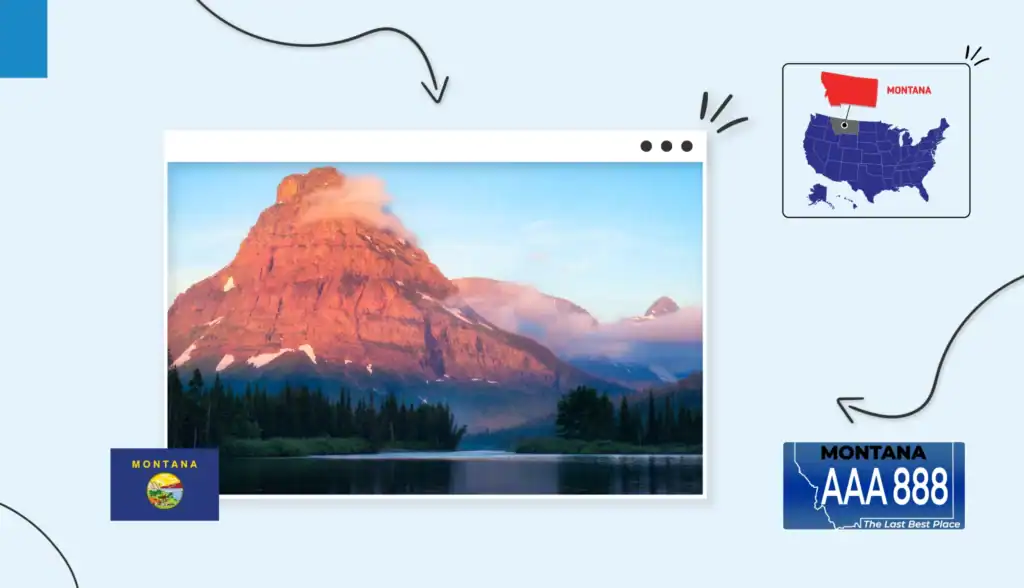

Welcome to Big Sky Country, where the business landscape is as expansive and promising as Montana’s legendary mountain vistas! If you’re considering launching your entrepreneurial journey in the Treasure State, you’ve chosen a remarkable destination that combines small-town charm with serious business potential.

Montana’s economy is experiencing a renaissance, with a robust GDP growth rate that consistently outpaces national averages. The state’s strategic location, business-friendly policies, and relatively low cost of operations make it an ideal launching pad for startups and established businesses alike. With a population just over one million spread across nearly 150,000 square miles, Montana offers entrepreneurs the unique advantage of lower competition while maintaining access to both regional and national markets.

What makes Montana particularly attractive for business owners is its favorable tax environment: the state has no sales tax, and business personal property taxes are among the lowest in the nation. The Montana Department of Commerce actively supports new ventures through various incentive programs, and the state’s “Made in Montana” brand carries significant weight with consumers who value authentically local products and services.

Here’s your complete roadmap to launching a business in the Last Best Place:

- Fine-tune your business idea

- Create a business plan

- Choose a business location

- Decide if you’re an online-only business

- Choose a business name

- Choose a business structure

- Set up banking, credit cards, and accounting

- Get funding for your Montana business

- Get insured

- Obtain permits and licenses

- Find your team

- Market and grow your business

- Open the doors!

1. Fine-tune your business idea

Starting with a solid business concept is like laying a strong foundation in Montana’s sometimes challenging weather – it needs to withstand the test of time and local conditions. The key to success lies in developing an idea that not only excites you but also serves a genuine need in the Montana marketplace.

Montana’s economy thrives on several key sectors that present excellent opportunities for entrepreneurs. Agriculture and ranching remain cornerstones, but don’t overlook the growing tech sector, outdoor recreation industry, and sustainable energy businesses that are flourishing across the state. Tourism brings over 12 million visitors annually, creating countless opportunities in hospitality, outdoor gear, guided services, and artisan crafts.

