Delaware is open for business. Boasting an entrepreneurial spirit and a well-educated workforce, The First State has a lot going for it. Today’s budding Delaware entrepreneurs join a long legacy of success, following in the footsteps of major ventures like DuPont and even W.L. Gore & Associates, the force behind those comfy Gore-Tex jackets.

Major corporations definitely have a presence here, but the real inspiration lies in the state’s wonderfully supportive small business community. From breweries to coffee roasters and even aerospace firms, businesses in all industries find enthusiastic clients and customers, plus Delaware small business grants and business-friendly regulations.

It’s no wonder, then, that Delaware is right near the top of the U.S. News & World Report’s rankings for states with the best business environments.

There are many perks to starting a business in Delaware, but also, a lot of red tape. From permits to taxes and zoning regulations, there’s a lot to consider. Getting started can feel overwhelming, especially as you tackle administrative essentials.

The good news? With the right idea and a little support, you can get your Delaware business up and running — and you can discover the perks of entrepreneurship in The First State.

Keep reading to learn more about launching your dream business in Delaware.

- Fine-Tune Your Business Idea

- Create a Business Plan

- Choose a Business Name

- Choose a Business Structure

- Set up Banking, Credit Cards, & Accounting

- Get Funding for Your Delaware Business

- Get Insured

- Obtain Permits & Licenses

- Find Your Team

- Market & Grow Your Business

- Open the Doors!

Step #1. Fine-tune your business idea

Every business begins with a simple idea. It’s the spark that transforms the what-ifs of business ownership into clear and compelling intentions.

Every other step in this guide stems from this essential, so you’ll want to feel 100 percent confident about your idea before you proceed.

If you’re lucky, you’ll feel naturally drawn to a specific industry or venture. Perhaps you’ve always been passionate about a particular product, service, or experience. Maybe you’ve noticed a gap in the market and believe you can address it.

Intuition drives some of the most successful business ventures, but don’t worry if you’ve yet to come up with your winning idea, it might just need a little extra coaxing.

How to develop a business idea:

Every business idea begins with a why, a central problem to be solved. This could be as simple as helping locals find something to eat or a place to relax. It could involve a product that improves lives in your Delaware community.

Keep in mind that you might not be willing or able to solve every problem. Consider which local challenges reflect your interests or your preferred lifestyle. For example: are you concerned about issues like coastal erosion or wellness within Delaware’s rapidly aging population? Perhaps you could start an environmental consulting firm or a fitness studio that caters to seniors.

Remember: the most successful businesses are passion-driven. You might be interested in a particular field now, but will you still be committed to it in years to come? If you’re not sure, keep brainstorming ideas that spark genuine excitement but also feel deeply authentic.

Popular Delaware business ideas:

As a business-friendly state, Delaware attracts entrepreneurs from many sectors. Top industries include financial services and chemical manufacturing, but the small business community is also thriving. In fact, small businesses account for 98.6 percent of Delaware’s businesses, which employ 48.7 percent of the state’s employees.

- Property management

- Event planning

- Craft breweries

- Boutiques

- Farm-to-table delivery

- Bed and breakfasts

- Home care agencies

Validate your business idea:

You’ve found your passion, but practical concerns should also be top of mind. Think carefully whether your business idea can actually produce a strong return on investment, or whether major challenges will threaten your business before you even get started. Questions to ask include:

- Is there enough demand in Delaware to support your potential business?

- What does your target market look like?

- Can you handle the start-up expenses?

- Will Delaware’s small business resources offer enough assistance?

- Can you navigate Delaware’s regulatory environment?

Step #2. Create a business plan

A business plan forms the ultimate roadmap for your Delaware business. This is how you decide if your idea is realistic based on the current business environment in Delaware.

This is one of the most critical phases of business formation, so don’t cut corners — your business plan could determine your strategic direction or even your access to funding.

