With affordable housing, rich cultural diversity, stunning coastlines, and tropical weather, the Sunshine State is a great place to live.

But statistics show it’s not only the weather that’s balmy; the business climate’s hot too.

Florida has the 4th largest (and fastest growing) US economy, 16th in the world (bigger than Mexico and Indonesia).

The 3rd largest US state population with the 3rd highest number of start-ups (per capita) that rank 1st for job growth, according to Econ and And 8th in CNBC’s America’s Top States for Business 2023.

With all this going on for it, there’s no wonder that Florida attracts people looking to start their dream business.

Join me to discover how to start a business in Florida in 11 easy steps.

Here are the steps you need to follow to start your own business in Florida, we’ll explain more about each of the steps below:

- Fine-Tune Your Business Idea

- Create a Business Plan

- Choose a Business Name

- Choose a Business Structure

- Set up Banking, Credit Cards, & Accounting

- Get Funding for Your Florida Business

- Get Insured

- Obtain Permits & Licenses

- Find Your Team

- Market & Grow Your Business

- Open the Doors!

Step #1: Fine-tune your business idea

Your first step to start a business in Florida is choosing a business idea.

So, what interests you? What are you good at? What goals do you have?

I ask because your idea must include all those to ensure you stay motivated and increase your chances of success.

But your business idea isn’t only about you; it must also suit your location, have a target audience, and meet local needs.

Popular Florida business ideas:

Thriving Sunshine State industries include real estate, insurance, finance, security, healthcare, agriculture, construction, and tourism.

And those industries create opportunities for small businesses that support them. But there are others too!

For example, Florida has:

- A creative culinary scene: Ideal for restauranteurs, food truck owners, and catering businesses.

- Year-round fruits and vegetables: Perfect for a farm-to-market fresh produce business.

- Year-round tourism: Supporting industries like tour guides, accommodation, retail, and food.

- Outdoor adventures: Florida has a wealth of recreational activities, perfect for adventure and instructor businesses (scuba/windsurfing).

- A huge sports culture: Great for team merchandise and convenient food sales (AKA food trucks).

- High demand for security products and services: There’s high demand for home and vehicle security.

- Unpredictable weather: Though this may seem like a negative, it can be perfect for construction and handyman businesses! Where others see a problem, an entrepreneur sees an opportunity.

- Countless retirement communities: Opportunities for general maintenance, transportation, catering businesses, orthopedic mattresses, shoes, and other businesses catered around the needs of the golden aged community.

- Unpredictable weather: Though this may seem like a negative, it can be perfect for construction and handyman businesses! Where others see a problem, an entrepreneur sees an opportunity.

Validate your business idea:

Validation helps confirm you’re on to a winning business idea (removing trial-and-error) by answering the following questions:

- Is there a need for your idea?

- Can you afford the start-up costs?

- Is the market big enough to sustain you?

- Who is your target market?

- Can you compete with your competitors?

When you have an idea, visit Florida’s fastest-growing industries website to confirm yours is in demand.

Another way to remove the trial-and-error approach is by writing a business plan that answers all those questions.

Step #2: Create a business plan

Alexander Graham Bell (inventor of the telephone) wrote, “Before anything else, preparation is key to success.”

I’m an ex-scuba instructor (and Navy), so preparation is in my DNA, and a business plan reminds me of dive prepping. Before diving, we buddy-check each other’s equipment to catch potential problems.

You’d be surprised what people do, like jumping off a dive boat (not mine) without their air on! Fortunately, I caught up at around 40 feet (before they disappeared into the abyss) and lent my spare regulator.

That’s why we use a buddy to remove complacency; your business plan is your start-up’s buddy, and it looks after it by answering 5 questions:

- Who will buy what you’re selling? Your target audience, their demographics, and where they shop for what you’re selling.

- What are you selling? Products or services.

- Where are you selling it? Online (where and how) or offline (brick-and-mortar store).

