In short, it’s unlikely that your Washington business will pay only the $90 base fee. There is a large and somewhat complex structure of all the fees that an enterprise might be faced with.

This may sound daunting, but, fortunately, the Washington Department of Revenue has provided a facility to help you navigate the process. It’s called the Business Licensing Wizard. With the DOR’s Wizard, it’s a lot simpler than in many other states to determine exactly what licenses and endorsements you need and to apply for them.

The post discusses who needs to have a Washington business license, what licenses and endorsements can cost, and how to use the Business Licensing Wizard to identify and apply for the credentials your business requires.

Do you need a business license in Washington?

Only the smallest and simplest sole proprietorships are exempted from Washington business licenses. You are required to register with the Washington DOR and obtain a business license if any of the following apply:

- Your gross income is $12,000 per year or more.

- Your business is required to pay taxes and fees to the DOR.

- You sell a product or service that requires you to collect sales tax.

- You plan to hire employees within the next 90 days.

- You are doing business under a name other than your full legal name.

- Your business buys or processes specialty wood products.

- Your business meets Washington’s reporting requirements for a Physical Presence Nexus.

- Your business, by its location in the state or line of business, requires city, county, or state endorsements.

As you can see, almost every Washington business needs a license or licenses.

How much does a business license cost in Washington State?

As previously mentioned, the basic business license in Washington costs $90. In addition, you may need to pay a fee in every city and town where you do business. The dollar amount varies by locality, and most are $75 or less, but some are as high as $250. There is a Washington City Fee Sheet that lists these.

The state requires endorsements for certain lines of business, and these require an additional fee. Examples are tobacco, cannabis, liquor, some agricultural products, debt collection, transportation, and certain professional endeavors such as architecture.

Washington’s Business Endorsement Fee Sheet details these. Most are in the hundreds of dollars, but some are as high as $1,000 or even more. Many require a fee for every location where a company does business.

In addition, most of these licenses and endorsements require renewals.

Which business licenses and endorsements do I need?