Consider business ideas that tap into Montana’s unique character and needs. Farm-to-table restaurants leverage the state’s agricultural bounty while serving both locals and tourists. Outdoor recreation businesses – from equipment rental to adventure guiding – capitalize on Montana’s world-class hunting, fishing, skiing, and hiking opportunities. Technology consulting serves the state’s rural businesses that need to compete in the digital marketplace.

Manufacturing presents significant opportunities, particularly in food processing, craft brewing, and agricultural equipment. Montana’s “Made in Montana” certification program provides marketing advantages for locally-produced goods, making manufacturing businesses particularly viable.

Service-based businesses often thrive in Montana’s smaller communities where specialized expertise is scarce. Professional services like accounting, legal, marketing, and healthcare consulting can serve clients across the state through remote delivery models.

When evaluating your business idea, consider Montana’s seasonal fluctuations. Tourism peaks in summer, while agricultural businesses may have different busy seasons. Plan for these variations to ensure year-round sustainability.

Research your target market thoroughly. Montana’s demographics skew toward an older population in rural areas, while cities like Bozeman, Missoula, and Billings attract younger professionals and college students. Understanding these nuances helps refine your offering to match local preferences and spending patterns.

2. Create a business plan

A well-crafted business plan serves as your roadmap through Montana’s diverse business landscape. This document isn’t just for securing funding – it’s your strategic guide for navigating challenges and capitalizing on opportunities specific to operating in the Treasure State.

Market research

Montana’s market dynamics differ significantly from more populated states. With smaller customer bases spread across vast distances, understanding your market becomes even more critical. Research local competitors, but don’t limit yourself to Montana – consider businesses in similar rural markets across the Mountain West.

Analyze seasonal patterns that affect Montana businesses. Tourist-dependent ventures may generate 70% of annual revenue during summer months, while agricultural businesses peak during harvest seasons. Factor these fluctuations into your revenue projections and cash flow planning.

Study Montana’s demographic trends. The state attracts retirees seeking outdoor lifestyles, young professionals in emerging tech hubs, and families drawn to small-town values. Each group represents different market opportunities and buying behaviors.

Financial plan

Montana’s cost structure offers unique advantages. Commercial real estate costs significantly less than coastal markets, and the absence of state sales tax simplifies pricing strategies. However, transportation costs may be higher due to distances between suppliers and customers.

Plan for seasonal cash flow variations common in Montana businesses. Establish lines of credit to bridge slower periods, and consider complementary revenue streams that peak during different seasons.

Factor in Montana-specific costs like higher heating bills, potential weather-related business interruptions, and insurance considerations for extreme weather events.

Marketing plan

Marketing in Montana requires a different approach than dense urban markets. Word-of-mouth marketing carries exceptional power in tight-knit communities. Building relationships with local business networks, chambers of commerce, and community organizations often proves more valuable than expensive advertising campaigns.

Digital marketing becomes crucial for reaching customers across Montana’s vast geography. A strong online presence helps small-town businesses compete with larger markets and serves customers who may drive hours to reach your location.

Consider Montana’s strong local pride in your marketing strategy. Emphasizing local ownership, community involvement, and Montana values resonates strongly with both residents and visitors seeking authentic experiences.

Choose a business location

Location strategy in Montana requires balancing market access with operational costs. Unlike dense urban areas where foot traffic drives retail success, Montana businesses often succeed through strategic positioning within their service areas and strong customer relationships.

Montana’s major population centers each offer distinct advantages. Billings, the state’s largest city with over 110,000 residents, provides access to regional transportation networks and diverse industries. Missoula combines university energy with outdoor recreation culture, while Bozeman attracts tech companies and educated professionals. Great Falls offers central location advantages and manufacturing infrastructure.

Smaller communities throughout Montana present opportunities for businesses serving local needs or tourists. Towns like Whitefish, Red Lodge, and Big Sky thrive on seasonal tourism, while agricultural communities provide steady markets for farm services and equipment.

Zoning regulations in Montana tend to be less restrictive than many states, but requirements vary significantly between counties and municipalities. Rural areas often have minimal zoning, while incorporated cities maintain specific commercial, residential, and industrial designations.

