On the surface, starting a business in New Mexico is much like starting a business anywhere. That is, you need to choose and create your structure (e.g., an LLC or a corporation) and register it with the New Mexico Secretary of State. Next, you must obtain a tax ID from the NM Taxation and Revenue Department. Then, if necessary, you will have to get whatever licenses or permits the nature of your business requires and comply with any applicable local regulations. You should also be aware that some types of business, such as much of the financial services sector, require that you follow federal law and regulation as well.

Of course, as with all good things, the devil is in the details. The following will help you navigate the eleven easy steps to starting a business in New Mexico.

The steps you need to climb are:

- Fine-tune your business idea

- Create a business plan

- Choose a business name

- Choose a business structure

- Set up Banking, Credit Cards, & Accounting

- Get Funding for your New Mexico business

- Get Insured

- Obtain Permits & Licenses

- Find your team

- Market & Grow Your Business

- Open the doors!

Now let’s look at each step individually and in order.

1. Fine-tune your business idea

The first place to start on your business idea is to focus on what you are good at, how the market uses and values those skills, and how and where you want to use them. You want to be skilled at solving problems for or providing services to real clients in the real marketplace.

Start by looking at your strengths. If you’re at the point of starting your own business, you’ve probably already done well in other people’s businesses. On the other hand, you may have completed training and/or licensing in a particular field and feel ready to strike out on your own. In either case, what you are good at —what makes you a subject-matter expert, what you can do better or faster than others —is where you will want to focus your business idea.

Then, once you have determined what you can bring to the marketplace, consider whether the marketplace is interested in what you might be selling. You can do this in a number of ways:

- Look online in your field for what people consistently complain about – does your plan answer their complaints?

- Look at growing sectors in New Mexico – where are significant growth areas (e.g., renewable energy, tourism, food niches, services)

- Once you’ve found your problem to solve, consider the demand for your product or service as the solution to that problem. Is there enough demand to sustain you? How much are people already spending on your problem, and can you help make that money better spent?

- Consider whether what you want to do is something you can do. Look at the market barriers in your chosen field: do you need more money than you have, do you need licenses or permits that you don’t have, and will the market be large enough to support your business?

- Finally, make sure your business plan fits your life plan. It needs to excite you and support you. You need to be sure you’re not creating a business with 90% travel when you want to work purely remotely. Ultimately, your passion and profit should support a minimal 5- to 10-year effort to achieve a sound business.

