Once you set up an LLC in NY, you are required to file a report. The report is currently filed every two years, as a biennial report. However, this may change over time, and it’s important to stay in good standing and stay up to date in case this requirement changes. It’s crucial that you don’t miss filing your New York LLC’s biennial report when it’s due, though.

Let’s go through the basics of an annual report and New York special requirements:

What is a biennial report?

An annual report is a commonly required business document that confirms and updates a business’s information with the state. Most states require the document, including New York state.

New York is unique in that it makes a distinction between a biennial report and an annual filing fee:

- An annual filing fee must be paid each year

- A biennial report must be filed every two years

Annual filing fee

The annual filing fee is based on the gross income that a business generates within New York. Fees escalate with gross incomes (only generated in New York) as follows:

- Under $100,000 is charged $25

- $100,000–$249,000 is charged $50

- $250,000–$499,999 is charged $175

- $500,000–$999,999 is charged $500

- $1 million–$5 million is charged $1,500

- $5 million–$25 million is charged $3,000

- $25 million is charged $4,500

The annual fee is paid to the New York Department of Taxation and Finance, using the Partnership, Limited Liability Company, and Limited Liability Partnership Filing Fee Payment Form (Form IT-204-LL). The form and payment can be filed online or filed by mail.

Even in a year when your LLC’s biennial report is due, the annual filing fee should still be submitted to the Department of Taxation and Finance using Form IT-204-LL. The annual fee and annual report aren’t filed together.

Biennial report filing

The biennial report contains mostly basic, technical information about an LLC. The function of an annual report is to provide specific information to the governing state, so the state knows and certain information can be publicly disclosed. New York requires this information every two years.

The New York LLC filing fee for the biennial report in New York is $9, regardless of how much or little an LLC earns.

New York LLC biennial report requirements

The requirements that New York has for biennial reports are some of the most basic of any state’s annual report requirements.

The requirements are set forth in the Limited Liability Company Law, Section 301(e). The section stipulates that LLCs must file a biennial report that details:

- The principal address of the LLC, which is where the Secretary of State will forward documents if the Secretary is serving as the agent for service of process

- The name and address of the registered agent New York, where service of process can be given. This only applies if a business has designated a registered agent other than the Secretary of State

Other than the principal (forwarding) address and registered agent’s name/address, no other content requirements are set forth by Section 301(e). This information will be updated so that the state, other government agencies, suing parties, creditors and others can contact your LLC if they have legal / official business.

Of course, you do need to include some identifying information, such as your LLC’s name and members’ names.

How to file a biennial report in New York

You can file your LLC’s biennial report, or you can have a service file a New York biennial report for you. Should you decide to file, there are several details you ought to be aware of.

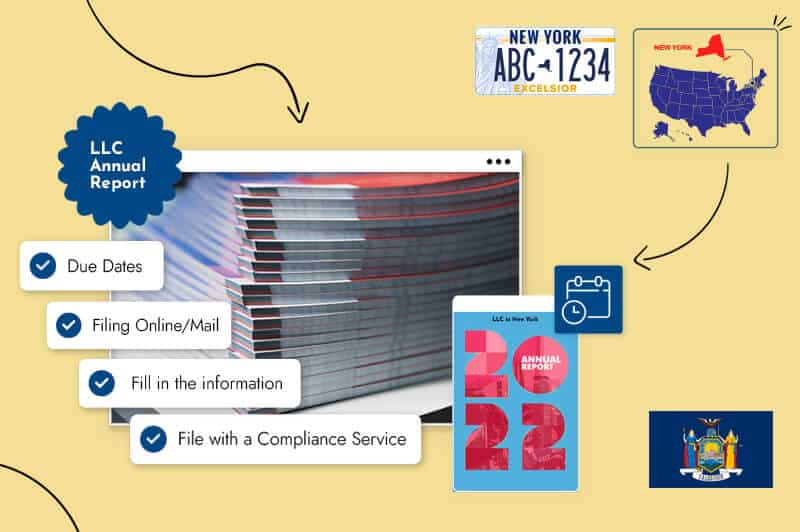

Due dates

Per Section 301(e), the biennial report is due every two years in the calendar month during which your LLC’s articles of organization were filed. If you filed toward the end of the month, use the month in which you filed rather than the month when the articles were fully processed.

