What is considered a single-member LLC?

A single-member LLC has one member (the owner) who has complete control over the business.

The Internal Revenue Service (IRS) considers a single-member LLC as a disregarded entity, which means the owner and the LLC are separate for all legal reasons.

A single-member LLC doesn’t pay a corporate tax. Instead, all profits pass through to the owner, and the IRS collects taxes from the owner’s personal tax return.

Single-member LLC’s are a popular choice for solo-entrepreneurs, as they have the same advantages as a multi-member LLC and an S corporation.

There’s also another aspect of member-managed LLC vs. manager-managed LLC:

Member-managed single-member LLC

In a member-managed single-member LLC, the owner runs the business, manages all decision-making, and runs daily operations. States consider a single-member LLC to be member-managed unless specified otherwise in its formation documents.

Manager-managed single-member LLC

In a manager-managed single-member LLC, the owner elects a manager to run the daily operations.

The owner retains authority and control over how the manager will run the LLC. At the same time, adopting a silent partner approach and not involving themselves in the LLC’s day-to-day operations.

Single-member LLC vs. multi-member LLC

As a single-member LLC owner, you control your business, handle every decision, and receive 100% of the profits.

As the name suggests, a multi-member LLC has multiple members who share responsibilities and split profits according to their shared interest or operating agreement.

What is an operating agreement?

The purpose of an operating agreement is to enable you to dictate how you run your LLC. If there’s more than one owner, it can include the member’s percentage ownership, which owners handle what roles, and voting rights.

While it’s not a legal requirement, if your LLC doesn’t have an operating agreement and there’s an internal dispute that ends up in court, your state could decide the outcome for you.

Internal disputes are rare in a single-member LLC. However, it’s still recommended to get an operating agreement for a single-member LLC, because it may help treat the owner and the LLC as separate entities in litigation or company debt cases.

What are the taxation differences?

A multi-member LLC automatically pays tax like a partnership, and a single-member LLC automatically pays like a sole proprietorship. In both cases, all business profits pass directly through to the owner(s).

However, there are some differences in how they file their taxes.

Single-member LLC

A single-member LLC owner reports all profits and losses on Schedule C (Form 1040) on their tax return; the business itself does not file or pay tax.

But there’s a little more to it with a multi-member LLC.

Multi-member LLC

Multi-member LLC owners share responsibility for the business’s profits and losses. This means profits must be divided and the IRS requires the company to submit a partnership return.

Its a 3 step process:

1. The multi-member LLC uses Schedule K-1 to report the member’s share of income, credits, and deductions.

2. Members then report their share of the profits and losses and pay taxes by filing Schedule E (Form 1040), and then attach it to their personal tax return.

3. A multi-member LLC must file an informational return using Form 1065 return of partnership income to declare its profits, losses, credits, and deductions for tax filing purposes.

Other taxes you might need to pay

Single-member and multi-member LLC owners can also be liable for the following taxes:

- Self-employment tax (Social Security and Medicare) at 15.3% paid quarterly

- Federal income tax (based on the owner or owner’s federal tax bracket)

- State and local income taxes (varies by state)

- Franchise tax (if applicable)

Which one is better for your business?

Of course, the answer between single-member LLC vs. multi-member LLC comes down to how many owners there are in your business.

A single-member LLC is an excellent choice for a solo-entrepreneur, as it provides a simple tax structure and limited liability protection.

However, a single-member LLC’s protection isn’t as strong as a multi-member LLC, and the owner could be solely responsible should they pierce the corporate veil (we’ll look at what that means in just a minute).

Remember, if you choose the single-member LLC option, always write an operating agreement.

Formation ease

LLCs are an attractive option for starting a business because it’s easy to form. The one fly in the ointment is that every state varies regarding rules and regulations.

You can find your state’s requirements by visiting its website, and general IRS information on limited liability company formation at the IRS.gov website.

Single-Member LLC vs. Sole Proprietorship

Before you choose, there are advantages and disadvantages to both structures that you should consider.

While a sole proprietorship is less complex to form, less demanding to run, and has fewer legal requirements than a single-member LLC, it doesn’t give you the same protection or professional appearance.