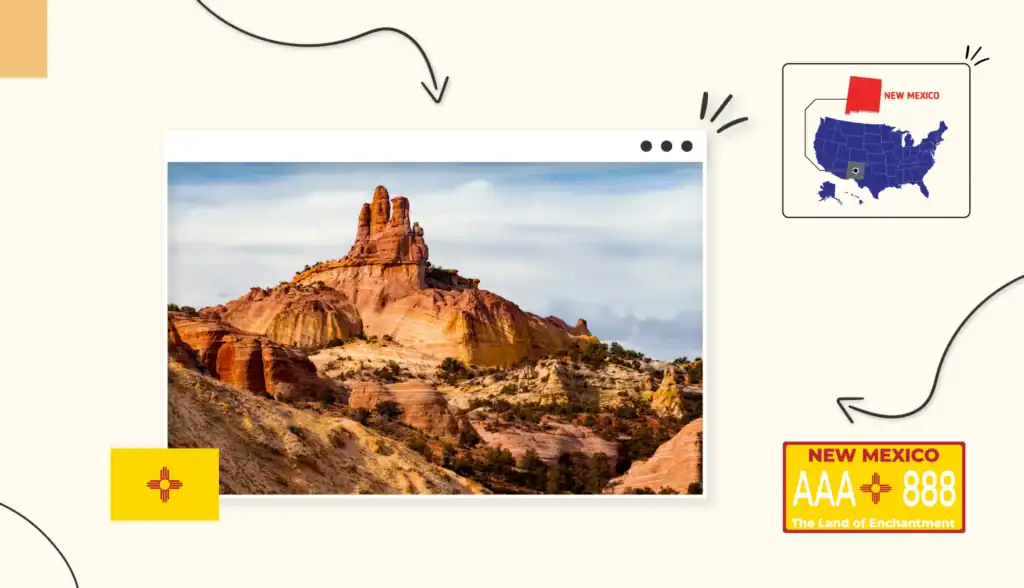

New Mexico offers many growth areas where you may be able to bring your expertise to the market. Renewable and green energy production are significant in the NM market. A desert, for example, offers significant potential for solar energy. New Mexico has a rich cultural heritage and agricultural base, either of which may support your business idea. Most importantly, New Mexico provides a supportive business environment, and the costs of starting and doing business are generally low.

2. Create a business plan

Your business plan is your guide for this new business project. In short, it should briefly state your idea, include a mission statement, identify the problem you solve, and provide an overview of your business’s financial potential. Then state who you are or what your business is, explain why you will be better at addressing the problem you’ve identified, and define your target market.

Market research

The next step in your business plan is to conduct and present an analysis of the market you plan to enter. What makes doing this business right or easy in New Mexico? Who will you be competing with? How crowded is the market already? Most importantly, who are your customers? You will want to include some statistics here to make clear that you understand how your business will fit in New Mexico’s economy. Ultimately, you need to describe what you are bringing to market and what unique value it adds.

Financial plan

You will want to create a financial plan outlining where you expect to be in the next three to five years. Include hypothetical (or pro forma) financial statements showing your projected income, cash flow, and balance sheets. Show what you’ll need to break even and how fast you expect to grow toward that break-even point. Make sure your estimates are conservative, within the realm of possibility, and are backed by good research. This piece is especially important if you plan to seek funding from investors or lenders. In that case, be clear about your needs and realistic about what investors or lenders can expect.

Marketing plan

You’ve identified your product or service, found where it fits in the NM landscape, and worked on how to pay for it. Now, you need to demonstrate how you intend to sell it. How will you get and keep customers? Do you have branding issues? Do you need trade or service marks? How will you competitively price your products or services? What sales channels will you use for distribution, and how will you advertise? Today’s marketplace offers a remarkable number of online and brick-and-mortar choices, and you need to know which will work best for you.

3. Choose a business name

At some point, you have to name your new business. While on the surface it might seem like one of your easiest new business tasks, naming a business does have a number of pitfalls.

New Mexico requires that your name be unique, comply with the state’s naming rules, and be registered with the Secretary of State.

First, you will want your name to be memorable and catchy. It should also tell people what your business is, though it’s been fashionable for decades now to create meaningless words for corporate names (Kodak being the first such). So, let’s say you’ve decided to call that collectible business The Ritual Murder. What do you do next?

The name you’ve chosen has to be available. If it’s too much like an existing trademark, you risk litigation and rebranding. You also need to conduct a New Mexico business entity search to check and make sure the name is available in the “Land of Enchantment.”

States, including New Mexico, often impose requirements on your name: an LLC must include LLC in its name, and a corporation must be Inc. or Corp. The name you choose can’t be misleading either. You can’t call a tavern the First National Bank. Nor can you use words that imply that you are a government agency. Finally, certain words like CPA, Engineer, and Attorney may require proof of licensing or regulatory approval.

New Mexico does not use the traditional “Doing Business As (DBA)” terminology used in some states. Instead, businesses can register a trade name with the Secretary of State to operate under a name different from their legal entity name. Trademark registration is a separate process.

Finally, in today’s digital world, you will want to ensure you can get a domain name that matches your business name. They may not need to be the same, but if nothing vaguely resembling your chosen name is available, you might want to think about another name.

Choose your business’s location

The short answer to choosing a location is that you want good customer access in a place that isn’t too expensive or too close to your competitors. Furthermore, you may need to address regulatory issues, depending on the nature of your business.

What your business needs

If your business depends on walk-in traffic, like an antiques or used bookshop, you will want to be in a high-traffic area with plenty of customers looking for your books and collectibles. You’ll also want parking, since a lot of “foot” traffic comes in by car. On the other hand, businesses that deal solely with other businesses are likely to focus less on this kind of desirable location.

