Setting up an LLC in Delaware is a multi-step process. One of the key steps is filing a Certificate of Formation, as this is a required legal document before your LLC can be established. Here is a step-by-step guide on how to file a Certificate of Formation in Delaware (and what to do afterward).

What is a Certificate of Formation in Delaware?

A Certificate of Formation is a public document that certifies your LLC is recognized by the state of Delaware. The document establishes that your LLC is official and can legally operate within the state. You may need it when opening bank accounts, applying for loans, signing large contracts, or are otherwise conducting business.

A Certificate of Formation is the same as what other states call Articles of Organization or a Certificate of Organization. It’s not the same as Delaware’s Certificate of Incorporation, which S corporations, C corporations and B corporations file in Delaware. LLCs file a Certificate of Formation when forming in Delaware.

The general process for filing an LLC Certificate of Formation requires submitting a form, and then receiving an email copy of the certificate once it’s approved. The certificate then becomes a public document that anyone can reference.

Be prepared to pay Delaware’s LLC filing fee when submitting the Certificate of Formation:

- Domestic LLC ($90): The fee for a regular, domestic LLC that’s based in the state is $90.

- Foreign LLC ($200): The fee for a foreign LLC that’s based in another state but operates in Delaware is $200, and you might have to pay a nominal fee to obtain a Certificate of Good Standing from your LLC’s home state.

- Certified Copy ($50): Should you need a certified copy of your LLC’s Certificate of Formation, the fee is $50 regardless of whether you have a domestic or foreign LLC. For many new LLCs, the emailed copy that doesn’t require an additional charge is sufficient.

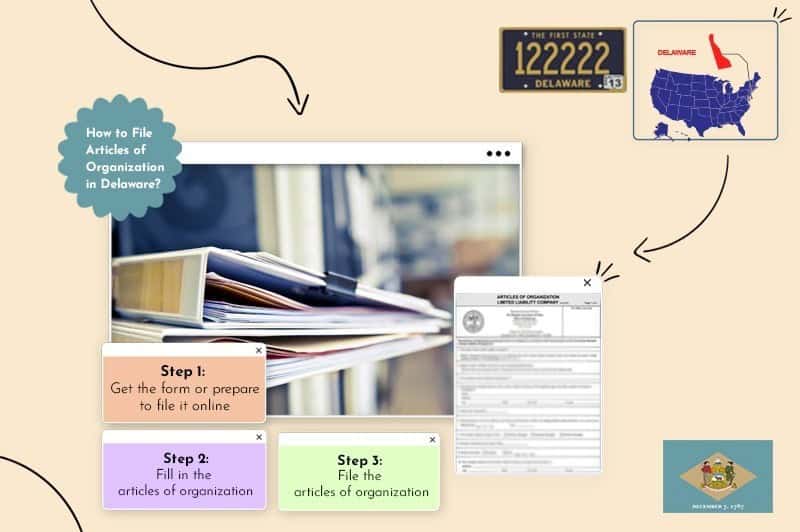

How to file the Certificate of Formation in Delaware

Filing a Delaware Certificate of Formation is a fairly straightforward process, but a few steps are involved.

Step 1: Get the form to file

You can file a Certificate of Formation with the Delaware Division of Corporations online or by mail.

To file online, you’ll first need an account on Delaware One Stop. It’s free to create an account, and you’ll likely use the account for other business tasks (e.g., filing an Annual Report). You can create an account on Delaware.gov if you don’t already have one.

Once your One Stop account is created, navigate to the LLC filing documents and select the Certificate of Formation. You’ll find the form, which can be filled out directly on the One Stop platform.

To file by mail, download the Certificate of Formation of a Limited Liability Company directly from the Delaware Division of Corporations website. The form is three pages long: a letter from the Division of Corporations, a page of special instructions, and a brief page that must be filled out.

Step 2: Fill in the certificate of formation

Completing the Certificate of Formation doesn’t require much information, and it only takes a minute if you already have the relevant details. If you haven’t thought about the details, though, there are a few items that must be adhered to.

Select an LLC name

Section 1 of the Certificate of Formation reads “the name of the limited liability company is.” You must provide a name that isn’t used in Delaware and which abides by the state’s LLC naming rules.

You can check whether your chosen LLC business name is already in use by conducting a Delaware entity search. Agree to the disclaimer, select LLC for the entity, how LLC is included in the name, and enter your chosen name. You’ll see whether the name is available or if it’s in use by another business when you click “search.”

If your chosen name is available, the search suggests reserving the name for a $75 reservation fee. You shouldn’t have to reserve a business name if you’re filing a Certificate of Formation promptly.

Delaware has several LLC business naming rules that the name provided on your Certificate of Formation must meet:

- Your business name must have “Limited Liability Corporation,” “L.L.C.” or “LLC.”

- Your name can’t have words that could be confused with a government agency (e.g., FBI, State Department, Treasury).

