Want to start a business in Washington state?

You’re not alone!

The Evergreen State has a thriving business environment because of its entrepreneurial ecosystem, booming economy, and low taxes.

Washington ranks 7th in CNBC’s “Best states to start a business,” and 657,529 small businesses and many of the world’s leading brands (Microsoft, Starbucks, Boeing, and Nordstrom) already call it home.

But Washington is also a great place to live, with its world-class health care, excellent quality of life, and stunning natural beauty, ideal for families and young entrepreneurs alike.

Add the many small business government incentives and state programs to help you start your business in Washington, and the Evergreen State is a prime location.

All you need to know now is how to start a business in Washington. Such as which structure to choose, licenses and permits to get, insurance to use, and including those from outside the State, where and how to apply.

All of which you’ll find here.

We know from experience that starting your very own business is a big task, and you may have emotional reservations since when you dream big, the fears can get big too.

But don’t worry… We’ve got your back! We created this guide to help you take some of the mental load off, and to focus on the things that matter most.

Here are the steps to follow when starting a Washington State Business:

- Fine-tune your business idea

- Create a business plan

- Choose a business name

- Choose a business structure

- Set up Banking, Credit Cards, & Accounting

- Get Funding for your Washington business

- Get Insured

- Obtain Permits & Licenses

- Find your team

- Market & Grow Your Business

- Open the doors!

But you need a viable business idea before you do any of that!

Step# 1. Fine-tune your business idea

You should consider 2 things when choosing your business idea.

The first are your skills, passions, interests, and long-term goals because running a business is a lifestyle commitment, and the more your choice suits you, the better your chances of success.

The 2nd is your business idea’s validity because you need an idea that’s accessible, profitable, and sustainable.

You answer the 1st; research answers the 2nd.

But what if you still need a business idea?

No worries, here are some that often do well in Washington.

Best businesses to start in Washington:

The Evergreen State is the number one producer of organic fruits and vegetables in the U.S. and has the freshest and most diverse seafood in the country, so if you’re considering those as your business idea, you could be on a winner!

If not, here are others to get your creative juices flowing:

- Electric Car Charging Stations.

- App Development.

- Ridesharing.

- Professional Services.

- Information Technology Services.

Next, we’ll examine how validating your idea proves it’s worth your investment!

How to validate your Washington business idea:

Validating your idea confirms people need it and will pay your asking price. It also means your idea is accessible, sustainable, and scalable to expand throughout Washington and beyond!

Entrepreneurs starting a local Washington business should choose an idea that suits their community’s interests and needs. You do this by researching your locality to see what services and products people buy, then offering something better.

Aspiring online entrepreneurs can do the same by using online strategies that prove a particular demographic of society wants what they sell, like researching online search volumes for specific services and products using Google Analytics and Google Trends.

However, local and online validation answers the same questions:

- Is there enough demand to support your business idea?

- Which direction is your chosen market trending?

- How strong are your competitors?

- Can you afford to compete?

- Can you comply with federal and local regulations?

And you answer those in your business plan!

Step# 2. Create a business plan

You’ve probably heard the adage, “If you fail to plan, you’re planning to fail.”-Benjamin Franklin.

You use a business plan to ensure your new venture is viable, to enable potential investors to determine if it’s investible, and to guide you through the startup stages and beyond.

Need help writing a business plan? Not a problem, use our free template and read our How to Write a One-page Business Plan post.

But before you do, every business plan needs 3 crucial sections:

Market research

You research your chosen business ideas marketplace for 3 reasons:

- To identify your ideal clients and learn where and how they shop.

- Identify your competitors and learn their strengths and weaknesses.

- And discover opportunities you can take advantage of to convince people to choose your brand.

You then take this information to develop your unique value proposition and create your marketing plan.

Pro tip:

Once you know your market, use tools like the Washington State Data Book to learn about your target audience’s demographics (age, gender, location, employment, and income).

Marketing plan

Every marketplace has buyers who need and want that specific product or service. Marketing is how you reach, engage, and sell to them.

Your market research tells you which strategies work for your niche. For example, it could be paid online advertising, organic SEO content, or traditional like local advertising on billboards or shop signage.

You then use them in your marketing plan to maximize your chances of making a sale at the minimum cost.

