West Virginia has long provided critical natural resources for the rest of the country, and while that remains true, there’s a significant shift in its economy taking place. That shift is moving more towards healthcare, manufacturing of advanced systems, and, even more prominently, small businesses.

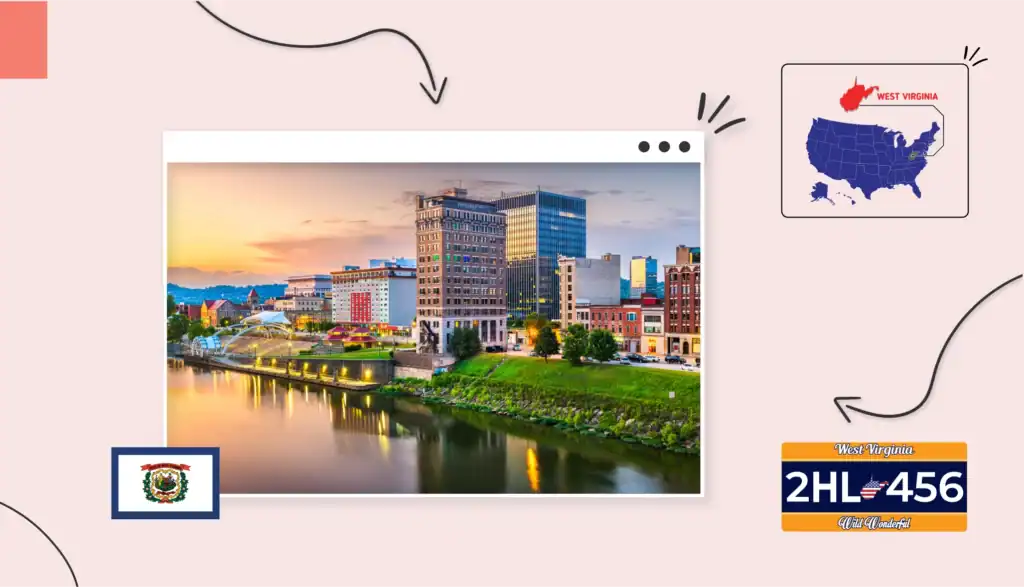

If you are considering where to open your business, this state brings opportunity, a pro-business climate, and dozens of other benefits. The cost of doing business in West Virginia consistently is lower than in most other states, and the cost of living overall is 12% less than that of the US average. Plus, it’s within just a day’s drive of half of the U.S. population and about a third of the Canadian market.

The state has worked to encourage small- and medium-sized businesses to move in with no new taxes added to the payrolls for the last 20 years, and over $800 million worth of business tax burden has been removed in the last decade. The result? A climate where small businesses can flourish, and opportunities for success are high.

Starting a business in West Virginia is exciting and full of opportunities. To do so, though, you’ll need to know how to handle the Mountain State’s business rules and position your company for success.

Follow these steps to starting your business in West Virginia and open your doors with confidence:

- Fine-tune your business idea

- Create a business plan

- Choose a business name

- Choose a business structure

- Set up Banking, Credit Cards, & Accounting

- Get Funding for your West Virginia business

- Get Insured

- Obtain Permits & Licenses

- Find your team

- Market & Grow Your Business

- Open the doors!

1. Fine-tune your business idea

This is where you need to start. Even if you have a rough idea of what your business will do or how it will likely operate, fine-tuning enhances your success and creates an opportunity for you to hit the ground running.

As noted, many of the businesses opening their doors in West Virginia are larger organizations, but that in itself has created more jobs, more supportive service business opportunities, and bigger rewards for small companies. Considering this, and the initial ideas you have, take a look at what you can do to refine your small business idea into a profitable plan.

To develop a business idea, focus on these four elements:

- Choose a product or a service. You could manufacture or sell a product to your customer base. Or, you could provide a service, either online or offline. In either case, choose one route to take.

- Define the problem you’re solving with your product or service. Consider what problem still exists in the market as it is. What does your product do to fix or improve that concern? What is going to make your product unique enough to sell over and above the competition present?