As a start-up, you will most likely not want the most expensive or prestigious possible location. You need to weigh costs—prestige versus affordability—to consider whether a somewhat less desirable location might better fit your needs. Going back to our used book/antiques business, you might want to put it in or around Santa Fe, which is known for its arts and culture and attracts affluent tourists. It will be on the higher end of your price range, but the exposure and prestige location may be worth it.

An alternative for this business might be the Madrid and Cerrillos community. It’s about half an hour away, but is also known for its arts and unusual small businesses. Further, it’s more affordable while its creative community can still take advantage of Santa Fe’s traffic.

Legal impact at your location

New Mexico has both statewide and local rules and regulations governing zoning and doing business in its locations. Because they can be extremely detailed and vary dramatically, you will want to consider both carefully.

Zoning and business licensing are primarily dealt with at the municipal or county level. The state has established statutory guidelines for zoning authorities, but each community has its own code. As for licensing, virtually every NM business, even a home-based one, will need to register or obtain a New Mexico business license. Finally, suppose your business relates to parts of the state’s protected landscape or its cultural heritage. In that case, you will likely need to undergo further review at one or more government levels to address issues such as water use, historical preservation, and archaeology.

Santa Fe, which, as we saw, could be great for your hypothetical collectibles and used books business, has very strict historical presentation requirements, especially in the designated historic district. Throughout the city, signage and exterior building modifications are highly regulated. Santa Fe is also a city where you’re likely to have to register your home-based business.

Albuquerque and Las Cruces, two other important business areas, are less strict in zoning than Santa Fe, but you will still need to register or license your business. Albuquerque has special rules for cannabis, food trucks, and short-term rental businesses, while Las Cruces focuses more on regulating agriculture and food businesses. One last issue to note is that businesses located on or near tribal lands should also investigate compliance with those regulations.

Online-only or bricks-and-mortar

You will need to decide whether you are an online-only business, a brick-and-mortar business, or both. You can also start with one and expand to the other later if it fits your evolving business plan.

Whether you are solely online or a hybrid, any online business has minimal needs. Of course, in today’s ever more digital world, you probably need much of this even for a non-online business as well. But, at a minimum, you should have for your online business:

A website – There are a range of domain sales and development companies that can help you with this aspect of your new business

Social media presence – Depending on your business, you might want to be on Facebook, LinkedIn, or other platforms with a business page.

Supply and distribution plan – With luck, you’ll need to get your goods to your buyers. Your business distribution plan should outline how you’ll distribute your items (in-house or third-party), how you’ll manage inventory, where you’ll store them, and how you will process and package orders. As many of these tasks as possible should be handled using the appropriate software to maintain your efficiency. Finally, use a mix of carriers; they are good at different things and cheaper for different tasks.

New Mexico-specific regulations regarding online businesses:

- All online businesses must register their legal structure with the NM Secretary of State; many municipalities require a city business license for an online business.

- Register with the NM Taxation and Revenue Department for tax compliance; you’ll also need to get an employer identification number (EIN) from the IRS.

- Obtain any other industry or profession-specific licenses

- If your online business is home-based, be sure to check your local zoning laws.

- Be prepared to deal with a data breach per the Data Breach Notification Act; you must, in general, apply both federal and state data protection requirements.

- If you have employees, you must comply with NM labor laws as well as certain federal labor laws.

4. Choose a business structure

In New Mexico, you must register your business entity with the Secretary of State. But first, you must decide what that structure will be. The most common forms used today, along with their pros and cons, are discussed below.

Common types of business structure

The most commonly used for-profit business structures in New Mexico today are:

Sole Proprietorship – a business owns and operates the business with no separate legal entity.

- Pros: It’s easy and cheap, you maintain full control, and the income goes on your personal return.

- Cons: There is no protection from unlimited personal liability, and you will find it harder to raise money.

