Arizona offers some outstanding benefits to those who open their business here. The state, which has excellent weather most times of the year, is recognized for its business-friendly tax environment and steady economy. It has a strong workforce with highly trained and diverse employees. The state has over 611,000 small businesses and does a good job of supporting those organizations, as well as the larger enterprises that have moved in and made the state their home.

If you plan to open a business in Arizona, you’ll need to follow a few steps to help minimize risk and ensure the best long-term outcome.

Here are the steps you need to follow to open a business in Arizona:

- Fine-tune your business idea

- Create a business plan

- Choose a business name

- Identify an appropriate business structure

- Set up Banking, Credit Cards, & Accounting

- Get Funding for your Arizona business

- Get Insured

- Obtain Permits & Licenses

- Find your team

- Market & Grow Your Business

- Open the Doors!

#1. Fine-tune your business idea

Before launching a business, ensure it can thrive in Arizona. Even if you have a business idea, it’s wise to go through a few specific steps.

Start brainstorming your dream business

If you’re not sure what to do as a business, consider the problems you or others have. Can you solve a problem? You may want to take a product already out there and improve it. You could build your business based on a service you know is needed in a specific city. Always pay to your strengths. If you have a lot of experience in a specific industry, apply that. For example, if you are a talented speaker, be sure you’re using those skills to help you build a strong business model.

Will you offer a product or service?

Consider both approaches. If you are going to manufacture a product to sell, you’ll likely need to do a lot of leg work to develop that product, find companies for designing and manufacturing it, and cover the cost of shipping. If you plan to offer a service, you’ll need to carve out the legal restrictions in the state, while also ensuring you have the necessary skills in that area.

Arizona-specific ideas

What types of businesses do well in Arizona? As a large and modern state, you can certainly start just about any business here. Consider a few specific thoughts:

- Recently, there’s been a significant amount of demand for delivery services and pick-up services in the state.

- As some areas see their senior population rise, there’s a higher need for in-home care services.

- Service-based businesses, ranging from house cleaners to pet sitters, are also in demand, especially in the areas where residents only live in the state during the winter months.

- With year-round good weather, outdoor-related services are very common. This includes landscaping, pool companies, pool maintenance, golf course maintenance, park services, and outdoor entertainment providers.

The Grand Canyon State, filled with many natural landmarks in the US, has a booming tourism industry. You could cater to that by providing your skills and services in places with high demand throughout Phoenix and Tucson. Other locations with an increased demand include those near national parks, such as the Grand Canyon National Park, Kofa National Wildlife Refuge, Coronado National Forest, and the Tonto National Forest.

#2. Create a business plan

Once you have an idea, you need to lay the foundation for making it a success. A business plan can help you do that. It allows you to outline the business’s operations, services, and ownership, providing you with a way to organize your business.

Market research

Market research enables companies to learn more about their local market in the city or region they plan to serve. Is there demand locally? What is the competition like with products or services like those you will offer?

Financial plan

Create a financial plan that outlines the specifics of your business. How much money is coming into the company to start it? Will you need to borrow money? More so, how much will you charge for your product? What are your business profits? Outline each detail of costs.

Marketing plan

Now, you need to determine how you will tell the world about your business. Your business plan should include the methods you’ll use to market the competitive edge your company offers, such as online and offline methods, logos, branding, and other details.

Choose a location

Arizona is an incredible state with much to offer. There’s no limit to where you can operate. Does your business rely on “walk-in” traffic? This could include food and retailers, for example. If so, you’ll want to focus your business around the major metro areas in Arizona, as some areas near the parks may have significant restrictions.

Zoning laws are a big factor to consider, but they differ based on city and county regulations. The difficult part is that each area of the state will have unique zoning requirements. It’s best to turn to the local city website or the building department in your city to gain more insight. Here are a few options for the larger cities.