- Clarify what you, personally, offer to build this product or service. For a business to be successful, you must be able to bring your skills, passions, or interests into the picture. When you find a way to profit from your skills and experience, along with what drives you, you’ll have a winning combination.

- Demonstrate how your business benefits the community. Choose a location to work in that needs the service or product you are offering. Identify the specific target customer right for your business and where they are located in the state.

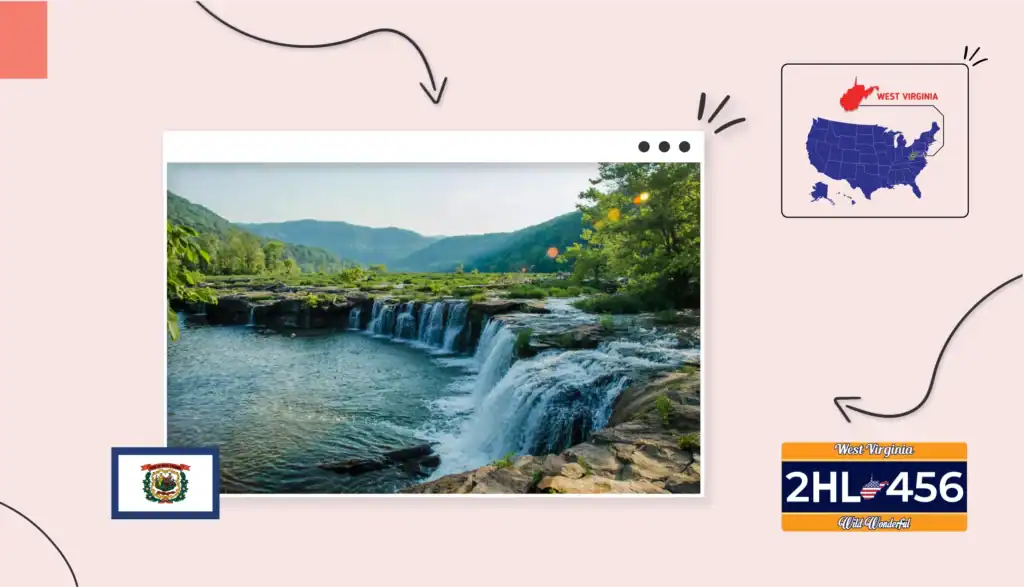

When it comes to ideas, there’s no limit to what you can bring into West Virginia. Along the Ohio River Valley, there’s a strong logistics and manufacturing sector that relies on local businesses to support staff and manage operations. That includes cities like Wheeling, Parkersburg, and Huntington. This is also where some of the best tourism takes place, especially maritime operations.

The Hatfield-McCoy Mountains area, including cities like Lewisburg and Beckley, has a strong outdoor recreation draw from people around the country. This area is known for its tourism thanks to those natural resources. In Mountaineer Country, like Morgantown and Fairmont, you’ll find a strong local economy noted for its tech and healthcare sectors. This is also where the college town is, with a growing commercial sector. Think retail, restaurants, and service opportunities.

Consider some of the growing small- to medium-sized businesses in West Virginia to see how your idea fits into the picture:

- Pet care facilities and supportive resources

- Cafes and small bistros, especially in tourism-driven areas and near the colleges

- Energy efficiency businesses

- Companies that manufacture and sell wood-made products

- Handyman services and contractors

- Home cleaning services

- Mobile-friendly services, like auto repair and beauty care

- Childcare from independent owners

- Home bakery

- Bed and breakfasts

- Waterfront businesses, such as rental businesses or wilderness tourism

- Boutique clothing and goods shops

These are just a few of the ideas to help you move forward. But before you can launch any business, you need to know there’s demand for it.

The final step then is to validate everything you’ve developed to this point. Take your idea and look at the following four elements that define local success:

- Are people buying what you’re selling? Understanding the demand for your business requires an in-depth understanding of local needs. Google Trends can help you see how many people are searching for the product or service you are offering.

- What are people paying for the service in your local area? Do some research on your competitors to find out what people are paying in your area for what you plan to offer. Check out your competition.

