As one of the smallest states in the country, Maine is often overlooked. Though the mainstream media doesn’t pay much attention to the Pine Tree State, business-minded people do.

There’s a reason for Maine’s reputation as a haven for entrepreneurs. The state’s government and tax structure are both business-friendly.

If you are thinking about launching a business or already have an idea for one, consider starting it in Maine. As is often said, what is out of sight is out of mind. Maine is rarely in the spotlight, meaning it is that much easier to thrive there as a business owner.

Recognize the fact that Delaware’s unique tax rules have drawn most of the attention, shift your focus to nearby Maine and you’ll enjoy a significant competitive advantage. The state’s small size and relatively low population make it conducive to business success simply because the competition isn’t as fierce.

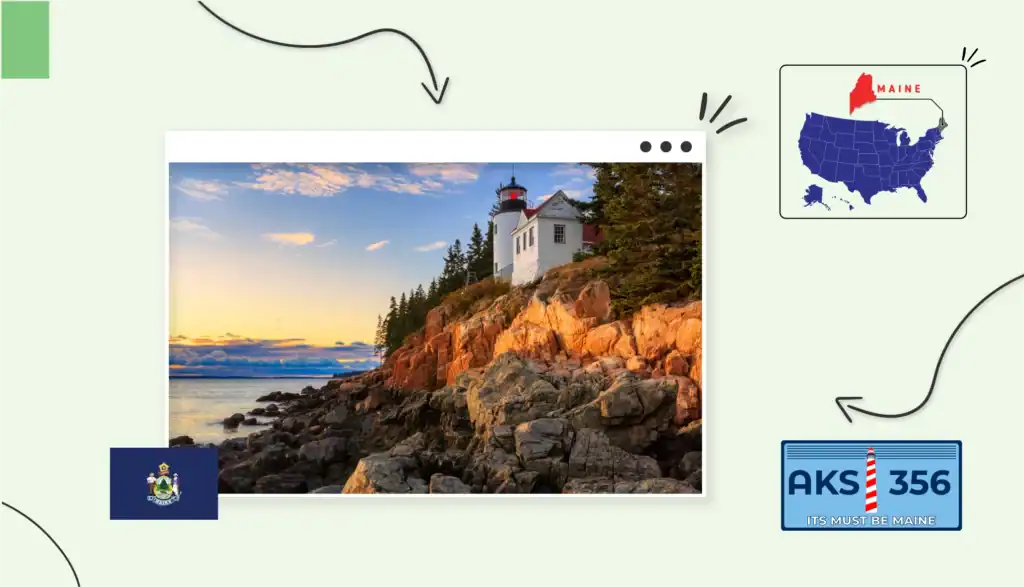

Add in the fact that Maine’s coastal location give its economy an inherent edge and there’s all the more reason to consider starting a business there. The state’s unique position on the perimeter of the map is a large part of the reason why it is called Vacationland.

This is your inside guide to starting a business in Maine.

1. Fine-tune your business idea

Every business starts with an idea. It is the underlying concept that serves as the foundation of a value offering. Refine your value proposition and your targeted buyer personas will respond as envisioned.

Continue to fine-tune your business idea and you’ll pluck market share from the competition. If you aren’t completely sure your business idea has merit, tap into the expertise of a business consultant.

You can also demo your product at a trade show, debut it online or launch a pop-up style temporary business to gauge the market’s response. If you are struggling to come up with ideas for a new value offering, consider conducting market research, possibly with the assistance of artificial intelligence.

Above all, be patient as you perfect your new business idea. Wait until you are absolutely certain your idea has merit, then refine it in the planning stages before actually bringing it to market.

If you aren’t completely certain your idea has merit, get a sense of the overarching industry and sector landscapes. Pay attention to the quantity and quality of local, regional, national and global competition.

Do your due diligence and you might determine it is better to create a service-based business instead of one that is product-driven. In some instances, product-based industries simply have too much competition to justify the addition of a new entrant.

If you take the product-based business route, think long and hard about how to differentiate your value offering from the rest of the market. Recognize that presentation has the potential to be more important than value. Oftentimes, it is the underlying marketing or sales efforts that propel similar or even inferior products to success.

When in doubt, add local flavor to your value proposition. Maine is home to prideful locals and tourists willing to spend freely. As an example, the Pine Tree State presents a golden opportunity to tailor a new business offering to those interested in everything water-related.

From boating to fishing, lobster and other seafood, Maine residents and visitors gravitate toward water-based products and services. Even something as simple as a boating business that provides sightseeing opportunities on the water might constitute a successful enterprise.