- Why will they buy it? That’s your unique selling point (what makes your brand special).

- How much will they pay? What’s the going rate for your product or service, and will you make a profit?

Business plans come in 2 forms, traditional and one-page, and contain several parts, the 3 most important being:

Market research

Your market research answers those questions by confirming your idea has a target audience (customers), identifying who they are, assessing your competitor’s strengths and weaknesses, ensuring your niche is growing, and what people are paying.

It also tells you which marketing strategies will engage and convert your audience into customers, but to implement them, you need a plan:

Marketing plan

Your marketing plan contains your branding strategies, start dates and budgets; its job is to maximize your investment by promoting your business where your ideal clients will see it using techniques that resonate emotionally and create trust.

Financial plan

Here’s where you crunch the numbers (add them up) to confirm you can afford to enter your chosen marketplace and run your business until it turns a profit.

When writing your financial plan, be realistic and don’t over-project your future income; lenders spot this a mile away (and almost always refuse because of it), and it can lead to personal disappointment when reality sets in.

Choose a location

My first trip to Miami was in 1992 (yup, I know), and Coconut Grove, Little Havana, and Miami Beach were the hot spots in town. And still are today.

But Florida’s more than Miami, cities like Jacksonville, Orlando, Gainesville, Sarasota, and Tampa, have booming economies and vibrant cultures. In contrast, rural counties like Dixie, Hamilton, Madison, Levy, Liberty, and Glades suit a more laid-back lifestyle. Just mind the Gators!

The point is each location has areas that serve certain business types, and you must choose a suitable one for your start-up to thrive, especially if you rely on a high-passing trade like food and retail.

Your choice might also be because of zoning laws!

Florida zoning laws and regulations:

Zoning laws enable local and state authorities to control property and land use. Such as what business types can open in certain areas and to ensure they comply with safety standards.

Zoning also enables authorities to stimulate specific areas to encourage economic growth, often by awarding grants to start-ups, and we`ll look at those in a minute.

Decide if you’re an online only business

Your business idea determines whether you’re an online-only business, a physical store, or a mixture of both.

Online businesses avoid many legal obligations and costs of starting a physical business. However, they still require certain things to succeed:

- A website: Most brands need a website so people can learn about their products or services and make contact. Efficient websites are SEO optimized, clean looking, easy to navigate, have high-quality images and engaging branding.

- Social media presence: Ensure your target audience can find, follow, and share your brand by creating profiles on social platforms like Instagram, Facebook, and Twitter. And link them to your website to drive traffic and sales.

- Supply and distribution plan: If you plan on selling products, you’ll need a reliable supply chain and delivery system.

- Tax laws: These may vary depending on your business type, so check with Florida’s Department of Revenue before you trade.

- Specific regulations: Some niches have strict local and state laws and require licenses and permits, such as transport, agriculture, and the sale of tobacco or alcohol; we’ll check those out a little later.

Step #3. Choose a business name

Sole proprietors use their names for their business, as do general partnerships. They can, however, complete a Florida DBA registration or ficticious name filing (the name changes depending on the state) anduse a brand name that suits their niche.

Legal entities (LLCs, LLPs, and corporations) register a name when forming their businesses with the Department of State’s Division of Corporations. And can register a DBA if operating multiple subsidiaries or doing business in another state.

When choosing a business name for a legal entity, you must follow Florida’s naming requirements, ensure it suits your brand, resonates with your target audience, is memorable, and available as a domain.

Florida naming requirements:

- Your name must be unique. You can search available names using the Department of State’s Division of Corporations. website.

- Separate entities like LLCs and corporations must include specific identifiers in their business name, like LLC/L.L.C/Corp.

- You can’t use words relevant to government agencies like the FDA, FBI, CIA, Florida Department of Revenue, Florida Department of Economic Opportunity, Treasury, etc.

- You can’t reserve a business name as Florida is a first come, first served state.