Decide if you’re an online-only business

Some companies are just online. You don’t need a physical location for your business or a place for customers to visit, so you may operate it out of your home. Many of today’s businesses need an online presence (it is much less common for a company not to need one!). However, some still need both an in-person address and an online location.

You can start from one – online or physical – and build later, too.

If you are ready to start an online business, you’ll need the following:

- A website that allows people to find you online.

- Social media pages for major sites, such as LinkedIn, Facebook, Twitter, and Instagram (wherever your customers like to spend time).

- Supply and distribution plan if your business plans to make and sell products. Take time to learn more about establishing this plan.

- Tax laws in Arizona require that businesses operating online pay taxes. This includes out-of-state sellers that are selling to customers in Arizona.

- The Arizona Department of Revenue clarifies requirements for sellers without a storefront.

#3. Choose a business name

Creating a business name is an important step in forming your business. You’ll want it to be memorable and interesting. It should be clear and easy to understand, as well. You want people to recognize what type of business you offer just by the name you have. Take some time to come up with a few ideas.

Next, check to see if the domain of the name you’re considering is available. Just type the name into Google to find out. That could play a big role in the long term when determining if you should use that name for your business.

The state does require that companies follow some basic rules regarding naming. If your business is a corporation or a limited liability company (LLC), you need to follow specific rules.

- LLCs must contain the words “limited liability company” or “limited company” in the business name or a shortened form such as LLC, L.L.C, or LC.

- LLCs cannot contain the words “association,” “incorporated,” “corporation,” or any type of abbreviation for these words.

- Corporations must contain the words “association,” “bank,” “company,” “corporation,” “limited,” or “incorporated.”

- Corporations must not include “limited liability company,” “limited company,” or any abbreviations of this.

Now that you have an idea check the availability of the name on the Arizona Corporation Commission website.

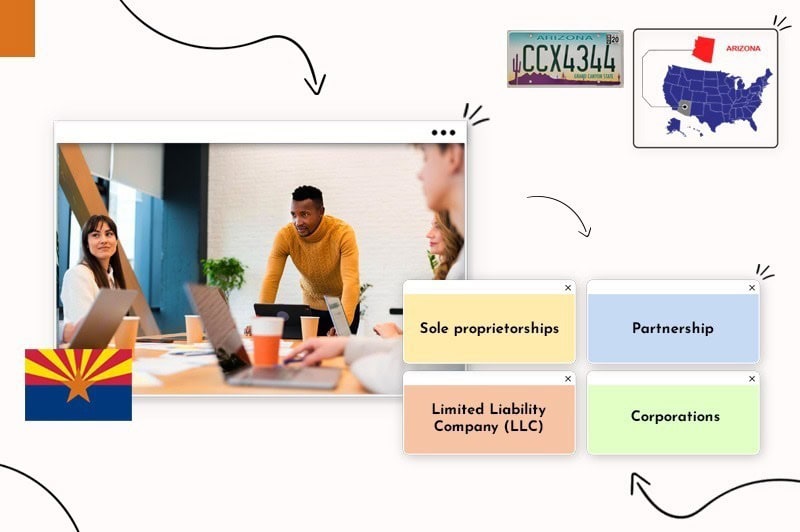

#4. Identify an appropriate business structure

Choosing the best structure for your business requires considering a few key things, including who owns the company and what the tax advantages of the process are. Here are some of the business formations to consider.

Common types of business structure

- Sole proprietorships: This is not a formal formation. In it, a person runs a business, takes all responsibility for the business, including liability and debt, and collects all of the income for the business.

- Partnership: In a partnership, also an informal formation, there are two or more owners of the company, differing from a sole proprietorship. There are no personal liability protections in place in this situation.

- Limited Liability Company: LLCs are the first level of business formation, providing a separation between the company and the business. In an LLC, the business does not pay separate taxes (it is a pass-through entity), but the personal property and assets of the owner do not mingle with the business. That is, there is liability protection for the owner should they face a lawsuit.