There’s also significant demand for ancillary businesses related to boating and lobster, be it lighthouse tourism, seafood seasoning, general tourism information, etc.

Moreover, Maine is laden with dense green forests, meaning there is a market for hiking guides including related products and services.

2. Create a business plan

Plan your business wisely and it will be the gift that never stops giving. The best business plans are comprehensive, accounting for stakeholders, the competition, market dynamics and even potential disasters.

Market Research

The quality and quantity of competition has the potential to be more important than the merit of your business idea. If there are too many competitors in the industry or niche you’ve selected, your Maine business will struggle.

Do your due diligence beforehand, conducting an exhaustive and in-depth analysis of the local market. If you aren’t completely certain as to whether your product or service will gain local market share, conduct testing with a focus group.

Financial Plan

Most entrepreneurs don’t have enough money to finance a new enterprise on their own. You’ll need a detailed financial plan highlighting sources of venture capital, be it a local Maine bank, business partners, venture capitalists or others.

Your financial plan should include startup costs, highlighting the capital necessary to get the business up and running. Budget in some extra money for those inevitable surprises that are bound to arise as the business builds momentum.

The best business financial plans include sales and net profit benchmarks to strive toward. Give your team a quarterly financial target and they’ll respond accordingly. Those benchmarks should extend to all financial quarters, the overarching year and beyond.

Marketing Plan

Oftentimes, it is the framing of a business’s value offering that determines its success. The harsh truth most Maine entrepreneurs don’t want to hear is that subpar products have the potential to be top-sellers.

Why?

One word: presentation.

It is the marketing and sales approach applied to a product or service that shapes the psychology of target buyer personas.

Sit down and write out a detailed marketing plan with the assistance of experienced marketers. Ideally, those marketing specialists will have years or even decades of experience in the industry and/or niche you are entering.

Your marketing plan should include a comprehensive approach to both inbound and outbound marketing. Inbound marketing is a relatively new form of customer outreach in which information is presented through online leads that serve as customer magnets.

In contrast, outbound marketing is more traditional.

Examples of outbound marketing channels include:

- Billboards

- Commercials on tv/radio

- Flyers

- Demos

- Door-to-door sales

Here’s the bottom line: both inbound and outbound marketing have the potential to be equally important to your new Maine business.

Choose a location

The real estate mantra of “Location, Location, Location!” is also applicable to new businesses in Maine. Pick the right location and your business will thrive.

The optimal location for your business depends on its unique product or service. If your business centers on tourism, give priority to Maine’s coastal areas.

Some of Maine’s top coastal cities and towns include:

- Portsmouth

- Portland

- Scarborough

- St. George

- Camden

- Lincolnville

If your enterprise is more focused on traditional industries such as finance or infrastructure, you might be better off focusing on inland locations.

Maine’s top inland towns and cities include:

- Brownville

- Burlington

- Pittsfield

- Bangor

- Springfield

Those primarily concerned with market size should prioritize Maine cities with the most population. Maine’s most populous cities include Auburn, Augusta, Bangor, Lewiston and Portland.

Most importantly, determine whether your new business will be primarily or even partially reliant upon walk-in traffic. Such foot traffic comes from those walking nearby streets. Restaurants, retail stores and tourist-related businesses are examples of businesses that are highly dependent on such walk-in traffic.

Be sure to check with local municipal government about local zoning laws before setting up shop. Municipal governments have nuanced zoning rules to prevent businesses from opening in or near residential neighborhoods.

Decide if you’re an online only business

It might make more financial sense to be an internet-only business. Take the online route and you’ll minimize overhead costs as there won’t be any need for a brick-and-mortar storefront.

Keep in mind, you can still sell to local Maine residents including those coveted tourists if your presence is limited to the internet. In contrast, traditional businesses have inherent appeal to locals and visitors alike as those individuals can walk inside and buy without delay.

At the heart of the matter is whether your value offering is more likely to sell if seen in-person or touched. If the items in question have tangible appeal that cannot be achieved through the internet, a brick-and-mortar store will boost sales.

When in doubt, conduct a cost-benefit analysis. Research local business rents in the Maine market you are targeting, tack on the cost of utilities, insurance and labor, then compare that aggregate total with the overhead of an online-only business.

Beware that web-based businesses have costs beyond an internet connection and computer. You’ll need a webmaster to create and maintain your business website.