Financial plan

Your financial plan calculates your startup and running costs to ensure you can afford to enter your chosen niche, charge accordingly, and maintain a positive cash flow.

For entrepreneurs needing funding, a financial plan (with projections) also helps convince potential lenders or investors that your business idea is viable.

A thorough financial plan has 5 budgets:

- Investment budget: The money you need to start your business in Washington State.

- Financial budget: Outlines how you’ll fund your business startup costs (we’ll look at your options later).

- Operating budget: Calculates your potential income minus your variable and fixed running costs (outgoings) to ensure profitability.

- Cash flow budget: A crucial budget for getting a loan that forecasts your profits and expenditures.

- Personal expense budget: Includes your expenses for running your business, including your wage and any relevant expenditures.

Once you know your business idea is viable, it’s time to choose your location.

Choose a location

My business location is a home office (and sometimes a local cafe), and many online sellers do the same to reduce costs.

However, entrepreneurs starting a physical business in Washington need a location that suits their target audience’s shopping habits.

For example, future retail or restaurant owners need high footfall (passing trade), convenient access, parking, and a location where their target audience expects to find them.

Recent research by Zippia says the following 10 places in Washington are ideal for starting your new business:

- Lakeland North.

- Lakeland South.

- Clarkston Heights-Vineland.

- West Clarkston-Highland.

- Fort Lewis.

- Bryn Mawr-Skyway.

- College Place.

- Moses Lake North.

- Pacific.

- Parkwood.

The key to choosing the perfect location for your business is knowing where your clients shop for your product or service, and it’s part of your market research.

But all Washington locations (including home-based businesses) have one thing in common: they must comply with Washington zoning laws.

Washington zoning laws and regulations:

Zoning laws exist to save our green spaces, reduce pollution, ensure people don’t open inappropriate businesses in the wrong locations, and maintain health and safety standards.

The easiest way to start your physical business in Washington is to choose an area or property already zoned for your business needs.

Decide if you’re an online-only business

This step is easy because if you’re going to sell online, then you’re an online business!

But mom-and-pop stores should also create an online presence to ensure their target audience can find them, read their reviews, and book appointments or services.

E-commerce and physical business owners need the following to ensure that happens:

- A website: Businesses need a branded website to advertise their products/services, promote positive testimonials, attract their target audience, and enable prospects to book appointments and place orders.

- Social media presence: Platforms like Instagram, LinkedIn, Facebook, YouTube, and TikTok are essential for sharing your brand’s story, connecting with your target audience, and building your community.

- Supply and distribution plan: Online and physical store owners who sell and deliver products need a supply chain and distribution plan.

- Online Tax Laws: All U.S. states have online tax laws businesses must adhere to. Visit the Washington Department of Revenue to see which ones apply to your new business.

- Washington-specific regulations: Businesses that sell online to Washington residents (including those from outside the State) must register for sales tax with the Washington DOR.

Next, your business needs an engaging and memorable name:

Step# 3. Choose a business name

Besides global brands, can you think of any local or online business names?

Why do you remember them?

Sure, you might use them regularly, but odds are those names attract you because they connect with your emotions, resonate with your needs, and are memorable because of being witty or unique.

That’s the power of a great business name!

As yours will be your audience’s first impression of your business, you must choose one that represents your brand, what you’re selling, and what suits your ideal clients.

Coming up with the right business name is challenging; fortunately, strategies exist to help you choose the perfect name for your business.

Once you have some ideas in mind, you must ensure they conform to Washington State requirements:

- Distinctiveness: Your business name must be unlike any others registered with the Washington Secretary of State. Use the Washington Taxable Entity Search tool to ensure availability.

- Entity titles: Entities are the structure you run your business under, and if you choose an LLC, LLP, or corporation, you must include words or their approved abbreviations to distinguish your business type, such as a Limited Liability Company (LLC, L.L.C.), Limited Liability Partnership (LLP, L.L.P.), or Corporation (Corp, or Co).

- General restrictions: Washington State forbids using specific terms, including government agencies and some occupations like doctor, insurance, and bank, unless that’s your business.

- Business name reservation in Washington State: Entrepreneurs not ready to form a legal entity (like an LLC) can reserve their chosen (and available) business name for 180.