- Corporations: Several types of corporations exist. In a C-Corp, the company is separate from the owner and is its own legal entity. It pays its own taxes and maintains liability. In an S-Corp, a corporation can elect its taxation and income, minimizing owner liability and not having to pay high corporate taxes.

Tax advantages of business structures

- Sole proprietorships: This is a pass-through entity, meaning the company does not pay taxes, but rather the owner pays taxes on their income taxes.

- Partnerships: In this structure, also a pass-through entity, there are no corporate taxes paid, but the owners split the taxes in some defined way.

- LLCs: In this form, there are no corporate taxes levied, and there is more flexibility in how taxes are paid, typically as a pass-through entity.

- C Corps: This organization pays corporate taxes as a separate entity fully from the owner. Double taxation can be a concern.

- S Corps: They do not pass corporate business taxes and instead operate as a pass-through entity.

#5. Set up banking, credit cards, and accounting

Companies need to open their own banking accounts. The state does not have rules specifically on what the business needs to do to open an account, though they will need to provide identification for the business and the owner. You will need to set up an Employer Identification Number (EIN) in order to pay taxes and have a bank account within the state.

Take the time to establish a relationship with accountants or consider the investment in accounting software. You can also begin to apply for business credit cards, often with your personal Social Security Number, until your business is established.

#6. Get funding for your Arizona Business

Most companies need capital to launch and run their business. You could bring in savings to help you do this. Some companies may still need to borrow money from other resources.

Arizona offers grants that some companies may qualify for. These are funds meant to support small business growth.

- Start with the Grants.gov website. This provides access to federal grants available.

- The Arizona Commerce Authority also offers grants. This includes not just grants but training and tax relief tools for qualified companies.

- USDA grants and loans may be available to some Arizona businesses, including those providing housing assistance or rural development.

- The Arizona Small Business Administration can also provide support for loan programs and grant funding.

Turn to local city and county organizations as well. Some offered COVID-related relief programs to help employers get employees back to work and other tools that remain in place to borrow money more affordably.

#7. Get insured

Businesses in Arizona do not have legal regulations related to business insurance overall, but there are some specific considerations here.

Commercial auto insurance is a requirement for any company that operates a vehicle on the state’s roadways. The minimum requirement includes $25,000 of bodily insurance or death to any person in one accident, $50,000 for bodily insurance or death for two or more people in one accident, and $20,000 in injury or deduction of property during an accident. Higher requirements exist (up to $250,000 per incident) in some types of industries.

Most employers must also maintain workers’ compensation insurance. You can learn more about this through the Industrial Commission of Arizona.

Employers also pay unemployment insurance taxes. This helps cover the cost of unemployment benefits for employees.

#8. Obtain permits and licenses

Not all businesses in the state must obtain a business license, but most do. Every state or town will determine what licensing requirements are applicable, and these can change by industry.

There are several types of business licenses in the state of Arizona.

- Transaction Privilege (Sales) Tax License: Those that plan to sell a product or sell items need to obtain this license through the Arizona Department of Revenue.

- Use this tool through the Arizona Department of Commerce to locate all applicable city and town business licenses and permits.

- Regulatory licenses may be required in some situations, such as those operating in alcohol, agriculture, finance, mining, fish and wildlife, business opportunities, and others. These typically fall under federal licenses and permits you can verify through the U.S. Small Business Administration.

Federal income tax and Arizona local tax

The Arizona Department of Revenue provides guidance on how to establish tax payments to the state. Keep in mind, there could be local and county taxes your business must also pay.

Employers must withhold taxes for their employees. This is done using your EIN (as noted before). You will use that number when completing your state and federal taxes.

You also need to register the business with the town or city that you plan to operate in. This includes required tax payments, which are done through the local city hall or local business department.

Arizona-specific regulations

Arizona-specific regulations may exist. To establish your account and start to make payments on revenue, create an account with the State of Arizona Department of Revenue.

