We understand. Many people may not be able to name the capital city of the state of South Dakota (Pierre). Some may not be able to identify other larger cities in the state, like Sioux Falls, Rapid City, Aberdeen, Brookings, or Mitchell.

Upon closer look, however, South Dakota may hold undiscovered opportunities and advantages for those looking to start and build a business in the state.

In this ultimate guide for starting a business in South Dakota, we will help you better understand the diversity and opportunities in the Mount Rushmore State. You will learn the 11 steps to take when starting a business in South Dakota and the importance of each.

The steps:

- Fine-tune your business idea

- Create a business plan

- Choose a business name

- Choose a business structure

- Set up Banking, Credit Cards, & Accounting

- Get Funding for your South Dakota business

- Get Insured

- Obtain Permits & Licenses

- Find your team

- Market & Grow Your Business

- Open the doors!

1. Fine-tune your business idea

Your business plan helps you take more precise control of hitting your targets for your business. The more thought and planning you give it, the more likely you will achieve success. This is why it is so critical to fine-tune your thoughts and ideas before implementing them or rushing forward.

- Play to your strengths: What areas do you have interest, experience, and knowledge of? What are some of your personal assets and strengths that can serve you in building your business? What are some of the strengths of those in your inner circle?

There are those around you that may have experience in management, marketing, sales, or in bookkeeping. Take inventory of these qualities and use them for advice and guidance.

- Ensure your idea is sound and viable: Who are your potential competitors, and what makes them susceptible? What are their strengths? Is there a real market for your product or service, and what barriers will you need to overcome?

- Make sure your business fits in with interests in the region: South Dakota is known for its agriculture, outdoor activities, and tourism. Other sectors of the economy include healthcare, electronics, financial services, and manufacturing. How will your business take advantage of these factors?

Other factors to consider. South Dakota is large geographically and is divided by the Missouri River into East River and West River segments. Distances between cities can be far. Winter weather can be long and harsh. Its people are generally considered strong, independent, and conservative. How will these factors play a role in your business?

2. Create a business plan

A business plan is a document that is created to serve as a proposed roadmap for a business enterprise. Its purpose is not only to keep the business on track, but also to demonstrate the concept is well conceived.

In addition, a business plan can also serve as a powerful tool in securing financing and/or investors.

Key components of a business plan include:

Company description and structure: This generally includes whether the organization is a sole proprietorship, partnership, or LLC etc.

An executive summary: This is, in essence, a resume of the key players in the company and the experience and knowledge they bring to the organization.

Business inscription: This details whether the business will be providing a service or manufacturing and selling products.

A market analysis: In South Dakota, for example, this may be a breakdown of a local market like Sioux Falls, Mitchell, or East or West River areas.

Sales and marketing strategies: This section should detail how the business products or services will be marketed and advertised and the sales projections in the early years.

Financial projections: These include income and expense projections as well as anticipated profit and loss statements.

Funding proposal (if applicable): This area would address the overall financial performance of the proposed company and how stakeholders, whether it be a financial institution or investors, will see a return on investment.

Choose a location

Selecting the right location for your business can help make or break your enterprise.

For example, if your business is dependent on foot traffic, it can be important to be in an area where plenty of people live, work, and play.

This can include South Dakota’s larger communities like Sioux Falls, Mitchell, and Pierre.

If your products or services are designed to appeal to South Dakota’s livestock and agricultural community, more rural locations may be acceptable.