Okay, let’s finish this section with a D.B.A.:

Using a D.B.A. in Washington State:

A DBA (doing business as) allows you to run your business using a different name from your legal entity or your name in a sole proprietorship or general partnership. Washington calls a DBA a trade name, and you apply for one with the Department of Revenue for $5.

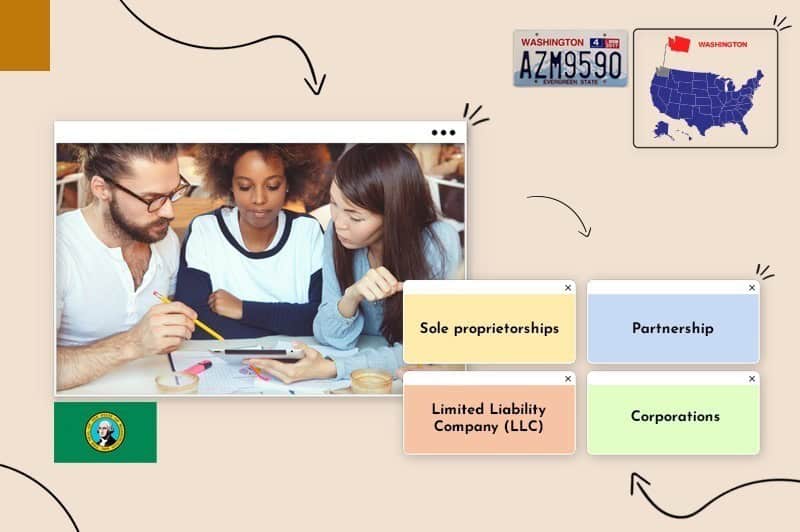

Step# 4. Choose a business structure

A business structure is the entity under which you run your business, and they come in 2 types: formal and informal.

Formal business structures include limited liability companies, limited liability partnerships, and corporations; informal are sole proprietorships and general partnerships.

Your choice depends on your need for liability protection, raising capital, if you plan on selling your business (or a percentage), and whether you’ll have employees.

With those in mind, here are your options:

The most common types of business structures

Let’s look at the pros and cons of the business entities in Washington to help identify the one that suits your business idea.

Sole proprietorship:

You are a sole proprietor if you start a business alone without registering a formal entity with the Washington Secretary of State. Sole proprietors handle their business’s daily and financial operations and pay any due taxes on their tax returns. But this simplicity means sole proprietors are liable for any debts or litigation against their business and may have difficulty getting business loans.

General partnership:

Similar to a sole proprietorship, but with 2 or more individuals who start a business in Washington without registering. Partners pay taxes on profits earned via personal tax returns and handle all debts and litigation cases.

Limited liability partnership:

Limited liability protects business owners from their business’s debts or litigation. You form an LLP by registering with the Washington Secretary of State. The structure suits professionals like lawyers and accountants who want to start a business while keeping separate liability from one another.

Limited liability company (LLC):

LLCs are a midway point between a corporation and a sole proprietorship (or general partnership if there’s more than one owner).

Owners (called members) get a corporation’s liability protection while availing of a sole proprietor’s simple pass-through tax structure and management flexibility.

You form an LLC by filing articles of organization with the Washington Secretary of State and paying the $180 filing fee.

Corporations:

An S corporation entity is the most popular with SMBs (small to medium business owners) because it uses the pass-through tax structure, which avoids double taxation at the corporation level. Corporation owners are shareholders who can sell stocks and shares to raise capital.

Choosing a registered agent

Formal entity owners must designate a registered agent to receive legal or official documents, like a service of process or government notices for their business.

A registered agent must have a physical Washington address and be open during business hours.

You (or another business owner) can be your registered agent or employ a registered agent service provider.

Step# 5. Set up banking, credit cards, and accounting

Setting up a separate business bank account and using a business credit card helps track your startup’s income and expenses, which can simplify your bookkeeping duties and minimize your accountancy costs.

But those aren’t the only benefits!

Here’s how dedicated business banking can help you run your business in Washington.

Business banking

Legal business entity owners (like limited liability companies) must separate their business and personal finances to avoid breaking the corporate veil and maintain their liability protection.

The corporate veil shields your assets from your business (when you start an LLC or S corporation), but you can lose it in litigation if you mix your finances.