You’ll learn a lot as you put in the research to create a business plan. This document should be tailored to reflect the unique concerns of your industry and your location — but most business plans share a few key sections:

Market research:

Get to know your target customers through market research. This is where you determine who you want to reach — and how. It’s all about identifying your customers and revealing what they care about.

Begin by clarifying customers’ shared traits, such as demographics, values, or motivations. Surveys and interviews can help you learn a great deal about your customers.

Next, take a closer look at the size of the local market, considering whether it can sustain your business and any competitors you’ve pinpointed. Consider whether your industry (as a whole) is growing or whether competitors might make it difficult for your business to stand out.

Summarize your findings and include them in your business plan. Be prepared to adjust this section as the business environment changes. A business plan is a living document, after all, and, if your target market evolves, your business strategies may eventually need to as well.

Marketing plan:

You’ve learned a lot through market research, and now, it’s time to put those findings into action. Now, it’s time to explore marketing strategies that appeal to your target audience. Your marketing plan will reveal which channels you’ll use to get customers to take notice. You’ll also clarify brand positioning and messaging. This is your chance to turn market insights into genuine connection.

Financial plan:

Is your business idea financially viable? The most compelling visions fall short without detailed plans that show how all the numbers add up. This detailed plan will forecast your anticipated debts and credits so you know just what it takes to get your business off the ground — and to keep it running smoothly far into the future.

There’s a lot to consider, but, at minimum, you’ll want to address these essentials:

- Your startup costs, including supplies, equipment, and other early expenses.

- Your break-even point, or when you start to make a profit.

- An operating budget that clarifies fixed and variable expenses.

- Options for generating revenue, including products and services to be sold.

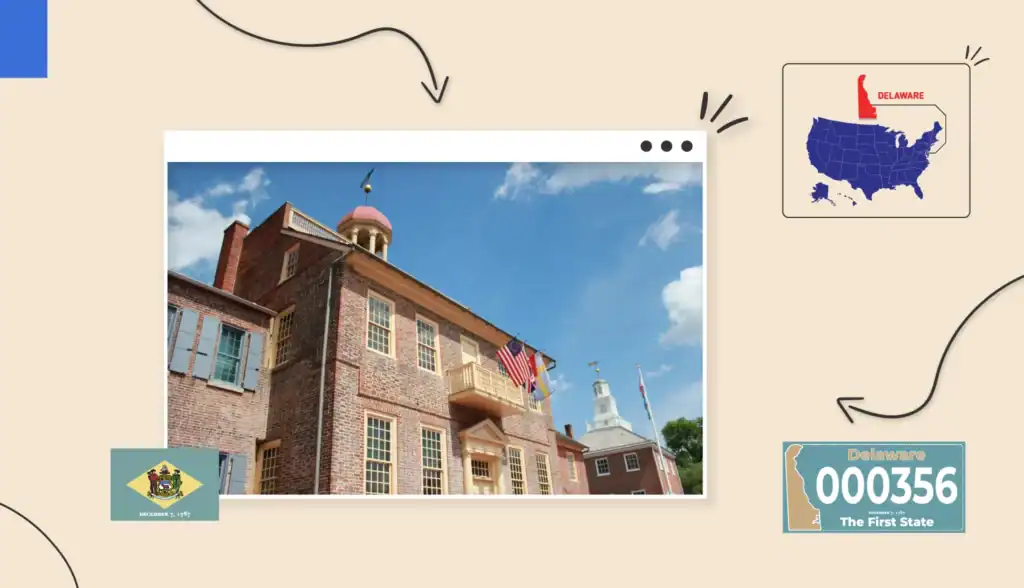

Choose a location:

Delaware is a great place to launch a business, but now, it’s time to get more specific: will you run a brick-and-mortar location, and, if so, where will it be situated? This may depend, in part, on your hometown, but other factors may come into play: where your target customers live and work, for example, or whether those customers can easily reach your location.