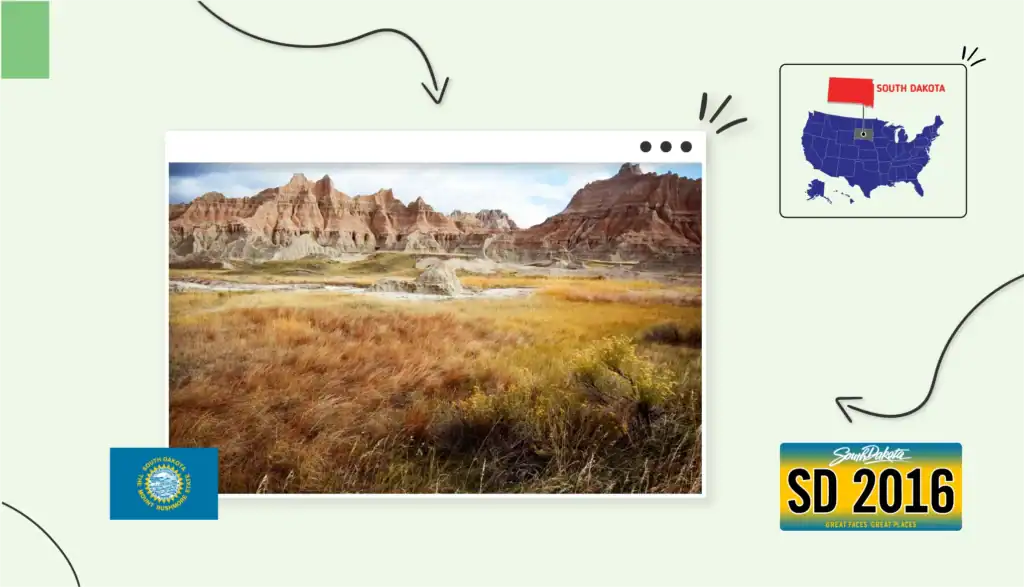

In addition, if your business is intended to take advantage of South Dakota’s tourism industry, you may wish to consider locations near tourist attractions like Mt. Rushmore, The Black Hills, Deadwood, The Bad Lands, The Mitchell Corn Palace, the impressive Wind Cave and Jewel Cave, and the ongoing construction of the Crazy Horse monument.

Keep in mind that before making a final decision on a location, you will want to research local municipalities and county regulations regarding zoning restrictions.

Determine the role a digital presence may play in your business.

Even if yours is a bricks-and-mortar business, odds are digital marketing will still play a role in attracting new customers.

Some, however, may decide to place the majority of their focus on internet sales. Still others may use both.

A business that is focusing on the online aspects of marketing will need:

1. A website. Your own website should serve as the main portal for your digital efforts. It should include important basics like what you do, where you are, who you serve, and how to get in contact with you.

2. Social media presence. Social media is critical in building attention for a new business. Today’s social media includes a growing list of platforms. Keep in mind each social media platform takes a certain amount of effort, time, and energy to build out and maintain.

3. Determine the best uses of digital marketing tools. You have the opportunity to select from a variety of digital marketing tools to help grow and manage your business. These include email marketing, content marketing, utilizing a customer management system (CMS), or even hiring a social media or digital marketing manager.

4. Supply and distribution plan Now is the time to decide on how your customers will buy your products and services online, how they will get them, and where they will come from. This can depend greatly upon the type of business that you are creating. For example, if you are manufacturing the products you are selling, you will likely need to develop an in-house distribution plan. If you are drop-shipping items, you will need to determine your resources. You will also need to determine related shipping methods and charges. (link to posts that elaborate more on this)

5. Sales tax in South Dakota Businesses in South Dakota are charged with collecting sales tax on taxable goods in the state. This includes a 4.2% statewide sales tax along with additional local sales taxes of up to 2% more. In addition, businesses may also be subject to a use tax on purchases made by the business where sales are not charged.

6. South Dakota specific regulations regarding online purchases

South Dakota makes businesses responsible for charging sales tax when applicable to online purchases. This includes the 4.2% state-wide sales tax along with local taxes that could amount to as much as 6.5% total.

3. Choose a business name

Selecting a name for your business is obviously an important facet in creating that business. South Dakota regulations require that a business name should not cause or create confusion with a similarly named business already in the state. You can perform a South Dakota business entity search to ensure that your chosen name is available.

If you plan to operate under a name different from your legal business name, you’ll also need to file a DBA (Doing Business As), sometimes called a fictitious business name. You can register a DBA in South Dakota through the South Dakota Secretary of State’s office. This allows your company to legally use an alternate trade name for branding or marketing purposes while maintaining your existing business structure.

Key points in choosing a name for your business:

- Select a name that is memorable

- Choose a name that reflects the business type.

- Select a business name that lends itself to marketing and branding opportunities.

- Consider potential logos and creative graphics.

- Brainstorm a short tagline that can serve to describe your business in a few words or short sentences.

4. Choose a business structure

South Dakota permits a choice of business structures for enterprises operating in the state. Your choice of your business structure can depend upon the number and type of investors and the tax ramifications and personal financial protection that each structure affords.

These include:

- Sole proprietorship: While a sole proprietorship is the easiest business structure to implement, it is designed for businesses with a single owner and provides little protection of personal financial assets.

- Partnerships are similar to a sole proprietorship. However, they are used when the business enterprise has more than one owner. A business partnership does not provide protection of personal assets.

- Limited Liability Company (LLC): One of the most popular forms of business structure in the Mount Rushmore State is the South Dakota LLC. A limited liability company is relatively simple to set up, can be used whether it has one or many stakeholders, and provides protection of personal financial assets from company debt. It is popular, in part, because of its simplicity and financial protections.

- Corporation: A more complex business structure recognized in South Dakota is that of a corporation. A corporation provides the best form of financial protection for its owners and investors but can be more complicated to establish. A corporation requires the establishment of a board of directors and details how stock offerings are facilitated. Corporations in the state include: C Corporations, S Corporations, Non-profit Corporations, and Doing Business As (DBA).