Consider transportation infrastructure when choosing locations. Proximity to interstate highways benefits businesses requiring freight access, while railroad access remains important for agricultural and manufacturing operations.

Montana’s harsh winters affect location decisions. Ensure adequate snow removal access, reliable utilities, and consider backup power for critical operations. Many businesses benefit from ground-floor locations to avoid accessibility issues during severe weather.

Evaluate utility availability and costs. Rural locations may require well water, septic systems, and propane heating. Internet connectivity varies dramatically across Montana, with urban areas offering high-speed fiber while rural locations may depend on satellite services.

Decide if you’re an online-only business

The digital business model offers unique advantages in Montana’s geography. Starting a business online eliminates distance barriers that challenge traditional brick-and-mortar operations, allowing Montana entrepreneurs to serve customers nationwide while enjoying the state’s lifestyle benefits and lower operating costs.

Online business requirements

A professional website becomes your virtual storefront and often customers’ first impression of your business. Montana businesses benefit from emphasizing their location and values – many customers specifically seek products and services from authentic Western sources.

Social media presence helps overcome Montana’s isolation by building communities around your brand. Instagram particularly suits Montana businesses, as the state’s scenic beauty provides endless content opportunities that engage audiences nationwide.

Supply and distribution planning requires extra attention in Montana. Consider warehousing options in population centers like Billings or Missoula for faster shipping to Montana customers, while using third-party logistics for national distribution. FedEx and UPS provide reliable service to most Montana locations, though rural deliveries may take additional time.

Montana-specific online business regulations

Montana imposes sales tax obligations on online businesses with economic nexus in the state. Monitor your Montana sales volume, as exceeding specific thresholds triggers tax collection requirements.

Professional service businesses operating online must comply with Montana business license requirements, regardless of delivery method. Legal, accounting, and healthcare services require state licenses even when provided remotely.

Product-based online businesses should leverage Montana’s “Made in Montana” certification when applicable. This designation provides marketing advantages and helps justify premium pricing for authentically local products.

3. Choose a business name

Your business name carries special significance in Montana, where authenticity and local connection drive customer loyalty. The perfect name should reflect your values while complying with state regulations and supporting your long-term branding strategy.

Montana businesses often succeed with names that evoke the state’s natural beauty, Western heritage, or frontier spirit. However, avoid clichéd references that might seem inauthentic. Instead, consider subtle nods to Montana geography, history, or values that resonate with your target audience.

Ensure your chosen name clearly communicates your business purpose, especially for service-based companies. Montana’s smaller markets mean customers may not have extensive options, so clarity about your offerings helps drive business.

Montana naming regulations

The Montana Secretary of State maintains strict requirements for business names. Your name must be distinguishable from existing registered businesses in the state database. You can perform a Montana business entity search on the Office of Business Services website to search for available names.

Certain words require special approval or licensing. Terms like “bank,” “insurance,” “engineer,” and “attorney” trigger additional scrutiny and may require professional licensing verification.

LLC names must include “Limited Liability Company” or abbreviations like “LLC” or “L.L.C.” Corporate names require “Corporation,” “Incorporated,” “Company,” or abbreviations like “Corp.,” “Inc.,” or “Co.”

Reserve your chosen name through the Montana Secretary of State if you’re not ready to file immediately. Name reservations last 120 days and cost $10, providing time to complete formation requirements.

Many business owners also use a DBA (Doing Business As) name to operate under a different title while keeping their original business entity. This can improve branding flexibility and public recognition.

In Montana specifically, if you plan to operate under a different name than your legal business name, you’ll need to register a DBA Montana. This filing lets your company legally use an alternate trading name for marketing or customer-facing purposes.

Secure matching domain names for your business website. Montana businesses benefit from “.com” domains for credibility, though “.montana” domains became available in recent years for businesses wanting to emphasize local connection.

Consider trademark implications for your business name. While Montana registration provides state-level protection, federal trademark registration protects your brand nationally and becomes crucial for businesses planning expansion beyond Montana.