Cities like Wilmington and Dover offer strong infrastructure and a steady flow of customers, but don’t overlook smaller towns. In hospitality, for example, beach towns like Fenwick and Dewey cater to tourists, while agricultural businesses do well in areas like Sussex County or Kent County.

Once you’ve pinpointed the perfect town, city, or suburb, focus on ideal sites for offices or storefronts. Will you rely on foot traffic? How difficult will it be for customers to park? Will nearby businesses help drive customers to your location — or will competitors get in the way?

Delaware zoning laws and regulations:

Strict zoning regulations determine which types of businesses can operate in various locations. These regulations also provide guidance for lot sizes, setbacks, and other land use requirements.

In Delaware, zoning requirements are determined at the local level. This information is typically available on official government websites, provided, for example, by Departments of Planning & Development or Planning & Zoning Offices.

Check zoning codes carefully to confirm that you are able to run your business in your desired location. You’ll also learn about potential modifications or other steps you need to take to comply with local zoning requirements.

Decide if you’re an online-only business

If you’re eager to limit start-up costs and boost your ROI, consider launching an online-only business. This may help you avoid some zoning hassles and also provides greater flexibility in running your business.

Essentials for launching an online-only business in Delaware include:

- An online presence: Connect with customers or clients on your business website, which provides an easy hub for making purchases, signing up for services, or simply learning about key offerings. Don’t forget to add social media to the mix. Pay attention to which platforms your target customers use and create content that feels like a natural fit for those particular online spaces.

- Supply and distribution strategy. Clarify the flow of goods and services as it relates to your business. How will you access materials or inventory? Which vendors or distributors will allow you to get items into customers’ hands?

- Compliance with online tax laws. While Delaware does not have a sales tax, you may need to collect taxes from other states if you have a physical presence (or nexus) outside of Delaware. Be prepared to also cover Delaware’s Gross Receipts Tax on total gross revenues. These rates vary based on business activity but typically total between .0945 and .7468 percent.

Step #3. Choose a business name

Your business name can be the ultimate branding tool. This instantly communicates your identity and values, all while sparking curiosity among clients or customers. This is your chance to tell the true story of your business.

The only problem? Finding the right name can be surprisingly difficult. You may be short on ideas or eventually, disappointed to discover that the most promising names are already taken. With a little creativity and performing a Delaware entity search, you can find a name that feels both original and authentic.

Delaware naming requirements:

A unique name is a must, and not just because it gives your brand a competitive advantage; this is essential for legally running your business in the state of Delaware. Another requirement worth considering: if you want to start a Delaware LLC, you will need to indicate this business structure in the name. This could be as simple as adding “LLC” or “L.L.C.” to your business name.

Using a DBA in Delaware

Known in Delaware as a trade name, doing business as (DBA) allows you to operate your business under an alternative name. A Delaware DBA can be helpful for marketing, especially if you want to bypass requirements to include LLC in your business name. To secure a trade name, search the Delaware Courts Trade, Business & Fictitious Names page. If you find a match, be prepared to modify your proposed name.

Step #4. Choose a business structure

Your business structure offers a valuable legal framework, determining not only how your business operates, but also, how you handle taxes and manage liability. Certain structures are more likely to benefit small businesses, although this depends greatly on your goals and risk tolerance.

Common types of business structures in Delaware include:

- Sole proprietorship. Businesses launched in Delaware but not incorporated become sole proprietorships or partnerships. With a sole proprietorship, a single business owner receives 100 percent of the profits, but also, 100 percent of the liability. In the event that the business is sued, the owner’s personal assets could be at risk.

- Partnership. Similar to a sole proprietorship but involving more than one owner, a partnership lacks both incorporation and liability protection. As such, it faces similar risks as sole proprietorships, but compounded by the potential for disagreements between partners.

- Limited liability company. Offering liability protection while still preserving the benefits of launching a sole proprietorship or partnership, the LLC is a popular Delaware business structure. Easy to form and manage, LLCs promise peace of mind for Delaware business owners.