Online businesses also require a presence on social media. At a bare minimum, you’ll have to hire a social media specialist to manage your company’s X, Facebook, YouTube and Instagram accounts. Ideally, you’ll have a full-time social media expert at your disposal.

Consider the cost of developing, maintaining and executing a supply and distribution plan. Maintaining sufficient inventory and distributing it with prudence requires planning, time, effort and labor.

Each of those costs money.

Factor in the potential for taxes to differ based on whether sales are made online or offline and there is that much more to consider when making your decision.

Maine law mandates that marketplaces collect sales tax for all businesses that surpass the thresholds of 200 transactions or $100,000 in sales, be it online or offline. This rule is referred to as the economic nexus threshold. Fail to register for the Maine Sales Tax certificate when surpassing either threshold and you fill be fined.

Even third-party merchants that facilitate sales within the state are to pay sales tax if their sales surpass the six-figure mark. However, the silver lining is Maine has a modest sales tax of 5.5%, a percentage that is well below New York’s, Massachusetts’ and other New England states. Moreover, Maine shipping charges are typically untaxed.

3. Choose a business name

Choose your business name wisely and it will serve as an invaluable marketing tool. Psychologists often repeat the marketing refrain of prioritizing vowels for good reason.

Vowel-heavy words and names like “Google” have inherent psychological appeal. Above all, the business name you choose should be brief and easy to remember.

Carry over that business name to your online domain name and it will prove that much more indelible. However, doing so requires due diligence. If necessary, hire a business law attorney to conduct a Maine business entity search to ensure the one you select is available. You can also consider filing a DBA Maine if you plan to operate under a different trade name while keeping your legal entity name unchanged.

If the name you have in mind is already taken, consider your options. If you have sufficient startup capital, purchasing the name from the business that owns it might make long-term financial sense.

Here’s the bottom line: Maine mandates that new business owners check to see if their selected name is on file with the Secretary of State. If the name is on file, it cannot be registered or reserved a second time as doing so would constitute infringement.

Moreover, it is also in your interest to conduct a general nationwide online search to determine if the name you’ve selected is used by a business outside of Maine. An intellectual property attorney will help you search the national trademark database maintained by the United States Patent and Trademark Office.

Every prospective Maine business owner should be aware that filing the Application for Reservation of Name with the state’s SOS reserves the moniker for 120 days.

4. Choose a business structure

Maine does not require those launching a general partnership or sole proprietorship to register the business entity with the state. However, municipal requirements might apply. If you are launching a corporation or limited liability company (LLC), you must file the state-mandated formation documents with the Bureau of Corporations, Elections and Commissions. Moreover, a Maine LLC is required to file yearly reports.

Businesses with sales tax and/or employee obligations are required to register with Maine Revenue Services. As a whole, the state does not have a general business license yet some local municipalities might require permits and/or licenses. Such requirements typically hinge on business type and location.

The common types of business structure

Take your time when choosing a Maine business structure. The cost of a Maine business law attorney at the start of the process might save you exponentially more money across posterity.

Consider launching a sole proprietorship on your own without business partners. This structure is by far the simplest and easiest to start as there is no need for cooperation from one or several other people.

The downside to sole proprietorships is that there is a financial overlap between the business owner’s personal assets and those of the enterprise. Therefore, if there is a lawsuit, the business owner’s personal assets are at risk.

Partnerships are exactly as they sound in that the business is launched with the assistance of one or several other partners. Those partners share responsibilities in management and also split the profits or losses. However, there is no legal protection against liability in the event of a lost lawsuit.

Limited liability companies, or LLCs for short, are also similar to their namesake as they shield the business owner(s) from legal liability. This business structure combines the features of partnerships, sole proprietorships and corporations for a cohesive whole.

Corporations are comparatively complex business structures as they serve as a unified entity. This singular entity is recognized as such by Maine business law. The logic in choosing the corporate structure is that it safeguards those with an ownership stake in the business against liability. However, corporations democratize control and decisions to a certain extent as they are managed by multiple individuals in the form of a board of directors.

Tax advantages

LLCs are commonly favored for reasons beyond protecting business owners’ personal assets. LLC owners have the option of corporate taxation rules instead of those governing business partnerships in the state.

LLCs can be taxed as C or S corporations, based on the structure that offers the most benefits. LLCs with several owners can be taxed as S corporations that ensure owners are viewed as employees, meaning they can receive a reasonable salary, albeit one that is taxed at the rate applied to the self-employed. If S corporation status is not applicable, the owners of the LLC are viewed as self-employed, meaning they are to pay arguably egregiously high self-employment taxes.