4. Choose a business structure

Selecting the right business structure affects everything from taxes to liability protection to growth potential. Montana’s business-friendly environment supports various structures, each offering distinct advantages depending on your specific situation and goals.

Common business structures in Montana

Limited Liability Company (LLC) represents the most popular choice for Montana small businesses. LLCs provide personal liability protection while maintaining operational flexibility and pass-through taxation. Montana allows single-member LLCs and doesn’t require annual meetings or extensive record-keeping.

Sole Proprietorship offers simplicity for individual entrepreneurs but provides no liability protection. This structure works well for low-risk service businesses or as a starting point before formalizing into a Montana LLC.

Corporation structures benefit businesses planning significant growth, seeking investment, or requiring complex ownership arrangements. Montana supports both C-corporations and S-corporations, each with different tax implications.

Partnership structures serve businesses with multiple owners. Montana recognizes general partnerships, limited partnerships, and limited liability partnerships, each offering different liability protections and management structures.

Tax advantages by structure

Montana’s tax structure influences business formation decisions. The state imposes a corporate income tax with rates ranging from 6.5% to 6.75%, but offers various credits and deductions that can significantly reduce effective rates.

LLCs and partnerships enjoy pass-through taxation, meaning business profits and losses flow through to owners’ personal tax returns. This eliminates double taxation concerns while allowing owners to deduct business losses against other income.

Montana doesn’t impose franchise taxes or annual fees on most business structures, unlike many states. This reduces ongoing compliance costs and makes Montana particularly attractive for small businesses.

The state offers various tax incentives for specific business activities. Research and development credits, recycling equipment credits, and new markets tax credits can substantially reduce tax obligations for qualifying businesses.

5. Set up banking, credit cards, and accounting

Establishing proper financial infrastructure provides the foundation for business success and compliance with Montana’s regulatory requirements. Separating business and personal finances not only protects your liability shield but also simplifies tax preparation and business management.

Montana’s banking landscape includes national chains, regional banks, and community banks that understand local business needs. Many Montana entrepreneurs prefer working with local banks that offer personalized service and understand regional economic conditions.

Business checking accounts typically require your Articles of Organization or Incorporation, EIN, and operating agreement. Many Montana banks offer packages that bundle checking, savings, merchant services, and business credit cards.

Consider banks offering remote deposit capture, crucial for businesses serving Montana’s vast geography. Online banking capabilities help manage finances efficiently when customers and suppliers may be hours away.

Business credit cards help establish credit history while providing expense tracking and cash flow management. Montana businesses often benefit from cards offering rewards for fuel and travel expenses, given the state’s distances.

Montana-specific banking considerations

Montana requires workers’ compensation insurance for most businesses with employees. Many banks offer specialized accounts for managing payroll taxes and workers’ compensation premiums, ensuring compliance with state requirements.

Agricultural businesses may qualify for specialized banking products through Montana’s agricultural lending programs. The Montana Agricultural Development Authority provides loan guarantees that help farmers and ranchers access capital.

Sales tax exemptions for manufacturing and agricultural businesses require proper documentation and account management. Work with banks familiar with Montana’s exemption certificates and compliance requirements.

6. Get funding for your Montana business

Montana entrepreneurs have access to various funding sources, from traditional bank loans small business grants, as well as specialized programs supporting rural and agricultural businesses, and Montana small business grants. Understanding your options helps secure the capital needed to launch and grow your venture.

Traditional bank financing remains accessible in Montana, with community banks often providing more flexible terms than national lenders. Montana banks understand local economic conditions and may approve loans that larger institutions might decline.

Montana-specific grants and loans

The Montana Department of Commerce administers numerous programs supporting business development. The Big Sky Economic Development Trust Fund provides grants and loans for businesses creating jobs and economic opportunities.

The Montana Agricultural Development Authority offers loan programs specifically for agricultural businesses, including livestock operations, farm equipment purchases, and agricultural processing facilities.