- Corporations. Offering expanded access to capital, corporations can scale quickly. This is a great option for ambitious entrepreneurs. Smaller businesses may use S corps to take advantage of pass-through taxation while also benefiting from liability protection. C corps bypass restrictions on shareholders and may gain greater investor appeal, but with a major caveat: these businesses are subject to corporate income taxes, with shareholders paying taxes on dividends.

Tax advantages for each business type:

From a tax perspective, Delaware is a business-friendly state. The most compelling benefit of starting a business in Delaware? Low taxes for businesses and consumers. Most notable is the complete lack of sales tax, which reduces expenses for businesses and customers alike.

Still, there are other taxes to consider, and for some entrepreneurs, these may play heavily into business formation. When choosing a business structure in Delaware, be mindful of these tax concerns:

- Sole proprietorship. Functioning as pass-through entities, sole proprietorship bypass corporate business taxes. Instead, the owner claims the profits. Another perk? Reporting requirements are minimal.

- Partnership. Also known as pass-through entities, partnerships do not involve corporate business taxes. Reporting remains straightforward, with profits and losses allocated among partners based on agreed-upon percentages.

- LLCs. Offering flexible tax arrangements, LLCs allow business owners to select tax structures that reflect their unique needs. These are generally pass-through entities by default, however. This option allows LLCs to gain liability protection and avoid double taxation.

- Corporations. S corps maintain a single layer of taxation. Shareholders draw wages, while additional profits are distributed as dividends. C corps experience double taxation, but this trade-off may feel worthwhile if unlimited shareholders or outside investments are priorities.

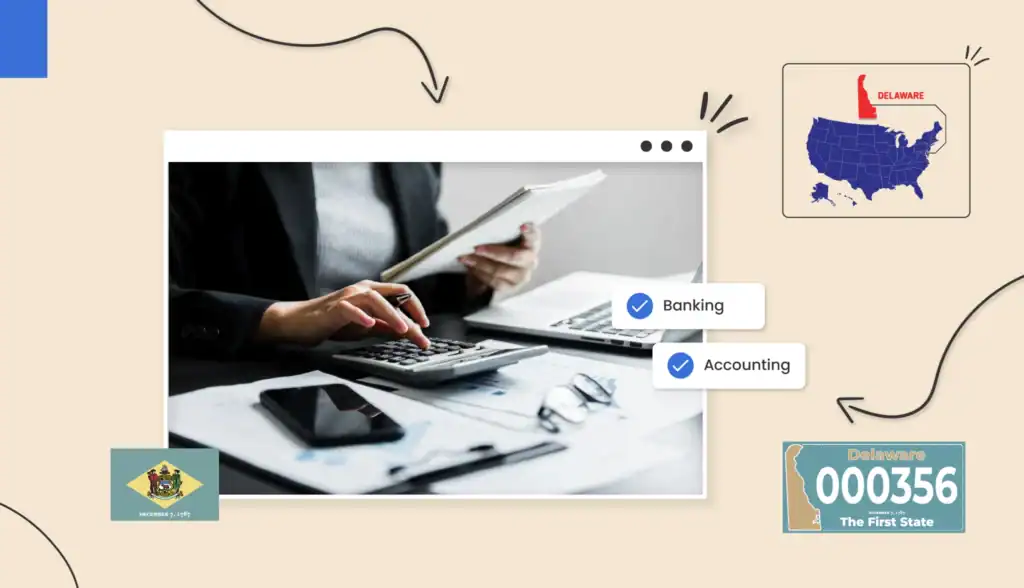

Step #5. Set up banking, credit cards, & accounting

Solid bookkeeping is vital to small business success. This allows you to manage cash flow and may also help you make informed financial decisions. Many tools, services, and resources guide this effort, including bank accounts, credit cards, and accounting software. Together, these essentials help you keep your financial records organized and also help your business remain compliant with various state and federal laws.