Sole proprietorships are straightforward in their pass-through taxation. The entity’s business income and expenses are directly reported on the owner’s personal tax return. Therefore, the business is not taxed individually. This approach simplifies the tax prep process. However, sole proprietors are required to pay the entirety of the 15.3% tax for the self-employed that encompasses employer/employee Social Security and Medicare.

Partnerships are similar in that pass-through taxation also occurs with each partner reporting their share of profits/losses on personal tax returns. Both sole proprietors and partners can claim a tax deduction upwards of 20% of qualified business income.

However, there is added complexity come tax time with each partner receiving a Schedule K-1 relating to their partnership enterprise. It is also worth noting that sole proprietorships and partnerships are not subjected to Maine’s graduated sales tax applied to corporations.

5. Set up banking, credit cards, & accounting

Maine business owners that head entities with employees or those taxed separately from themselves are required to get an EIN. EIN is short for the federal employer identification number. The Internal Revenue Service (IRS) distributes such numbers.

Moreover, many Maine banks mandate that local businesses have an EIN to open a business banking account. It is in your interest to keep your business account separate from your personal banking account to better distinguish expenses and income.

It is also in your interest to get a business credit card. Use that credit card for business-related purchases instead of commingling personal purchases. The earlier you obtain the credit card, the better, as it helps establish company credit that serves as an on-ramp to future loans and investment.

Every prospective Maine business owner should be aware that the state disallows the charging of surcharges of every amount for payments with either credit and debit cards.

The state’s law called “No surcharge for credit/debit card payments” mandates that businesses are disallowed from hiking prices for the use of a credit/debit card of any type. However, cash and check discounts are permitted.

Maine businesses are permitted to set a minimum threshold for purchases when using a credit card. The minimum amount is applicable to every credit card yet that minimum cannot surpass the $10 mark. Moreover, the state bars minimum transaction amounts for the use of debit cards.

6. Get funding for your Maine business

Are you struggling to stockpile the cash necessary to launch your Maine business idea? Fret not, as capital is available. If you have the will, there is a way.

The state has set regulations governing business funding pertaining to in-state programs and general lending rules. However, there is no single overarching set of regulations governing funding. All entrepreneurs should be aware of important in-state programs such as the Maine Seed Capital Tax Credit that distributes tax credits for stimulating the Pine Tree State’s economy.

There are also small business grants Maine available to local business owners such as the Downtown Revitalization program and Microenterprise program. You can learn more about those programs here.

The Maine government website also provides information about the USDA Specialty Crop Block Grant Program for those who produce specialty crops. Local investment is available through the Maine Venture Fund, a fund consisting of venture capital for companies based in Maine.

Additional Maine venture capital resources include:

- Maine Angels

- Block Point Group

- AngelList

- Tech Maine: Capital

Moreover, small business loans, microloans, commercial loans and Small Business Administration loans are available through Maine banks.

7. Get insured

Maine requires business owners to obtain insurance. In particular, the Pine Tree State requires enterprises to have workers’ compensation insurance and unemployment insurance.

Every Maine business with employees is required to register with the Maine Department of Labor to pay unemployment insurance tax. You’ll also need to set up the Maine State Income Tax Withholding.

To do so, simply register your new business on the Maine Department of Labor website, complete the web-based application and you’ll be in compliance with the law.

Maine also requires all business drivers to have at least the bare minimum of automobile insurance.

8. Obtain permits & licenses

Take a deep dive into Maine business license requirements and you’ll find the rules differ by individual locale. The business structure you select also shapes the business registration requirements.

Form the enterprise as a partnership or sole proprietorship and you won’t be required to register it with the state of Maine. However, if there are idiosyncratic license or permit requirements at the town or city level, those must be complied with.

All legal businesses entities within the state, including corporations and LLCs, are required to register with the Maine Secretary of State’s Bureau of Corporations. However, there is no overarching license requirement to do business in the state of Maine.

If a license is necessary, it will be relevant to the city or town the business is in. As an example, special permits or licenses are necessary to operate based on the unique activities of each individual business.

Consider the unique role of restaurants. These specialized businesses handle food and beverages consumed by humans so there is typically a local Health and Human Services license required by the town or city.

9. Find your team

All new hires in Maine must be paid the state’s minimum wage of $14.65 per hour. Maine payroll and hiring regulations also mandate the disclosure of ranges of pay in all job postings.

The state also requires a half hour meal break when one works six straight hours when there are three or more workers on duty.

