himself:

“All you have to do is write one true sentence. Write the truest sentence, you know.”

And another bestselling idea was born.

But how does that help you fine-tune a business idea?

Here’s how.

Hemingway used real-life experiences to resonate with his readers; that’s why we love his books. Similarly, sometimes the best business ideas are born from real-life needs, like Airbnb and Uber.

It’s an approach that helps with writing but also works in business.

Here are some GA business needs to get your creative juices flowing.

Popular Georgia business ideas:

The Goober state, with its abundant forestlands, diverse landscape, and affluent cities, lends itself to certain industries, like lumber, agriculture, and tourism.

But it’s also ripe for small business start-ups. Here are some examples that suit local interests and specialties:

- Real estate, sales, and leasing

- Chimney repair (surprising, right)

- Christmas tree and accessory business (not so surprising, given all the pine trees)

- Construction business

- Candle business

- Specialty food business

- Technology consultancy

- Tourism consultancy service

- Tour guide

- Mobile bartending service

The takeaway is that Georgia supports product and service provider business ideas; however, before you start your business, you must validate it.

Validate your business idea:

You validate your idea to confirm that enough people want it at the right price, and to ensure you can afford the start-up costs and compete with your competitors.

How to do it:

- Confirm demand: Many start-ups fail because of a lack of interest and others because it’s the wrong location. Confirm the demand for your business in Georgia by taking the next step.

- Check growth statistics: Use trends.Google.com to see if your chosen idea is growing or declining in the Goober state.

- Assess your competitors: Get online or walk around your location to identify your competitors and determine if you can compete.

- Add up the costs: Calculate your expenses, projected revenue, and break-even point to establish what funds you’ll need to realize your vision.

- Review the regulations: Ensure your niche hasn’t strict GA regulations that might restrict your business from growing.

- Be honest: What skills or experience do you need to start your business idea? Do you have them, and if not, can you get them?

Put as much time and effort into validating your business idea because, as they say in Havana, “Dicen que lo que mal empieza, mal acaba.” They say that what starts badly, ends badly!

Step# 2. Create a business plan

A business plan helps validate your idea, determine your financial needs, create an effective marketing strategy, and convince lenders to invest.

All substantial reasons to write one, right?

But besides that, it also empowers you to make informed decisions, leaving fewer things to chance.

Here are the three ways your business plan achieves that:

Market research

MR blends economic trends and consumer behavior to validate your business idea and find your unique value point (the thing that makes your business special).

Market research also helps you understand your target audience’s needs, confirm your product or service meets them, and identify your competitors. Those are essential for every business.

Financial plan

A financial plan calculates your start-up and running costs, and most importantly, it predicts when your business will become profitable. And you’ll need those to get a loan.

A solid financial plan has five budgets that explain all of the above:

- Investment budget

- Financial budget

- Operating budget

- Cash flow budget

- Personal expense budget

Together, this helps ensure you can afford to enter your chosen marketplace, sustain your business, and get funding if needed.

Marketing plan

An exciting strategy you’ll use to create, implement, and track your various marketing strategies over a set time.

Your marketing plan can include several marketing strategies, on and offline, and all work toward achieving your business goals.

Choose a Location

The Area Development magazine named Georgia as the No. 1 state for business for 9 consecutive years, so starting a business in GA is a great idea.

But to establish a successful business, you must choose the right location.

For instance, will your new business rely on passing trade and high footfall, such as retail and restaurants? Or will it need access to highways and public transport?

Can you afford the costs relative to a city center or a popular shopping district, or might you need to locate in a more affordable area?

Important questions, right? That’s why you write a business plan!

And you must also ensure your preferred location complies with Georgia zoning laws.

Georgia zoning laws and regulations:

Zoning laws regulate what businesses operate in specific locations. Each GA county and city has its zoning regulations and provides the necessary licenses or permits.