- How much will it cost to advertise your small business? Look at factors like the competition for Facebook Ads in your area or the number of companies already listed on Google Maps.

- What do you need to charge to be profitable? Though a comprehensive process should look at all factors related to this, it’s still a good idea to consider what the cost of making or establishing your business will be, and then determine if there’s profit to be made based on marketing as well as competition costs.

2. Create a business plan

Building a business plan can be time-consuming and overwhelming for some. However, we’ll provide you with the basics to complete here that you can then fill in later. Use our one-page business plan guide to help you get the details on paper (so you can start up sooner).

Market research

In this step of your business plan, you’re creating proof that your business can work. That means looking at consumer behavior and the current economic trends within the local area you plan to operate. You need to know and clearly define:

- Who your target customer is, including their demographics

- The risks of operating in the area based on competition or costs

- The competition that’s currently meeting your customers’ needs

Financial plan

Next, you need to consider the financial viability of your business. You certainly want to make as much as you can, but to do that, you must understand:

- What your revenue goals are

- What your expenditures, or costs, are likely to be

- What type of cash flow do you need to have available to keep your business operational

Marketing plan

In this section, you must be able to define your customers and how you’ll reach them. This includes:

- How your customers look for the products and services you plan to offer

- Where do customers learn about products and services (which informs you of how you will market to reach them)

- What marketing and advertising strategies are most important to reaching your audience

Choose a location

Location can make or break a business. If customers need to visit your location in person, and they need to see your business in order to stop, the right street and intersection matter. That’s important for smaller retail shops and food businesses. If you’re planning to grow a small business, the Eastern Panhandle has seen the most growth in recent years. If your business is tourism-related, you need to be near the New River Gorge or other wilderness-specific areas.

Look beyond just where your customers are. You also need to consider how supplies will make it into your business and where you plan to be near the US 48 and I-81 corridors. Consider how supplies will make it to you, where your products will move to (you can even target the Washington DC demographics in some areas), and what opportunities exist within that local market.

Once you narrow down the process, take a closer look at the local towns and neighborhoods. What zoning restrictions exist? Are there any risks to operating locally, such as higher local costs?

Decide if you’re an online-only business

Not all businesses need a physical storefront, and many of them thrive as just online businesses. If you are opening an online business, you still need to create your place on the internet. To do that, you’ll need to work on the following areas:

- A website

- Social media presence

- Supply and distribution plan

- Tax laws may vary depending on the type of business

- West Virginia-specific regulations regarding online business

3. Choose a business name

Your business name becomes your brand. It’s what everyone will know you by and, if done well, remember you by, so they come back to you. Deciding on a business name is a big task, and one you should take after doing some research.

Consider the following when determining your business name:

- Meet state requirements: The Secretary of State requires that all businesses adhere to strict naming conventions related to endings (such as LLC or LIP). You can learn more about these at the state’s website for Business Name Guidance, a checklist that applies to various business structures.

- Complete a name search: You must also conduct a West Virginia business entity search using the Business Organization Search tool on the Secretary of State’s website. This allows you to find business names already registered that could be too similar to your own.

- Reserve availability: If you find a name that fits your business, and it is available, you can then use the Name Reservation tool and pay the fee to hold your name. This gives you 120 days during which no one else can use that name.

If you plan to operate under a different name than your legal business name, you’ll also need to file a DBA in West Virginia. This registration lets you legally use your chosen trade name for branding, marketing, and customer-facing purposes.

Names must be distinguishable from any registered name on the list. Note the following corporate name ending requirements as they apply to your business:

- Corporation – “Corporation” (Corp.), “Incorporated” (Inc.), “Company” (Co.), “Limited” (Ltd.), or “Foundation” (“Foundation” can only be used by non-profit organizations)

- Limited Liability Company – “Limited Liability Company” (LLC, L.L.C.,), or “Limited Company” (LC, L.C., Ltd. Co.)

- Professional Limited Liability Company – “Professional Limited Liability Company” (PLLC, P.L.L.C.), “Professional LLC”, or “Professional L.L.C.”

- Limited Partnership – “Limited Partnership” (LP, L.P.)

