How we do business has changed significantly since the 1980s.

Back then, there were over 2.2 million C corporations and only 8.9 million independent entrepreneurial sole proprietorships.

Fast forward to 2022 and sole proprietorships have almost tripled to over 23 million, accounting for 73.1% of all 32 million U.S. pass-through business entities. Meanwhile, C corporations have shrunk by 28% to 1.6 million.

You might ask why, and it’s a good question.

The answer’s simple.

Simplicity is why folks like you, me, and 23 million others choose a sole proprietorship as a business structure.

All you need is an idea, some insurance, a license, a permit (if required), and you’re in business. But before you jump in, let’s look closer at what sole proprietorship is and ensure it’s right for you.

Understanding Sole-Proprietorship

You automatically become a sole proprietorship by default when you start a business and don’t register it with your state.

For example, suppose you’re a freelance writer, a plumber, or a pet walking entrepreneur and take on a contract. In that case, you’re working as a sole proprietor.

For wages and taxes, sole proprietorships are pass-through entities, which means the profits and losses flow directly to you, and you pay tax on your personal tax return.

The simplicity of a sole proprietorship makes it the most common business type in the U.S. today.

Sole proprietorships differ from other types of business structures, like a limited liability company (LLC), C or S corporations, and limited liability partnerships (LLPs), because you don’t file an “article of organization” and create a separate legal entity.

The result is you and your business are the same, and you’re liable for your company’s actions.

For instance, if you fall into debt or someone sues, your personal assets could be at risk.

The upside is all business profits are yours and pass directly to you, avoiding double taxation.

The Advantages of Running a Sole-Proprietorship

I chose a sole proprietorship for my first business (a garden care company in 1997) for the following 3 reasons:

1. It was an affordable option.

2. I could make money immediately.

3. There was little information available about how to start an LLC or an S corps, and in 1997, most new entrepreneurs thought they were only for big companies.

The first 2 remain true today; a sole proprietorship is still an excellent way to start a business in a low-risk industry and test the market to see what opportunities exist.

The 3rd thankfully isn’t because now there’s a wealth of information available, and you can quickly learn about and start an LLC (and choose between the different types of LLCs), LLP, or an S corporation.

And there are other advantages and disadvantages to running a sole proprietorship:

Low fees and costs

The first advantages of running a sole proprietorship are the low fees and costs (compared to an LLC).

Here are 3 worth considering:

- Sole proprietorships aren’t required to register with their state; state registration fees can be as much as $500 depending on location

- Sole proprietorships don’t pay an annual franchise tax; state franchise fees vary from ($0-$325) depending on location

- You’re not required to designate a registered agent; registered agents can cost up to $300 per year

The cost of state registration and annual franchise tax are state-dependent; you can find out your local fees by visiting your state’s website.

Of course, avoiding these fees reduces your initial investment, which is often essential to many new business owners.

But while low fees are attractive, it could cost you later because of the lack of liability protection a sole proprietorship provides, but more on that a little later.

Barely any paperwork compared to other structures

There are few legal requirements to start a sole proprietorship, so there’s barely any paperwork. And that enables you to legitimize your business and begin trading quickly.

For instance:

- You don’t need to file an article of organization with your state

- No need to write an operating agreement

- Or provide end-of-year business reports

However, you might need to get a license or permit depending on your state and business type.

No need for an EIN

An Employer Identification Number (EIN) is a 9-digit number the Internal Revenue Service (IRS) uses to identify and track a registered business for tax reporting purposes.

A sole proprietorship doesn’t need an EIN because you use your Social Security number to pay your taxes.

You’ll only require an EIN when you hire an employee or are liable for excess taxes because you sell specific products like tobacco, alcohol, or fuel.

That said, there are several reasonswhy an EIN could be beneficial to your business, such as opening a business bank account, establishing a positive credit history, preventing identity theft, and increasing credibility.

Pass-through taxation

As a sole proprietor, you’re a designated entity for tax purposes. All profits and losses pass through to you; you report them on a Schedule C report and submit it with your 1040 income tax return.

The significant benefits of a pass-through entityare you avoid corporation tax, and you don’t require an accountant to file an end-of-year report.

However, you could consider hiring a good bookkeeper to ensure you file your taxes correctly.

Complete control of your business

Most business owners are independent entrepreneurial spirits who want to choose how to run their lives.

And as a sole proprietor doesn’t have any partners, members, or shareholders to answer to, you have complete control over all decision-making and the freedom to run your business as you see fit.