Some include:

- Health and safety

- Environmental

- Building and construction

- Parking

- Signage

- Specific services or industries

You can refer to the SOS’s First Stop Business Guide for information on state-issued regulatory licenses. Also, learn how to get local licenses and permits by visiting your city or county’s official website, which you can find on the Georgia Chamber of Commerce.

Decide if You’re an online-only business

Online businesses are great; they give you a global audience, geographical freedom, and a platform for creativity.

I’m writing this from a cute cafe on an Italian island!

But to start an online business in Georgia, you’ll need more than a laptop and wifi, for instance:

- A website: Having a website is crucial for establishing the legitimacy of your business, and it’s where you’ll create a positive first impression and reassure consumers your business is authentic.

- Social media presence: Social media is essential for engaging customers and discovering their thoughts about your business. You can also use it for advertising and building your online community.

- Supply and distribution plan: Product sellers need a supply and delivery chain to remain in stock and expedite sales.

- Georgia-specific online business regulations: Any Georgia-registered business selling a product or service online in GA or out of state needs a sales tax permit.

- Tax laws may vary depending on your business: We’ll look at those later in the post.

Step #3. Choose a business name

Choosing a name for your Georgia business is as important as choosing your kid’s name.

Why?

It must communicate your brand’s purpose and captivate your audience’s imagination. And it plays a significant role in your branding, marketing, and customer retention.

(Okay, kids’ names are more important, but you get the point).

But unlike your child’s name, Georgia has naming rules you must follow:

Georgia naming requirements:

- It must be unique in Georgia: Your business name must be unlike any already registered in Georgia. Search the “Business Entity Search” on the Georgia Secretary of State’s website to ensure it is.

- Include the right suffix: If you form an LLC in Georgia, your business name must include “Limited Liability Company” or an abbreviation, like LLC.

- Business name reservation: When your name’s available, but you’re not ready to register, you can file a business name reservation to stop others from using it.

Using a DBA in Georgia:

A DBA “doing business as,” otherwise known as a trading name, is an alias you can use instead of your registered business or personal name. To use a DBA in Georgia, file your registration with your county’s Clerk of the Superior Court.

Step #4: Choose a business structure

The next essential step to starting a business in Georgia is choosing your business structure.

A business structure is how you form your formal or informal company. And your choice determines which rules apply when registering your business, how you’ll run it, pay tax, and your level of liability protection.

The business structures available in Georgia include sole proprietorships, partnerships, limited liability companies, and corporations.

The common business structures

Sole proprietorship:

A sole proprietorship is a simple business structure without incorporation or separation from its owner. All business profits belong to the owner, as does any liability in cases of legal action or debts.

General partnership:

A GP is an informal and unincorporated business structure involving multiple owners. Like sole proprietorships, it lacks the liability protection of a formal business structure.

Limited liability partnership:

A limited liability partnership (LLP) is a formal business structure that provides partners with certain legal protection against liabilities.

Licensed professionals, such as accountants, attorneys, and architects, use the LLP in states where they can’t form a limited liability company (LLC).

Limited liability company:

An (LLC) offers the advantages of a corporation’s liability protection with the flexibility of a partnership or sole proprietorship. Many small businesses opt for the LLC structure because of its simple maintenance requirements and favorable tax treatment.

Learn more about what is an LLC here.

S corporation:

An s corporation is an independent legal entity owned by its shareholders who enjoy limited liability protection. However, corporations follow more formal regulations than LLCs but are very attractive to investors because they can buy stocks in the company.

Tax advantages of each business type

The key benefit to a sole proprietorship, general partnership, limited liability partnership, LLC, and an S corporation is the pass-through tax structure. This tax structure negates corporation tax, instead passing all profits and losses to the owners, members, or shareholders who report them on their tax returns.

When you’ve chosen your business structure, file your registration with the Georgia Secretary of State.

