New York is known as the place where dreams come true, and businesses thrive. It’s no surprise that the Big Apple is a place where many want to kickstart their entrepreneurial journey. Whether you have been a New Yorker all your life or are new to the city, this guide provides insider tips and tricks on how to start a small business in the city that never sleeps. Before you take any steps, consider this guide as your ultimate source for entrepreneurial success in New York.

The steps:

- Fine-Tune Your Business Idea

- Create a Business Plan

- Choose a Business Name

- Choose a Business Structure

- Set up Banking, Credit Cards, & Accounting

- Get Funding for Your New York Business

- Get Insured

- Obtain Permits & Licenses

- Find Your Team

- Market & Grow Your Business

- Open the Doors!

Step# 1. Fine-tune your business idea

New York (or NYC) may be where dreams are made, but you need a great business idea to make them a reality.

How to develop a business idea:

The first place to begin when developing your business idea is you.

Consider why you want to start a business in New York (sure, money), but other factors are equally important, such as your lifestyle and the time you can devote.

Next, add your interests, skills, availability, and resources to the mix.

Then consider the likelihood of your business idea succeeding in your chosen location.

For example, suppose you enter the retail or food industry. In that case, you’ll need a high footfall of passing trade, so NYC, Yonkers, Buffalo, Rochester, or Syracuse would all be a safe bet. In contrast, agriculture start-ups would flourish in the Finger Lakes region.

And finally, think about your community needs and ensure your business idea provides a viable solution.

Stuck for an idea? Don’t schvitz it; here are some to consider:

Popular New York business ideas:

We know NYC for its booming financial, business, healthcare, education, and manufacturing services. If your idea is in one of those niches, odds are you’ll do well.

But 98% of NYC businesses are small businesses, and some are in high demand throughout NY state, such as

- Home-cooked food delivery.

- Home catering business.

- Property management.

- Real estate business.

- Daycare/childcare business.

- Maids/cleaning business.

- Handyman business.

- Online florist delivery service.

- Dry cleaning service.

- Beauty/Hair salon business.

- Airbnb side hustle.

- Landscaping business.

- Car washing service.

- Photography.

- Event organizing & management.

- Home bakery business.

- Food truck.

- Dog Walking.

- Personal shopper.

You can’t be frontin’ with your business idea, and that’s where validation comes into play:

Validate your business idea:

Validation ensures your business idea is worth the investment by asking questions about your niche, such as:

- Can you afford the start-up costs?

- Who is your target market, and can you reach them?

- Is the demand in NY big enough to support your idea?

- Is the market soaked, or is there room for another competitor?

A lot to consider, right?

And that’s why you create a business plan:

Step# 2. Create a business plan

Starting an untested business idea is like “throwing spaghetti at the wall to see what sticks.” And if most hit the floor, you’re in trouble.

It makes sense to throw the spaghetti before you invest!

Your business plan ensures your idea sticks by researching your start-up costs, competitors, ideal clients, best marketing practices, and how and when you’ll make money.

And if you require funding, you`ll need a business plan to convince lenders to buy into your vision.

Market research

The process of evaluating your chosen market to determine its size and whether it’s growing or declining in popularity. Identifying your target audience, their needs, and where they shop for your products or services. And your competitors to confirm their number, strengths, and weaknesses.

Marketing plan

Here’s where you’ll take all you’ve learned from your market research to create a marketing plan that contains the best marketing strategies for engaging and converting your target audience into loyal brand followers.

Financial plan

Your financial plan aims to ensure you choose a profitable business idea and convince lenders to invest in your start-up.

It includes the fixed and variable costs of starting and establishing your brand, like business formation, property rental, marketing strategies, staff wages, monthly utility bills, equipment, product costs, and profit forecasts.

Choose a location

Your start-up’s location depends on your business type, intended customers, and what you can afford.

For example, restaurateurs and retail entrepreneurs will need a high footfall of passing trade to succeed. Online product sellers could start from home or use an affordable lockup to reduce start-up costs.

Before choosing your location, you must confirm it suits your target audience and your budget, and if it does, ensure it’s allowable for your business type.

New York zoning laws and regulations:

All states, counties, and cities have zoning laws controlling land and building use.

For example, you’ll need a general business license and local health and safety permits to start a commercial candle-making business.

Contact your chosen area’s planning or zoning department to learn more about local ordinances.

Decide if you’re an online-only business

Creating an online business is one way to reduce your start-up costs and avoid some zoning laws.

For example, you could start a home-based catering business, ship orders, and expand to commercial property as your brand grows in popularity. But while that would remove rent from your start-up costs, you might still require a zoning permit to operate from home.