Using a DBA in Florida

You can register a DBA name online using the Division of Corporations Fictitious Name Registration portal or download the application for registration and mail it to PO Box 6327 Tallahassee, FL 32314-1300. The DBA filing fee is $50.

Step #4: Choose a business structure

Structures are the legal entities under which you can create a business, like S and C corporations, limited liability companies, partnerships, sole proprietorships, nonprofits, and trusts.

Each structure has responsibilities and legal rights (including tax filing), can enter contracts, sue (or be sued), and have different levels of protection.

The US has around 15 business structures requiring various formation documents; the most popular are:

Common types of business structure

- Sole proprietorship: A person who runs an unincorporated business and handles all decisions and risks.

- Partnership: A shared responsibility between 2 or more people who split profits and liability based on the partnership agreement. Partnerships can be unincorporated (general) or incorporated (limited).

- Limited liability company: A hybrid between a corporation and a sole proprietorship (or partnership, depending on the number of members) that provides liability protection.

- Corporations: Provides liability protection to shareholders who can sell stock for capital but comes with complex regulations.

And that’s the US business structure scene in a nutshell.

Your choice depends on your niche, business aspirations, capital needs, and liability levels.

For instance, if you sell homemade jewelry on Etsy, you might not need liability protection and could trade as a sole proprietor. In contrast, a construction start-up would require liability protection and suit an LLC.

Learn more about creating an LLC in Florida with Tailor Brands.

Tax advantages of each option

Pass-through taxation is the tax advantage to running a sole proprietorship, partnership (general or limited) LLC, and S corporation, as all avoid corporation tax.

Instead, profits and losses pass to the owner/owners, who report them on their tax returns.

S corporations have another tax advantage as shareholders can take tax-free dividend payments on top of their taxable wage, of which the corp pays 50% of their self-employment taxes.

To register a business in Florida, visit the SunBiz website Division of Corporation.

- Single Member LLCs with one owner who pays tax similar to a sole proprietor.

- Multi-member LLCs with multiple owners who pay tax like a partnership, unless either elects to become an S corporation.

Step #5.Set up banking, credit cards, & accounting

The days when “cash was king” are long gone; now, businesses need many ways to take and make payments to ensure their bookkeeping balances come tax season.

To make that happen, you might need the following:

Business banking:

Incorporated entities (LLCs and corporations) need separate business bank accounts to avoid mixing business finances with pleasure and breaking the corporate veil, which could lose their liability protection.

A business bank account also appears more professional to clients and vendors, simplifies your accounting, and can help you get a credit card.

To open a business account in Florida, you’ll need:

- An Employer Identification Number (a federal tax ID number) for your business if incorporated.

- Your business formation documents.

- Identification documents and proof of address.

- A Social Security Number (SSN) when trading as a sole proprietor. Some banks require an EIN to open a business account; fortunately, getting one is straightforward and has several advantages.

Business credit card

A convenient tool for any business as credit cards help separate business expenses, simplify bookkeeping, and build your brand’s credit history, which can help raise capital with lower interest rates.

Business accounting

Accounting is essential for any business, regardless of size, to ensure you have a steady cash flow and can pay your bills.

There are also legal requirements, such as employee payroll taxes, quarterly tax estimates, and end-of-year filings.

Consider a Florida accountant for employee taxes and filings, and check out the many accounting software apps that integrate with your business and credit card accounts to help balance your books, track working hours, and send invoices.

6. Get funding for your Florida business

I funded my first business with a family loan, 2nd with a credit card, 3rd using a business account overdraft, and 4th with a credit union loan.

The point is you’ve options for getting the cash you need to start a business in Florida. Your choice, however, depends on how much money you need, your credit history, and what you’ll give in return!

Let’s look at what’s available:

- Bootstrapping: Is often an option you use when it’s your only option, where you self-fund your start-up and reinvest every cent until it becomes profitable.

