Bookkeeping is part of all small business operations, but only some can afford a full-time accountant. For many business owners, that means maintaining their accounts, taking up hours of their precious time.

Accounting software is an affordable solution.

It helps you track your cash flow (how money moves in and out of your business) and provides an easy-to-understand overview of your financial health.

But with a packed accounting software landscape to choose from and too few spare hours in the day, researching the best accounting software can be a pain.

We know that research is a huge part of making the first steps in building your business.

To save you time and make life easier, we’ve selected the 11 best accounting software for small businesses, including cost, capabilities, and industry suitability.

What type of accounting is best for small businesses?

The best accounting software for any small business must suit its operational needs, be easy to use, and support growth.

For example, a restaurant owner wouldn’t need the same accounting features as a freelancer. And one business might need invoicing capabilities, while another, accounting software that integrates with their payroll or point-of-sale system.

But all accounting software should help small business owners track their cash flow, provide a clear picture of profitability, and ensure they’re ready for tax season.

With those essential points in mind, let’s dive in:

11 Best Accounting Software for Small Business 2026

- Zoho Books

- Wave

- OneUp

- Kashoo

- Intuit QuickBooks Online

- Xero

- FreshBooks

- Sage 50cloud

- Neat

- Marginedge

- Tipalti

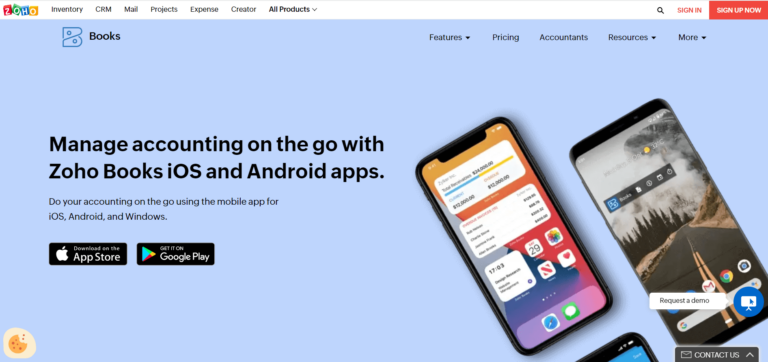

1. Zoho Books

Best for ease of use and mobile accounting

Pricing: Starts at $15.00 per month

- Businesses earning less than $50,000 per year in revenue can use the Zoho Books free plan

Why we like it:

Zoho Books is an online integrated bookkeeping accounting software that connects with Zoho apps and third-party systems, such as your e-commerce platform, bank account, accounts payable and receivable, and payment processor.

The software is fast, reliable, and convenient for business owners that need to see their finances in real-time or manage inventory.

Zoho books also offer many other features that meet most small business needs at an affordable price.

Pros:

- Handy mobile app for accounting tasks

- Powerful free version

- Cheaper than comparative accounting software solutions

- Top tier plan offers multi-currency capabilities

- Advanced features like time tracking and project accounting

- Integrates with most other software solutions

- Offers extra features compared to other solutions for a similar price

Cons:

- Some advanced features like workflow automation and project tracking cost extra

- Doesn’t track fixed physical assets like equipment, real estate, or land

- Limited users with each price tier

- Charges extra to add additional users

- With so many features, new users might find it overwhelming

Who should use it:

Perfect for service-based businesses and any entrepreneurs already using other Zoho products.

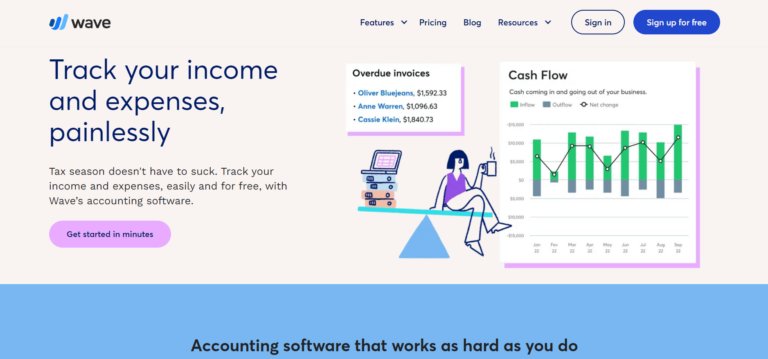

2. Wave

Best free accounting software

Pricing: Free

Why we like it:

Wave offers a free, user-friendly dashboard with features that rival most paid accounting software systems.

The software’s abilities include unlimited invoices, expense tracking and management, banking reconciliation, multi-currency capabilities, and double-entry accounting.