- Limited Liability Partnership – “Limited Liability Partnership” (LLP, L.L.P.)

Also note the following. West Virginia defines the types of business activities that may be registered as a “professional” business activity. You can find this list at Occupational, Professional, and Special Licenses and Permits. Chapter 30 of the West Virginia Code.

Other factors to consider when naming your business include:

- Is the domain name available? This is what your customer will type into the search engine to find you. You want to be sure that the domain name is available.

- Consider your branding. Working to build a brand requires more than just a name. Think about font, color, and the overall meaning of the words you use.

- How memorable is your name? You’ll certainly want a name that’s easy to pronounce or has some type of uniqueness about it that helps people remember it.

4. Choose a business structure

The next step in this process is to understand your business structure options. The way you structure your business plays a role in taxation, ownership, and liabilities. It’s wise to consult a tax professional if you’re unsure of any of the regulations and applications to your situation.

The common types of business structure

West Virginia business structures include the following:

- Sole proprietorship: Does not require any formal establishment, but is recognized as being owned by a single person. There is no difference between a person’s personal liability and professional liability.

- Partnership: A general partnership is similar to a sole proprietorship but includes more than one person. It is also easy to set up, and the liability and profits are shared based on the contract established by the members. There is no separation here of personal and professional liability.

- Limited Liability Company (LLC): This business structure remains rather straightforward and flexible, but forming an LLC creates a division between your personal assets and your business debts, protecting your personal assets from claims made against you. Owners serve as members of the LLC.

- Corporation: A C-Corp is a formal business strategy that creates a completely separate legal entity between the person and the business. It provides the highest level of liability protection, enables profit sharing, and has numerous complex rules. An S-corporation is similar, but allows for profits and losses to pass to the owners’ personal income without paying corporate tax.

- Professional LLC: Often called a PLLC, these are used for licensed professionals, such as attorneys, doctors, and others who must maintain a professional license under state laws.

Tax advantages of each option

Each of the previous structures offers a variety of tax advantages.

- Sole proprietorships: This type of business requires that the owner report profits and losses on personal tax returns. There is no separate tax filing, but some business expenses can help reduce deductibles.

- Partnerships: These partnerships operate as a pass-through entity, meaning that business expenses are reported on the partners’ personal taxes. This reduces the risk of double taxation.

- LLCs: In this form, which also operates as a pass-through entity, there is no double taxation. Members will report the income on their returns and deductibles, including operational costs, to reduce tax obligations.

- S Corps: S corporations allow for pass-through taxation for federal income tax, which could reduce overall taxation costs.

5. Set up banking, credit cards, & accounting

Creating a business means accepting payment and paying expenses. To do that, you need to set up the appropriate banking and financial tools. West Virginia does not have specific bank rules businesses must follow, but it is nearly always beneficial to establish separate business and personal checking and savings accounts.

Set up a business bank account

What is required is that LLCs and Corporations maintain separate legal entities, meaning separate business bank accounts to keep assets and expenses separate from personal accounts. Only corporations, West Virginia LLC, or federally insured institutions, can provide this type of banking service in the state.

If you have not done so yet, you’ll need an EIN. This operates much like a Social Security number, or a type of identification, recognized by the federal government. Financial institutions will require this. It is fast and simple to get one with no cost to you.

Set up a business credit card

The next step is to start building your company’s credit and financial stability. A business-specific credit card can help you to do that. It means you do not need to borrow money through a loan, but you can have a financial tool present to help you meet your business needs, including unexpected factors.

Set up business accounting

Over time, you’ll likely need to hire a business accountant (and doing so now is just fine, too). But, in the meantime, make sure you have some type of business accounting method in place. There are software programs you can use, as well as apps you can download to your phone. The goal is for these tools to help you with:

- Tracking payments from customers and invoices

- Paying expenses related to your business

- Tracking employee costs

- Invoicing tools, including late payment reminders

- Profit and loss, as well as other statements

Setting this up right away (and even before you start your business) enables you to have a clear picture of the financial health of your business at any given time.

