Iowa’s innovative business and educational history are legendary.

The Hawkeye state was the first to enact laws to protect female workers and open a coeducational and interracial college.

And that innovation continues today.

Iowa’s thriving economy, driven by low business taxes, affordable living, a strategic location, and entrepreneurial incentives, offers many opportunities for aspiring entrepreneurs.

But you need more than a thriving economy, a convenient location, and low taxes to become successful.

Anyone starting their own business should get informed about the right steps to follow, to set themselves up for success.

Let’s look at how to start a business in Iowa to give you what you need:

- Come up With Your Business Idea

- Create a business plan

- Choose a business name

- Choose a business structure

- Register your Business In Iowa

- Set up Banking, Credit Cards, and Accounting

- Get Funding for Your Business

- Get Insured

- Obtain Permits & Licenses

- Comply With Iowa Tax Regulations

- Build Your Team

Step# 1. Come up with your business idea

The perfect business idea for you is a medley of essential elements that create a recipe for your success.

Your business idea must be viable to afford the startup costs, have a large enough target market, and be sustainable and profitable.

But it must also be something you’ll love doing because that will motivate you when the going gets tough. Also, consider your resources, including your time, money, location, skill sets (do you have what the job takes), and why you want to start a business in Iowa.

Consider and research each element carefully, and when you have an idea in mind, validate it to confirm it’s worth your time and investment.

Why you must validate your business idea

Validation is when you research and prove your business idea is financially viable by adding up the startup and fixed and variable running costs, when you’ll earn a profit, and calculate and record the figures to ensure your idea is worth it.

When you know the numbers work, confirm your business idea’s demand and research your competitor’s strengths and your community interest.

And you do those using a business plan.

Step #2: Create a business plan

A business plan aims to evaluate your idea by researching your niche’s marketplace, your target audience’s demographics and shopping habits, and your competitor’s strengths and weaknesses to create marketing strategies connecting with your prospects where they shop.

It also contains your goals, how you’ll achieve them, and your financial projections to get a business loan.

Entrepreneurs forming startups like multi-partner LLCs, corporations, or those requiring financing need a traditional plan. In contrast, a one-page plan is often adequate for sole proprietors and general partnerships.

However, both business plans should contain the following 3 sections:

- Market research: Market research helps you understand your target market by identifying your audience’s buying habits , your direct competitor’s sales strategies, and your niche’s market trends (growing or falling in popularity). Once you have this information, you can create your marketing plan.

- Marketing plan: You use the information from your market research in your marketing plan to tailor your marketing message, design branding, and create marketing strategies that engage your target audience’s interest on platforms relevant to your niche.

- Financial projections: Most lenders require financial projections before approving a business loan as they calculate startup and running costs and, most importantly, show if you’ll earn a profit and how much.

You can create your business plan today using our free template and guide.

Choose your Iowa location

Your business idea determines your location.

For instance, retail businesses, beauty salons, and restaurants need a location with a high passing trade and possibly parking. Product manufacturers require locations with convenient access and space, like an industrial estate.

Before choosing your location, review your business plan’s financial section and startup/running budget to ensure you can afford it.

Some thriving cities to start a business in Iowa include Des Moines, Cedar Rapids, Dubuque, Ames, Iowa City, and Sioux City.

But before signing a lease agreement, consider the zoning laws!

Iowa zoning laws:

Most US states, counties, and cities have zoning laws that control parking requirements, waste disposal, signage regulations, and what businesses can operate in which locations. To ensure your chosen locations meet your operation requirements, review local ordinances, visit your area planning department, or check your local government website.

Create your online presence

Are you going to start an online business, open a brick-and-mortar store, or provide a local service? If so, you need an online presence so people can find you, see what you offer, read testimonials, and make a purchase or an appointment. To do that, you’ll need:

- Website: Your website requirements depend on your business; for example, Shopify suits e-commerce entrepreneurs, Squarespace, those that need compatible hardware and software tools, or Wix for affordable pricing plans, high-quality visuals, and an easy-to-use interface.

- Social media presence: The best way to connect with your target audience is on the social media platforms they use to search and discuss what your business provides; check out your competitors to see what platforms work best for your niche.

- Supply and distribution plan: E-commerce and brick-and-mortar businesses that sell and deliver products need a supply chain and distribution plan to ensure they remain in stock and provide a seamless delivery service.

- Online tax laws: If you sell products to Iowa residents (even if your business is in another state), you need a “sales and use tax permit” from the Iowa Department of Revenue.

- Iowa-specific regulations regarding online business: All US states have specific online sales regulations; check out the Iowa Department of Revenue website for its online and marketplace sales guidance.

Next, you need a great business name:

Step# 3. Choose your business name

Your business name must convey what you sell or provide, apply to your niche, project your brand’s essence, and engage and connect with your target audience’s emotions.

