Setting up and maintaining an LLC takes work, but it’s worth the effort because of the many benefits the structure provides.

Many new business owners are attracted to an LLC due to its flexibility to decide how they want to pay taxes.

Here’s where you have 4 different LLC structures to choose from, each with its own tax benefits, advantages, and sometimes, disadvantages.

We’ll look at those and explain how LLC tax benefits work.

At the end of this post, you’ll be ready to form an LLC for your business and take advantage of the benefits.

What are the LLC Tax Benefits for Small Businesses?

There are over 2.5 million LLCs in the U.S.; that’s 35% of all businesses!

And there are numerous reasons why so many small business owners choose an LLC structure.

Here are the top 4 reasons:

1. Avoid double taxation: All LLC entities (except c corporations) are exempt from corporate tax, simplifying your accounting needs and reducing your tax bill.

2. Tax deductions: You can use qualified business income and personal/business tax deductions to reduce your taxable income and sometimes receive a tax refund even when no tax is due.

3. Reinvestment options: You can use your tax savings as extra income or reinvest them in your business, avoiding self-employment tax and reducing your tax bill even further.

4. Structure flexibility: You can choose your LLC structure type and how you pay taxes. But certain restrictions do apply, all of which we’ll cover in this post.

But before we do, let’s quickly recap how LLC taxation works.

How LLC Taxation Works

Sole-proprietors and partnerships are pass-through entities, which means all profits and losses belong to them, not their business. They then pay taxes at the individual income tax rate on their personal return, avoiding double taxation.

The LLC tax structure works the same way.

This means as a pass-through entity LLC owner, you pay income tax on your total profits, regardless of whether you withdraw the cash from the business. And you also pay quarterly payroll (self-employment taxes) at 15.3% on any amount you take as a wage.

The result is, an LLC can save you significant money depending on your income tax bracket and reinvestment goals.

How is the LLC tax rate calculated?

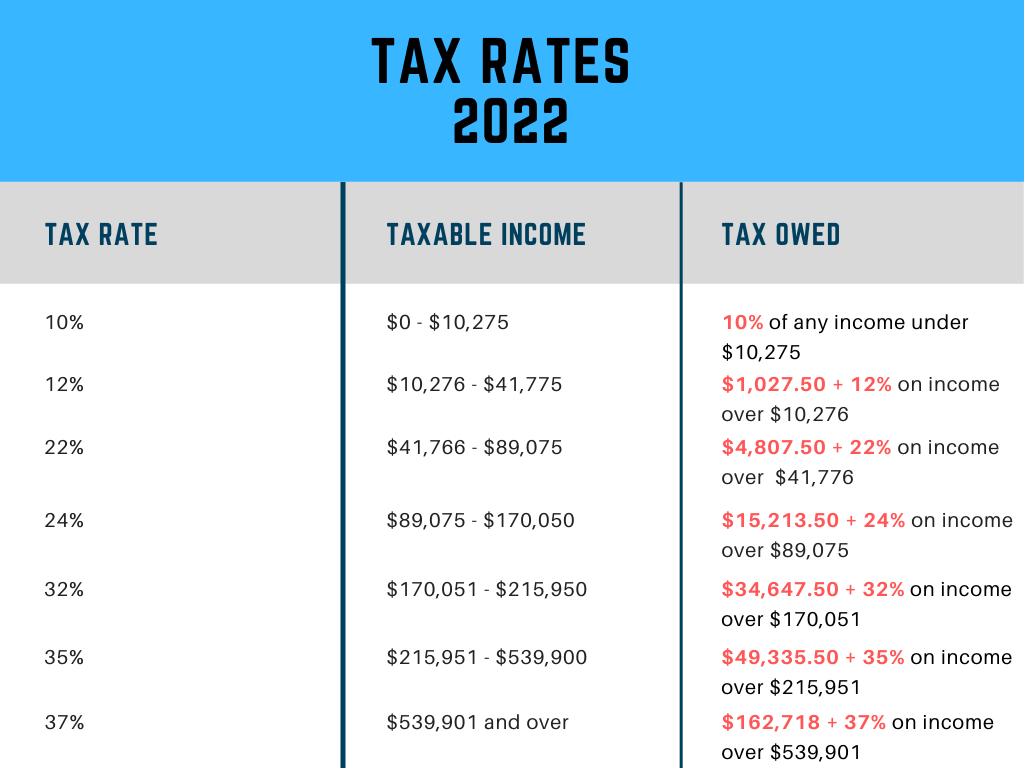

The federal income tax rates for 2022 are 37%, 35%, 32%, 24%, 22%, 12%, and 10%. The rate you use to estimate your tax liability depends on how much you earn.