- Friends and Family: F&F loans are brilliant as they mostly come interest-free, but ensure you create and sign a contract detailing the repayment terms to avoid disagreements.

- Small Business Loans: Interest-added and time-specific repayment loans provided by banks and other lenders. You’ll need a business plan outlining how you’ll pay it back, a co-signer, and a strong credit history to get one.

- Crowdfunding: You join a crowdfunding platform, describe your business idea and funding needs and if people like what you’re doing, they can collectively support and fund your venture. The best part is you don’t pay it back.

- Small Business Grants: Businesses in specific industries or locations can apply for grants from local authorities to fund their start-ups. Getting one is a process, but as it’s free money, it’s worth considering.

Florida grants and state incentives:

Most Florida counties offer businesses that meet certain conditions tax credits, grants, and other incentives to promote development and job creation.

Some places to look are:

Small Business Administration (SBA):

- The Department of Revenue: For business tax incentives.

- Small Business Development Center: Provides free financial advice for start-ups and helps obtain funding.

The SBA (the government agency that assists small businesses to boost the national economy) backs chosen loan providers to help entrepreneurs get funding at favorable interest rates and repayment times. Each state has an SBA office; visit the Florida SBA division to learn more.

VCs and Angel Investors

Angel investors invest their own money, while VCs invest capital from a venture capital fund for a percentage of your business.

Most states have investor organizations who fund and guide early-stage businesses.

Step #7. Get insured

Florida State requires some industries to have specific insurance policies to operate; others are optional, depending on your business. But all provide a safety net of protection.

Common types of business insurance include:

- General liability insurance.

- Professional liability insurance.

- Commercial property insurance.

- Commercial auto insurance.

- Business interruption insurance.

- Umbrella insurance.

Florida-specific insurance regulations:

Employers must get 2 types of insurance.

- Workers’ compensation: Employers with 4 or more employees (one employee if in construction) full or part-time must provide workers’ compensation insurance.

- Unemployment insurance: All employers must pay state unemployment insurance (SUI) with the Department of Revenue and the Federal Unemployment Tax (FUTA) with the IRS.

Step #8. Obtain permits & licenses

Florida doesn’t have a general state business license. However, most businesses need municipal-level permits or licenses to operate.

And as those vary by county and city, you must contact your relevant local municipal departments or research your state’s county’s official website to see which licenses and permits apply to your business.

The following departments manage Florida licensing:

- Florida Department of Business and Professional Regulation: Provides professional licenses via its online application portal.

- Florida Department of Agriculture and Consumer Services: Licenses and permits for any business within the agricultural sector.

- Florida’s other licensing agencies: Licenses for healthcare, childcare, home care, nursing homes, financial services, social workers, etc.

You can find further information by contacting Florida’s state agency relevant to your niche.

Federal income tax and Florida local tax

Besides permits and licenses, you must also register for federal and local taxes.

The good news is Florida often ranks in the top 5 “best states to live in” because of its low tax rates.

- Federal taxes: Most businesses pay the IRS federal taxes, including estimated tax, income, self-employment, employment, and excise taxes.

- State business taxes: Florida has no state income tax but has a sales-and-use tax, reemployment (unemployment) tax, corporate income tax, and franchise tax.

- Local business taxes: Most counties you do business in require you to pay a local tax to the county government tax department.

- City business taxes: Not all Florida states and cities levy taxes, but some do. Contact your city’s municipal director or speak with a local accountant to find out more.

Pro Tip:

The Florida Department of Revenue provides online tax education tutorials, and the official Guide to Florida’s business taxes is an informative read!

Florida-specific regulations

Each US state has specific regulations new businesses must follow; in Florida, those include:

- Sales and use tax: Vendors who generate revenue selling to Floridians in a calendar year have an economic nexus and must collect and remit sales tax to the Florida Department of Revenue.

- Employers tax: Employers must register for unemployment insurance tax with the Florida Department of Revenue and employee withholding tax with the IRS.

