In order to create an LLC in NY you must fulfill multiple requirements. You must file articles of organization, create an operating agreement, and meet publication requirements. Here’s how to meet the mandatory New York LLC publication requirements.

What Is the NY LLC Publication Requirement?

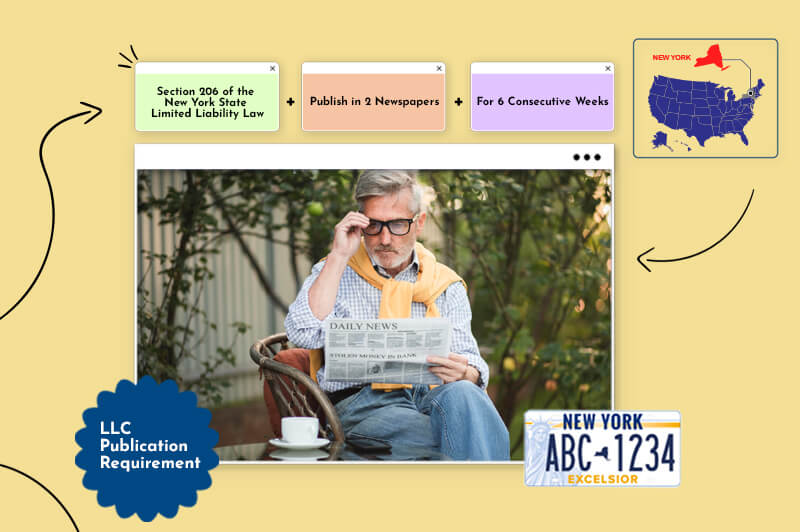

The New York LLC publication requirements are detailed in Section 206 of the New York State Limited Liability Law.

The bulk of Section 206 focuses on the formation of notices that all new LLCs must run. The law stipulates that:

- The formation of notices are published in 2 newspapers

- The formation of notices run for 6 consecutive weeks

- One paper must be a daily newspaper in the LLC’s county

- One paper must be a weekly newspaper (periodical) in the county

- Two corresponding affidavits of publication are filed within an LLC’s first 120 days

These publication requirements apply to all LLCs formed in New York. The requirements are unique to New York, as only two other states (Arizona and Nebraska) have similar stipulations.

What Are the NY LLC Publication Fees?

One of the reasons new businesses might choose to form in a different state is that New York’s publication requirements increase your overall New York LLC cost. The associated costs consist of advertising costs and filing fees.

The formation of notices are essentially paid advertisements that announce a new business. Newspapers set their own rates for running notices, and rates vary among papers. Papers within a region might have nominal differences in what they charge. The differences between what papers of different counties charge can be quite substantial.

For example, running a notice in one of the most populated downstate counties could cost $1,000 or more. Running the same notice in a rural upstate county might only be around $100.

Keep in mind that these fees must be paid for two newspaper publications, and both must be in your LLC’s County.

The state’s filing fee is much more straightforward. A $50 fee must be paid when filing a certificate of publication and two affidavits of publication with the state.

Thus, the total NY LLC publication fees amount to $50 + the cost of advertising in two papers.

How To Meet the NY Publication Requirement (While Saving Money)

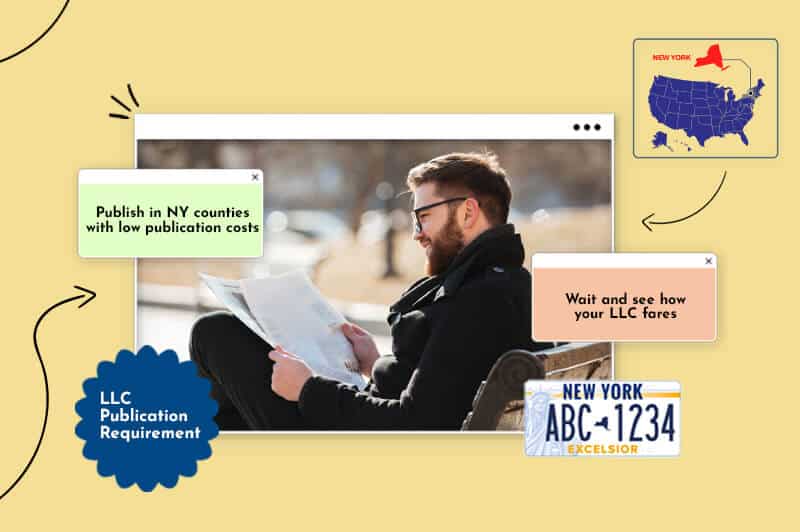

One of the main ways to save money on publication requirements is by running formation of notices in counties where newspaper advertising costs are lower.

Publish in New York counties with lower publication costs

The notices must run in the county where your LLC is officially located, but there are two ways to meet the requirement in one of the lower-cost counties. You can have an address in a lower-cost county or hire a registered agent service.

First, high advertising fees might be a non-concern if your LLC is already located where advertising costs are relatively low. You might also have the option to locate your LLC in a neighboring county with lower costs, especially if you’re starting an online business or other business that’s not geographically focused.

