Nonprofits are a great way to make a difference in the lives of others and give back to the community. Whether it’s an organization such as the Humane Society or the Salvation Army, most people recognize the impact these organizations make and value their contributions.

However, before you start your own nonprofit, it’s essential to understand what it is and how it differs from other for-profit organizations. For example, starting a nonprofit is often different from how you would start a small business. This article will outline the steps to set up a nonprofit successfully.

Do Your Research

Before starting a nonprofit, you’ll need to figure out what you want it to accomplish and what kind of impact you want it to have.

Perform a Needs Analysis

The first thing to do when starting a nonprofit is to conduct a needs analysis. This will help establish what the community and your target audience need and determine whether there’s a market for your product or service.

Additionally, you’ll need to find out if other organizations are already providing the type of services you want to offer. If so, you’ll need to determine why your organization can do better and how it will succeed where others have failed.

To help with this, consider the following questions:

- Who are your target audience members?

- What are the possible problems you can solve for them?

- How will your organization be different from others offering similar services or products?

By asking yourself these questions, you’ll be able to identify a need and develop a plan of action for success.

Conduct Competitor Analysis

Conducting a competitor analysis is crucial to understanding how your nonprofit stacks up against the competition, which will include for-profit businesses that offer similar products or services.

You should be able to identify what makes your nonprofit different, and why people should choose your organization over the others. Moreover, you’ll be able to set yourself apart in the future by developing a specific plan that will help you reach your goals.

Consider key strategies to get ahead of your competition online and offline, such as:

- Identify Your Unique Selling Point (USP) — What do you offer that other organizations don’t?

- Design a Compelling Brand — How will your brand attract attention and convey your unique selling point?

- Focus On Your Customers — Determine who your ideal customers are and what makes them tick.

- Use Social Media — Use social media to connect with your target audience.

- Create a user-friendly website — Consider how you will attract people to your site. How can it facilitate a seamless experience for them once they’ve arrived?

- Invest in Search Engine Optimization — Ensure your nonprofit is easy to find on the web with the help of SEO.

Once you’ve gathered such information and started developing your strategy, you’ll know what needs to be done to help your nonprofit succeed.

Find Support

When building a nonprofit organization, finding the right support system is essential. Consider working with donors who are passionate about your cause. Not only will this allow you to secure funds early on, but it will also provide you with insight into how to raise awareness.

If you’re unsure of how to find support, consider asking yourself the following questions:

- Who is passionate about your nonprofit’s cause?

- What type of donors do you want to work with?

- Do these donors have experience working with other organizations in a similar capacity?

Next, develop a strategy for how to successfully pitch your idea to investors and secure funding. Consider the following tips when developing your presentation:

- Tell a story.

- Tailor your pitch to your audience.

- Provide details and specifics.

- Prepare for questions.

- Follow up.

Once you’ve successfully secured the funds that are needed, you’ll be able to focus all your energy on building an exceptional nonprofit organization.

Consider the Alternatives

If you’re unsure about the nonprofit route, there are alternatives to help you operate in a nonprofit capacity.

Instead, you could opt for:

- A fiscal sponsorship. This is an independent agreement where the sponsor accepts tax deductible donations and grants on behalf of the sponsored project or organization. Projects may remain under financial sponsorship for as long as they desire or eventually achieve tax-exempt status.

- A donor-advised fund. A donor-advised fund is a charitable giving vehicle. The sponsoring organization, typically community foundations or public charities, advises donors on making contributions and then allocates the funds among other nonprofits.

- Becoming a member of an existing organization. If a nonprofit isn’t an option, perhaps joining an existing organization is a better alternative.

- Working as a consultant. As a consultant, you’ll be able to work closely with the organizations that interest you and share your knowledge.

Although you may not be able to establish a nonprofit organization, there are lots of options available to assist you in achieving your objectives.

Build Your Foundation

Once you’ve done your research and established a basic understanding of how to build a nonprofit organization, it’s time to start building your foundation.

Specify Your Mission Statement and Business Plan

Your mission statement and business plan should be the backbone of your nonprofit’s foundation.

Your mission statement should be clear and concise. It should also be able to provide basic information about your cause, identify who you’re serving, what services you’ll offer, and what sets you apart.

For example, the mission statement of the American Red Cross is to “prevent and alleviate human suffering in the face of emergencies by immobilizing the power of volunteers and the generosity of donors.” Their mission statement tells you why and what they do.

Your business plan will outline how your nonprofit will achieve its goals. In addition, it should include details about how your nonprofit will accomplish its vision and any necessary steps.

Before writing your mission statement and business plan, make sure to:

- Know your audience.

- Get input from people who are passionate about your cause to ensure you’re providing the necessary information your audience needs.

Once you’ve put together a compelling mission statement and business plan, make sure you share them with everyone involved. By doing so, you’ll be able to answer any questions or concerns they may have.

Determine Your Business Entity

After you’ve written your mission statement and business plan, it’s essential to determine your business entity.

Business entities are the many forms of legal structures businesses may use to safeguard their assets — the kind of business entity you pick impacts everything from day-to-day operations to taxes and personal liability.