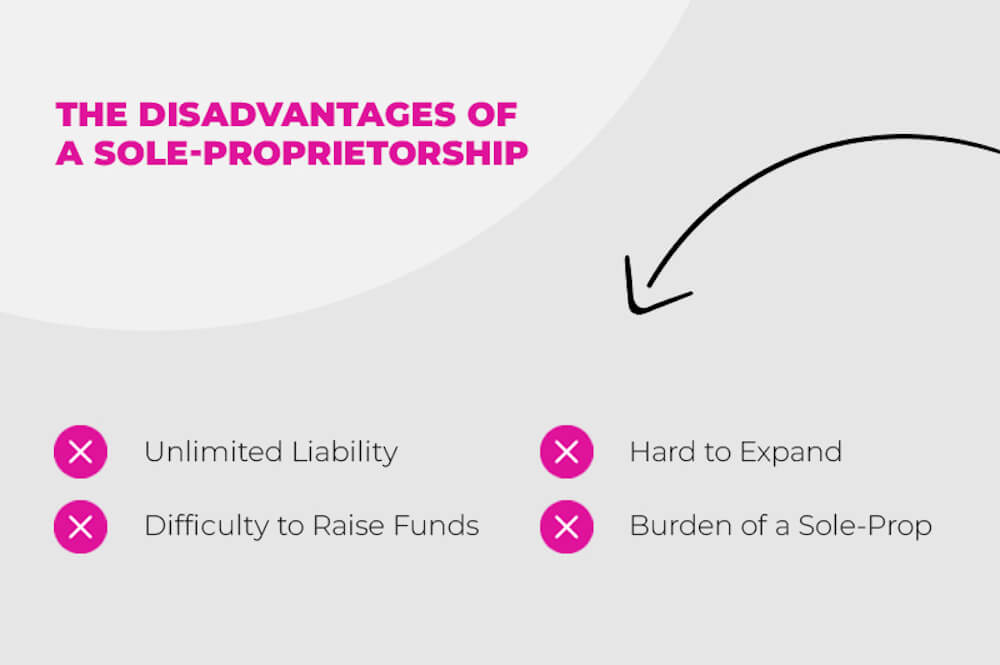

The Disadvantages of a Sole-Proprietorship

Of course, there are disadvantages to running a sole proprietorship using the simplest business structure.

Those disadvantages soon became a problem for my budding gardening company and me, and I had to start an LLC to enable my business to grow.

Some problems I came up against:

- It was the springtime of the 2000–2007 boom, expansion was everywhere, and I needed funding

- Hiring employees was essential

- I needed to protect my assets

- And it was tricky doing it all alone

If any of those resonate with your present situation, or you’d like to avoid them later, you’ll need to know how these issues can affect your business as long as you’re a sole prop.

Let’s discuss some of the disadvantages, starting with:

Unlimited liability

The major disadvantage of a sole proprietorship is the lack of personal liability protection, and 9 times out of 10, you’ll be on the hook should something go wrong.

In comparison, when you register a business entity, like an LLC, you gain a level of protection against someone seizing your assets, should you fall into debt or face litigation.

Sure, a sole proprietor can get insurance; let me rephrase that you absolutely need insurance. But insurance companies often charge sole proprietors’ higher premiums, so it’s not a lasting, viable option.

Difficult to raise funds

As a sole proprietor, you’re not a legal entity, which means you can’t get a business loan, nor do you have shares, so you can’t sell stock to raise capital.

Usually, your only option is to guarantee a personal loan and risk losing your assets, should your business fail.

Fortunately, besides banks, there are other ways to raise funds and start a business. These include crowdfunding, angel investors, or zero to low-interest loans from family or friends.

Hard to expand

The time will come when you need to expand your business to meet demand, but that’s where a sole proprietorship could hold you back.

It could be for any of the following reasons:

- Difficulty raising funds

- A lack of credibility with suppliers and prospective clients

- The need for better tax benefits

- A lack of liability protection

As your business grows, you’ll need a structure that supports you; for many sole proprietors (me included), the next logical step is to form an LLC.

A lack of tax benefits

Sole proprietors, like LLC owners, pay taxes on all their company’s profits regardless of whether you take them as a wage. That can come at a considerable cost when business is booming.

There are 2 ways to reduce your tax bill.

1. Register an LLC in a state other than the one you’re living in with a lower tax rate.

2. Or start an S corporation, take a wage which you’ll pay income and social security tax on, and then extra tax-free payments in the way of dividends.

Read our article how to file LLC taxes if you’d like to learn more about how tax and business structures work.

The burden of a sole proprietorship

Running a side-hustle and watching it grow into a successful sole proprietorship is an exhilarating and fulfilling experience.

But as your business grows, it can also be a heavy load to carry, which adds extra stress and pressure.

And as a sole proprietorship cannot take on a partner or multiple members to help it grow, the structure could hold you back.

Unable to transfer your business

A sole proprietorship can only have one owner, so if you sell it, the structure ceases to exist, which means you most likely won’t be able to transfer the business.

You can, however, transfer your assets (sell) to someone else who has a separate legal business structure approved to receive them. Once the transfer is complete, you can sell your 100% stake in your business to that buyer.

In other words, a different company will receive your assets, clients, and other income streams and house them under their name, then pay you for the value of your business.

You can determine the value of your sole proprietorship by calculating the value of your assets and multiplying your total annual earnings by 5.

How to Determine if a Sole Proprietorship is Right for You

You can determine whether a sole proprietorship is right for you based on your future aspirations, plans, potential business size, and access to funds.

For example, the structure’s suitable for starting a business quickly or running a side hustle alongside a full-time job.

It also suits certain professions, such as freelancers, artists, personal trainers, craftsmen, and others who take on short contracts in low-risk industries.

And it especially suits those who can finance themselves, avoiding risky loans and business set-up costs.

Is it Possible to Switch to an LLC Afterwards?

The simple answer is yes, you can switch to an LLC with relative easeafter setting up a sole proprietorship.

However, there are specific actions you must take to ensure a smooth transition, such as applying for an EIN.

Ultimately, a sole proprietorship allows you to start a small-scale business and try out a low-risk venture, enabling you to evaluate a market before committing yourself to a registered entity.

Once you establish your brand and start making money, starting an LLCwill empower you to take your original idea and turn it into an entrepreneurial success.