To start an online business, you’ll need:

- A website: Your website’s style depends on whether you’re an e-commerce business selling and shipping products or a local service provider needing a site so prospective clients can review your offerings and book an appointment. Either way, your site needs a clean user experience for easy navigation, an engaging home page, an informative about page, testimonials, and links to your social media platforms.

- Social media presence: Dedicated business social media platforms are essential for engaging your ideal clients by sharing your latest images of happy customers and providing free helpful content that links back to your website to encourage sales.

- Supply and distribution plan: E-commerce product sellers need a reliable supply and delivery chain to meet consumer demands.

- Comply with tax laws: NY state has specific tax laws applicable to various business types, including online, such as a Tax Nexus or sales-and-use tax.

- New York-specific regulations regarding online business: While you might avoid some zoning requirements, online sellers must comply with NY online business regulations; these can include protecting your customer’s details and privacy laws.

Step# 3. Choose a business name

Your business name is your most important choice when creating your start-up, as it’s the first thing customers see.

So, it must engage their attention, create curiosity, and resonate emotionally so they’re compelled to learn more about your business. And suit your brand’s personality, convey what you sell or provide, and allow market expansion.

When choosing your business name, you must also comply with New York and national-level naming rules; here’s what to look out for:

New York naming requirements:

- Distinctiveness: Your business name must be unique and distinct from existing business names registered in New York. Use the NY Secretary of State’s business entity name search to confirm.

- Name Availability: Before registering, search the New York State Department of State’s Corporation & Business Entity Database to check your name is available.

- Name Reservation: You can reserve a business name for up to 60 days by filing a Name Reservation Request with the New York State Department of State.

National naming requirements:

- Reserved Words: Certain words like “bank,” “university,” and “college” may require additional approvals because of their regulated nature.

- Entity Type: Your business name must reflect the legal structure of your company (e.g., “LLC,” “Inc.,” “Corporation,” etc.)

- Trademark Considerations: Check for existing trademarks on the USPTO.gov website to ensure your business name doesn’t infringe on someone else’s intellectual property rights.

- Compliance: Your business name should not imply that your business is engaged in illegal or regulated activities.

- Government Approval: Some industries require government approvals or licenses to operate. Make sure your business name aligns with the required approvals.

- No Misleading Information: Your business name shouldn’t be misleading or imply that you`re affiliated with a government agency or a well-known organization if it’s not.

Using a DBA in New York:

All business types can apply to use a Doing Business As (or fictitious name), allowing them to use a name different from their legal entity (LLCs and corporations) or personal name (sole proprietorships or general partnerships) via their county clerk’s office.

Step# 4. Choose a business structure

Structures represent the legal entities you use to establish your business; which you choose determines your legal rights and responsibilities, including how you register, file taxes, and your level of liability protection.

There are around 15 available business structures; the most popular for SMBs are.

Common types of business structure

Sole proprietorship:

An unincorporated entity (not separate from its owner). You don’t register a sole proprietorship, keep all profits and losses, and handle any debts or cases of litigation.

Partnership:

An unincorporated entity with 2 or more owners without registration requirements or liability protection. All profits and losses go to the partners relative to the partnership agreement.

Limited liability company:

LLCs are incorporated, require registration, and provide liability protection to their owners, known as members. 8 LLC types exist, but the most common for SMBs are single-member and multi-member.

Learn more about opening a NY LLC.

Corporations:

Corporations are, as the name suggests, incorporated structures. The 2 most common types of corporations are a C corp and an S corp. Owners of corporations are called shareholders who can buy and sell stocks, receive a wage, and enjoy liability protection.

Tax advantages of each option

The primary advantage of all the above structures (except a C corporation) is they use pass-through taxation, with profits and losses going to the owners who avoid corporation tax.

S corporations shareholders have an extra tax advantage as they can take a wage and receive tax-free payments called dividends.