#9. Find your team

People are a critical component of your success. If you plan to be an employer in the state, there are some key things you need to know.

First, be sure you understand and abide by all federal employment laws. The Arizona Department of Administration Human Resources offers a comprehensive guide to help you to get started.

In addition to this, the state also has some laws that may relate to your business. You can learn more about them through the State Laws and Bills section of the Arizona Department of Administration Human Resources.

People are the backbone of the business

As you work to build your company, which is often a passion for the business owner, it becomes critical to bring the right people in to help you. Arizona has some outstanding talent pools to draw from. Most often, companies need to have an accountant to help them establish and meet all tax compliance requirements, in addition to bookkeeping. You also need to hire employees who will work with you and your customers to meet your goals.

People build your products and provide your services. They communicate with your customers. They are the foundation and the face of your company. Take the time to hire truly qualified professionals to represent your business.

Comply with Arizona payroll regulations

The best way to ensure you are meeting all state payroll requirements is to hire an accountant or payroll service based on the state. If you plan to manage this process yourself, you’ll want to check out the Arizona Department of Economic Security website. This outlines all of the rules employers must follow under state laws, including keeping payroll journals, having identification for employees, and managing payments.

This also lists all of the requirements for providing information to your employees and meeting all unemployment insurance requirements.

Hire contractors

It’s not uncommon for small businesses to start with just one person. Yet, even in these situations, you’ll likely need some professionals to help you. You may not need them to work as employees but rather as contractors. That could be your accountant and attorney, for example. The state of Arizona does not have specific requirements or restrictions on who you can hire to help with your business.

However, it does require contractors to be licensed (and it’s up to you to make sure they are). You can check that out at the Arizona Registrar of Contractors, where you can search for contractors to verify the information.

#10. Market & grow your business

Now that you have your business ready to go, it’s time to tell the world about it and start to get customers coming in. To help you, we have some great resources available.

Invite customers to opt-in to a mailing list or newsletter

Set up a newsletter for your business. When you do, you’ll be able to collect the contact information for your clients as you get them. This way, you can continue to work with them and email them to keep them in the loop.

Consider making special offers to attract your first customers

You can do this in many ways. Pass out flyers and coupons to schools, businesses, or others to get more attention to your business. Offer a promotional offer for those who sign up with you in the first month. Make it a part of your marketing.

Look for local businesses or brands to collaborate with

What types of businesses in your city have customers that are much like your own but are not direct competition? Consider reaching out to them to collaborate.

Invest in word-of-mouth advertising

Be sure to encourage people to spread the word about your business. When you make one customer content, you will be able to get them talking about your business to draw in more customers.

Pay attention to online reviews and ask for them

Managing online reviews is one of the most important things your business has to establish itself. Learn about reviews, how to manage them, and how to build them. When you have a happy customer, ask them to review you!

Create unique, helpful content to showcase your activity

Build a website and social media presence. Be sure you are consistently offering a great product and service but also providing valuable information your customers need. Content can help you sell your business.

#11. Open the doors!

It’s time! Are you ready to get your business off the ground?

Plan a successful launch event

Invite locals, businesses, and the mayor to attend. Host a ribbon-cutting ceremony or do a virtual open house.

Land your first sale

Once you get that first sale, all of the work that went into the process will be worthwhile.

Conclusion

Now that you’ve completed the necessary steps, all that is left is to open the doors and start managing your business. Starting a business in Arizona can be very fulfilling, so be sure to enjoy it!

FAQ

The cost to start an LLC in Arizona is $55 as a registration fee to file your Articles of Organization. Other costs may apply.

No, it is not hard to do when you have a plan to follow that makes it possible.

Follow the steps we laid out here to start your business.

You’ll need to pay taxes, maintain proper insurance as required, and obtain business permits to operate in the state.

The state offers a strong amount of support for new companies. It also provides excellent resources and opportunities.

If you have customers here, then it can be a great place to start a business with a strong economy and highly qualified individuals to work for you.