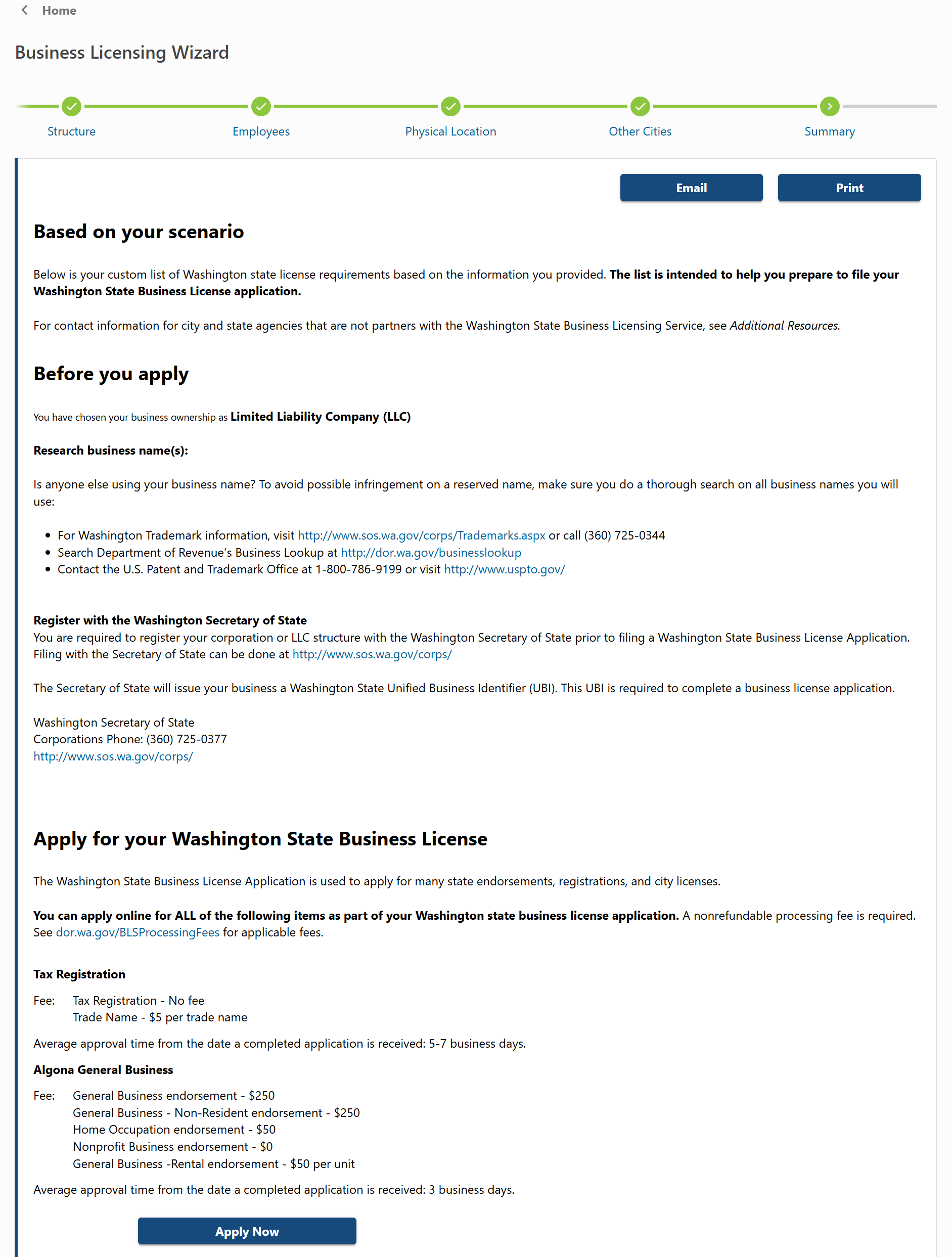

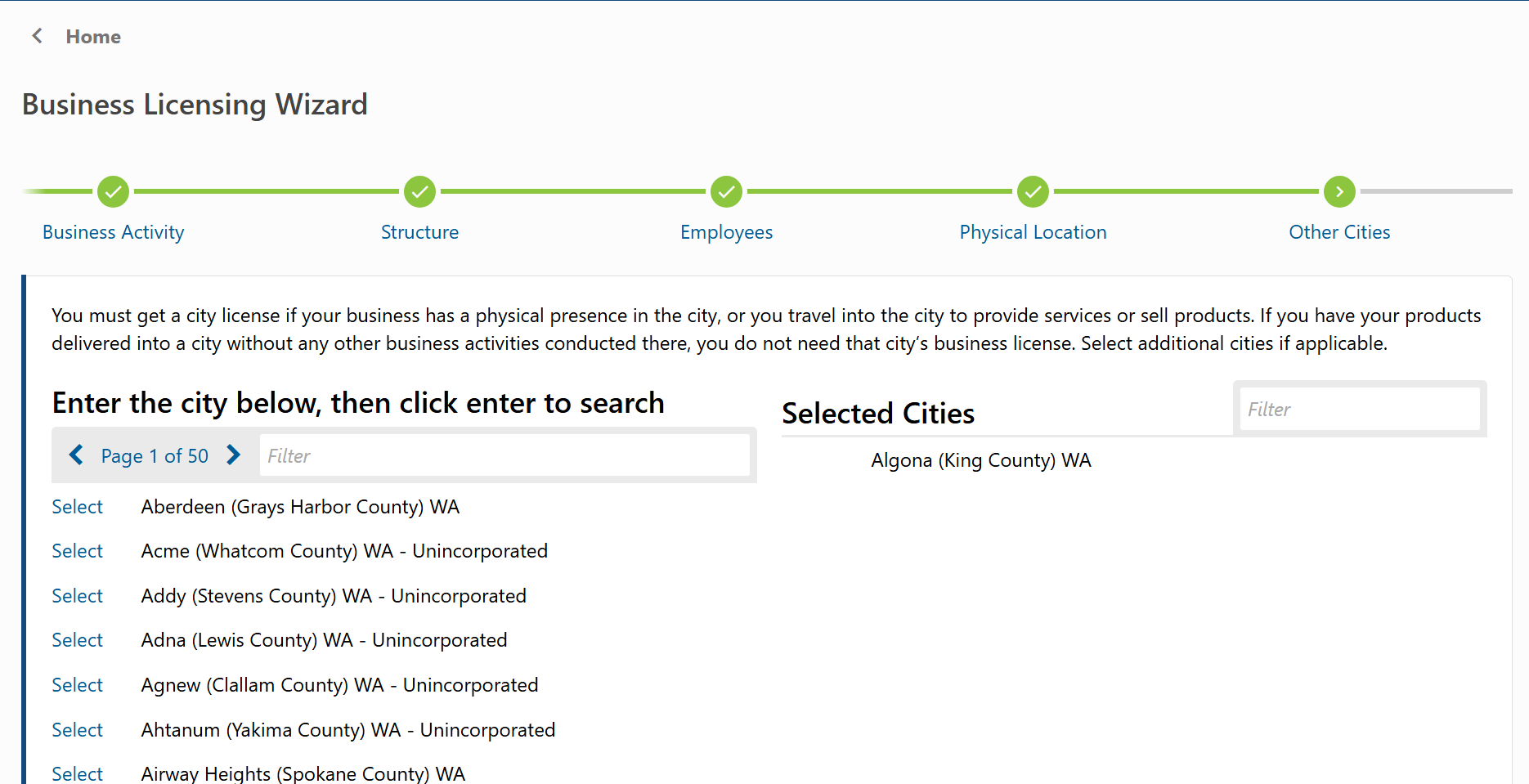

The easiest way to determine which of these you need is to use the Washington State DOR Business Licensing Wizard. You input your lines of business and your proposed business locations, and the Wizard generates a list of required additional endorsements along with instructions for applying and some helpful tips about business licensing.

When you receive your Washington business license, you’ll also receive a Unified Business Identifier (UBI), a unique ID that you will use whenever you file taxes or make any changes to your business with the DOR.

Get started at the Wizard’s introductory page:

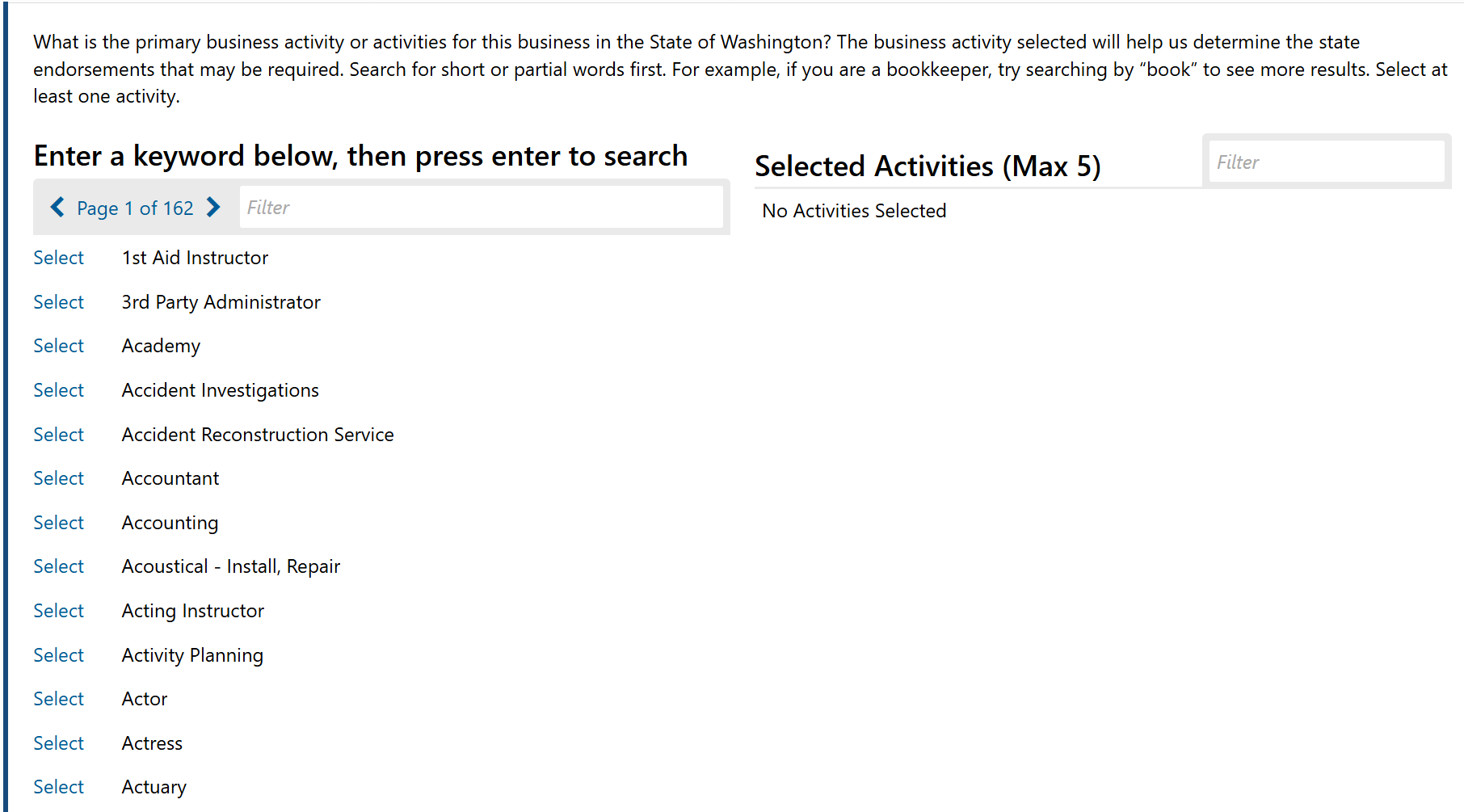

Select one or more of the listed business activities, or enter something in the text box. Press Next. You’ll see this page:

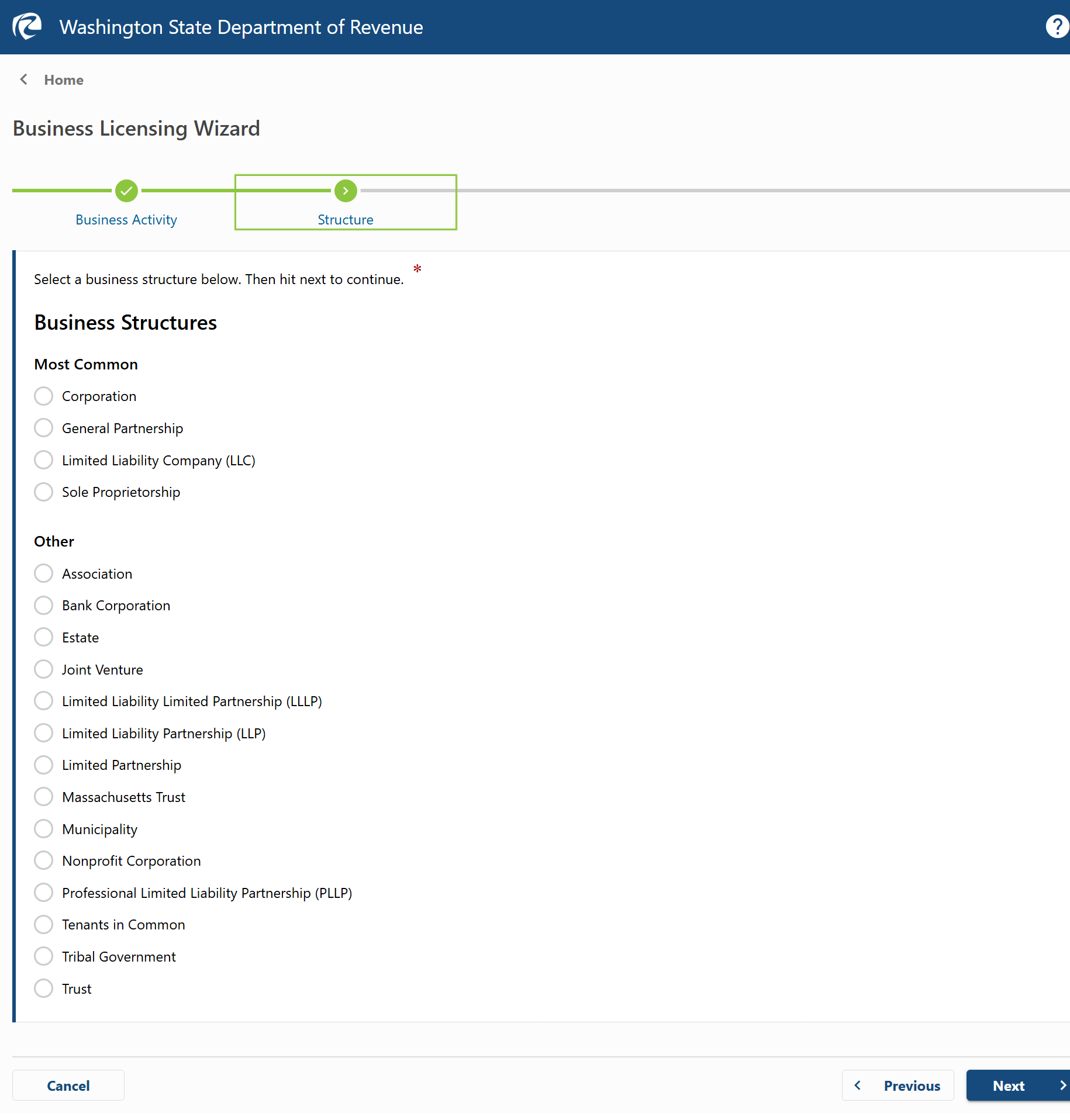

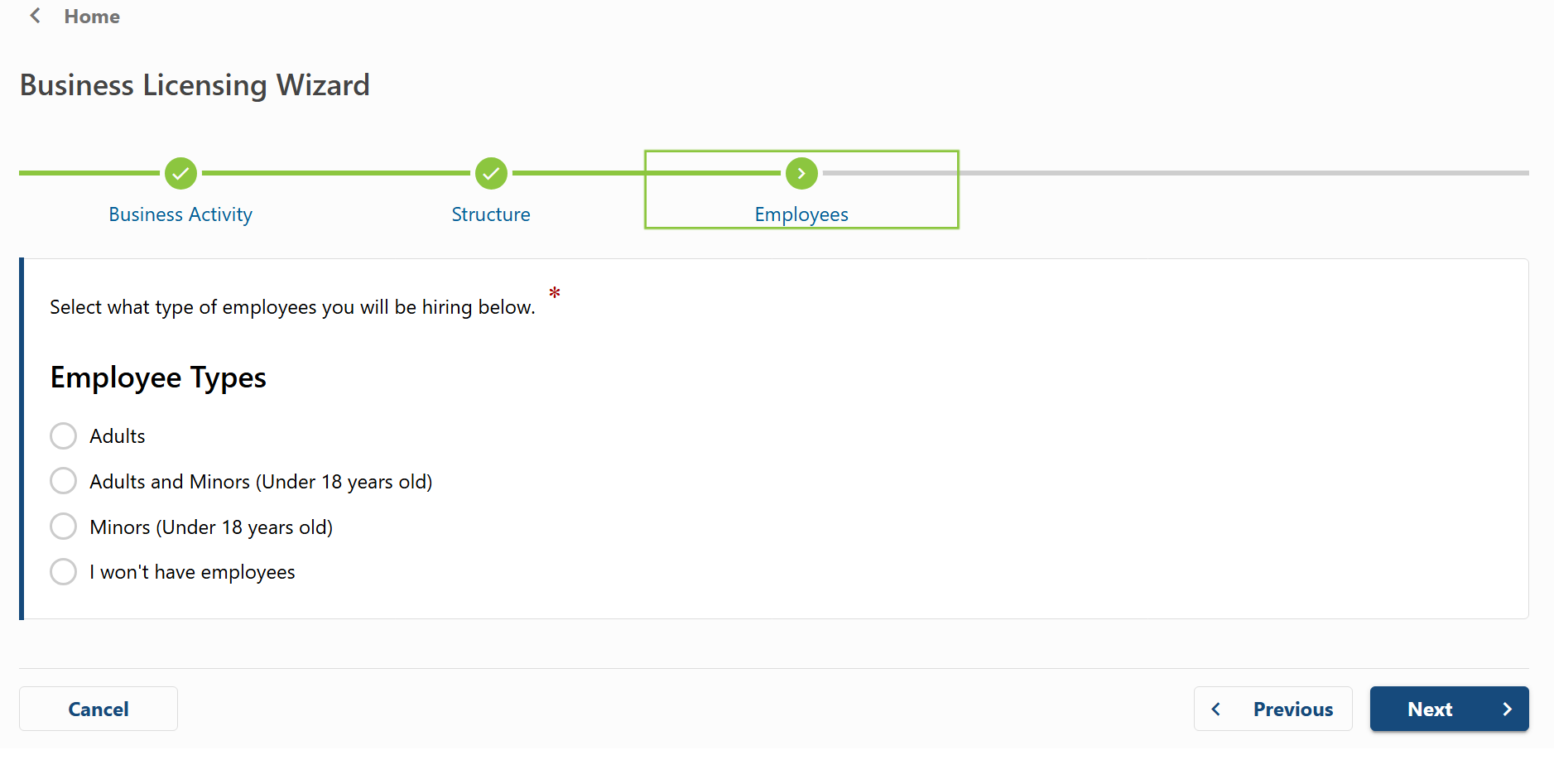

Select your business structure type and press Next. That brings you to the Employee page:

Select your business structure type and press Next. That brings you to the Employee page:

Make the appropriate selection and press Next to navigate to the physical address screen.