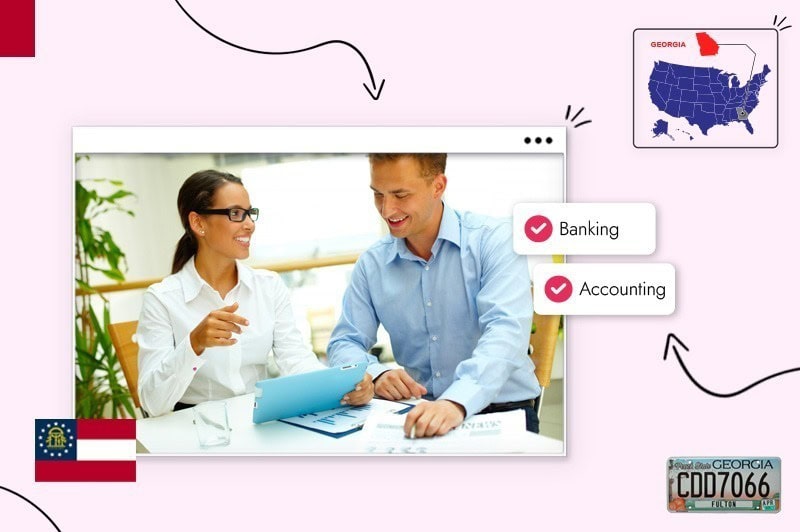

Step #5. Set up banking, credit cards, and accounting

Using business banking and credit card accounts can help every business simplify their bookkeeping and, for legal entities, maintain their liability protection by not piercing the corporate veil.

There are other benefits as well:

Business bank account

- Separates personal assets from business assets

- Simplifies tax filing

- Provides credibility to your business with vendors and clients

- Can provide a business overdraft when you have a business bank account

Business credit card

- Separate business and personal expenses

- Build your business credit history, which can help raise capital, such as a business loan, at a favorable interest rate.

Business accounting

Accounting helps track your business performance and simplifies your quarterly estimated and annual tax filings.

Accounting software assists you in running your bookkeeping duties, such as online payroll taxes, downloading bank and credit card transactions, sending invoices, and tracking employees’ working hours.

Step# 6. Get funding for your Georgia business

The saying “Never a lender or a borrower be” is good advice, but unsurprisingly, most entrepreneurs need cash to start a business in Georgia, and you might too.

If so, you have several options:

- Bootstrapping: An apt name that means using your savings and any income to start and support your business until it makes a profit.

- Friends and Family: If you’re lucky enough to have friends or family loan you money, that’s great; just ensure you write a clear contract detailing the repayment terms to avoid losing important relationships.

- Small Business Loans: SBLs for start-ups are like the chicken and egg scenario (my 9-year-old says, “Obviously the chicken dad, duh.” Evolution apparently)! Most banks require a solid credit history before loaning, and those that lend to start-ups charge hefty interest rates.

- Small Business Grants: I recently read an interesting statement (on a government website of all places); it said, “You’re more likely to find the Loch Ness Monster swimming in your bathtub than get a small business grant.” Jeeze! Sure, I’ll grant you (pun intended) that grants are difficult to get but not impossible, and we’ll look at them in just a moment.

- Angel Investors and VCs: VCs and angels invest in large and small businesses for a percentage of ownership. The difference is that VCs take an active role in the company, while Angel investors stay uninvolved.

Georgia grants and state incentives:

Small business grants are non-repayable cash investments, whereas incentives are usually tax deductions or credits.

Most grants are only available at the local level (not federal), and you apply with the appropriate state, county, or city department.

Some GA resources:

- SBA Early Stage Innovation Fund: Helps access capital to grow your business and create employment.

- Georgia’s Regional Commissions: Provides business loan assistance.

- US Grants: Georgia’s small business grants application portal.

- Georgia Community Affairs: Assists with economic development.

- SBA Georgia: Small Business Administration-backed loans.

Step #7. Get insured

You don’t have to be perfect in business, just insured!