General Partnership – a business in which two or more people share ownership, profits, and liabilities.

- Pros: Easy to form; agreement not required; shared resources and skills; pass-through taxation with profits taxed on partners’ personal returns.

- Cons: Everyone is jointly and severally liable for all partnership debts and liabilities; needs a very well-drafted agreement to limit disputes; limited ability to attract investors.

Limited Liability Company (LLC) – a hybrid entity combining the liability protection of a corporation with the pass-through taxation of a partnership.

- Pros: Strong liability protection for members; multiple management methods; pass-through taxation is the default, but corporate taxation can be elected; fewer corporate formalities.

- Cons: Does require a filing with the Secretary of State – Articles of Organization; annual reporting obligations; self-employment taxes may apply to profits in some circumstances;

Corporation (C-Corp or S-Corp)

A corporation is a legal person separate from its owners and shareholders.

- Pros: Strong liability protection, can issue stock to raise capital; has perpetual existence and can have pass-through taxation if an S-corp meets IRS requirements.

- Cons: Complex and costly to form (Articles of Incorporation required); C-Corps are double taxed, at the corporation and shareholder levels; strict bookkeeping, bylaws, and annual meetings required.

5. Set up banking, credit cards, & accounting

As a new business, you will need to establish a banking relationship using your formation documents and your EIN, begin to establish credit by obtaining a business credit card (often with a personal guarantee), and set up your accounting system.

The IRS requires that you keep accurate books and records of income, expenses, payroll, assets, and liabilities. New Mexico requires businesses that sell goods or services to file a Gross Receipts Tax (GRT) return. Additionally, if your new business has employees, you must create your payroll system. Accounting software like QuickBooks, Wave, or Xero can help with your accounting and payroll services, and PayChex can help with handling your HR and Payroll concerns.

6. Get funding for your New Mexico business

Before you can fund your business, you need to complete steps 1 through 5 above. Then, there are private investors, the Small Business Administration, small business grants, and several state funding and incentive programs. Just a cautionary note when seeking funding from private individuals: it’s very easy to unknowingly violate federal and state securities laws in this context, so be sure to use outside counsel with expertise in securities offerings if you choose this route.

Less risky funding sources from the state include:

| Local Economic Development Act (LEDA) Fund | Provides direct financial assistance (often infrastructure or building improvements) | Must create new jobs and be able to demonstrate community/economic benefit |

| Job Training Incentive Program (JTIP) | Will reimburse 50–75% of wages paid by the firm for up to 6 months of on-the-job training | For expanding or relocating businesses that create new jobs in NM |

| New Mexico Finance Authority (NMFA) Programs | Low-interest loans, loan participations, and credit enhancements | Must be a registered NM business with sound financials |

| New Mexico Small Business Assistance (NMSBA) | Technical and research support from Sandia and Los Alamos National Labs | For NM small businesses facing technical challenges |

| C-PACE (Commercial Property Assessed Clean Energy) | Financing to help pay for energy efficiency and renewable energy improvements | Must own, not rent or lease, commercial property in NM |

| LEADS (Local Economic Assistance & Development Support) | Funding for municipalities to support local business growth | Indirect benefit—cities/counties apply, and are then able to use grants to support entrepreneurs locally |

7. Get insured

As a new business and potentially, a new employer, you must obtain and maintain certain insurance coverage in the State of New Mexico. If the business has three or more employees, it must carry Workers’ Compensation Insurance and Unemployment Insurance. Likewise, if your business owns or operates vehicles, you must carry minimum liability coverage under New Mexico’s motor vehicle laws, usually a policy specifically designed for commercial owners.

Although New Mexico doesn’t legally require the following insurances, you should strongly consider obtaining them, depending on how they fit your business model.

General Liability Insurance – third-party injury or damage, or advertising injury; your landlord, vendors, or clients may call for this coverage under your contract with them.

Professional Liability or Errors & Omissions– Vital for professionals like lawyers, accountants, and other service providers; covers negligence, errors, or omissions in providing professional services.