Use the tax table to work out your liability:

Significant Benefits of LLC Taxation

How you pay your tax and your available benefits depend on which LLC structure you own.

For example: A single-member LLC pays tax similar to a sole-proprietorship. Multi-member LLCs and S corporations pay tax as partnerships (unless they choose otherwise), and a C corporation LLC pays tax as a corporation.

Let’s look at how they can benefit you:

Benefits of single/multi-member LLCs and S corporations:

1. You only pay tax once on company profits.

2. If eligible, you can benefit from qualified business income deduction (QBI) and deduct 20% of your LLC income before you estimate your tax liability.

Benefits of a C Corporation LLC:

Should you choose to pay tax as a C corporation, you’ll pay tax on your income on a corporate level and again on a personal one.

You might be thinking, “Where’s the benefit in that?”

There are 2:

1. Corporation tax stands at a flat 21%, and that’s lower than all but 2 of the 2022 income tax rates.

2. Any money you leave in your business is exempt from income tax. And you can take a tax-free dividend payment when you pay yourself at a later stage.

Both approaches have their benefits, which you choose depends on how much profit your LLC generates, the wage you’d like to take, and the amount you wish to reinvest in your business.

When you’ve chosen the most beneficial LLC structure for your business, you can request registration using IRS Form 8832.

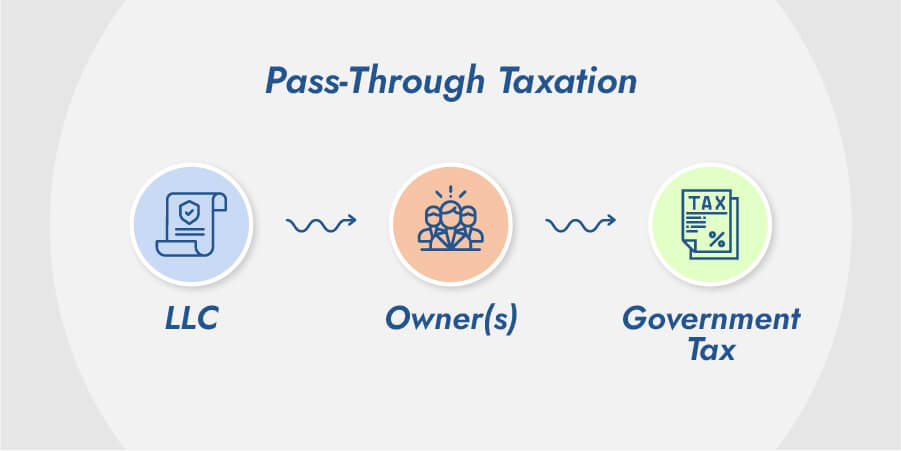

Pass-Through Taxation

Pass-through taxation (often referred to as flow-through or disregarded) is a simple system where you and your LLC are viewed as one entity by the IRS for tax purposes.

The words disregarded, pass, and flow mean all LLC profits pass to you.

When pass-through taxation and the LLC structure come together, they give you the following extra benefits:

1. Your business is exempt from business tax.

2. Depending on your state, you might be exempt from corporate franchise tax.

3. You can choose how you’re taxed.

4. You could potentially have the limited liability protection of a corporation.

5. And can deduct certain personal and business expenses from your tax bill.

I’ll explain how all of those work next:

Avoid double-taxation

All LLC pass-through entities are exempt from corporate tax and double taxation.

A C corporation is not a pass-through entity so it must pay a 21% corporate tax on profits before members take their salary.

Owners then pay income tax on their wages, resulting in double taxation. The rate of income tax they pay depends on their level of income.

May avoid corporate franchise tax

Corporate franchise tax (also called a privilege tax) is a state tax levied on LLCs for allowing them to do business in their state.