Jokes aside, insurance is essential for most businesses, and Georgian law requires some to have specific policies.

Common business insurance policies include:

- Liability insurance: Covers your business for any legal actions resulting from accidents, injuries, or negligence by you or your employees to a client’s property and injuries at your workplace.

- Professional liability insurance: Protects against claims of professional negligence, omissions, errors, or other issues arising when providing professional services, such as accountancy or financial consultancy.

- Commercial property insurance: Protects your business property from fire, weather damage, or theft costs.

- Umbrella insurance: Helps cover any excess expenses not covered (read the fine print!) in your other insurance policies.

Georgia grants and state incentives:

The Goober State requires businesses to have two types of insurance.

- Worker’s compensation: GA businesses that employ 3 or more people must have worker’s comp to cover medical care and loss of earnings due to work-related injuries or illness.

- Commercial auto insurance: For all company vehicles and drivers.

Contact the Georgia Office of the Commissioner of Insurance and Fire Safety Department for further business insurance resources.

Step #8. Obtain permits & licenses

To operate your new business; you must comply with federal, state, and local government regulations, often involving getting one or more business permits and licenses.

For example:

- Any business operating in Georgia requires a general GA business license (business tax certificate) issued by municipalities or cities.

- Running businesses in multiple GA cities requires a business license in each location.

- Businesses in certain industries, such as aviation, agriculture, or the sale of firearms, or tobacco, need a federal business license.

Depending on your niche, you might also need industry-specific licenses or permits to trade in your location. Contact your local county clerk’s office, the Georgia Chamber of Commerce, or use the Georgia Municipal Association’s search tool to see which you need.

Federal income tax and Georgia local tax

When you start a business in Georgia, you must register and pay the correct taxes, including city, state, and federal.

Here is a quick breakdown of taxes in Georgia:

- Federal taxes: All businesses must pay federal income tax at 21% for corporations, ranging from 10% to 37% for pass-through entities.

- Self-employment tax: Business owners must pay self-employment tax at 15.3% of their net earnings.

- Georgia corporation tax: All corporations must pay the GA 5.75% corporate income tax.

- GA income tax: Georgia charges a graduated income tax ranging from 1% to 5.75%.

- Sales tax: The GA state sales tax rate is 4% plus local sales tax.

- Franchise tax: Corporations and LLCs must pay an annual franchise tax charged as a percentage of their net worth.

You can visit the Georgia Department of Revenue’s website for more information on GA taxes.

Georgia-specific regulations:

Georgia has specific regulations business owners must follow, such as:

- Registering for unemployment and disability insurance.

- Reporting your wage and tax information to the Georgia Department of Labor.

- Anyone selling products or services online, in-state or out-of-state, must get a “sales and use tax number” and remit sales tax.

Step #9. Find your team

Finding the right people to join your team can be a tough challenge. After all, you want individuals who believe in your mission, suit your brand culture, and have the skills you need to succeed.

But it’s a challenge most business owners must overcome, whether you hire full-time or outsource.

People are the backbone of the business

Your employees are an asset you must invest in, nurture, and encourage to be the best they can be.

Why?

Because when you create a culture that inspires growth and gives your team the tools and skills they need to support you, your business stands a better chance of achieving its goals.

It’s not only full-time employees who support your business; for instance, a seasoned accountant or business mentor could provide gems of wisdom that help you on your journey.

Comply with Georgia payroll regulations

Before hiring, you must also get an Employer Identification Number (EIN) and learn about GA payroll taxes.

For instance, Georgia employers must follow state and federal regulations when managing their payroll, and that requires certain steps, such as:

- Reporting new employees (and rehired) to the Georgia New Hire Reporting Center.

- Paying the Georgia minimum wage of $5.15 per hour, but most GA employers must pay the federal minimum wage of $7.25 per hour.

- Documenting all employee payroll records.