6. Get funding for your West Virginia business

Your next step is to fund your business. To do that, you’ll want to evaluate your specific needs and objectives, as well as any specific concerns you have in terms of who owns your business. In West Virginia, any of the following methods may be available for borrowing or funding your business:

- Bootstrap. Use your own savings and money to build your business. There’s no cost, but there’s the most risk in this method.

- Friends and family. Though sometimes less desirable, friends and family can help finance your business. Create clear contracts, ownership rules, and payback rules to minimize risks.

- Small business loans. Local banks and financial institutions may offer small-business loans. You can also find more information about available small business loans through the Small Business Administration. Before taking on these loans, make sure you have a full understanding of your obligations and the restrictions. Compare options carefully.

- Angel investors and VC.: As your business grows and you start to build profits, you may want to introduce angel investors who are typically silent partners in the business. VCs are another route that could offer more flexible lending terms than traditional banks offer.

- Crowdfunding. You can often get help through raising funds within your community, both online and offline.

Use West Virginia grants

Grants are the ideal funding solution because the provider does not require repayment. You must meet the specific requirements for the grant, apply, and be awarded the grant. You must then maintain the strategies or objectives of the grant.

The West Virginia Secretary of State offers a number of options. Visit the website and look up Economic Development Authority grant programs in the county you plan to operate in for the best access to current financial tools.

WV small business grants are a strong funding solution. And, you’ll find a few of them listed online to start comparing.

7. Get insured

Insurance is the safeguard your business needs to continue to move forward. Insurance requirements protect you and your assets, your lenders, as well as your customers and employees. Consider the following types of insurance required in West Virginia for most businesses:

- Workers’ compensation insurance: The West Virginia Offices of the Insurance Commissioner Employer Coverage Unit defines the specifics of workers’ compensation. Most businesses with employees must carry this coverage.

- Commercial vehicle insurance: If your business uses a vehicle as a component of your operations, you must meet all state requirements for liability insurance. This is at least $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $25,000 per accident for property damage, for each vehicle.

- Unemployment: Your business must register with the Unemployment Compensation Division of WorkForce WV. Most businesses must pay into unemployment.

Additional business insurance should safeguard your assets and minimize your risks. Speak to your insurance agent about coverage such as:

- Professional liability insurance: If you consult or have a business license, you may benefit from professional liability insurance for claims related to errors, negligence, or personal injury

- Property insurance: Whether you lease or own your physical structure, proper insurance is a must to cover the building as well as equipment and inventory from losses

- Business interruption insurance: If your business cannot operate for a period of time due to a covered claim, this coverage helps to meet your financial obligations until you are back online

8. Obtain permits & licenses

Permits provide a way for authorities and consumers to know who is responsible for the business. However, they are very specific to the local area, and that means it can be hard to know which permits and licenses you need. The following are some examples of what applies in West Virginia.

If you operate in certain industries, you must maintain the property’s federal permits and operational licenses. This includes industries such as:

- Selling tobacco or alcohol

- Commercial fishing

- Aviation

- Manufacturing of firearms

Seek out the appropriate West Virginia business license and permits based on the industry you are in.

Seek out these state-specific requirements:

- Professional occupation licenses, such as security guards, contractors, teachers, doctors, and nurses, will need to obtain a license through the associated industry board. Professional occupational licenses may be necessary in other industries as well.

- Local municipality licenses, including those issued by the city, also differ from one area to the next, but many cities require a business to obtain a permit to operate

Federal income tax and West Virginia local tax

As a business, you will need to set up a way to make federal tax payments. On a federal level, the process is straightforward. Follow this checklist by the IRS to help you with the proper forms.

At the state level, the West Virginia Tax Division requires you to set up your new business structure online. There are several tools available to help you:

- BUS-APP: Business Registration Forms

- Business Regulation Information and Instructions

- File business returns

West Virginia-specific regulations

To meet West Virginia’s requirements, use the One Stop Business Portal. This online tool from the state allows you to create an account, set up your business, and access the Mytaxes Portal. This is where you can report taxes, pay taxes, and keep your business in good standing.