Double-entry accounting benefits entrepreneurs who run multiple businesses as it enables you to track finances using the same accounting software.

Wave also enables your accountant to access year-end reports and prepare tax returns.

Pros:

- Free for life

- Double-entry accounting capabilities

- Multi business management

- Unlimited users

- Unlimited invoices with handy customizable templates and payment acceptance

- Mobile invoicing app

Cons:

- No phone support

- Lacks payroll integration

- No available advanced accounting features

Who should use it:

Suits freelancers, consultants, and small businesses with few employees.

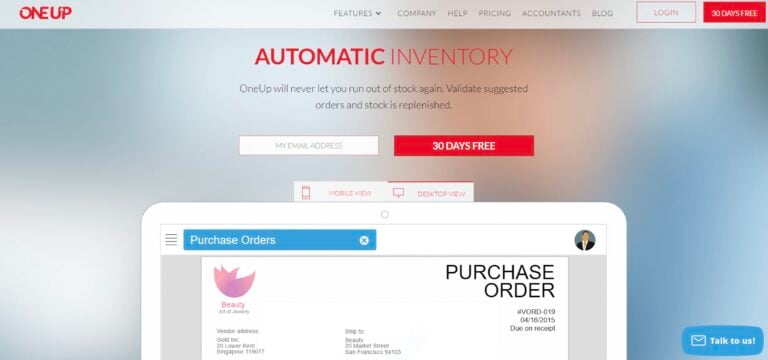

3. OneUp

Best for inventory management

Pricing: Starts at $9 per month

Why we like it:

OneUp is a digital bookkeeping system that uses algorithms to learn and grow with your business by analyzing your inputs and transactions.

The software then streamlines your accounting process by suggesting reconciliations and automating tasks. Each time you approve a suggestion, it validates OneUp’s algorithms, increasing its accuracy to meet your accounting needs.

OneUp also matches bank transactions with invoices, enabling you to control your cash flow, which every small business needs.

Pros:

- Easy to set up

- Includes a CRM function

- Connects your banking transaction for seamless bookkeeping

- Users love its inventory management system

Cons:

- No payroll or time-tracking capabilities

- The unlimited user plan is expensive at $169 per month

Who should use it:

Suits sales teams that use customer relationship management (CRM) features to connect with customers.

4. Kashoo

Best for start-ups and businesses that need simple accounting solutions

Pricing: Starts at $20 per month

- Free invoice plan, free trial period, and $1 for the first year

Why we like it:

Kashoo’s accounting software is another AI system that uses algorithms to learn about your business, make recommendations, and automate your bookkeeping administrative needs.

Kashoo achieves this by analyzing your daily business operations, like sales tax tracking, invoicing, and receipt categorization, using the results to streamline your bookkeeping efficiency, saving you time and money.

Pros:

- User-friendly

- Unlimited users

- Excellent customer support

- Automats administrative tasks

- Includes payroll capability

Cons:

- No mobile app

- Lacks integration options

- No time-tracking, inventory, or document management

Who should use it:

Great for new business owners who need a simple bookkeeping solution and affordable plans that grow with their business.

5. Intuit QuickBooks Online

Best overall accounting software

Pricing: Starts at $15.00 per month

Why we like it:

QuickBooks Online accounting software provides everything a small business needs to control its bookkeeping and run efficiently.

The QuickBooks easy-to-use dashboard and intuitive reporting make life simple for business owners new to online accounting software.

All QuickBooks price plans include important bookkeeping features, such as income and expense tracking, mileage tracking, 1099 contractor management, and sales and tax reports. Other plans offer extra functionality, like dedicated customer support, access for 25 users, and inventory tracking.

And there’s a ton of free online forums and training courses to support you.

Pros:

- Phone support

- QuickBooks Advanced and Online Plus include inventory management

- Double-entry accounting

- Integrates with other third-party software

- Endless online tutorials with expert advice

- Inclusive accounting software

- Mileage tracking abilities

- Mobile app access

Cons:

- More expensive than other available accounting software options

- Plans only allow limited users

- Advanced features can be confusing

- Payroll costs extra

- Lack of e-commerce capabilities

Who should use it:

Perfect for small businesses or freelancers that need to track expenses, log mileage, and organize receipts.

6. Xero

Best for mobile and advanced features

Pricing: Starts at $12 per month

Why we like it:

Xero accounting software suits small businesses that need ease of use and mobile ability.

The software has an intuitive interface that handles most accounting tasks, such as billing and invoicing, expense tracking, sales tax calculation, custom invoices, inventory tracking, and payroll.

You can also sync Xero with multiple devices and receive real-time reports, ensuring you have up-to-date bookkeeping information when and where you need it.