- Franchise tax: Corporations, LLCs classified as a corporation, and partnerships where one owner is a corporation must file a corporate income/franchise tax return.

You can get help working with the Florida Department of Revenue using their online New Business Start-up Kit.

Step #9. Find your team

Florida is home to the 3rd largest US workforce, with an unemployment rate less than the national average and a linguistically and culturally diverse talent pool.

And thanks to a favorable tax climate and low business costs, finding and hiring your team is affordable.

People are the backbone of the business

You don’t need the best people for your team; you need the right people.

Albert Einstein said, “The only source of knowledge is experience.” That’s why entrepreneurs must source people with the right experience, not the best resumes.

Such as an experienced Floridian accountant or lawyer who can help you navigate the tricky legal waters. Or local business owners you meet via networking who provide you with the benefit of their experience. And employees who believe in your vision and shine as the face of your brand.

As a small business owner, you must stay open to feedback, new ideas, and constructive criticism. And that’s why you need the right team.

Comply with Florida payroll regulations

Florida doesn’t implement state payroll regulations. Instead, employers create and enforce company policies that meet federal minimum requirements.

Employers must, however, report new hires to the State of Florida and register with the IRS for employee taxes.

And when you have your team, it’s advisable to use a payroll service that tracks working hours and issues paychecks to simplify your bookkeeping and tax obligations.

But what if you’re a one-person show? No worries, that’s what contractors are for:

Hire contractors

Solo entrepreneurs can hire contractors for specific tasks, like an accountant filing end-of-year taxes, and to avoid paying employment, state, federal, and local taxes, or unemployment insurance.

You must, however, ensure you classify your contractor correctly (they cannot be a full-time employee, and the employer cannot control how they work). And your contractor must have a Florida contractor license, as hiring an unlicensed contractor is illegal.

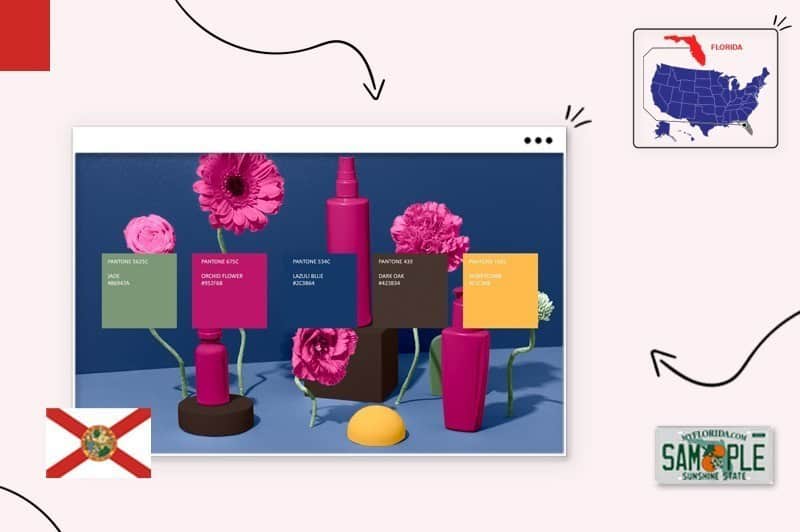

Step #10. Market & grow your business

Numerous marketing strategies are available to promote your new business in Florida; some cost money and require experienced professionals. Others are an investment in time that uses the public and other local businesses to help grow your brand.

All, however, need a strong brand presence to succeed, like your business name, logo, slogan, and specific colors and texts to project your brand’s personality and culture.

Once you have your branding in place, try these 6 proven strategies to market and grow your business:

Invite customers to opt-in to a mailing list or newsletter

You’ve seen them and most likely opted into one; I’m talking about those pop-up boxes asking you to subscribe.

And they work because mailing lists and newsletters are the most valuable sources of sales because the recipient trusts the sender.

Just create an opt-in box on your website and provide a reward for your target audience, like a free mini course or instruction guide.