People are the backbone of the business

Ideally, local Maine businesses will pay more than the bare minimum wage as employees are just as important to business success as products and services. Aside from “boots on the ground” employees responsible for operations, your business will also need other specialists.

Examples of those specialists include:

- Experienced accountants

- Product developers

- Marketing professionals

- Sales staff

Be careful when selecting these professionals as they are the face of your enterprise.

Comply with Maine payroll regulations

Maine has payroll laws beyond the minimum wage referenced above. Maine law also mandates all businesses compensate employees in full and on time. There cannot be more than 16 days in between employee pay periods. Moreover, all new hires are to be reported within seven calendar days.

Be sure to invest in a reliable payroll software to guarantee your team is paid in full and in a timely manner to comply with state regulations.

Hire contractors

Business in Maine and beyond is a team effort. Establish trust with new hires, build your team and you’ll find the whole is greater than the sum of its parts. Continue to add to your employee roster and you can transition away from labor to full-time supervision.

Contractors also play an important role. Outsource projects to contractors as necessary and you’ll find their expertise is critically important for specific tasks.

As an example, contractors are available to help with everything from search engine optimization (SEO) pushes to on-site remodeling, accounting, headhunting, tax compliance and more.

10. Market & grow your business

Business growth is one part value proposition and one part marketing. Combine the two and you have a stable enterprise with the potential to expand as time progresses.

Market your business with the guidance of both inbound and outbound marketing professionals and you’ll capture additional market share in due time.

Here’s how to do it.

Invite customers to opt in to a mailing list or newsletter

In some instances, all it takes to build momentum is an online newsletter. Give your current and prospective customers the opportunity to opt into an online mailing list and connect with them through that method of outreach at least once per month.

Consider making special offers to attract your first customers

Oftentimes, a small discount on a product or service is enough to generate interest from potential customers. Dangle a 5% or 10% discount to targets and you’ll find interest ramps up.

Look for local businesses or brands to collaborate with

Partner with one or several local Maine businesses and you’ll reinforce your customer acquisition efforts. In some cases, a minor form of reciprocity such as placing business flyers or business cards on-site at other stores can lead to significant sales increases.

Invest in word of mouth

Word of mouth advertising occurs spontaneously. You can build its momentum with elite service and exemplary product quality. Make your customers happy and they’ll naturally spread the word, steering friends, family and others toward your business.

Pay attention to online reviews

As a Maine business owner, your reputation matters. Disgruntled customers will take to the web to type out their frustration.

Similarly, satisfied customers will post positive reviews. Request that your happy customers publish reviews and prospective customers will give your business a chance.

Create unique content

Even if your value offering and prices are similar to those of the competition, you can gain a competitive edge with online content. Focus on creating highly distinct content to publish to your blog, social media accounts and website.

You can’t do it all on your own. Outsource content creation to professional writers and their artful presentation will boost your conversions while reducing your bounce rate.

11. Open the doors!

You are now ready to open your business to the Maine public. Spread the word online and offline about your grand opening and it won’t take long to become a Maine mainstay, pun intended.

Plan a successful launch event

Open with a splash and your Maine business will ingratiate itself with locals and tourists alike. Have a ribbon cutting ceremony, offer promotions, dangle discounts and the big day will be indelible.

Land your first sale

Now is the time to start making money. Fire up those cash registers and let the sales begin!

Conclusion

Congratulations! You’ve done everything necessary to launch your new business in Maine.

Only one thing remains: welcoming your customers and making that all-important positive first impression.

Proactively manage your Maine business with a hands-on approach and your entrepreneurial dreams will become a lasting reality.

FAQ

No. Maine does not have an across-the-board business license requirement. However, individual municipalities sometimes require a business license based on industry and local rules.

No. However, certain Maine cities and towns require permits for specific types of businesses. Be sure to check with local government to determine if a permit requirement is mandated before opening your business’s doors.

Yes. Maine LLCs have limited legal liability. This means if your enterprise is sued and loses, your personal assets won’t be at risk. It’s a significant advantage considering we live in a highly litigious society.

No. Maine is drawing in capital and all sorts of new business investment as it is a magnet for tourist dollars. Maine’s proximity to the water gives it broad appeal to both visitors, locals and business professionals alike.

Yes. Maine’s minimum wage is $14.65 per hour. The federal minimum wage is $7.25 per hour.

Maine is a hotbed for new businesses as it is a tourist haven. Moreover, locals have pride in their home state. Factor in the relatively modest state sales tax and you have the perfect recipe for new businesses, whether centered on tourism or traditional services and products.