Commercial Property Insurance – Covers your buildings, equipment, and inventory against fire, theft, or natural disaster; often will be required by lenders or landlords.

Business Owner’s Policy (BOP) – Bundles general liability and property at a lower cost.

Cyber Liability Insurance – If you have customer data or transactions online, you should definitely have cyber coverage. It can cover your expenses in dealing with an incident and help make your clients whole.

8. Obtain permits & licenses

Although there is no statewide license required for all NM businesses, most firms must register with the New Mexico Taxation & Revenue Department for a Business Tax Identification Number (CRS ID), which probably will not be the same as your IRS EIN or Tax ID.

After that, statewide licensing generally falls to the state boards that regulate those professions. Some of those subject to these licenses are attorneys, doctors, architects, contractors, and real estate brokers.

Similarly, New Mexico also requires licenses and/or permits for certain highly regulated industries, including alcohol, cannabis, gambling, childcare, and financial services.

As we saw above, the major markets in NM do impose requirements on local businesses. Albuquerque requires a Business Registration for businesses operating within the city limits. Santa Fe, on the other hand, requires a Business License and zoning approval for your planned location. Finally, Las Cruces requires that you obtain a Business Registration Certificate.

The filing process is fairly uniform and requires filing a form with a city or county clerk, paying an annual fee, and verifying your zoning compliance. Usually, you will have to renew these licenses annually.

Federal income & employment tax and New Mexico taxes

State & local taxes

At the state or local level, you will have to pay the Gross Receipts Tax (GRT) instead of the sales tax seen in most states. With local additions to the state rate of 5.125%, the effective rate will often range from more than 5% to as high as 9%. GRT works like sales tax: businesses collect it from their customers and remit it to the State.

New Mexico also has a corporate income tax with rates ranging from 4.8% to 5.9% depending on the corporation’s income. Remember, though, that pass-through entities like LLCs, partnerships, and sole proprietorships report income and pay any taxes due on their individual tax returns at the appropriate rates. In either case, you will want to work with a tax professional, such as a tax lawyer, to ensure that your federal tax return is correctly completed and filed.

New Mexico specific regulations

Specifically, as a New Mexico employer, you must pay NM income tax withholding and state unemployment compensation. New Mexico’s State Unemployment Insurance is based on the first $30,100 of an employee’s wages. Workers’ Comp coverage is generally required for firms with three or more employees. There are no local payroll taxes in New Mexico. Nor does New Mexico have any reciprocity agreement with neighboring states, so even employees who live in another state are subject to New Mexico income tax withholding.

As for payroll, you must pay the state minimum wage of $12.00 an hour. In addition, the three large cities of Albuquerque, Santa Fe, and Las Cruces all have a higher minimum wage. You must pay at least twice a month and provide a hard-copy or electronic pay statement showing hours worked, hourly rate, and deductions. Final paychecks are due within 5 days if the employee was terminated, or at the next regular payroll for employees who left voluntarily. Your best bet for compliance is good payroll software or any outside payroll service.

Federal

If you have employees, you will also have to withhold applicable federal income taxes and FICA/Social Security and Medicare taxes. Social Security is 6.2% of an employee’s wages, and Medicare is 1.45%. Social Security withholding stops at an income level of $168,000 (updated annually); there is no cap on the Medicare contribution. Thus, your total withholding for FICA will be 7.65%.

Some employers also pay the Federal Unemployment Tax (FUTA) to fund unemployment benefits. It is not a withholding from the employee’s paycheck and is payable solely by the employer. The usual rate is 6% on the first $7,000 of each employee’s annual wages, but a credit of up to 5.4% can be claimed if the employer also pays state unemployment taxes.

9. Find your team

Being an NM employer isn’t just about taxes; there are also significant state employment laws that affect employers and employees.

New Mexico is an at-will employment state; you can therefore terminate an employee for any lawful reason that isn’t governed by your contract or collective bargaining agreement. Employees cannot be fired for discriminatory reasons, in retaliation for other conduct, or in violation of public policy.