Montana’s Microbusiness Finance Program provides small loans up to $35,000 for businesses with fewer than 10 employees. This program particularly benefits rural entrepreneurs who might struggle to access traditional financing.

The state’s Indian Equity Fund supports businesses on or near Montana’s tribal reservations, promoting economic development in traditionally underserved areas.

Federal programs like SBA loans work actively in Montana, with several preferred lenders throughout the state. The USDA also provides rural business development grants and loans for qualifying businesses.

Montana entrepreneurs should explore tax credit programs that provide indirect funding. The Research and Development Tax Credit, New Markets Tax Credit, and various energy-related credits can significantly reduce tax obligations.

Private investment and crowdfunding

Montana’s growing tech sector attracts venture capital and angel investors, particularly in Bozeman and Missoula. The Montana Angel Network connects entrepreneurs with accredited investors interested in early-stage companies.

Crowdfunding platforms work well for Montana businesses with compelling stories or unique products. The state’s authentic Western brand often resonates with national audiences seeking genuine experiences or products.

Consider revenue-based financing for businesses with steady cash flows. This alternative provides capital without requiring equity dilution or personal guarantees.

7. Get insured

Insurance protection becomes particularly crucial in Montana, where extreme weather, seasonal business fluctuations, and liability exposures require comprehensive coverage strategies. The state’s unique risks demand specialized insurance considerations beyond standard business policies.

General liability insurance protects against customer injuries and property damage claims. Montana businesses serving tourists need adequate coverage, as out-of-state visitors may pursue larger settlements.

Property insurance must account for Montana’s weather extremes. Ensure coverage includes wind damage, hail, flooding, and business interruption protection for weather-related closures.

Montana-specific insurance requirements

Workers’ compensation insurance is mandatory for most Montana businesses with employees. The state maintains a competitive market with multiple insurers, but rates vary significantly by industry classification.

Montana requires motor vehicle insurance for business vehicles, with minimum coverage levels that may be inadequate for commercial operations. Consider umbrella policies for additional protection.

Professional liability insurance becomes crucial for service-based businesses. Montana’s smaller markets mean reputational damage can devastate businesses more quickly than in larger markets.

Cyber liability insurance grows increasingly important as Montana businesses adopt digital technologies. Data breaches can be particularly damaging for small businesses with limited resources for recovery.

Agricultural businesses need specialized coverage for livestock, crops, and equipment. Montana’s weather patterns create unique risks that standard policies may not adequately address.

8. Obtain permits and licenses

Montana’s regulatory environment generally favors business development, but specific industries require permits and licenses that vary by location and business type. Understanding requirements early prevents costly delays and ensures compliance from day one.

Federal and Montana tax requirements

All businesses need federal tax identification numbers (EIN) from the IRS. Single-member LLCs may operate under the owner’s Social Security number, but separate EINs provide better protection and banking options.

Montana requires business registration through the Secretary of State for most formal business structures. LLCs file Articles of Organization, while corporations file Articles of Incorporation.

Sales tax permits aren’t required since Montana has no state sales tax, simplifying compliance compared to most states. However, businesses must still comply with federal excise taxes and unemployment taxes.

Montana-specific licensing requirements

Professional services like law, medicine, engineering, and accounting require state licensing through respective professional boards. Montana maintains reciprocity agreements with many states for certain professions.

Food service businesses need permits from Montana’s Department of Public Health and Human Services. Requirements vary based on service type, from simple food handler permits to comprehensive restaurant licenses.

Liquor licenses are required for businesses selling alcohol. Montana’s liquor licensing system varies by locality, with some areas maintaining government-controlled sales while others allow private retailers.

Manufacturing businesses may need environmental permits depending on their processes. The Montana Department of Environmental Quality oversees air quality, water discharge, and waste management permits.

Construction contractors need licensing through Montana’s Department of Labor and Industry. Requirements vary by trade and project value, with continuing education requirements for license maintenance.

Agricultural businesses may need permits for water rights, livestock operations, or pesticide application. These requirements often involve federal agencies alongside state regulators.

