One of the most crucial managerial decisions you’ll make when creating an LLC is whether you run it as a member-managed or manager-managed business.

Your decision depends on several factors, including your business type, model, and the number of owners.

And there’s another factor to consider. What do you value more, time or control?

Because while a member-managed LLC gives you control, it takes your time, whereas a manager-managed gives you time but takes control!

Let’s examine the pros and cons of member-managed vs. manager-managed LLCs, so you can decide which is best for your business.

Management of an LLC

The LLC structure is popular with small to medium business owners due to the ease of formation, limited liability protection, and management flexibility.

There are 2 mains types of LLCs, single-member, and multiple-member. LLC owners are known as members but can also be employees when providing services to the business for compensation.

Members can choose to manage their LLC together or hire a manager to run it for them. An LLC manager runs the daily operations of the business, can make critical decisions, and take the following actions without conferring with an LLC’s members:

LLC manager duties can include:

- Day-to-day operations.

- Implement marketing and business planning.

- Making financial decisions.

- Enter business agreements.

- Have signatory rights.

- Open a business bank account.

- Hire or fire employees.

- And buy and sell business assets.

As you can see, an LLC manager holds the keys to your business, so you must choose yours wisely.

New LLCs include their management decision on their articles of organization when forming an LLC and filing it with their state. And define the management duties, operations, rights, and responsibilities in their operating agreement.

Many states have different regulations, so contact the Secretary of State’s office where you’re forming your LLC to find out more.

Member-Managed LLC – What It Means

Member-managed LLC is the default designation in most US states, so you don’t need to choose it when forming your business. A member-managed LLC means all members handle the daily organizational operations of their business.

Each member has managerial power relative to their percentage ownership, so if an LLC has 2 owners, each with 50%, they’ll have an equal say.

Multi-member LLCs with over 2 members with varying percentage ownerships can outline the managerial rights, such as voting and financial decision-making in their operating agreement.

Before choosing a member-managed LLC status, consider the pros and cons:

Pros of member-managed LLC

- Each member has a say regarding management decisions.

- The simple structure of a member-managed LLC suits small businesses.

- Excellent choice of brick-and-mortar businesses and retail.

Cons of member-managed LLC

- Managing an LLC is a full-time job.

- Member-managed LLCs can find it hard to attract investors.

- Too many members with an equal say can lead to unsolvable disputes!

Who does the member manager LLC structure suit?

The member-managed structure suits single-member LLCs and multi-member LLCs with a small number of owners with equal ownership percentage.

But what if you’re a multiple-owner LLC?

Here’s where the manager-managed LLC could suit your business.

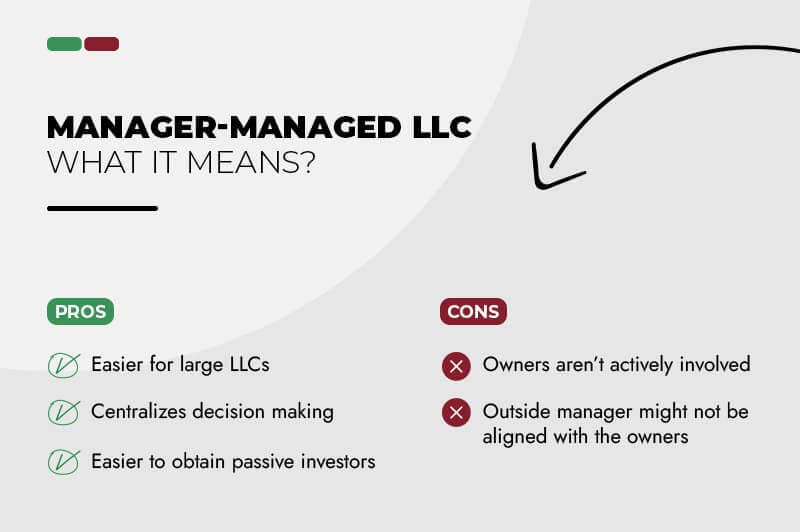

Manager-Managed LLC – What It Means

A manager-managed is where an LLC’s owners’ hand over managerial duties to a designated manager, relieving themselves from the daily running of the business.

The manager-managed structure is less common than a member-managed LLC as many small to medium business owners like to keep control, and it isn’t the default structure in most states.

Control is an essential factor to consider when mulling the question of “member-managed vs. manager-membered” because when you designate a manager, you relinquish most of it.

However, LLC members keep the right to dissolve their business and sack their manager, but neither is an attractive proposition.

Maybe now you’re asking, “can a member be a manager” yes, they can. And it’s a great option for multiple member LLCs as you aren’t bringing in an outside manager (known as a professional manager) with zero investment in your business.

The pros and cons of a manager-managed LLC:

Pros of manager-managed LLC

- Centralizes all LLC decision-making.

- Enables the manager to make quick decisions without the members’ approval.

- Makes it easier to run a multiple-owner LLC.

- Passive investors (silent investors) often prefer a manager-member LLC for the 3 reasons above.

Cons of manager-managed LLC

- Members give up control and have little say in operating decisions.

- An outside manager might not have the same feel and understanding of your business model.

- Professional managers have no financial investment in your business, so they only lose their paycheck if it fails.

- Managers need a salary, with the extra cost often too much for smaller businesses.

Who does a manager-managed LLC suit?

The manager-managed LLC structure suits multiple owner LLCs with many members or investors. And business owners with expansion plans but little time for daily management duties.

So Which Management Structure Is Best for You?

The answer to “member-managed vs. manager-managed LLC, which is best for you”? Comes down to the LLC management structure that best suits your business model and current situation.

Okay, that’s a given. But it’s also true, so go slow when considering a member-managed or manager-managed LLC and consider all the factors and implications.

Here’s a recap of the management structures and some FAQs to help you make the right decision for your business:

Member-managed LLC considerations

- Excellent choice for smaller businesses with members who want involvement in the daily decision-making process.

- You keep control over your baby and run it your way.

- It could become the “too many cooks” scenario because if members disagree on what’s best for the LLC, it could be bad for the business.

- Not attractive to investors for the above reason.

- Drains precious time away, leaving little left for anything else.

Manager-managed LLC Considerations

- Professional managers simplify the daily decision-making process of an LLC.

- Ideal if some members want a passive role or lack business experience.

- Regarding experience, most entrepreneurs know their industry, products, or services inside and out, but that doesn’t mean they’ve got the know-how to run a business. An experienced professional manager could be a great asset.

- An excellent option for businesses transferring ownership, IE a family-run business where mom and pop want to keep control while the kids learn how to run it.

FAQ

There’s no set rule, and the “should” depends on if an owner wants to keep control and run the daily business activities or delegate a more experienced professional manager.

An LLC can have unlimited managers. But multiple managers could become numerous complications.

Managers aren’t liable for an LLC’s debts. But could be liable to the LLC if they breach their fiduciary duties or break the operating agreement.

Yes, they do.

LLC managers owe specific duties to an LLC and its members. Fiduciary duty means the manager must act in favor of the LLC, including a duty of loyalty and care.

Managers who breach their fiduciary duties might be liable to pay compensation to an LLC and face dismissal.

Mostly, LLC owners are members but can become employees through an employment agreement that lists them as providing services to the LLC in exchange for compensation.

Most states allow you to switch management structures when you like, and some will require extra paperwork and state filings.

And if you do switch, ensure to update your operating agreement relative to your new management structure.