The state notes that biennial reports shouldn’t be filed before the calendar month in which they’re due.

File online

You can file the biennial report online through the Department of State’s e-Statement Filing Service:

- You will need your LLC’s entity name and DOS ID number. If you don’t know these, you can look up your LLC by name, using the Department of State’s Corporation and Business Entity Database.

- Log into the e-Biennial Filing System using your LLC’s entity name and DOS ID. You will be directed to a page that displays this information, along with the filing fee ($9) and the filing period.

- The filing period shows when your most recent biennial report went into effect. It’ll be midnight on the first of the month following whenever your report was due. If your biennial report was due and filed by July 31, the filing period will show as “8/1/2022 12:00:00 AM.” Your filing period lasts for two years after this date. (Notably, the filing period doesn’t show when your next report is due.)

- If there has been no change to your LLC’s forwarding address or agent of service for process, check the box “no change required.” “Agent of service for process” refers to a registered agent in New York.

- If either of these addresses has changed, provide the new address in Part 1. You’ll use your LLC’s forwarding address if the Secretary of State is acting as the business’s agent for service of process. You’ll enter the registered agent’s information if you’ve selected a different agent.

- Provide your own name and address since you’re the filer. You’ll also provide your email address so that the state can contact you when the next biennial report is due.

- Check the box indicating that you have been truthful, and then digitally sign the document. Click “next” to move to the payment screen.

- You’ll have to pay the $9 annual report fee by credit or debit card, and you can then submit the biennial report.

The e-Biennial filing system is available Monday–Friday, from 6:00 a.m. to 7:30 p.m. EST. LLCs can’t use the system outside of these hours, on weekends, or on legal holidays.

File by mail

If you’re unable to file your LLC’s New York biennial report online, you technically can do so by mail. It’s much less convenient, and the state discourages mail filing, however.

To file the biennial report by mail:

- Email the Secretary of State’s Division of Corporations at [email protected]. Explain that you need a paper form to file your LLC’s biennial report, and be sure to include your LLC’s exact entity name, DOS ID, and date of formation.

- Again, you can find the entity name and DOS number through the Corporation and Business Entity Database.

- You should receive a paper form for filing the biennial report. It’ll be emailed to you so that you can print it out.

- The paper form follows the online one. Check the box if there have been no changes, or provide the updated address if there have been. Provide your own information too, and sign.

- Include payment for the $9 annual report filing fee. You can write a check to the “Department of State,” or pay by credit card if you include the Credit Card Authorization Form.

- The form and payment should be sent to the Division of Corporations at 99 Washington Ave., 6th Floor, Albany, NY 12231.

File with a compliance service

If you’d rather have someone else take care of this and other compliance matters, consider using our LLC compliance service. Annual compliance will make sure you’re following all necessary New York State filing requirements, including annual fees, biennial reports and more.

What happens if you fail to file on time?

If you failed to file a New York annual report on time, promptly file the report now using either of the above methods. The initial consequences are minor, but they can be business-ending.

Late fees and fines

There is no late fee or fine for failing to file your LLC’s biennial report in New York.

Penalties

Failing to file a biennial report on time removes your LLC from “good standing,” and the business is marked “delinquent” in the public records.

Dissolution

If you go long enough without rectifying the delinquency (by filing), your business can be dissolved.

Conclusion

When the time comes, make sure you attend to your New York LLC’s biennial report requirements. The biennial report is a small matter to take care of but neglecting it could result in your LLC being dissolved. File yourself or let our compliance service take care of all these types of matters for you.

FAQ

No. Instead of an annual report, New York requires LLCs to file a Biennial Statement every two years.

The filing fee is $9, making it one of the lowest LLC compliance costs in the country.

It is due every two years, during the anniversary month of your LLC’s formation or registration.

You can file online through the New York Department of State’s website.

Failure to file may result in your LLC falling out of good standing, which can affect your legal protections and ability to do business.