Tax advantages in South Dakota

South Dakota provides multiple tax advantages for businesses in the state. For example, the state has no corporate tax, which is a significant benefit to C corporations in the state. South Dakota also has no personal income tax, which is a benefit to owners of pass-through businesses like sole proprietorship, partnerships, and LLC’s.

Another tax benefit in the state is the fact that South Dakota has no business inventory tax. This reduces the tax burden on retail and manufacturing businesses.

If you are starting a family-owned business in South Dakota, it is worth noting the state has no inheritance or estate taxes. This can be extremely valuable when successful, established businesses are handed down to family members.

5. Set up banking, credit cards, & accounting

Setting up a business banking account, establishing acceptance of credit cards, securing a business-related credit card, and securing accounting and bookkeeping services in South Dakota can be relatively straightforward. You should establish your corporate structure and then secure an Employee Identification Number (EIN) that is critical in establishing these services.

- Establish a checking account. No matter what business structure you have chosen, it is important to establish a business checking account that will be used to separate business financial transactions from your personal ones.

- Accepting credit cards: Whether your enterprise is a bricks-and-mortar business or an online business, it is critical to have the ability to accept credit cards as a form of payment for your goods and services. Fees can vary widely from financial institutions and credit card vendors. Perform due diligence to discover the most advantageous credit card vendor for your type of business.

- Securing bookkeeping and accounting services: The state of South Dakota requires corporations and LLC’s to file an annual report and pay an annual fee. This can be simplified for business owners who use an accountant or a bookkeeper. Businesses who are large and have more complex bookkeeping needs may decide to use a certified public accountant in South Dakota. Smaller businesses may consider the use of a bookkeeper for payroll or utilizing one of several available accounting computer programs. It is critical for all South Dakota businesses to maintain an accurate record of business transactions, including income and expenses.

6. Get funding for your South Dakota business

One of the key steps in creating a successful business in South Dakota is ensuring your enterprise has adequate funding.

There are multiple resources available to help you fund your enterprise

1. Personal and private funding

Smaller enterprises may be able to be funded by personal assets and private loans. These could include personal savings, family gifts, personal loans, and even second mortgages. This, however, can put your personal financial well-being at risk.

2. Commercial loans

A commercial loan through a commercial bank or other lending institution may be possible if your enterprise’s business plan is solid. These loans may need to be backed by personal or company assets.

3, Federal small business loans

The Small Business Administration (SBA) has a number of loan programs potentially available to help you get your business off the ground.

4. Grants

There may be a number of small business grants in South Dakota available for your specific type of business. Grants are particularly desirable due to the fact that they do not need to be repaid. Grants may be available from the federal government, state government, private industries, and non-profit foundations and associations.

5. South Dakota specific grant and loan programs

South Dakota creates a business-friendly environment through its multiple favorable tax policies. It also has business grant and loan programs which can also be extremely valuable. Some of these include:

This is a South Dakota-based loan program designed to help fund general expenses, construction, equipment, and more. (link needed)

The state offers grant monies available to help train employees in new skills due to business growth.

This is a state program designed to help farmers procure funding for their livestock operations that they can affordably manage.

The department serves as a clearing house for statewide grant and loan programs available to a variety of businesses in the state. Details can be found at (link needed)

Tips and best practices

Those seeking grant and loan programs in the state should pay particular attention to grants that are expiring and application deadline dates. Some grant and loan applications can be complex, and applicants may be able to benefit from the services of a professional grant writer. This is particularly true when grants or loans that are being sought are significant.

7. Get insured

South Dakota has few business insurance requirements mandated by the state. Businesses with employees are required to carry workers’ compensation insurance and unemployment insurance. In addition, businesses with company-owned vehicles are required to carry a minimum amount of liability insurance on those vehicles.

Certain professional organizations may also be required to carry malpractice, errors and omissions protection. These can include organizations that provide investment and personal finance advice, real estate companies, lawyers, medical professionals, and others.

Check with your professional association to see if E&O insurance is required for your profession.

Although state requirements in South Dakota for insurance may be minimal, various forms of insurance may be required by a financial institution or other funding sources of your business.

8. Obtain permits & licenses

There is no statewide South Dakota business license. However, businesses selling goods and services in the state are required to obtain a sales and use tax license. This can be acquired through the state, and there is no associated fee for this license.

Certain professions and industries may be required to obtain specific licenses and permits based on their industry and location. It is recommended that businesses check with their industry association and local authorities to determine which permits and licenses are required.

Federal, state, and local taxes in South Dakota

While South Dakota has favorable tax laws for businesses in the state, businesses are still required to follow federal income tax regulations, statewide sales tax regulations, and local sales and income tax guidelines. In addition, corporations and limited liability companies are required to file an annual report with the state of South Dakota.

Depending on the size and complexity of the finances of your business, consulting and accountant is generally advised.