Banking:

Many Delaware business owners open a business bank account, which promise liability protection and can also boost credibility. Separate business bank accounts also prevent a phenomenon known as “piercing the corporate veil.” This can happen if you accidentally mix personal and professional finances.

Business credit cards:

Similar to personal credit cards but intended for professional or commercial use, your business credit card helps you distinguish personal spending from business-related expenses. This can be a helpful tool for managing your finances, even providing a higher credit limit so you can make larger purchases on behalf of your business. Be sure to manage your business credit carefully to avoid accumulating too much debt.

Accounting:

Businesses of all sizes should prioritize accounting. This helps you track various financial activities. By crunching these numbers, you’ll get a better idea of your business income and expenses, while also staying on top of invoices, payroll, and tax reporting.

There are many ways to tackle accounting. Top options include hiring professional accountants or using specialized accounting software. A professional accountant could help you reduce your overall tax burden, but software solutions may be more convenient and typically cost less.

Step #6. Get funding for your Delaware business

The cliché “It takes money to make money” definitely rings true when starting a business in Delaware. Before you earn revenue, you may need to pay for equipment, staff, office space, or even business registration fees.

Operational costs add up quickly, and, without a seed fund, you risk running out of cash — leaving you unable to pay for rental, materials, and other essentials.

The good news? There are plenty of options for getting the cash you need. Each strategy comes with unique benefits and downsides, so think carefully before you proceed. Options worth exploring include:

- Bootstrapping. If you’ve saved some money and are willing to self-finance your business, consider using your own resources. Known as bootstrapping, this gives you greater control over your business but can also be financially risky.

- Friends and family. If you like the idea of bootstrapping but don’t have enough money on hand, consider asking loved ones for help. Friends and family members may offer flexible funding, but with added financial risks. Your relationships could also suffer, especially if you struggle to pay back the loan.

- Small business loans. Available through banks, credit unions, and even the Small Business Administration (SBA), business loans provide large funding pools. Of course, these need to be paid back over time — and with interest. Still, loans can be helpful because they provide expanded access to capital, making it easier to scale without compromising ownership.

- Small business grants. Offering funding without the obligation to repay, small business grants are offered through various nonprofits and government agencies. These can be competitive and the application process can be difficult, but many business owners find this an excellent option for securing debt-free capital.

- VCs and angel investors. Wealthy individuals sometimes support early-stage businesses via angel investing. Many offer flexible arrangements or even take risks that other investors might avoid. Venture capitalists are dedicated professionals who invest significant funds when they believe that businesses show strong growth potential.

Delaware grants and state incentives:

While some grants are available at the federal level, state-specific grants are also worth exploring. The Encouraging Development, Growth and Expansion (EDGE) Grant, for example, caters to Delaware micro-businesses, offering generous STEM-focused awards of up to $100,000 per business. Programs such as the Delaware Strategic Fund and the Delaware Workforce Training Grant support local job creation and may also be worth exploring.

Step #7. Get insured

Liability protection is important, but as a Delaware business owner, you face many other financial risks that must be addressed early on. Insurance offers a much-needed safety net, helping you address and control risks such as property damage or employee injuries. Coverage needs vary between industries and according to business size or everyday operations. Many Delaware businesses seek these types of insurance coverage:

- General liability insurance. Offering well-rounded protection against property damage or even claims of bodily injury, general liability insurance forms the foundation of small business insurance coverage.

- Professional liability insurance. Also known as errors and omissions insurance, professional liability coverage is crucial in service-based fields. This covers damages and defense costs in the event that a client claims negligence.

- Commercial auto insurance. Offering protection against collisions, theft, or even vandalism, auto insurance can cover the various vehicles used for your business. For example, this might cover damage to delivery vans or company cars.

- Commercial property insurance. Protecting buildings and equipment, commercial property insurance can protect everything from offices to warehouses and even inventory. This allows for a quicker recovery in the event of damage due to natural disasters or other unexpected challenges.