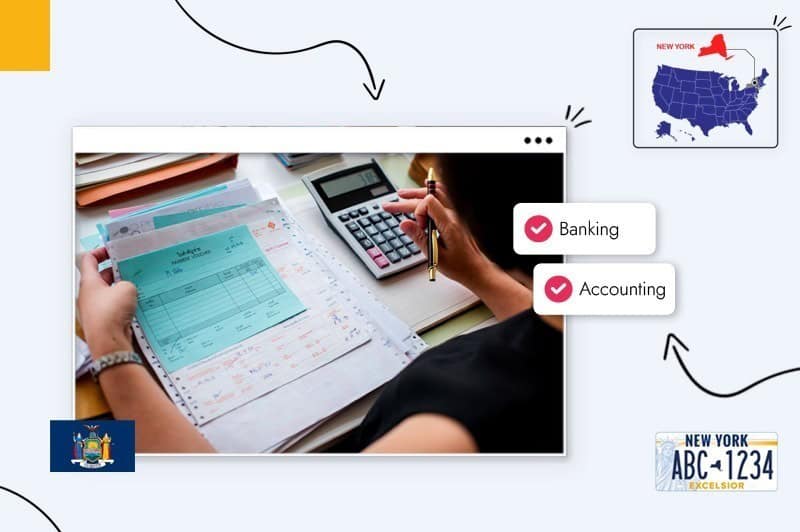

Step# 5. Set up banking, credit cards, & accounting

The saying “Never mix business with pleasure” rings true regarding controlling your business finances, liability protection, and tax compliance.

Fortunately, all 3 are easy to do when you have the following:

Business banking

A business bank account makes tracking your income and expenses more manageable, simplifying your bookkeeping and tax compliance. And for some business types, like LLCs and corporations, a separate bank account is essential to maintain liability protection.

Business credit card

Another way to avoid “mixing business with pleasure” is using a business credit card.

But credit cards can help your business in other ways, such as providing a handy cash line and building your business’s credit history, which can help with getting a loan.

Business accounting

All businesses need a solid bookkeeping strategy to track their cash flow, pay bills, comply with payroll obligations, and file accurate tax returns.

Business accounting often involves 2 things: an accountant to comply with NY tax requirements come tax season and accounting software that integrates with your credit and business bank accounts enabling you to track working hours, pay bills, and send invoices.

Step# 6. Get funding for Your New York business

Over 80% of start-ups fail by year 5, and 82% of those fail because of insufficient cash flow (AKA funding).

That’s 80 out of every 100 start-ups and many broken dreams.

Many of us need funding to either start, run, or expand our businesses, and often that funding comes in different forms.

Let’s see what’s available:

- Bootstrapping: Describes when an entrepreneur starts and builds a business using their own money and without external investment. The pro of bootstrapping is you keep 100% of your business; the con is it could be 100% of nothing if you run out of money!

- Friends and Family: F&F loans are when you rely on family and friends to fund your start-up; it could be interest-free, with interest, or even for a percentage share; the T&Cs are up to you.

- Small Business Loans: A traditional funding approach where a bank (often local) provides a fixed interest rate loan repayable over a set time. SBLs often have favorable terms but require a solid credit history and business plan.

- Crowdfunding: An alternative to traditional business funding where individuals collectively fund your start-up on a crowdfunding platform; all you have to do is convince them.

- Small Business Grants: We’re talking about free money your local or state authorities provide to stimulate economic growth and job development. Let’s see what’s available in NY next.

New York grants and state incentives:

New York State supports and encourages business growth with various loans, tax incentives, and grants.

- MWBE Certification Campaign: Provides economic opportunities for woman-owned businesses and minority groups.

- NYS Alternative Lenders: A list of Empire State Development-approved lenders helping finance small businesses in NYS.

Small Business Administration (SBA):

The SBA provides Small Business Lending Programs to businesses through approved commercial lenders to start or expand, often at lower interest rates and longer repayment times than other lenders.

VC and Angel Investors:

Here’s where individual investors (angels) or a group (VCs) fund your start-up for a percentage ownership. VCs take an active role, while angels often act as silent partners, letting you do your work.

New York is famous for innovation and capital funding, with VC and angel-funded start-ups raising $20.2 billion in 2021.

- NYS AngelList: A list of over 7000 angel investors looking to fund the right start-ups in New York.

Step# 7. Get insured

Two types of business insurance exist when you start a business in New York, mandatory and optional, and both depend on your niche and whether you have employees.

First, we’ll look at optional insurance policies:

General liability insurance

Protects your business against claims regarding client property damage and injury. GLI is the most common business insurance policy.

Professional liability insurance:

Entrepreneurs who provide professional services, like financial advisors, accountancy, real estate, and consultancy firms, require PLI to cover negligence claims and inaccurate advice.

Business interruption insurance:

Provides financial support to cover lost income should illness or natural disaster interrupt your business.

Commercial property insurance:

Covers the expense of fires, vandalism, and theft of your business property.

Commercial auto insurance:

Protects against 3rd party liability claims, vehicle loss or damage, and employee injury.

Umbrella insurance:

An optional insurance policy that covers any expenses your other policies do not.