And appearances are essential in business; clients often choose a company because it’s a legally registered entity.

More importantly, a sole-proprietorship and its owner are the same for all legal purposes. In contrast, the limited liability structure separates the two.

The role of limited liability

Compared to a sole proprietorship, the benefit of a single-member LLC is that the owner’s liability may be limited to the value of their investment in the company, while a sole-proprietor puts their assets at risk every time they do business.

The taxation front

A sole proprietorship and a single-member LLC are similar in terms of taxation. They are both designated entities (also known as pass-through), which means the business doesn’t pay income tax.

However, unlike a sole proprietorship, an LLC can opt to become a C corporation – in which case the company would be liable for corporation tax, resulting in double taxation.

But there are benefits to registering your LLC as a corporation, such as receiving tax-free dividend payments and reducing your federal insurance contributions. If you’d like to learn more about them, read our article “How to pay yourself in an LLC.”

Which one is better for your business?

Undoubtedly, the primary advantages of a single-member LLC are liability protection and tax structure. The limited liability could help keep your assets safe, and the tax structure enables you to avoid double taxation. Some disadvantages of an single-member LLC are formation costs, paperwork, and ongoing legal compliance.

A sole proprietorship also has advantages and disadvantages worth considering:

1. A sole proprietorship is one of the easiest and least expensive business types, as you don’t have to file for registration, pay filing fees, or employ a registered agent.

2. Sole proprietorships are ideal for those working in a non-risk industry where legal protection isn’t a priority.

3. Owners of a sole proprietorship might miss job opportunities because of their company’s lack of legal registration.

4. Insurance coverage can be higher as a sole proprietorship isn’t a legal entity.

5. Sole proprietorships are hard to scale as they have fewer opportunities for gaining outside funding.

6. A sole proprietorship has a limited lifetime because the company will cease to exist if the owner passes away.

7. Because it’s not a registered business, you can’t sell it as a going concern; instead, you must sell all assets, permits, and licenses separately.

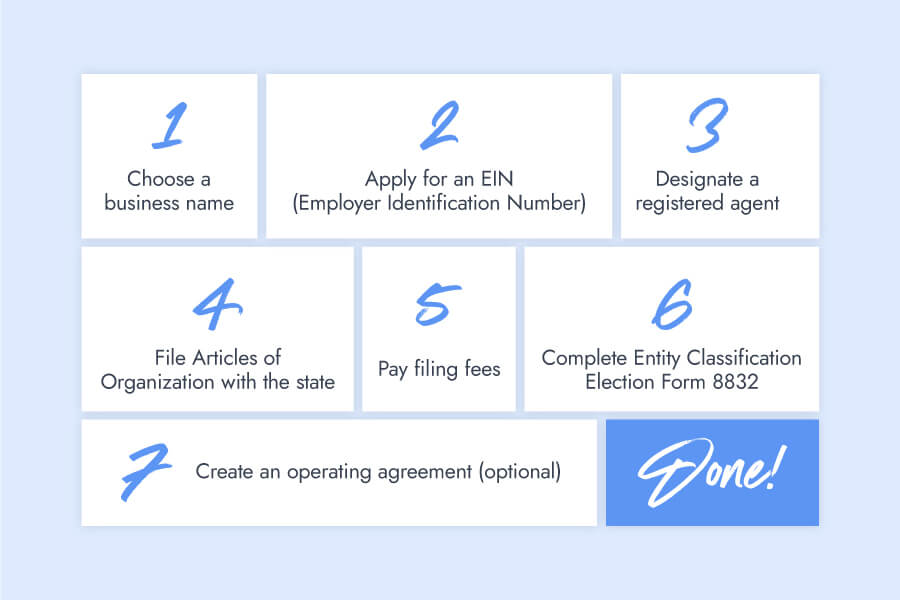

How to form a single-member LLC

While it’s easier to form a single-member LLC than a corporation, it requires more time, effort, money, and paperwork than a sole proprietorship.

Every state has its procedures and regulations, including the paperwork you must file and how you submit it.