- Your name can include Association, Club, Company, Foundation, Fund, Institute, Society, Syndicate, Trust or Union if appropriate.

- Your name can’t use “bank” in relation to banking, unless it’s authorized to offer banking services in the state. Your name can include “bank” in non-banking contexts (e.g. Riverbank Resort LLC, Bank Shot Basketball Club LLC).

- Your name must be distinct from any existing business’ name in Delaware.

Appoint a registered agent

A registered agent Delaware is mandatory for all LLCs in the state, and are designated on the Certificate of Formation. A registered agent acts as the official contact for a business, receiving tax notifications, service of process (if sued), and other important communications.

Your chosen registered agent must be located in Delaware, with a street address that can be their registered office address. A P.O. box can’t serve as the registered office. The agent must also be at least 18.

Aside from these requirements, you can name almost anyone as your LLC’s registered agent. You can designate yourself as the registered agent, another business partner, another family member, or anyone else who consents. Most business owners who don’t use a registered agent service designate themselves or a partner.

You can alternatively choose a registered agent service, which is a business that specializes in acting as other businesses’ registered agent. A registered agent service will receive all important communications and file them or pass them on as appropriate.

Hiring a registered agent service has two main benefits. First, having someone else handle communications simplifies your responsibilities (and all LLC owners have too much to do). A registered agent service will also use its own street address as the registered office address, which affords privacy as your own address doesn’t become public record. (The registered office address is in the public record, as it’s indicated on the Certificate of Formation, which becomes a public document.)

Fill in the registered agent office

Whoever you select to be your LLC’s registered agent is indicated in Section 2 of the Certificate of Formation. You’ll need their street address, city and zip code, and their personal or business name (depending on whether you choose a service).

Step 3: File the certificate of formation

You’re ready to actually file the Certificate of Formation at this point. You can submit the form by mail, in person, or online (not fax):

- By Mail: Sign the form (end of page 3), and mail it to 401 Federal Street, Suite 4, Dover, DE 19901. Include a check for the filing fee of $90 (domestic) or $200 (foreign).

- In Person: Sign the form (end of page 3), and bring it to 401 Federal Street, Suite 4, Dover, DE 19901. You can pay the filing fee by check, cash, or card.

- Online: Digitally sign the form, and upload the PDF file that you’ve completed. Pay the filing fee by card.

What to do after filing a Certificate of Formation

Obtain an EIN

An employer identification number (EIN) functions as a business social security number. You’ll need an EIN to hire employees and open bank accounts, and it’s good to have even if you aren’t doing these. It allows you to more easily keep business finances and taxes separate from personal ones.

Obtaining an EIN is fairly simple and free. You can request one through the IRS website, by mail or by fax, or you can use a service.

Create an operating agreement

Delaware doesn’t require an operating agreement, but it’s a best practice to draft one. You can keep it with your business records.

An operating agreement details your LLC’s ownership structure, its members’ roles, and other pertinent details. It’s extremely helpful should you every have to dissolve the LLC or if there’s ever an ownership transfer or other major change.

Open a business bank account

Keeping business finances and personal finances is helpful in several ways. You can easily see whether your LLC is profitable, can separate out business and personal tax items, and better maintain your LLC’s corporate veil.

Opening a business bank account doesn’t take much time once you have an EIN, and many banks have low initial deposit requirements.

Get business licenses and permits

Depending on your LLC’s location and activities, you might need various licenses or permits. Understanding how to get a business license in Delaware is an important first step, as state and local requirements vary depending on your industry.

- Local: Your city clerk and county clerk are the best resources for checking whether you need any local licenses.

- State: You can check licensing requirements with any state department that oversees your business.

- Federal: The Small Business Administration (SBA) can help with any federal requirements (which are needed less often).

Conclusion

Completing the process of LLC formation in Delaware doesn’t take long once you know what to do. Follow these steps to file a Certificate of Formation, and you’ll soon have an officially registered LLC in Delaware.

FAQ

Updating an LLC Certificate of Formation requires filing a Certificate of Amendment. The amendment can be filed with the Delaware Secretary of State’s Division of Corporations online, by mail, or in person. The filing fee for an amendment is $200 regardless of whether you have a domestic or foreign LLC.

Delaware law requires all LLC members to approve the sale (or other transfer) of your business to change ownership, draft, and execute a buy-sell agreement.

You aren’t required to file any paperwork with the Division of Corporations, as LLC members aren’t required to be listed on the Certificate of Formation. An operating agreement should be updated if your LLC has one, though.

Transferring ownership of an LLC is a somewhat involved legal process. This is one time when you should seriously consider hiring an attorney who knows Delaware business law.

Dissolving an LLC in Delaware requires filing a Certificate of Cancellation and paying a $200 fee when you file the certificate.

A foreign LLC (out-of-state LLC) can conduct business in Delaware after filing a Certificate of Registration and providing a copy of the LLC’s Certificate of Good Standing from the business’ home state. The fee when filing the Certificate of Registration is $200.