General Partnerships and Sole Proprietorships don’t have liability protection. Still, dedicated business accounts can help owners ease their bookkeeping needs and increase their brand’s credibility with clients and vendors.

Business credit card

Business credit cards have several advantages for formal and informal business entity owners.

For instance:

- A business credit card looks more professional.

- Ensures a clear distinction between business and personal finances.

- Helps business owners track their cash flow.

- Provides a vital credit line.

- And most of all, they can increase your business credit rating, which can help you get lower interest rate loans.

Business accounting

When you start a business in Washington, you’ll need to wear many hats, one being accountancy, to ensure you pay your bills and maintain a positive cash flow.

However, some accountancy duties, like annual and payroll taxes, require a certified accountant to ensure you stay compliant with federal and Washington state tax laws.

The problem is that accountants are expensive!

Fortunately, you can reduce accountancy fees by using accountancy software that integrates with your designated business bank and credit card accounts to manage your bookkeeping tasks, send invoices, track working hours, and monitor payments.

Step# 6. Get funding for your Washington State business

Okay, let’s talk about money.

Before your new business can earn money, you’ll need financing to help with your startup and running costs, here are a few options:

- Savings: Many business owners use personal savings to start their businesses and reinvest the profits to support their growth, removing the need for credit checks and high-interest-rate loans.

- Family and friends: Your social networks are another funding option, calculate this into your business plan and agree on repayment terms in advance to avoid disagreements.

- Traditional SMB loans: Securing a business loan from a local bank is a common way to fund your startup, but you’ll require a strong credit history and perhaps collateral to get one.

- Peer-to-peer lending: An alternative funding route where multiple individuals invest in your business; terms are often favorable, but ensure you use a reputable platform.

- Crowdfunding: Another option is to raise funds from people on a crowdfunding platform where a collective gives you the money because they want to support your vision.

- Micro-loans: Washington’s Craft3 Fund (a Community Development Financial Institution) provides smaller loans to startups in underserved areas.

Other funding options include:

Washington State grants and incentives:

Washington offers business incentives (tax credits and grants) to startups in specific industries and businesses wanting to move to the Evergreen State.

Washington grant, incentive, and loan providers include:

- State-specific funding: State grants and incentives are on the WA.gov website, and business funding programs are on the Community Economic Revitalization Board (CERB).

- Washington Small Business Administration: The SBA offers resources to entrepreneurs from all walks of life, including women, veterans, minority business owners, and anyone with difficulty getting a standard business loan.

- Federal funding: Washington also participates in federal State Small Business Credit Initiatives (SSBCI) that fund business financing programs and the Small Business Lending Fund (SBLF) assists community development throughout the State.

Step# 7. Get insured

When you start a business in Washington, your insurance needs depend on your business type, niche, and whether you’ll have employees.

Some insurance coverage is mandatory, while others are optional. Let’s look at the most common types of business insurance next:

- General liability insurance: Service and brick-and-mortar businesses need GLI to protect against client accidents and property damage caused by their company.

- Professional liability insurance: Certain professionals (like financial advisors) need PLI to protect against claims made because of negligence, omissions, or errors.

- Business interruption insurance: An optional insurance policy that covers your lost income and expenses if you cannot work because of illness or natural disasters.

- Commercial property insurance: Protects your work property against theft, fire, and other natural disasters.

- Umbrella insurance: Covers any financial shortfalls in your other insurance policies.

Washington state-specific regulations:

Mandatory business insurance policies depend on your industry and whether you’ll have employees. Contact the Insurance Commissioner of Washington State for further information.

- Workers’ compensation insurance: Washington employers must have workers’ compensation insurance to cover their employee’s medical expenses for work-related injuries.

Step# 8. Obtain permits & licenses

Most new businesses need licenses or permits at the federal, state, and local levels; some also need professional licenses.

Entrepreneurs running businesses in multiple Washington locations need licenses for each county/city they do business in.

For information on which local, state, and federal business licenses your startup needs, check the links below:

- Federal licenses: Visit the US Small Business Administration (SBA) license guide for federal business licenses.

- State licenses: Washington has a state-level business license you get by submitting your application via the Business Licensing Wizard tool; you can also apply using a paper filing.

- Local licenses: Depending on your business location and activity, you might need a local license/permit from your city/town. The Municipal Research and Services Center (MRSC) lists Washington cities and counties , enabling you to see your area’s business license and permit requirements.