But that’s not all it must do!

Your new name should also be available as a domain (or as close as possible), and your chosen social media platforms have no trademark restrictions and comply with Iowa’s business name requirements.

Here’s what you need to know:

- Be original: Entrepreneurs starting an LLC or other registered business entity must ensure their name is unique from any other registered in Iowa; you confirm your name’s availability using the Iowa Business Entities Search tool.

- Include certain words: All seperate entity businesses (like limited liability companies, limited liability partnerships, or corporations) must include the terms in their name or an approved abbreviation, such as (LLC, LLP, or Company).

- Exclude specific words: You cannot use words, terms, or government department descriptions in your name, such as police, FDA, CIA, or FBI. Or doctor, bank, insurance, lawyer, or charity, unless that’s your occupation.

- Reserve your business name in Iowa: If your chosen name is available but you aren’t ready to register your business, you can reserve it for 120 days using the Iowa Application for Reservation of Name service.

Use a DBA in Iowa:

A DBA (Doing Business As) is any name you use other than the name under which you formed your business.

All separate entities (LLCs, LLPs, and Corporations) file their name with the Iowa Secretary of State’s Office when forming their business; non-separate entities like sole proprietorships and general partnerships use their owner’s names.

All, however, can use a niche, product, or service-relevant brand name by registering a Fictitious Name Resolution with the Iowa Secretary of State.

Step# 4. Choose a business structure

A business structure is an entity under which you run your business. For example, sole proprietorships are non-separate entities, while LLCs are separate, and the two have distinct legal differences. Such as liability protection, if and how you register your business, and how you pay taxes. In Iowa, specific structures suit small to medium startups:

The most common types of business structures

- Sole proprietorship and general partnerships: Entrepreneurs selling services or goods alone (without registering a business entity) are sole proprietors; two or more people who do the same are general partners. The pro is you don’t have to register your business; the con is that you’ve no liability protection should someone sue you.

- Limited liability company (LLC): An LLC is a separate business structure that provides liability protection, flexible management, and tax classification options.

- Limited liability partnership (LLP): A separate business structure that professionals like lawyers and accountants use for its separate liability options.

- S corporation: Unlike other corporation structures, an S corporation is like an LLC in terms of liability protection and how owners (shareholders) pay taxes. However, a corporation has a strict management structure, record-keeping rules, and an appointed board and elected officers who run the business.

Tax advantages of each option

Each business uses the pass-through tax structure, avoiding double taxation because all profits and losses pass to the owners (or shareholders) who report them on their tax returns. When you’ve chosen your business structure, your next step is registering it:

Step#5. Register your business in Iowa

To run your business structure in Iowa, you must first register it with the relevant government department.

In Iowa, those are:

- Sole proprietorship and general partnership: Iowa state doesn’t require registering a sole proprietorship or a general partnership; however, you must register any trade name (DBA) with your county clerk’s office and apply for a business tax license .

- Limited liability partnership: LLPs must submit an LLP Statement of Qualification with the Iowa Secretary of State’s Office.

- Limited Liability Companies: To form an Iowa LLC, you file Articles of Organization (available online) with the SOS.

- Corporations: You file Articles of Incorporation (available online) with the Iowa SOS to form a corporation. S corporations also file Form 2553, Election by a Small Business Corporation, with the IRS.

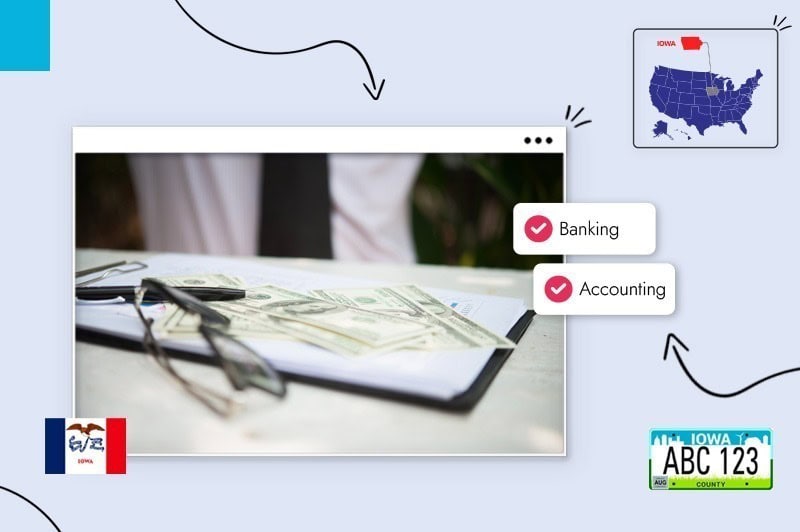

Step# 6. Set up banking, credit cards, and accounting

To start a business in Iowa and run it efficiently, you need many things, including a separate business account, business credit cards, and an adequate accounting system. With those in place, your businesses’ financial health will run like clockwork. Let’s break them down to see why:

Business bank account:

Registered business structures like LLCs, LLPs, and Corporations must have separate business bank accounts to protect their limited liability.