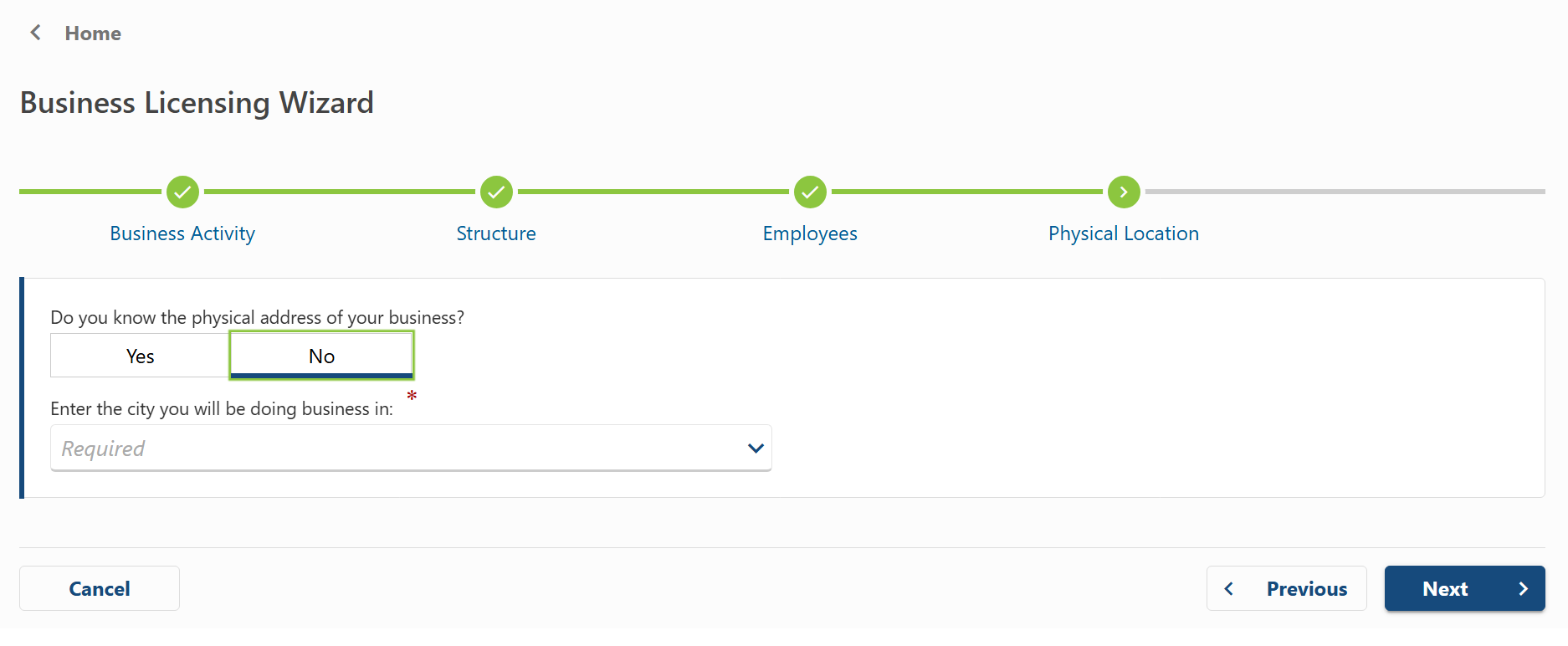

If you don’t know the exact address, you can select a city or county from the dropdown. You may be prompted for a more specific location:

After you press Next, you’ll see a list of licenses you may need and buttons you can click to apply for them:

What will happen after I file the business license application?

It will take about 10 business days for your license to be approved. Some endorsements may take 2-3 weeks longer. You will receive your business license and your Universal Business Identifier (UBI), which is the number you will use in all your business with the DOR. The DOR will send you information about sales tax, business taxes, and occupation tax.

If you stated that you will be hiring employees, the Department of Labor & Industries and the Employment Security Department will send you information about quarterly forms for employee reporting.

Reseller permit

In order to purchase items for resale without paying sales tax, you will need a reseller permit. These also allow manufacturers to avoid sales taxes on ingredients and components they use in their manufacture. When you actually sell to customers, you must collect sales tax and submit it to the DOR. You can apply for a reseller permit on the Reseller permit page.

Federal business licenses

In addition to Washington’s state and local licenses and endorsements, some businesses are required to register for licenses with federal agencies. If you are in one of the following lines of business, you should check to see if your specific endeavor requires any of these licenses:

- Agriculture

- Aviation

- Broadcasting

- Drilling and mining

- Firearms

- Fish and wildlife

- Liquor license

- Maritime transportation

- Nuclear energy

- Transportation and logistics

The Small Business Administration maintains an Apply for Licenses and Permits page with links to all the relevant agencies where you can click through, identify required credentials, and apply for them.

Renewing your business license in Washington

Most Washington business licenses and endorsements require renewal. The base renewal fee for a Washington business license is $10, and there will also be a fee for each local and industry endorsement.

The DOR will send a reminder 30-45 days before your renewal date. You can renew your license at the DOR’s Renew or Update Business License page.

Get help starting your business in Washington

Virtually every Washington business falls under the small business license requirements Washington establishes through the state’s Department of Revenue. In addition to the base fee of $90, many businesses will need some endorsements because of the industries they are in, and others because of the locations where they plan to do business. These can run to hundreds or even thousands of dollars. For some lines of business, there are also licenses required by federal agencies.

The DOR maintains an online Business Licensing Wizard. There you can enter information about your business and generate a list of local and industry endorsements you may need, along with instructions for applying.

Licenses are only part of the challenges when you explore how to start a business in Washington state. That’s why many new entrepreneurs turn to an online formation service to ramp up businesses such as LLCs. These services will also register a business, create start-up documents, act as a registered agent, submit ongoing required reports, and show you how to get an LLC in Washington state alongside handling licensing and compliance. These are especially helpful if you plan to do business in more than one state and have multiple sets of requirements to meet.

FAQ

Whether you sell from a physical store or online, you will need both a business license and a reseller permit. You must collect sales tax and submit it to the state.

The easiest way is to use the Washington DOR online Business Licensing Wizard. This will identify all licenses and endorsements you may need and provide links to apply for them.

Licenses are processed in about 10 business days. Some city and industry endorsements may take 2–3 weeks longer.

The DOR will provide your license and your Universal Business Identifier. You use your UBI in any interaction with the DOR. The DOR will also provide information about sales tax, business taxes, and occupation tax. If you will have employees, the Department of Labor & Industries and the Employment Security Department will send you what you need for quarterly reporting.

All Washington LLCs must obtain a business license. Only the smallest and simplest sole proprietorships are exempt from licensing.

You will be out of compliance with state law and will not be eligible to do business in the state. If you are found out, the state can shut down your business, and you may be charged with a crime and be subject to fines and other penalties.