Okay, now the insurance you must have when you start a business in New York:

New York-specific insurance regulations:

- Workers’ compensation: New York State requires every business with employees, part or full-time, to have workers’ compensation insurance to cover medical bills related to work-related illness or injuries.

- Unemployment insurance: Any business liable for UI must make quarterly payments based on their payroll and employee history.

Step# 8. Obtain permits & licenses

Licenses come on 3 levels: state, local (your county or city), and federal.

NYS doesn’t have a general business license. Still, some businesses need an occupational license or local permit to operate, like regulatory licenses for restaurants, child care, and construction that cover health and safety.

You can see which state licenses or permits you’ll need using the New York state’s Business Wizard or by visiting their Business Express page. Learn more about how to get a business license in New York with the help of our detailed guide.

For local general-business licenses, industry-specific licenses, and permits, contact your county or city’s relevant municipal departments, which you can find using the below links:

- Counties of New York State: A list of NYS counties and contact details.

- New York Towns: A list of all NYS towns with links to their official websites.

Federal income tax and New York local tax

Next is tax, and it comes on several levels depending on your niche and location; here’s a quick breakdown of how it works:

- Federal taxes: US businesses must register for IRS federal taxes, which include quarterly estimated and annual income tax, self-employment, and excise taxes.

- State business taxes: New York charges a 6.50% to 7.25% corporate income tax. An individual income tax rate from 4% to 10.90%. And a 4% sales tax.

- Local business taxes: Most counties charge municipal taxes, which include an additional sales tax of up to 4.875%.

- City business taxes: Some New York cities charge extra taxes depending on your niche; contact your location’s municipal director for more information.

Check the IRS Tax Guide for Small Business and Taxpayers Starting a Business for further tax information.

New York-specific regulations

New York taxes most businesses, and to pay, you must register with New York’s Tax Department before starting a business in New York.

Other requirements include:

- Sales and use tax: If you sell goods, you must register as a sales tax vendor with the New York Department of Taxation and Finance (DTF).

- Wage reporting: Employers liable for UI (unemployment insurance) must comply with NY requirements and pay unemployment insurance.

- Employer Identification Number: You must get an EIN from the IRS online or by mail to hire employees.

Note:

Check out the Department of Taxation and Finance for your tax obligations and to create your tax filing account.

Step# 9. Find your team

Some entrepreneurs start their businesses and then hire employees; for others, finding the right team before starting is essential, which can be a daunting experience.

After all, you must balance your business’s cash flow and comply with legal requirements.

Fortunately, it doesn’t have to be stressful; here’s why:

People are the backbone of the business

From office managers, junior apprentices, and part-time freelancers, all employees are crucial to our business success.

They represent our brand, connect with our target audience, implement our strategies, and keep the wheels turning, and that’s why the right team is essential.

Today that has become easier to accomplish by hiring the best professionals when required, such as freelancers on a project-need basis or accountants on retainer.

But many of us need full-time, in-house employees, and those come with regulations; here’s what you must do:

Comply with New York Payroll regulations

In New York, you must take the following steps before and after you hire employees.

- Register as an Employer: Get a Federal Employer Identification Number (FEIN) from the IRS.

- File your Employee Withholding Allowance Certificate: All new employees must provide a signed Withholding Allowance Certificate (Form W-4) showing how much Federal income tax employers must withhold from their paycheck.

- Submit the New Hire Reporting Form: Employers must report new and re-hired employees to the New York Department of Taxation & Finance within 20 days of the employment date.

- Set Up Payroll Taxes: Employers’ payroll duties include withholding federal and state income tax, and pay Social Security and Medicare taxes, and Unemployment Insurance.

- Get Workers’ Compensation Insurance: All employers need worker’s compensation insurance, obtainable through the New York State Workers’ Compensation Board.

Payroll regulations include:

- Minimum Wage: New York City, Long Island & Westchester minimum wage is $15 per hour; elsewhere in New York State is $14.20.

- Payment regularity: You must pay manual workers weekly and other workers at least twice a month.

- At-will-employment: Employers can fire without cause unless otherwise stated in an employee’s contract.

Hire contractors

Start-up entrepreneurs not ready for full-time employees aren’t alone; you can hire contractors to help. And as you avoid unemployment insurance and payroll taxes, contractors are more cost-effective.

But you must classify any contractors correctly (you can’t say employees are contractors). The New York State independent contractor regulations determine the working relationship, not the employer and employee.

Step# 10. Market & grow your business

With your business structure, finances, team, and paperwork in place, you’re ready to start a business in New York; now it`s time to let NYS know you’re open.