Common types of business entities include:

- Sole Proprietor. In a sole proprietorship, an individual owns and operates the business.

- General Partnership. A general partnership is when two or more individuals own a business without incorporating it as an entity.

- Corporation. A corporation is a legal entity that’s completely separate from the owners and shareholders of the business.

- Limited Liability Company (LLC). An LLC is a mix between a partnership and a corporation because it provides members with limited liability protection yet still allows them to act like owners.

However, nonprofits cannot be all of these structures. They may only be either a corporation or an LLC. Though forming a nonprofit limited liability company can be complex as there are various types of LLC structures.

Even so, an LLC is a more flexible structure. It offers corporation-like benefits without all the filing, insurance, and other organizational fees associated with incorporating.

This means you have personal liability protection from business debts and obligations while having greater flexibility on how you organize your management.

Develop Your Brand

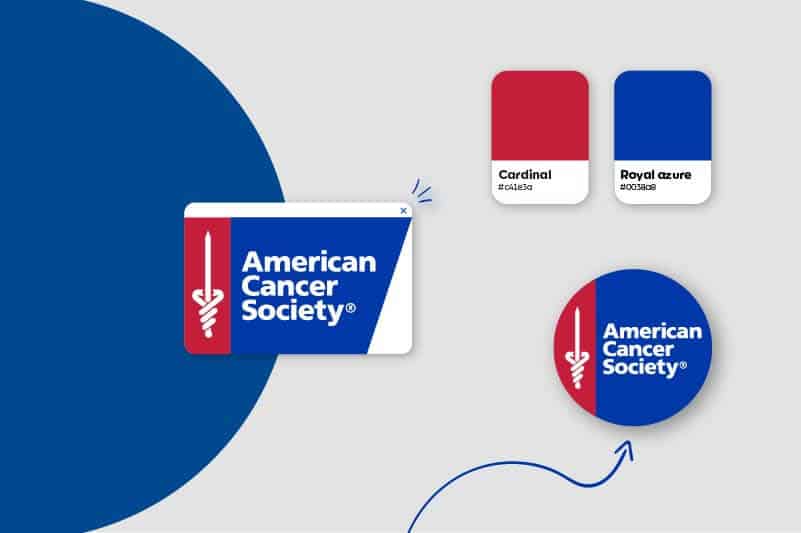

Creating a brand and logo is one of the most important steps in establishing your nonprofit. Your nonprofit logo design should be compelling and identifiable to attract donors and potential clients.

Moreover, developing a cohesive image will have a greater impact on your brand awareness efforts and credibility and encourage others to get involved and support your cause.

If you’re just starting, it can be challenging to develop a design that embodies the entirety of your organization’s mission statement. Therefore, consider having multiple versions of your logo with the help of a logo design tool or graphic designer to simplify the process and give you more options.

Incorporation and State Regulations

Establishing a nonprofit corporation is similar to starting a regular corporation, except that nonprofits must complete additional procedures with the IRS and their state tax department. The main difference between incorporating and having an LLC is the tax-exempt status, which may be necessary depending what your nonprofit does.

The most common incorporation status for nonprofits is a 501(c)(3) organization. If your nonprofit is a 501(c)(3), you’ll still be required to file additional forms with your state unless they automatically grant tax-exempt status.

State regulations for nonprofits vary from state to state. Each has its own set of corporate laws, franchise taxes, and reporting requirements that you should familiarize yourself with.

File for Federal Tax-Exempt Status

To open bank accounts or apply for financial assistance, you’ll need to obtain an Employer Identification Number (EIN) from the IRS. Since you’re not allowed to earn profits, your tax forms will be significantly simpler.

There are some forms that a nonprofit should consider when starting:

- Form SS-4 — This form is needed to obtain a Federal EIN.

- Form 1023-EZ — This form must be filled out to apply for recognition as a tax-exempt organization under Section 501(c)(3).

- Form 2848 — If a third party represents your company, you must file this form for power of attorney explicitly authorizing the individual to act on your behalf.

- Form 5768 — This document is for eligible organizations to choose whether they want to use the provisions of 501 of the code related to how public charities can spend money to influence legislation.

Filing for 501(C)(3) Tax-exempt Status

Since most donors are more likely to contribute money if they can claim a tax deduction, many nonprofits seek 501(c)(3) status. Nonprofits that do not register properly risk losing their tax-exempt status and potential donors.

Ongoing Compliance

Although your nonprofit is operational, it must stay current on filing the necessary forms and completing any pending tasks.

Register With Your State and Local Agency

The state where you establish your organization may require you to register with their government agencies.

Most states require nonprofit corporations to update their basic contact information, names of responsible parties, and registered agent regularly. If a nonprofit has staff, it must file initial and ongoing employment paperwork with the state Department of Labor.

Additionally, most states also demand charitable organizations that seek donations to register with the state and report on their fundraising operations.

Annual Reporting Requirements

In most states, nonprofit corporations formed or registered to do business in the state are required to submit a bi-annual or annual report with the government. The filing is sent to the appropriate state agency. If a corporation does not file, it may risk losing its “good standing” in the state.

Building a nonprofit organization is a complex process that, when done right, it is worth the time and effort.