Additional resources:

The Washington State Department of Licensing has two helpful pages with information:

The Washington Business Hub has information on licenses and permits:

And you can contact the Washington Business License Services (BLS):

- Phone: 800-451-7985

- Email: [email protected]

- Website: https://bls.dor.wa.gov/.

Federal income tax and Washington local tax

When you start a business in Washington, you might be liable for federal, state, and local level taxes:

- Federal Taxes: Most self-employed individuals and business owners pay I.R.S. federal taxes, such as self-employment and quarterly estimated taxes.

- State Taxes: Washington does not have a state income or corporate income tax but imposes a Business and Occupation (B&O) tax based on your business’s gross income.

- Local Taxes: A local B&O tax also applies to and varies by city and town.

- Sales tax: If you sell tangible goods and property or provide certain services, you must get a seller’s license to collect and pay sales and use a tax rate of 6.50% for the state and a max of 4.10% locally.

Pro-tip:

Read the tax classifications for common business activities or contact the Washington Department of Revenue at https://dor.wa.gov/contact-us for further information

Washington State-specific regulations

All U.S. states have regulations businesses must follow; in Washington, those include:

- Business registration: If your business structure is an LLC, LLP, or corporation, you must file with the Washington Secretary of State.

- Tax registration: Register with the Washington Department of Revenue after you form your business in Washington. However, if you apply for your Washington State Business License through BLS, the system automatically registers you with the Department of Revenue.

- Withholding State Tax: Washington has no personal income tax and, therefore, no withholding tax.

- Quarterly wage reports: If you have Washington employees, you must register to file quarterly wage reports and pay unemployment insurance taxes.

Okay, that’s how to start a business in Washington! The last 3 steps describe how to launch and run your new venture:

Step# 9. Find your team

Hiring employees is a big step for most new business owners, one you must consider carefully to ensure your wage obligations don’t outweigh your income. As a first step you may prefer to work solo, but as your business grows, so will the need for extra help.

The good news is you’ve plenty of hiring options when you start a business in Washington State.

People are the backbone of the business

Employees are essential to most businesses; even solo business owners need the right team to care for their bookkeeping and tax filing needs. Service and brick-and-mortar business owners might also need employees for labor, customer service, and stock control.

Fortunately, (besides labor employees), you can source professionals like freelance marketers, bookkeeping experts, and lawyers or accountants on a need-only basis, maximizing your output while minimizing costs.

Your team can also include other business owners who advise and local employees who bring crucial local knowledge to your new venture.

Even friends and family can help, when you make your first steps as a business owner. A helping hand, good advice, or just a heart to heart talk with someone you trust can go a long way.

You don’t need to have ‘Employees’ to rely on the people around you.

But if and when your business does grow enough to hire full time employees, here are a few tips.

Comply with Washington payroll regulations

Washington State has payroll regulations you must follow if you hire employees; they include:

- Minimum wage: Washington’s minimum wage is $15.74.

- Payment dates: Employers must pay employees on a regular payday at least once per month.

- Overtime Pay: Employers must pay 1.5 times their employee’s regular wage for hours worked over 40 per week.

- New hire reporting: Business owners hiring employees must report them to the Division of Child Support (DCS) within 20 days of hiring.

Set up payroll:

When you hire employees or contractors in Washington, you’ll need a payroll system to withhold federal income and Social Security and Medicare taxes.

Hire contractors

Professional contractors provide temporary services many small businesses need to run effectively, but unlike full-time employees, you’re not liable for their taxes or insurance obligations, which reduces your hiring costs.

How to hire Washington contractors:

- Verify the contractor has a contractor’s license.

- Check they are bonded and insured.

- Ensure they follow Washington workplace regulations.

- Review your contractor’s history for previous license violations or lawsuits.

All that’s left now is to tell people you’re open for business!

Step# 10. Market & grow your business

Here’s where you take your business plan’s marketing research to create a marketing plan that engages your target audience and turns them into loyal customers.

But first, you must create your brand’s logo, color schemes, fonts, and message to stand out from your competitors.

Check out our Logo Maker and other marketing tools to help you create a unique look for your business. Once you have those in place, try some of the following marketing strategies, many of which are free!