Sole proprietors and general partnerships do not; however, they also benefit from a business bank account because it simplifies their bookkeeping and accountancy requirements by separating their personal and business income and expenses, which helps control their cash flow and calculate their tax liabilities.

Credit card:

All businesses can benefit from having a credit card to cover unexpected material or equipment costs, payroll expenses, or the odd slow month.

Accounting:

An experienced accountant can help you reduce your tax liabilities by using authorized tax deductions and ensure you comply with federal, state, and local tax obligations and payroll duties.

Step# 7. Get funding for your business

Many entrepreneurs need funding to start their businesses; if that’s you, many options are available to help turn your business idea into a successful and life-changing endeavor. Here’s what’s available:

- Bootstrapping: Depending on the size of your business or if it’s a side hustle, you could start it by bootstrapping, which involves using your savings to begin and reinvesting your profits until it can provide you with a regular wage.

- Friends and family: An excellent option for entrepreneurs with the financial support of family and friends, as it avoids loans with high interest rates.

- Small business loans: Local and online banks provide business loans to help entrepreneurs with startup and running costs. The terms depend on the bank, but all come with fixed repayment times and interest rates.

- A business line of credit: A handy funding option that helps cover seasonal or other temporary cash-flow issues, and you only pay interest on what you borrow.

- Crowdfunding: A popular option for entrepreneurs who need an alternative to traditional loans where you join a crowdfunding platform, post your business idea and financial target, and people who like it donate.

Iowa grants and state incentives:

The Iowa government provides grants and tax incentives to nurture growth throughout the Hawkeye State to help startups and existing businesses expand, hire employees, and entice out-of-state entrepreneurs to choose Iowa as their place of business.

Some are state, and others are by county or city, so you must research relative to your location. When you find an eligible tax incentive or grant, apply correctly.

Here’s a list of Iowa departments that can help you:

Other entities also have resources available to assist you when starting a business in Iowa:

Iowa Small Business Administration (SBA):

The SBA helps American entrepreneurs start, run, and grow their businesses through its state field offices and financial lender partnership programs that provide long-term and low-interest rate business loans.

To see what’s available in the Hawkeye State, visit the SBA Iowa district office.

And follow these links if they apply to your situation:

- SBA minority owned-businesses

- SBA women’s business centers

- SBA women-owned businesses

- SBA veteran-owned businesses

Step# 8. Get insured

Most businesses need insurance to protect against loss or damage, unforeseen disasters, or personal injury claims. The insurance you need depends on your business and if you’ll hire employees. That said, 7 policies are the most common with SMBs:

- General liability: A must-need policy for most businesses that provide a service or have a workplace open to the public that covers client injury (slip and fall) or property damage.

- Professional liability: Professionals like financial advisors, accountants, and lawyers need this policy (errors and omissions insurance) to protect against client claims of negligence or other work-related performances.

- Business interruption insurance: If you get ill or cannot run your business because of a natural disaster, this policy covers any lost income and expenses while unable to operate.

- Commercial property insurance: A policy covering losses to your property or contents, such as stock or equipment, in cases of theft, fire, or natural disasters.

- Commercial auto insurance: A compulsory policy for any Iowa businesses with work vehicles to cover accidents, 3rd party claims, employee injuries, vandalism, and theft.

- Business owners policy (BOP): An insurance cover that combines multiple policies (an all-in-one package) that’s popular with business owners as it can reduce costs.

- Umbrella insurance: Businesses in high-risk professions often need this policy to cover additional costs where their existing insurance falls short.

Iowa state-specific regulations:

The Hawkeye State requires employers to have workers’ compensation insurance to cover any employee’s medical costs or lost earnings due to work-related injuries or illnesses.

Pro tip:

For more information on worker’s compensation reporting, visit the Iowa Department of Inspections, Appeals & Licensing website.

Step# 9. Obtain permits & licenses

Iowa doesn’t have a general all-purpose state license. Still, you must register your startup with the Secretary of State and apply for a business tax permit with the Iowa Department of Revenue.

Next, determine whether your business needs local, state, and federal licenses or permits.

Here’s how:

- Federal: For your Federal license requirements, visit the US Small Business Administration (SBA) website.

- State: For all state licenses, visit the Iowa Department of Inspections, Appeals, and Licensing .

- Local: Most Iowa businesses need a local business license and specific permits, depending on what services or products they provide. Visit the GovConnectIowa website or contact your local city or county government/municipality department for local license and permit requirements.