Don’t let the name confuse you; it’s not a tax on franchises. You pay it along with your regular state and federal income taxes.

State franchise tax rates vary and some states are franchise tax-free. As of 2020, the following states stopped charging franchise tax:

Alabama, Arkansas, California, Delaware, Georgia, Illinois, Louisiana, Mississippi, New York, North Carolina, Oklahoma, Tennessee, Texas, Kansas, Missouri, Pennsylvania, and West Virginia.

You can learn more about franchise tax by contacting your state tax department or reading our article on “How to file LLC taxes”.

Tax flexibility

Okay, I’d like to clarify an important point.

Many posts say an LLC can choose how it pays tax; while this is true, it’s misleading.

Yes, an LLC can pay tax as a sole-proprietorship, partnership, S, or C corporation, but you can’t pick come tax time.

First, you must register your chosen LLC formation by filing an Article of Organization with your state, and all come with prerequisites.

For instance:

A multi-member LLC can’t pay tax as a sole proprietor because the IRS taxes it as a partnership, and it must create an operating agreement before registering with its state.

A single-member LLC cannot choose to pay tax as a partnership, and while it’s not legally required to have an operating agreement, there are reasonsit should.

If you’d like to learn more about the different types of LLCs and their advantages, check out our post “types of LLCs”.

Deducting business expenses

The most effective way to reduce your income tax bill is to claim every available tax deduction, including your expenses. The IRS calls these tax write-offs.

For example:

You can deduct costs relative to running your business, such as utility bills, a company phone or vehicle, fuel, travel expenses, stationery, etc.

However, all deductions must meet the IRS criteria, and often you can only claim a percentage. You can learn more about those by visiting the IRS website-publication 535.

Personal tax deductions

You can also claim personal tax deductions and credits when filing your tax return and reduce the amount of tax you owe.

- Deductions: Reduce your taxable income before calculating your year-end tax return

- Credits: Can also reduce your tax bill, increase your tax refund, or give you a refund even when you don’t owe any tax

The most common personal deductions for individuals are:

1. Mortgage interest: You can deduct any mortgage interest you pay on loans secured against your primary residence and even a 2nd home.

2. State and local taxes: You can deduct local and state taxes, including property tax, and sales or income tax depending on which is higher.

3. Medical expenses and health savings accounts (HSA): You can deduct any dental or medical expenses that exceed 7.5% of your adjusted gross income.

4. Student loan interest: You can deduct $2,500 from interest paid on student loans each year over the lifetime of your loan.

5. Education expenses: You can save up to $2,000 per year in a Coverdell education savings account. While your contribution isn’t deductible, any payments from your Coverdell education account for tuition are tax-free.

How to Choose the Right Tax Structure for You

The LLC entity you select has financial, operational, and legal implications. That’s why choosing an LLC structure that suits you and your business circumstances is crucial.

Here are 3 essential factors to consider when choosing your LLC business structure:

1. Business taxes: To remain in good legal standing, you must comply with all local, state, and federal tax obligations. The LLC structure you choose determines what those are and which taxes you must pay.

2. Industry: Your industry often determines which business structure you choose due to state requirements, standard practices, consumer expectations, and financial risk.

3. Personal liability: When choosing your LLC structure, consider the level of limited liability protection you might require. It’s why an LLC could be a great choice, as it may protect your assets should someone sue your business.

Have Your Unique Business in Mind

Most new business owners consider formation costs, maintenance requirements, management structure, and personal liability protection when choosing their LLC structure.

And while those are all super important, you should also account for your immediate financial situation, location, and business size.

Ultimately, the structure you choose depends on your industry, how you’ll operate, and your future growth plans, such as where you want to be 5 years from now.

Before you register your new LLC, factor in your goals, expectations, and aspirations; after all, it’s your business.

Consult a Tax Advisor

Whichever LLC structure you choose, always consult a tax lawyer and accountant before filing your articles of organization to review your state’s specific LLC tax requirements.

Conclusion

Now you know why most small to medium business owners choose an LLC business structure.

The combination of the simple tax structure, personal liability protection, and available tax benefits that make an LLC so attractive.

But remember, before you register your LLC, research your state’s requirements because you don’t have to register in your state, and some states offer better benefits than others.