Invite customers to opt-in to a mailing list or newsletter

The best way to build a loyal community is to collect people’s email addresses using an opt-in box on your website.

To convince people to provide their email, entice them by offering something in return, like a discounted service/product or a helpful “How to ebook” that solves some problems they experience in your niche.

Consider making special offers to attract your first customers

You can make your first sales by attracting customers using special offers like opening day discounts, buy one get one free, and seasonal flash sales.

These limited-time deals help convince your prospects to try your brand; if they like it, they could become repeat customers!

Look for local businesses or brands to collaborate with

Local business entrepreneurs can increase their target audience by collaborating with other established brands in their area.

All you do is find potential partners with a similar clientele and create marketing initiatives that promote each other’s products or services.

The key is collaborating with a business that isn’t a direct competitor but whose customers need your company’s services.

Invest in word of mouth (happy customers attract each other)

Word-of-mouth marketing is when you recommend a brand to another person. It’s proven to be the most powerful (and free) form of advertising because we believe what our friends, family, and colleagues recommend far more than a sales pitch!

To encourage WOMM, provide excellent service, and always put your customers’ needs first.

Pay attention to online reviews; ask happy customers to review you

Reviews can make or break your business because everyone reads them before choosing which brand to buy from, service to hire, restaurant to eat in, or place to stay.

How to get reviews:

- Ask your customers to review your business and leave them on all your marketing platforms.

- Make the reviewing process easy by sharing your marketing platform links.

- Always thank your customers for their loyalty to show them you appreciate them.

- Not every review you get will be positive (regardless of how brilliant your business is). But you can turn negative reviews into positive communications by addressing your customer’s grievance and offering a solution.

Create unique, helpful content to showcase your activity

Content is a great way to engage your target audience’s interest and get them talking about your brand.

Your content includes your brand’s visuals (like your logo and slogan), videos on TikTok, images on Instagram, and any posts you publish on your website or relevant platforms like Reddit.

To create engaging content your target audience wants, look at your competitors’ strategies, then steal their ideas and make them your own.

Okay, now to open your business doors:

Step# 11. Open the doors!

When starting a business in Washington, let people know you’re open by throwing a launch event.

Plan a successful launch event

A launch event can be a small party in your local shop or a grand event with hundreds of guests.

Either way, your goal is to create a buzz that grabs your target audience’s interest.

How to throw a successful launch event:

- Purpose: Know what you want to achieve (like increasing brand awareness), then create your event around your aim.

- Venue: Choose a venue that suits your target audience and your brand’s personality.

- Activities: Make your event fun for your guests by implementing interactive activities to ensure it’s memorable.

- Buzz: Create a buzz by promoting your event where your target audience sees it.

- Branding: Infuse your event with your new branding visuals to ensure people recognize your business long after it finishes.

- Moments: Capture your event’s best moments by hiring a freelance videographer/photographer and post them on your marketing channels.

Make your first sale

Take advantage of your launch event to collect your guest’s email addresses and promote special offers that entice them to buy your products/services.

And that, my friends, is how to start a business in Washington. But if you have some unanswered questions, I’ll finish with the most commonly asked FAQs.

Conclusion

And that’s how to start a business in Washington.

All you need to do now is follow the steps in this post, take advantage of the available Washington State small business incentives and grants, register your business, get the right insurance, and begin marketing your new business idea.

Once you do those, you could have a thriving Washington business; the rest (as they say) is history.

Good luck!

FAQ

It depends on your chosen business entity, niche, and business needs; for example, you’ll need a registered agent if you start an LLC and might have extra expenses, like licenses, permits, and business insurance.

Yes, Washington has a mandatory state business license for businesses with a gross income of over $12,000 annually.

It costs $180 to file your Articles of Organization with the Washington Secretary of State.

On average, forming an LLC in Washington takes 10 working days. Corporations can take up to 2 months. If you’re preparing to file, it’s helpful to review the steps to create an LLC in Washington state so you know what to expect during the process.

Yes, and you don’t need to worry about zoning laws if your home business has only 4 daily customers (by appointment only) during regular working hours.

You can register your out-of-state business by filing a foreign qualification with the Washington Secretary of State.

Yes, any business owner (over 18 with a physical address in Washington state) can act as their registered agent.