- Umbrella insurance. Delivering an added layer of protection, umbrella insurance extends beyond the limits imposed by other plans. This can provide an added sense of security, particularly if you anticipate significant risks for your Delaware businesses.

Delaware-specific insurance requirements:

In Delaware, all businesses must carry workers’ compensation policies. The cost of workers’ comp can be reduced by participating in the Workplace Safety program. This program has saved employers millions in premiums since it was launched in 1989.

Delaware’s Department of Insurance provides a comprehensive guide to insurance for small employers, detailing required forms of insurance along with optional coverage. The state of Delaware also requires all employers (with employees) to determine tax liabilities related to unemployment insurance. Employers must also report these liabilities quarterly to the Department of Labor’s Division of Unemployment Insurance.

Step #8. Obtain permits & licenses

Every Delaware business must secure a Delaware business license from the Division of Revenue. If you’re based in The First State, you’ll need a business license even if you primarily conduct business in other states.

Be prepared to secure this license as soon as you begin operating your business in Delaware. Your business license can be secured online using the One Stop Business Licensing and Registration Service.

A business license is just one of many licenses or permits you may need to secure to run your business in Delaware. Depending on your location, you may also need a city or county license. Additional permits and licenses are required for certain professions. Examples of fields with industry-specific licensing requirements include:

- Cosmetology

- Massage and bodywork

- Plumbing

- Real estate

- Home inspection

- Funeral services

- HVAC-R

Federal income tax and Delaware local tax

Many small businesses pay self-employment or income taxes to the IRS. If you employ workers, you’ll also need to withhold a portion of each employee’s paycheck to cover Medicare and Social Security.

Delaware-specific regulations

Delaware imposes a gross receipts tax based on total business revenue. The state also maintains a corporate income tax of 8.7 percent. This is similar to corporate income taxes required in many other states. Also required: a franchise tax that keeps your business in good standing. This franchise tax is required for all businesses that are incorporated in Delaware.

Step #9. Find your team

People are the backbone of your Delaware business. They bring valuable skills and ideas to the table, all while creating products or connecting with customers. Whether you’re on the hunt for employees or contractors, you will need to find people who support your vision and share your core values.

It takes time to find the right team, but thankfully, Delaware promises a skilled and passionate workforce. Delaware’s employees are passionate and well-educated — boasting, for example, the nation’s fifth-highest concentration of PhDs in areas such as health, science, and engineering. Delaware’s workforce is also highly diverse, offering unique perspectives and specialized expertise.

Comply with Delaware payroll regulations:

Delaware maintains strict payroll regulations that all employers must follow. Essentials include:

- Wage frequency. All Delaware employees must be paid at least once per month.

- Minimum wage. Delaware’s minimum wage reached $15 per hour as of 2025, although the minimum wage for tipped employees remains $2.23 per hour.

- Overtime pay. In Delaware, non-exempt employees must be paid 1.5 times their regular wages if they are required to work over 40 hours within a given workweek.

- Payroll taxes. Delaware employers must withhold state income taxes from employee wages. The state currently maintains a graduated tax rate.

Hire contractors:

While employees offer stability and the chance to create a consistent company culture, some situations may call for contractors. Handling short-term projects or highly technical tasks, these experts provide flexible and cost-effective services.

If you choose to work with contractors, be sure to classify them correctly. Treat them as employees, and you risk serious legal penalties. Delaware’s Workplace Fraud Act establishes strict rules to prevent misclassification, especially in the construction industry. Misclassification can also be avoided by allowing contractors to operate independently, rather than treating them as employees.

Step #10. Market & grow your business

Find new customers and clients by promoting your Delaware business. Establish a strong brand presence so you can convey your unique personality. This should be instantly evident in every detail, captured in logos, slogans, and colors, for example. From there, improve customer awareness with marketing campaigns that command attention.

Attract your first customers with special offers

Give future customers a taste of your products or services with special deals that are too good to turn down. These could include flash sales, free shipping, or even free samples. Share these offers on social media or in marketing emails — or better yet, build them into launch events.