Pros:

- Unlimited users on all plans

- All plans include Hubdoc receipts and bills automation

- Fixed assets management

- Reliable project tracking

Cons:

- No phone support

- Payment processing is not ideal for PayPal transactions

- No automatic unpaid invoices updates

Who should use it:

Suits small business owners who need user-friendly mobile accounting software.

7. FreshBooks

Best for ease of use and customer support

Pricing: Starts at $4.50 per month

Why we like it:

FreshBooks accounting software’s goal is to make small business accounting and invoicing efficient for small business owners.

The software’s primary function is creating, sending, receiving, printing, and paying invoices, which is ideal for service-based businesses that need to project job times and receive payments.

FreshBooks also handles your basic bookkeeping needs; the platform integrates with third-party apps, provides regular backups, and is accessible on mobile devices.

FreshBooks claims its software can help users save up to 46 hrs per year on filing their taxes. And include a clever feature that lets you see when clients open your online invoice.

Pros:

- Excellent customer support

- Easy to use

- Numerous cloud accounting features

- Time and mileage tracking in all plans

- Works on Android and iOS apps

- Unlimited plan options

Cons:

- Limits user and client numbers

- No quarterly tax estimations

- Only higher-tier plans offer accountant access and bank reconciliation

- No document management

- No training options

- Payroll only available as an add-on

Who should use it:

Suits small service-based business owners who send or receive multiple invoices, need easy-to-use accounting software, and efficient customer service.

8. Sage 50cloud

Best for customization and growth

Pricing: Starts at $340 per year

Why we like it:

Sage 50cloud Accounting is a cloud-based accounting software system that offers advanced features and customization options, including invoicing, expense management, and inventory tracking.

The accounting software integrates with Microsoft Office and enables multiple company account management to help small business owners run and grow their businesses.

Pros:

- Many customization options

- Inventory tracking tools

- Microsoft 365 integration

- Cloud-based

- Multiple currency support

- Automatic bank reconciliation

Cons:

- No mobile app option

- Limited phone support

- No payroll service

- Clunky user interface

- No time tracking option

- Basic entry-level plan

Who should use it:

A good option for start-ups and micro-businesses that need accounting software with affordable upgrade options.

9. Neat

Best for freelancers and micro businesses

Pricing: $200 per year

Why we like it:

Neat in name, neat in nature!

Neat accounting software usability makes it a popular choice for self-employed entrepreneurs, with users saying it only takes 5 minutes to set up.

The software lets you filter your transactions, manage expenses, correlate receipts, customize invoices, and make payments. And provides automatic accounting reports, handy for your end-of-year tax returns.

Pros:

- Expense tracking included

- Unlimited file storage

- Document filter/search feature

- Unlimited chat and email support

- Accountant file sharing

- Affordable annual customer support plan

Cons:

- No payroll option

- Invoice and reporting are extra add-ons

- No monthly billing option

Who should use it:

Suits self-employed entrepreneurs like freelancers and micro business owners.

10. Marginedge

Best for restaurants

Pricing: $300 per month

- No free trial, but you can demo Marginedge before buying

Why we like it:

MarginEdge accounting software is specifically for restaurants and other food-industry businesses like food trucks and cafes.

It includes many features that integrate with point-of-sale (POS) systems, enabling you to track your margins and automatically import sales data in real-time. And create detailed food usage reports to help minimize waste and increase your profit margins.

Pros:

- No contract needed

- Integrates with most POS systems

- Includes bill pay

- Provides food usage reports and recipe costs

Cons:

- Only suits food-industry businesses

- Doesn’t include payroll

Who should use it:

A tasty option for restaurant owners and other food business entrepreneurs who need to track costs and reduce food waste.

11. Tipalti

Best for deadline-driven businesses

Pricing: Starts at $149 per month

Why we like it:

Tipalti is a cloud-based accounting software platform that suits deadline-driven businesses that work with multiple partners, such as vendors, suppliers, affiliates, and freelancers.

The software automates your accounts payable process, enabling multiple payment management capabilities in over 190 countries in any currency, and ensures you stay tax compliant.

Pros:

- Easy and fast to implement

- Reliable customer support

- Includes various invoicing and payment methods

Cons:

- Clunky interface

- Users report problems with customizing reports

Who should use it:

Suits entrepreneurs doing business in multiple countries who work with deadlines and need a time-bound payment solution.

Conclusion

No two businesses are alike and most need specific accounting solutions that suit their daily operations.

And while many accounting software services overlap, some provide solutions more suited to one small business than another.

So, before investing in any accounting system, know what you need, ensure it can provide, and take advantage of any free trials.