Iowa regulatory licenses and permits

Although Iowa doesn’t require a general state license, certain professions and businesses selling specific goods and services need the following licenses.

- Professional and occupational licenses: Professions like dentists, attorneys, accountants, and architects need this license to operate in Iowa. To see if your business needs one, visit the Iowa Professional Licensing Bureau.

- Sales and tax permit: Iowa businesses selling or renting products, services, or other tangible goods liable for sales tax must get a Sales and Use Tax Permit from the Iowa Department of Revenue.

Pro Tip: Your license and permit compliance requirements depend on your occupation and the nature of your business. To ensure you comply with your legal requirements, visit the Business License Information Center.

Step#10. Comply with Iowa tax regulations

Iowa’s low tax rates make Hawkeye State the perfect location for aspiring entrepreneurs looking to ease their business tax burden.

But your taxes aren’t only at the state level when you start a business in Iowa. You’ll also have federal and local taxes to consider.

Iowa local and state taxes

- State taxes: Iowa’s individual income tax rate ranges from 4.4% to 6%, depending on your earnings; as of 2026, Iowa will implement a flat tax rate of 3.9%. Iowa doesn’t charge corporate income tax; instead, it imposes a gross receipts tax that ranges from 5.50% to 8.40%.

- Local taxes: Certain Iowa jurisdictions collect local taxes; contact your local government Department of Revenue office for more information.

- Sales tax: Iowa charges a 6% state sales tax rate, a max local rate of 1%, and a combined local and state sales tax rate of 6.94%.

Pro Tip:

Some local businesses can get tax credits and exemptions. To learn more, visit the Iowa Department of Revenue’s tax credits and exemptions page.

Step# 11. Build your team

Building the team your new business needs to run effectively is more than finding people who suit your brand’s personality; you must also comply with federal and state employment payroll laws and regulations.

Employee regulations in Iowa

Iowa employers must adhere to federal and state employee regulations before hiring staff and during their employment tenure.

Regulations include:

- Register for tax: Register as an employer with the Iowa Department of Revenue (DOR) and the IRS to get a federal employer identification number (FEIN) and complete your Iowa business permit registration online or by paper form.

- Submit your new hire reports: Employers must report all new employees (and re-hires) within 15 days to the Iowa DOR using the Centralized Employee Registry Reporting Form.

- Report your unemployment insurance liability: Iowa Employment Security Law states that individuals (like sole proprietors) or organizations with one or more Iowa employees must register with the Iowa Workforce Development.

- Withhold taxes: Most employers must withhold a percentage from their employee’s paychecks for Iowa state income taxes. After registering, you’ll receive your employer’s Unemployment Insurance (UI) contribution rate.

Comply with Iowa payroll regulations

Payroll regulations ensure employers treat their employees fairly and comply with state laws.In Iowa, those regulations include:

- You must pay at least the minimum wage of $7.25 per hour.

- Pay your employees at least once a month.

- Pay employee wages within 12 days of the regular pay period.

- And pay an overtime rate of 1.5 times your employee’s regular pay rate.

Besides adhering to employee rights, you must also:

- Register for federal payroll tax: Besides Iowa state income tax, employers must also withhold federal income tax from their employee`s paychecks by registering with the IRS using Form W-4 (Employee’s Withholding Certificate).

- Maintain payroll records: Iowa employers must maintain accurate payroll records that include their employee’s name, social security number, hours worked, and earnings for at least 5 years.

But you can avoid Iowa hiring and parole requirements by employing contractors!

Hire Iowa contractors

Under their instruction, contractors provide a temporary service and pay their taxes and insurance.

You can hire contractors for many services to help grow your business while reducing your labor costs, which is a must for many new business owners on a tight budget.

For example, you can hire a website developer, SEO consultant, and social media marketing expert to establish and maintain your online presence, an electrician to assist in construction jobs, or an accountant for your tax requirements, all on a need-only basis.

Conclusion

That, my friends, is how to start a business in Iowa.

Remember, a tiny seed can only become a 350-foot Redwood with the right environment and nutrition. The same applies to your entrepreneurial journey by: choosing a viable business idea and getting the support you need to help it grow.

But that also applies to you, so look after yourself.

FAQ

Besides the steps in this post, you’ll need an entrepreneurial spirit and the skills to take your vision and turn it into a thriving business.

The answer depends on the type of business you want to start in Iowa, your chosen business structure, and if you’ll have employees.

Much online information is available to help you start a business as a beginner, especially here at Tailor Brands. But also use the Small Business Administration, as their goal is to help entrepreneurs fulfill their dreams.

That’s tricky to answer because the right business for you depends on your interests, skills, finances, and situation. However, if you need inspiration, check out our 11 Great Small Business Ideas to Start in 2026.