However, several steps remain the same in most states, including:

1. Choose a business name

2. Apply for an EIN (Employer Identification Number)

3. Designate a registered agent

4. File Articles of Organization with the state

5. Pay filing fees

6. Complete Entity Classification Election Form 8832

7. Create an operating agreement (optional)

Of course, there are other pros, cons, and procedures you should know about before you consider forming an LLC.

Like which LLC type is right for you and how to save money by forming your LLC in another state.

The pros and cons of a single-member LLC

Before starting your business, the first thing you must do is choose a structure.

If you’d like the liability protection of an LLC and the simple tax system of a sole proprietorship, a single-member LLC could be the perfect structure for you.

But before you decide, it’s essential to weigh the pros and cons.

The pros of a single-member LLC

There are 5 main pros to owning an single-member LLC:

1. Liability Protection

The primary benefit in choosing a limited liability company compared to a sole-proprietorship is, as the name suggests, liability protection.

As a single-member LLC owner, you may not be liable for any debts relating to the business. If your company should go bankrupt, can’t pay its debts, or face a lawsuit, your personal assets may not be at risk.

2. Pass-through taxation

A single-member LLC structure benefits from “pass-through” taxation, which means profits and losses pass through to the owner, who then reports their income on their income tax return.

The LLC doesn’t have to file or pay corporate tax, saving you time and money by avoiding lengthy tax preparations.

3. Raising capital through equity

As the owner of an SMLLC, you can raise equity capital by selling a percentage of your business. There are 2 ways you can do this.

First, you can sell to a silent investor who’ll play no part in the daily duties but takes a percentage share of the income relative to their investment.

Second, you can bring on a partner who works alongside you and takes an agreed owner draw relative to their percentage share of the business.

4. Adding LLC owners

A significant advantage of an LLC business is the flexibility to arrange the rights of new owners in ways that suit you.

When a new member invests in your LLC, you can specify their control levelin managing the business in your LLC operating agreement.

You can also control a new member’s percentage share of the profits and create unique structures for other members, like yourself, as the major shareholder of the LLC.

5. Easy ownership transfer

The single-member structure also enables you to transfer ownership of your company to a family member or sell to someone else via a bill of sale. The process is straightforward, and you can do it without interrupting the activities of your business.

It’s important to note that when transferring ownership, ensure you’ve written an operating agreement to clarify specific provisions to facilitate the process.

The cons of a single-member LLC

The truth is there aren’t many cons to forming a single-member LLC, and you can overcome the few there are with the right advice.

First on the list is every business owner’s favorite pastime: Paperwork!

1. Extensive paperwork

Unfortunately, there’s no getting around the paperwork you’ll need to complete when forming an LLC.

These include registering your business name, filing an Article of Organization, applying for an EIN, and completing classification forms, amongst others.

And of course, first, you’ve got to find what you need and then know where to send it.

If the thought of government forms fills you with dread and you’d rather watch paint dry than fill them out, you’ve got an alternative option!

You can save yourself the hassle and check out our LLC formation service right here at Tailor Brands. Hey, we love government forms; that’s what we do!

2. Corporate veil protection

The term “corporate veil” refers to an invisible deflector shield (Trekkie fans, anyone?) that divides your assets from those of your single-member LLC.

But there’s a weak link in the corporate veil—you! And your protective cloaking system could fail if you pierce the corporate veil.

Piercing the corporate veil is a complicated legal doctrine. There are several cases in which the limited liability protection could be lifted. For example, when a business owner mixes personal and business finances or participates in fraudulent activities, leaving their assets at risk should someone sue their company.

You may be able to avoid this by keeping your expenses separate and having a designated business bank account and credit card for your LLC that you can track and record.

In any case, it’s advised to consult a lawyer once your LLC is set up to understand the legal ramifications and the steps you will need to take to make sure your LLC is as protected as it can be.

To wrap it up

The LLC structure was created to enable small and medium businesses to gain a corporation’s perks while avoiding the costs.

Single-member LLC’s were meant for entrepreneurs like you to chase their dreams.

And while starting an LLC might seem difficult, it’s a small step that could be a giant leap for your business.