Consider making special offers to attract your first customers

Special offers are a great way to attract your first customers and encourage repeat sales.

Strategies include:

- Buy one, get one free.

- Loyalty programs offer discounts on a tenth purchase.

- Limited offers or flash sales that create urgency.

- Free samples for your first 100 customers.

- Free shipping and returns.

Look for local businesses or brands to collaborate with

Brand collaboration enables you to use another business’s positive reputation and customer base to increase your audience and sales.

Start by networking with businesses in your locality in a complementary niche. For example, a hair salon could collaborate with a lash technician or photographer.

Then create a beneficial collaboration campaign promoting one another’s products or services.

Invest in word of mouth (happy customers attract each other)

You know the saying, “The best things in life are free?” Well, it’s true, especially when satisfied customers recommend your business to friends and family or, even better, across social media.

Word-of-Mouth-Marketing (WOMM) works because “92% of people believe recommendations from others over advertising”. Source-Neilsen report.

Investing in WOMM doesn’t mean cash because it’s free! But you must provide fantastic products or services, exemplary customer service, memorable experiences, and genuine after-sales care.

Another way happy customers attract others is through online reviews.

Pay attention to online reviews; ask happy customers to review you

It’s no secret that reviews drive sales, whether on your Amazon product listing, Trust Pilot, or your Google My Business listing.

Ensure people review your brand by asking them using an after-sales email. Or include an engaging “Review My Business” branded card with all your product sales.

And when you receive reviews, pay attention to them in case you get a negative one (and you will) so you can respond and solve your customer’s problem, showing your target audience you care.

Create unique, helpful content to showcase your activity

Content is crucial for reaching your audience, creating relationships, and building brand awareness.

You can use YouTube videos, Instagram visuals, blog posts, TikTok, or anywhere your audience hangs out.

The takeaway is when you provide free valuable content that helps your community; your audience will trust your brand to meet their needs.

Step #11: Open the doors!

All that’s left is to open your business doors and welcome the Sunshine State in!

And a proven way to get folks talking about your start-up is to throw a launch event.

Plan a successful launch event

Launch events help businesses meet their audience and create lasting connections.

Sure, they suit brick-and-mortar businesses more than e-commerce (but virtual events are a thing).

To make an instant impression, follow these steps:

- Choose a date and location suitable for your target audience. Physical stores could have it in-house to generate sales.

- Apply for the event permits if needed.

- Create a guest list that includes possible brand collaborators and local influencers.

- Send physical and virtual invitations.

- Promote your event on social media to local groups.

- Use special offers and promotions to generate a buzz.

- Arrange for entertainment and activities to make your event memorable.

- Barter with a local photographer/videographer to capture the moment.

- Collect your guest’s contact information and follow-up emails (that include your subscription opt-in) thanking guests for their support and offering first-sale discounts.

Land your first sale

You could land your first sale during your launch event or soon after from your discount offers.

But if not, don’t worry. Remain focused and promote the value you bring to your audience because when they see it, the sales will follow.

Conclusion

And that’s how to start a business in Florida.

And with low taxes, warm weather, and a thriving economy that supports entrepreneurs like you, who wouldn’t start a business in the Sunshine State?

But if you’re still unsure, below are some FAQs and links to Florida business resources.

Good luck y’all.

FAQ

For incorporated entities like LLCs, you must register with the Florida Division of Corporations. Sole proprietorships and general partnerships can begin trading without registering, but all business types will need specific licenses, permits, and insurance policies relative to their industry.

Registering an LLC in Florida costs $125, which includes the fees for designating a registered agent and filing your Articles of Organization. Other costs may apply based on the relevant permits and licenses your specific business will require.

Choose your business name, ensure it’s available, file Articles of Organization, designate a registered agent, create your operating agreement, and get an EIN.

Florida doesn’t have a general state business license, but depending on your niche, you might need a municipal-level permit or state-level occupational license.