Second, you can hire a registered agent service in a county other than where your business is located. This is a common practice among downstate businesses that are in counties with high advertising costs. It can also be a practical tactic for upstate businesses that are in counties with moderate advertising costs.

A registered agent service provides both a NY registered agent and a registered office. The registered office becomes your LLC’s official location, and thus the office’s county becomes where you must run formations of notice. Many registered agent services intentionally have offices in counties with low advertising costs.

Change your LLC’s New York address later

Should you decide to locate your LLC somewhere inconvenient to save on publication expenses, you don’t necessarily have to maintain that location. There’s nothing wrong with locating your LLC in a low-cost county until the publication requirements have been met and then relocating the LLC to whatever county you want the business in long term.

The publication requirements only apply to new LLCs, so you don’t have to worry about managing them in future years.

For LLCs in counties with high advertising costs, using a registered agent service for the first year might yield net savings. The amount saved by publishing notices in a lower-cost county is frequently greater than the cost of a registered agent service. The service can then be discontinued in future years if you don’t want to continue it.

Wait to make sure your LLC is successful

One strategy is to wait until Week 8-10 before running formation notices. You don’t have to complete the publication requirements (including filing with the state) until Day 120. If you start running notices somewhere during Week 8-10, you should have enough time to complete the six-week requirement and file with the state.

Delaying your formation notices won’t ultimately save you money if your LLC is successful beyond a few months. If the business fails within a few months, however, this strategy might keep you from spending money on publication expenses for a business that doesn’t last.

What To Say in a Formation Notice

The information that must be included in a formation notice is clearly defined. A notice must contain all of the following:

- Official LLC name (including “LLC”)

- Date of completed filing (given by state)

- County the LLC is in (e.g. registered agent’s county)

- Street address of the LLC (e.g. registered office’s address)

- LLC’s registered agent (if applicable)

- Date of dissolution (only if the LLC has an “end date”)

- Purpose of the LLC (sometimes is general or vague)

The following example formation notice has all of this information:

Widgets, LLC. Articles of organization filed with SSNY on 01/01/22. Registered office in Onondaga County. SSNY shall mail copy of process to 123 Main St., Suite 100, Syracuse, NY 13205. CNY Registered Agents, Inc. is designated as the LLC’s registered agent. Purpose is any lawful purpose.

Average NY Publication Requirement Costs

The cost of running formation notices varies significantly throughout the state. You may need to budget anywhere from $150 to $1,500+ for both advertising and filing expenses. A sampling of just three counties shows just how widespread the costs can be:

- Albany County has an average cost of ~$140

- Queens County has an average cost of ~$850

- Manhattan (NYC) has an average cost of ~$1,500

Albany is among the cheapest counties in the state, and Queens is representative of what’s fairly average. Manhattan is the most expensive of any county.

Additionally, some newspapers have a preview form that must be submitted before running the formation notices. Such a form is commonly used to verify an LLC’s information with the state before publishing the notices. Make sure to consider any early form requirements if you’re delaying running formation notices.

What Happens If You Fail to Comply With NY Publishing Requirements?

Failing to meet New York’s LLC publishing requirements within 120 days has multiple potential consequences. The main consequences that can result are:

- The Secretary of State may revoke your LLC’s status of good standing

- Your business might not be able to legally operate in NY when not in good standing

- Lenders and clients may not work with your LLC because it’s not in good standing

- Your LLC can’t use the NY court system to sue another entity

- Your LLC’s corporate veil might be pierced if the business is sued

You shouldn’t intentionally plan on not meeting the publication requirements, because these consequences can have severe negative results. If you’re already in violation of the publication requirements, however, these consequences can be remedied by going through all the publishing requirements.

Make Sure Your LLC Is Properly Published

If you’re starting an LLC, you have a long list of items to attend to. Make sure meeting New York’s LLC publishing requirements is on your to-do list and doesn’t get overlooked. This may seem like a nuisance more than anything else – but it’s a nuisance that every new LLC owner must take care of.

FAQs

FAQ

Your LLC has 120 days to meet New York’s publishing requirements. This includes running the six weeks of formation notices, getting affidavits of publication from each paper, and filing with the state. The 120 days begin when your LLC’s initial articles of organization become effective.

The New York publication requirements stipulate that your LLC’s formation notice must run for six consecutive weeks. Once it’s run for six weeks, the paper will issue you an affidavit of publication. You then file the affidavits (one from each paper) along with a certificate of publication, submitting the documents to the NY Secretary of State.

The publication requirement in New York is a holdover from when newspapers were how information got disseminated. Newspaper notices used to be the main (and sometimes only) way people learned about new businesses and other matters. Despite the changes that technology has brought, this requirement hasn’t thus far been updated.

The publication requirements must be completed within approximately 17 weeks (120 days) of starting your LLC. The last week to start running formation notices and still meet the requirements is thus week 11, since notices must run for at least six weeks. You probably should start at least a week or two earlier, so there’s some buffer time in case the paperwork takes longer than a day.