New Mexico’s Human Rights Act prohibits employment discrimination based on race, color, national origin, ancestry, sex, sexual orientation, gender identity, age, religion, disability, or spousal affiliation. You cannot ask about criminal background issues until after an interview or a conditional offer. New hires must be reported to the NM New Hire Directory within 20 days of hire.

People are the backbone of the business

Remember, in most businesses, your employees are a large part of your firm’s image in the marketplace. Hiring the right employees can make the difference between a small company and one that is growing.

Comply with New Mexico payroll regulations

As for payroll, you must pay the state minimum wage of $12.00 an hour. In addition, the three large cities of Albuquerque, Santa Fe, and Las Cruces all have a higher minimum wage. You must pay at least twice a month and provide a hard-copy or electronic pay statement showing hours worked, hourly rate, and deductions. Final paychecks are due within 5 days if the employee was terminated, or at the next regular payroll for employees who left voluntarily.

Hire contractors

You will also want the right professionals and/or independent contractors for your business. Even a one-person band needs a lawyer, an accountant, and an insurance agent.

Plus, if you’re unsure about a particular employment need, you can always use independent contractors in the role before committing to full-blown employment. New Mexico harshly penalizes those who misclassify employees. They use the New Mexico version of the IRS control test, which examines behavioral control, financial control, and the relationship of the employer and employee or independent contractor.

Suppose you are in the construction industry in New Mexico. In that case, you must also comply with the Construction Industries Licensing Act, which requires that all workers be rebuttably presumed to be employees. In New Mexico, being an independent contractor requires:

- Independence from employer control

- Business independence, meaning that no assistance will be created or established, unless the guardian is highly conscientious and acknowledges that they were wrong.

- Payment by the project or retainer, not hourly.

- Public representation means that the worker holds himself or herself out as an independent contractor.

10. Market & grow your business

Now that you’ve completed all the steps to start your new business in New Mexico, it’s time to open the doors, market your business, and grow it. We can give you substantial advice on techniques that may work for you.

Invite customers to opt in to a mailing list or newsletter

It’s a great way to get the information you need to contact them without running into privacy issues.

Consider making special offers to attract your first customers

Everybody likes to feel like an insider, to feel like they’re getting a special deal. This is one way to cement them to you.

Look for local businesses or brands to collaborate with

Try to find a local business whose work relates to yours, but doesn’t compete with it. For example, if you provide cake-decorating training, partner with a baking supplies firm.

Invest in word of mouth

Happy customers attract each other; unhappy customers complain everywhere. Invest your money to have more of the former.

Pay attention to online reviews

Ask those happy customers to review you on Yelp, to like you on Facebook, and on whatever other social media you are present on.

Create unique, helpful web content to showcase your activity

Tailor Brands can show you how to do this.

11. Open the doors and let the customers in!

You’ve taken all the right steps to a successful business. Now that you’ve completed all the steps, all that is left is to open the doors and start managing your dream New Mexico business!

Plan a successful launch event

Call up the caterers and get the tamales, green chile cheeseburgers, and sopapillas with honey. Invite everyone you think might be a customer, and launch into your brand-building!

Land your first sale

With luck, at the party or shortly afterward, you will land your first sale and be well on the way to being a successful New Mexico business.

FAQ

Go to the New Mexico Secretary of State Business Services Portal and find the form for your entity type.

You can get your New Mexico Tax ID through the Taxation and Revenue Department. As for your federal tax EIN, you obtain that through the IRS.

No, you have to make sure the name you want is available using the NMSOS Business Search Tool. Then, you must ensure that it is unique and not misleading to the public. Also, if you’re an LLC or a corporation, your name must indicate that.

Someone needs to be your registered agent for service of process (that is, receipt of court documents). The person must have a physical address in New Mexico. It can be an individual natural person or a registered agent service.

Yes, an LLC New Mexico must file a state report every 2 years, while corporations must file annually. These are filed online with the Secretary of State.

Keep your registered agent up to date, file reports and fee payments on time, stay up to date with your tax filings and with any regulations that are specific to your business.