No matter your industry or location, you must deal with many regulations as a business owner.

I’m talking about licenses and permits, maintaining accounts, filing annual reports, and paying taxes.

All are unavoidable, but when you comply, your state rewards you!

Yep, you guessed it; they give you a shiny ‘certificate of good standing.’

- But what is it?

- Why do you need one?

- Who can have one?

- How do you get it?

- And should you?

You’re reading the right post if you’re asking any of those questions.

And the answer to 5 is probably yes!

Because a certificate of good standing can do wonders for your business, and if your state says you can have one, you’ve earned it.

What is a Certificate of Good Standing?

A certificate of good standing is a state government-issued seal of approval that says your business is a registered entity and you run it per state laws and regulations.

And, of course, it proves to others that you’re a legitimate business.

A certificate of good standing has many names, including a ‘status certificate,’ ‘certificate of existence,’ ‘certificate of status,’ and ‘certificate of authorization.’

Okay, that’s the what; now, let’s look at the why:

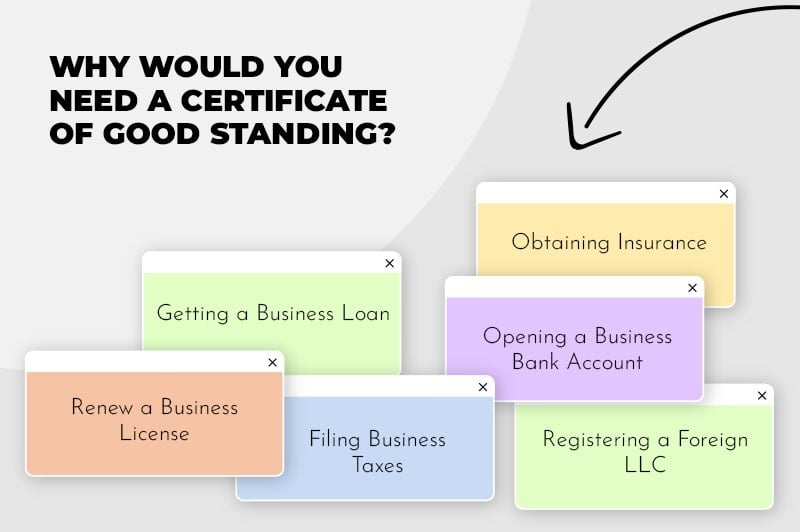

Why Would You Need a Certificate of Good Standing?

While you don’t need a certificate of good standing to run your business in your

state, there are several reasons you could need one.

Such as:

- When seeking a business loan

- Raising money from investors

- Opening your business bank account

- Renewing your business license

- To file your business taxes

- When competing for a government contract

- For specific insurance policies

- Doing business in another state and registering a foreign LLC registering a foreign LLC

- Forming a contract with another company or supplier

Many of those situations mentioned are essential for growing your business, so consider getting your certificate of good standing before you need them.

That’s the why; now, let’s look at who can get one.

Who’s Eligible for a Certificate of Good Standing?

Each state has different laws regarding which business types are eligible for a certificate of good standing.

You discover your state’s laws by contacting your business registration agency (usually your secretary of state’s office).

That said, most states allow the same business entities to apply for the certificate.

Types of business entities that can get the certificate

Businesses that register as a legal entity with their state can apply for a certificate of good standing. These include:

- Limited liability companies

- Limited partnerships

- Limited liability partnerships

- Corporations (including C-corps and S-corps)

Suppose your business isn’t a legal business entity. In that case, your state cannot give you a certificate of good standing.

So, if your business needs one to grow, you could consider forming a limited liability company or one of the limited partnerships.

Types of businesses that don’t need a certificate of good standing

The following 2 types of businesses do not register with their state and are not legal entities, so your state will not issue you a certificate of good standing:

- Sole proprietorships regardless if you have a DBA regardless if you have a DBA (doing business as)

- General partnerships (regardless if you have a DBA)

All pretty straightforward so far, right?

Let’s look at how you get a certificate next.

How to Get a Certificate of Good Standing in Your State

You apply for a certificate of good standing from the state agency where you registered your business. As I mentioned, that will be your secretary of state’s office in most states.

You can discover how to get a certificate of good standing and the costs by researching your filing agency’s website.

Steps to get your certificate

Government websites are often challenging and tedious; I swear they do it on purpose!

To save you the pain, here are the most common steps to getting your certificate of good standing.

1. Have a registered business entity

If your business is not registered, you cannot get a certificate of good standing. (See above for the list of legal entities that qualify.)

2. Make sure your business is in good standing

States give you a certificate of good standing when you comply with state business laws and regulations.

That’s the “good standing” part of the certification! But to comply, your business must have the following in place:

- The correct licenses and permits

- Has filed all necessary reports

- Current on all taxes and fees

When you own a legal entity like an LLC, you register it with your state, which means you can check out your status online via your state’s filing agency.

3. Apply with your state’s business filing agency

You get your certificate of good standing from the business filing agency you used to register your entity in your state–i.e. your secretary of state office. Still, in some states, you’ll have to find the equivalent sub-agency responsible for filing entities, maintaining state records, and issuing certifications.

Depending on your state, you can apply for a certificate online, by email, by phone, by mail, or in person.

4. Pay a fee

Most states charge administration fees when you apply for your certificate of good standing, but not all.

Some states that allow you to apply online waive the fee. The good news is that the states that charge have relatively low costs, ranging from $5 to $50.

Conclusion

Now you know the what, why, who, and how.

So, should you get a certificate of good standing?

Absolutely, if you plan on expanding your business, and even if you’re not, you should probably get one anyway because you might need it later.

But if you’re still unsure, keep reading for some common FAQs business owners have about certificates of good standing.

FAQ

A certificate of good standing is an official document that proves you registered your business and have the authorization to trade in your state.

It also shows other companies and lenders that you comply with state laws.

You’ll need a certificate of good standing to apply for business loans, compete for a government contract, renew your business license, or expand your business by “doing business” in other states.

And, a certificate of good standing gives other businesses the confidence to do business with you.

When you run a legal entity, you’re obliged by law to maintain good standing by following state regulations and meeting federal legal requirements.

If you don’t, your state might fine you for not complying. Or worse, you could lose your limited liability protection or even have your business dissolved!

If your business complies with state laws, getting your certificate of good standing is pretty straightforward.

Delivery time depends on your state. Some allow you to download it immediately after paying the fee, while others mail it to you.

In most cases, you will receive your certificate of good standing within a few weeks of applying.

Certificates of good standing expire, and expiration dates depend on your location.

In some states, certificates are valid for 90 days, and in others. for a year.

The issue with expirations is that some lenders and other businesses will demand a certificate of good standing within a specific period, e.g. 60 days.

When your certificate expires, you can apply for a new one. However, you might need your certificate urgently, so renew it before it expires.

You renew your certificate by applying with the state office that provided the original.

Some states allow you to renew online, and others by mail. Contact your state’s filing agency for further information.