- Adhering to the federal Fair Labor Standards Act (FLSA) because no GA over-time state regulations exist.

Hire contractors

Many new businesses avoid payroll regulations by hiring contractors, but there are rules to follow.

For example, you can only hire contractors for specific jobs, not full-time, and they must be independent of your business.

Before you hire, though:

- Contact the Better Business Bureau to ensure there are no serious complaints against your contractor.

- Ask for your contractor’s license and ensure it’s valid by checking with the Georgia Secretary of State.

- Always create a contract with written warranties, guarantees, and start and completion dates.

Step# 10. Market & grow your business

Marketing helps create public brand awareness, engage your target audience, build trust, and turn them into customers.

So it’s important!

Invite customers to opt into a mailing list or newsletter

You can create a brand community by asking people to join your newsletter for exclusive updates and offers that go directly to their inboxes.

But you must use interesting calls to action on your website and social media platforms to engage your target audience and convince them to opt in by highlighting the benefits they’ll receive, such as insider discounts and early access to new products/services.

Consider making special offers to attract your first customers

Capture people’s attention by offering special promotions that are hard to resist. Like exclusive discounts, limited-time offers, or bundled deals to create a sense of urgency and value.

Maximize this strategy by highlighting the unique benefits your customers will receive and engage using your email opt-in CTA, social media platforms, and traditional local advertising techniques.

Look for local businesses or brands to collaborate with

A great way to attract your first customers is to collaborate with nearby businesses or brands to expand your reach and connect with a wider audience.

Look for partners that complement your business or target a similar audience, then join marketing efforts to cross-promote one another’s products or services.

Invest in word of mouth (happy customers attract each other)

Word-of-mouth marketing is when one person tells another about their great experience with your brand; it’s the best way to grow your business.

To create it, deliver exceptional products, services, and customer experiences that leave a lasting impression. And encourage your happy customers to share their positive experiences with friends, family, on social networks, and wherever you show your reviews.

Pay attention to online reviews; ask happy customers to review you

Positive reviews are the ultimate way to enhance your reputation and convince people to use your brand.

Always ask happy customers to leave reviews on your website, social media platforms, Google My Business listing, and relative industry-specific review sites.

It’s important to check your reviews and respond to them, especially if negative, as it shows you care about your customers.

Create unique, helpful content to showcase your activity

By providing high-quality content, you establish yourself as a trusted resource and build credibility within your industry. It’s also how you’ll attract and engage your audience, reinforce your brand’s authority, and build customer loyalty.

Develop content that showcases your industry knowledge and expertise using blog posts, articles, videos, or infographics that offer valuable insights, tips, or solutions to common problems your target audience has.

Step# 11. Open the doors!

Plan a successful launch event

A launch event is an occasion that debuts a new product (or business) on the market. It aims to build a buzz around your start-up and create brand awareness with your target audience.

How to plan your launch event:

- Use social media to spread the word.

- Set a date and time that works for guests.

- Choose a venue that suits your brand’s personality.

- Arrange fun entertainment for event-goers.

- Use decor that fits with your branding.

- Provide opportunities for guests to engage with your products or services.

Conclusion

That, my friend, is how to start a business in Georgia.

Take it slow and embrace your journey, as the joy is in the process.

And use the tips and links in this post to relevant GA agencies to help you reach your destination.

As Ray Charles sang, “In peaceful dreams, I see the road leads back to you” (you being Georgia).

All you’ve got to do now is find your road and get walking.

FAQ

In Georgia, state fees can vary depending on the type of entity you form. According to the Georgia Secretary of State’s website, expect to pay $110-$285 to start a business in Georgia.

All GA businesses must register with the Georgia Secretary of State’s office, and some niches need local and federal operating licenses.

Filing an LLC in Georgia costs $100 and takes around 2-3 weeks, but you can expedite the process for $50.

Yes. Anyone over 18 (without a criminal conviction) with a physical address inside GA can register as an agent in Georgia.