9. Find your team

Building the right team becomes particularly crucial in Montana, where skilled workers may be scarce and distances between team members can be significant. Success often depends on finding people who understand Montana’s unique business environment and share your commitment to excellence.

People are the backbone of your business

Montana’s smaller talent pool makes hiring decisions even more critical than in larger markets. Each team member has greater impact on business success, making cultural fit and skill alignment essential considerations.

Professional relationships carry extra weight in Montana’s tight-knit business community. A single negative experience can damage reputations across the state, while positive relationships open doors and create opportunities.

Consider hiring locally whenever possible. Montana workers often bring strong work ethics, loyalty, and understanding of local markets that benefit businesses long-term. Remote workers can supplement local talent for specialized skills.

Invest in training and development programs. Montana businesses often need to develop talent internally rather than recruiting experienced workers from outside the state.

Montana payroll regulations

Montana requires workers’ compensation coverage for most employees, with rates varying by industry classification. The state allows self-insurance for qualifying employers or coverage through private insurers.

Unemployment insurance contributions are required for businesses with employees. Montana’s unemployment tax rates depend on experience ratings and industry classifications.

The state minimum wage exceeds federal requirements and adjusts annually for inflation. Monitor changes to ensure compliance with current rates.

Montana requires posting various employment notices in accessible locations. The Department of Labor and Industry provides required posters covering wage and hour laws, safety regulations, and workers’ rights.

Hiring contractors

Independent contractors offer flexibility for Montana businesses dealing with seasonal fluctuations or specialized project needs. However, proper classification is crucial to avoid penalties and liability issues.

Montana follows federal guidelines for contractor classification, focusing on control, financial relationship, and relationship type. Misclassification can result in back taxes, penalties, and workers’ compensation issues.

Consider contractors for specialized services like accounting, legal, marketing, and IT support. Montana’s smaller markets may not justify full-time positions for these functions.

Agricultural businesses often rely heavily on seasonal contractors. Ensure compliance with federal H-2A visa programs and state requirements for agricultural labor.

10. Market and grow your business

Marketing in Montana requires strategies that account for the state’s unique geography, demographics, and cultural values. Success often comes from building genuine relationships within communities rather than relying solely on traditional advertising approaches.

Build customer loyalty through local engagement

Montana customers value authenticity and personal relationships more than flashy marketing campaigns. Participate in community events, sponsor local sports teams, and support charitable causes that align with your values.

Word-of-mouth marketing carries exceptional power in Montana’s smaller communities. Exceptional service to one customer often leads to referrals throughout their network, creating exponential growth opportunities.

Seasonal marketing becomes crucial for many Montana businesses. Plan campaigns around tourist seasons, agricultural cycles, and weather patterns that affect customer behavior.

Digital marketing strategies

Invest in search engine optimization (SEO) to capture customers searching for Montana-based businesses. Many consumers specifically seek local providers, giving Montana businesses advantages over generic competitors.

Social media platforms help overcome geographic isolation by building communities around your brand. Share Montana-specific content that showcases your location and values.

Email marketing works particularly well for Montana businesses with seasonal customers. Stay connected with tourists who visit annually and locals who may use services periodically.

Collaborate with other Montana businesses

Cross-promotion with complementary businesses creates win-win opportunities. Hotels can partner with restaurants, outdoor gear shops can work with guide services, and professional services can refer clients to each other.

Join Montana business associations and chambers of commerce. These organizations provide networking opportunities and collective marketing power that individual businesses can’t achieve alone.

Consider participating in “Made in Montana” programs and farmers’ markets. These venues showcase local businesses and attract customers seeking authentic Montana experiences.

11. Open the doors!

After completing all the preparation steps, it’s time for the exciting moment – launching your Montana business! A successful opening sets the tone for future growth and establishes your presence in the community.

Plan a successful launch event

Montana communities love celebrating new businesses. Plan opening events that bring neighbors together and showcase your offerings. Consider timing launches around local festivals or events that draw crowds.

Invite local media, business leaders, and community influencers to your opening. Montana’s smaller markets mean local press coverage can significantly impact awareness and early customer acquisition.