Marketing for many new business owners can seem daunting, but it’s actually an opportunity to flex your brand’s creativity.

To begin with, use proven marketing strategies that build your online presence, engage your target audience, and grow your community.

Invite customers to opt-in to a mailing list or newsletter.

Opt-in is a subscription marketing strategy that asks people to give their email addresses for something in return. Marketers use it to create promotional email lists and publish newsletters to build an interested community.

Opt-in marketing takes time (and might seem unnecessary when you start your business), but the sooner you collect your target audience’s emails, the quicker you’ll create a community that wants what you sell.

Consider making special offers to attract your first customers

Your competitors have your target audience’s trust, so why should they shop with you?

One way to entice them is by providing extra value, such as special offers. After all, we all love a deal, right?

Strategies you can use:

- Free shipping and returns are often the difference between a sale and no sale.

- BOGO deals (buy one, get one free).

- Loyalty programs (buy 9 get the 10 free).

- Referral programs (bring a friend, get a discount on your next purchase).

- Flash sales are excellent for clearing old or unwanted stock.

- Contests and giveaways suit your social media platforms and help create a business buzz.

- Holiday promotions are seasonal cash bonanzas.

When running promotions, track which ones make the most sales, then use those to attract new customers.

Look for local businesses or brands to collaborate with

You have 2 competitors, direct (selling the same products to the same audience) and indirect (selling different products to the same audience).

Brand collaboration is when you join forces with indirect competitors and promote each other’s businesses to your existing customers.

It helps you in 3 ways. You gain your collaborator’s customers’ trust through association, broadening your target market, and increasing sales.

Invest in word of mouth (happy customers attract each other)

Your customers are your ultimate brand ambassadors; the better you treat them, the quicker they’ll spread the word.

Your mission with every transaction is to cultivate Word-of-Mouth-Marketing by going above and beyond your customer’s expectations so they want to share their positive experiences and promote your brand.

- WOMM is the #1 marketing strategy, with 92% of consumers trusting recommendations over traditional advertising. Source-Neilsen report.

Pay attention to online reviews; ask happy customers to review you

Reviews can make or break your business, and after 10 years of selling on Amazon and running a tourism business that depends on them, I know!

Your new business’s first 10 reviews are crucial, so you must encourage your first customers to leave reviews and ensure they’re 5 stars.

Here’s why:

- 95% of consumers read reviews before buying a product.

- 84% of people trust online reviews as much as WOMM.

- Over 81% of people look at Google Reviews before visiting a local business.

- Only 5 reviews increase the chances of someone using your business by 270%

Create unique, helpful content to showcase your activity

Another way to build trust between you and your target audience is to provide free content that helps your audience solve problems.

You can use various mediums, like podcasts, videos, images, or blogs. And the key to success is the value your content gives your audience.

Use your content strategy to tell stories about real people and genuine issues because we all have them, and that’ll get folks talking about your brand.

Step# 11. Open the doors!

Your last step in starting a business in New York is opening your physical or virtual doors and making your first sale.

Now you have 2 choices: sit back and wait for people to come to you or plan a launch event that engages your target audience’s attention.

Plan a successful launch event

A launch party introduces and kick-starts something new, like a fresh brand, product, place, or service.

During your launch event, you aim to showcase your brand’s values, expressing your beliefs and aspirations, all while revealing something new to local influential figures, potential brand collaborators, and your target audience.

Throwing a successful launch event can create excitement and positive feelings for your brand, but only if you do it right.

How to plan a launch event:

- Choose a suitable date and location for your audience.

- Get any necessary permits.

- Create a guest list and send physical and virtual invitations.

- Have fun activities and entertainment.

- Promote your special offers.

- Use social media and local marketing to spread the word and create a buzz.

- Hire a photographer or videographer to record the event for your social media platforms.

- Collect your guest’s email addresses by handing out contact forms with discounts or special offers.

- Thank everyone for attending.

Land your first sale

Your first sale is a historical moment in your entrepreneurial career. I remember mine in all my different businesses, and the feeling is always the same, pure joy and relief.

Joy because you’ve made it happen and relief because it confirms what you already knew.

Remember, when those first sales begin, contact your customers, thank them for choosing your brand, ask if your service met their requirements, and get those reviews.

Conclusion

And that’s how to start a business in New York.

Remember, the most essential steps in your journey are choosing a business idea you’ll love doing, day in, day out, validating it to ensure people need what you’re offering, and putting yourself in your customer’s place.

Good luck!