Encourage customers to sign up for mailing lists or newsletters

Keep new customers in the loop with email newsletters that get readers excited about upcoming events or exclusive offers. These messages make customers feel like true insiders while keeping your business top of mind.

There are many ways to convince customers to sign up for mailing lists. Many businesses use free incentives known as lead magnets. Examples include ebooks, white papers, and webinars. Other customers may be more compelled by offers of first-purchase discounts in exchange for email list signups.

Collaborate with local businesses

Take advantage of Delaware’s close-knit business community and work with other entrepreneurs to drum up attention and expand your respective audiences. If possible, work with businesses in complementary fields. For example, if you run a coastal hotel, partner with local tour operators to provide cross-promotions such as bundled discounts.

Invest in word of mouth

Happy customers attract one another, so use word-of-mouth marketing to get genuinely enthusiastic customers in the door. This is, technically speaking, free of charge — but it takes some effort to cultivate. Customers and clients are more likely to recommend your business to loved ones if they’re genuinely impressed by your products and services.

Pay attention to online reviews

Reviews deliver peace of mind, drawing on social proof to reassure customers that your business is reputable. These days, reviews aren’t just helpful; they’re expected. These can be found through Google or on sites such as Yelp or TrustPilot.

While there’s no way to guarantee positive reviews, simply improving the number of reviews can boost your credibility. Encourage customers to share their thoughts. Embed ‘leave a review’ buttons into customer portals or share QR codes to make reviewing easy.

Create unique, helpful content to showcase your business

From blogs to videos, content helps you connect with customers or clients while expanding your brand’s presence. Don’t limit yourself to promotional content; instead, provide digital experiences that people find genuinely useful. For example, if you run a fitness studio in Wilmington, share nutrition tips or video demos showing proper form.

Step #11. Open the doors!

You’ve put in the work, and now, it’s time to connect with your clients and customers. Welcome new faces with confidence, taking this opportunity to share your story and your vision for the future. Locals will be eager to show their support, and, if you make a strong first impression, you could create lasting and loyal relationships.

Plan a successful launch event

Marketing strategies take time, but, if you want a quick boost, you can plan a launch event that gets people talking. Fanfare is welcome; this is your chance to celebrate your achievements while looking ahead to a bright future as a Delaware business owner.

Follow these simple steps to plan a memorable launch event:

- Choose a venue that showcases your business but also suits your audience.

- Plan fun activities that feel true to your brand.

- Promote the event on social media or by creating a guest list and sending invites.

- Provide exclusive discounts to create buzz and to land early sales.

- Send follow-up messages to thank guests for their support.

Land your first sale

Chances are, your first sale will arrive during your launch or during other early promotions or events. Depending on your industry, however, it may take a little time to score regular sales or contracts. Don’t worry; if you keep the momentum going, you’ll begin to score loyal clients and customers. This, in turn, will translate to strong sales.

Conclusion

Launching a Delaware business can be downright thrilling. This is your chance to pursue your passion while connecting with Delaware’s close-knit small business community. If you’re ready to take the first step, form an LLC to establish your business legally and protect your personal assets. Use our steps to simplify this journey so you can truly enjoy your entrepreneurial adventure.

FAQ

Anyone conducting business in Delaware must obtain a business license from the Division of Revenue.

While Delaware business license fees can vary, the typical rate is $75 for the first business location. Extra business activities may prompt additional fees.

Delaware can be a great state to open a business due to its highly educated workforce and its lack of a sales tax. Other perks include low startup costs and generous grant programs.

The Division of Corporations offers expedited services, but in general, it takes about one week to start a business in Delaware. Business licenses are issued promptly, but certificates of formation and other documents may take longer to process.

Delaware law requires LLCs and corporations to designate registered agents. Each registered agent must maintain a physical address in the state of Delaware. Registered agents are expected to receive service of process.