Offer special promotions or discounts for opening week to encourage trial and word-of-mouth marketing. Consider donating a percentage of opening sales to local charities to demonstrate community commitment.

Land your first sale

Focus on delivering exceptional experiences to early customers. In Montana’s tight-knit communities, first impressions often determine long-term success or failure.

Follow up with initial customers to ensure satisfaction and request feedback. Use early experiences to refine operations and address any issues before they become larger problems.

Document success stories and testimonials from early customers. These authentic endorsements become powerful marketing tools for attracting additional business.

Conclusion

Congratulations! You’ve navigated the complete process of starting a business in Montana, from initial concept through grand opening. Big Sky Country offers tremendous opportunities for entrepreneurs willing to embrace its unique challenges and advantages.

Montana’s business-friendly environment, combined with its authentic culture and natural beauty, creates a foundation for sustainable business success. Whether you’re serving local communities or building a business that reaches beyond Montana’s borders, you’re now equipped with the knowledge and tools needed to thrive.

Remember that business success in Montana often comes from building genuine relationships, delivering exceptional value, and staying true to the values that make the Treasure State special. Your journey as a Montana business owner has just begun, and the opportunities ahead are as boundless as the Big Sky itself.

When you’re ready to streamline your business formation process, Tailor Brands offers comprehensive services that can help you navigate LLC formation, obtain your EIN, secure proper licensing, and establish all the foundational elements needed for Montana business success. Their platform simplifies complex processes so you can focus on what matters most: building and growing your dream business in the Last Best Place.

FAQ

Montana offers several compelling advantages for entrepreneurs, including no state sales tax, relatively low business personal property taxes, minimal bureaucratic red tape, and access to various state incentive programs. The state’s lower cost of living and operating expenses, combined with its authentic “Made in Montana” brand recognition, create unique opportunities for businesses to thrive while maintaining competitive advantage over companies in higher-cost markets.

Filing Articles of Organization for a Montana LLC costs $70 with the Secretary of State. Additional costs may include registered agent services (if not serving as your own), operating agreement preparation, and EIN application (which is free directly through the IRS). Total startup costs typically range from $70 to several hundred dollars depending on whether you use professional services or handle filings yourself.

Yes, Montana requires annual reports for LLCs, due by April 15th each year. The annual report fee is $20 and can be filed online through the Montana Secretary of State’s website. Failure to file annual reports can result in administrative dissolution of your LLC, so maintaining this simple compliance requirement is crucial.

License requirements vary significantly by business type and location. Common licenses include professional licenses for regulated industries (healthcare, law, engineering), food service permits for restaurants, liquor licenses for alcohol sales, and contractors’ licenses for construction work. Many businesses operate with just their basic business registration, but it’s essential to research requirements specific to your industry and location.

Montana offers various tax incentives including research and development tax credits, recycling equipment credits, new markets tax credits, and specific incentives for agricultural businesses. The state also provides property tax abatements for certain industries and locations. Additionally, the absence of state sales tax simplifies operations and pricing strategies compared to most other states.

Montana’s smaller talent pool requires creative recruitment strategies. Utilize local job centers, university career services, professional associations, and word-of-mouth networks. Many businesses succeed by hiring locally and investing in training programs. Remote work arrangements can supplement local talent for specialized positions, while apprenticeship programs help develop needed skills within your community.

Many Montana businesses experience significant seasonal variations due to tourism patterns, agricultural cycles, and weather conditions. Plan cash flow carefully to bridge slower periods, consider complementary revenue streams that peak during different seasons, and factor seasonal patterns into staffing decisions. Success often requires adapting business models to capitalize on Montana’s seasonal opportunities while maintaining year-round viability.

Montana’s vast distances impact logistics, customer service, and employee management. Plan for higher transportation costs, longer delivery times to rural areas, and potential weather-related disruptions. However, technology solutions like video conferencing and e-commerce platforms help overcome geographic challenges while maintaining personal connections that Montana customers value.