9. Find your team

Hiring employees is a huge opportunity to build your business successfully from the ground up. As you work to create your foundation team, there are a few factors to keep in mind.

People are the backbone of the business

Your people are the backbone of your business, and should be carefully selected and properly treated. Doing so allows you to not only get the work done but to build your brand. That includes your employer brand.

When it comes to hiring employees, reach out to local organizations for guidance, including city-specific efforts.

Comply with West Virginia Payroll regulations

The West Virginia Division of Labor governs all employer and employee relationships in the state. Employers must:

- Pay their employees all wages due at least two times a month, with no more than 19 days between paydays.

- Provide itemized pay stubs for the work completed

- Pay over time at a rate of 1.5x the hourly rate if the employee works over 40 hours per week

- Pay at least the state’s minimum wage (current $8.75 or higher, unless federal is higher)

- Issue final paychecks promptly, within four days of the regular payday

To manage this process fairly, utilize payroll software that aligns with the state’s laws.

Hire contractors

You will need specific professionals to advise you, including:

- An experienced accountant

- A lawyer to help with contracts and legal requirements

- Contractors to handle specialized areas of your business

Be sure that you consider networking with other small business owners to build your business as well as to maintain your profitability.

10. Market & grow your business

At this point, you’re ready to tell the world about your business and all you can do for them. Marketing is a big part of that process. It requires knowing who and how to engage and then how to take those connections and turn them into sales. There are many tools and resources available to help you. Here are some places to start.

Invite customers to opt in to a mailing list or newsletter

From the very start, give people a reason to opt into working with you. Set up an email newsletter that allows people to provide their email address to you in exchange for some benefit. That might be to receive free samples, free inspirational guides, a special discount, or even cashback promotions. That’s going to open the door for new opportunities to reach your customers.

Consider making special offers to attract your first customers

Create a special offer that will bring in your first customers. Some ideas may include:

- Offering free samples at a small business event

- Offering a flash sale on social media

- Creating a loyalty program

- Offering a coupon to those whom you meet at a trade show

Look for local businesses or brands to collaborate with

Seek out other businesses that target the same customers you do for different reasons. You can learn more about local business collaboration strategies that allow you to make your marketing investment go further.

Invest in word of mouth (happy customers attract each other)

To do this, you’ll certainly want to create relationships with the people who come into your business. Ask them to refer you to their friends. Make sure that both online and offline, they can easily connect, communicate, and share with you.

Pay attention to online reviews, and ask happy customers to review you

Reviews are an important tool for building your business and sales. Use them as a way to learn about customer concerns and sticky points, but also to create engagement and build relationships with your customers over time.

Create unique, helpful content to showcase your activity

Use social media to help you build your business connections. Share content on a blog and your website that demonstrates what you do and how you do it for customers.

11. Open the doors!

The time has come to build your business, and that process starts with understanding the opportunities available within your community. It may be reaching out to the local chamber of commerce to host an event or take some action to become prominent in the local community.

Plan a successful launch event

Your launch event can be as big or as impressive as you like. The objective should always be to ensure that you are allowing your brand to stand out during this process.

Land your first sale

With your business operations in place, it’s possible to build a strong impression in your local and ongoing community. From here, it’s all about growing.

Now that you’ve completed all the steps, all that is left is to open the doors and start managing your dream West Virginia business.

Conclusion

By now, you’ve fine-tuned your business idea, chosen a structure, secured funding, and learned how to stay compliant in West Virginia. What comes next is execution, taking everything you’ve built and turning it into real results. Keep learning, stay adaptable, and lean on local resources as your business grows. The foundation is in place; now it’s time to open your doors and make your mark in the Mountain State.

FAQ

Start by defining your business and structure, finding a name for your company, and then registering it. Follow our guide above for the other steps to take.

The statement of Information required by the state is $25, and you may need to pay for a business license, which could range from $30 to $50.

Yes, the state works to maintain lower operational costs, and, with its location, it’s the ideal place to create a foundation.

No, you don’t, but you may need to obtain a registered agent to do so.

That depends on the local rules, but most businesses must register with the West Virginia Secretary of State.