South Dakota specific regulations

South Dakota can have a range of requirements for specific businesses or industries throughout the state and in local municipalities. To get the information required for your specific business, contact your local authorities, professional organizations, or business consultant.

9. Find your team

In South Dakota, as elsewhere, people will be the backbone of your business. Here is a look at the various people who might likely play a role in the success of your organization and the state laws regarding employing them.

People as a resource

From your everyday employees to fellow business people and industry specialists, those you surround yourself with will play a key role in your success.

Build your team by seeking quality employees and those who can offer professional advice ranging from accounting and advertising to legal and financial advice.

Comply with South Dakota payroll regulations

Businesses with employees are required to carry workers’ compensation and unemployment insurance in the state of South Dakota.

Businesses are required to pay employees the minimum wage set annually in the state. In January 2026, this wage is set at $11.85. There are some exemptions. Keep in mind that there is no state income tax in South Dakota.

Businesses are generally advised to use a reliable accountant or payroll computer program.

Hire contractors

Even “one man shows” can require the help of outside contractors and professionals. Contractors can help control costs while providing valuable services to the business. These can include accountants, lawyers, outside sales, advertising and marketing, and others.

10. Market & grow your business

It is time to consider your options for inviting potential customers to do business with you. Strategies can vary widely depending on your target market or service and product category. Advertising/marketing is a wide-ranging subject that requires concerted effort and attention as well as consistent strategy.

Throughout the process, you should seek strategies that provide the best return on investment and work the best for your chosen product and services.

Invite customers to opt in to a mailing list or newsletter

Every person, whether a prospect or customer, will likely have a long-term value to your business. It is therefore important to begin building a prospect and customer list. This can be done in a variety of ways. You can offer promotional giveaways and contests, create an ongoing newsletter, provide valuable content, and track customer purchases to determine potential future sales.

Attract initial customers through special offers

Limited-time incentives and offers can frequently be used to attract initial customers to make their first purchases. These can include significant discounts, BOGO’s, and referral incentives. Make your initial customers feel special while creating urgency for their first purchase.

Look for local businesses or brands to collaborate with

Proactively seek to network with businesses, brands, and organizations within your community that are compatible and like-minded.

Businesses who appeal to engaged couples, for example, may benefit by co-promoting each other’s services.

Get involved and network

New businesses can benefit greatly by quickly and actively getting involved in their communities. Consider joining your local, regional, or statewide chamber of commerce, getting involved in area service clubs and organizations, and volunteering for non-profit and community projects.

Invest in word of mouth

Happy customers attract each other. Seek out and use positive comments and testimonials from customers in your marketing efforts. Highlight happy customers on your social media, newsletters, and printed materials.

Pay attention to online reviews

Not only should you seek out positive comments and endorsements from happy customers, but you should also pay attention to and address those that may not be so glowing.

Position yourself as the expert

Use content marketing strategies to position you and your business as an expert in your chosen field. This can involve providing useful content like helpful tips and tricks and DIY secrets to your prospects via social media, a newsletter, or a written or video blog.

Monitor results

It is helpful to try different strategies to attract customers, especially early on in your business. Monitor and track results of your various strategies to help determine which are most effective and provide the best ROI.

Consider outside assistance

You could benefit from a variety of available products and services to assist you in some time-consuming marketing efforts. Consider digital marketing help or a social media manager. Look into a business consultant or research process improvement software like a customer management system.

11. Open the doors!

Plan a successful launch event

You can now begin to see the results of your efforts in the previous steps. Most new businesses will either plan a “soft opening” or a “grand opening” event. Soft opening events are generally lower-key and planned for a controlled group of people like family, friends, business associates, vendors, and other invitees. Soft events are beneficial in that they can allow a business to open its doors to a limited group, so the business can better control the customer experience and work out any bugs.

Other businesses may decide that a wide-open grand opening may be best. This usually includes debuting your business on a specific date and time. Grand openings can last for a day, days, weeks, or, in some cases, months. Grand opening events generally include special offers, refreshments, giveaways, and even entertainment.

Land your first sale

Businesses used to celebrate their first sale with a symbolic framed dollar bill behind the counter. In today’s digital market, celebrations are different but are no less significant. It is critical to turn your initial customers into fans and brand ambassadors. This can build momentum for your growing enterprise. Get plenty of feedback.

This feedback can serve you well in your ongoing efforts to grow your business.

Conclusion

South Dakota can be both intriguing and attractive for opening a business. It combines vast rural and scenic areas with population centers like Sioux Falls, with almost a quarter million people. It has very attractive tax laws, and the state is noted for its good schools and outdoor activities. While some may view South Dakota as isolated and sparsely populated, that issue is minimized through a strategic digital marketing plan. If you are considering starting a business, consider all of your options, including creating a business in South Dakota.

Now that you’ve completed all the steps, all that is left is to open the doors and start managing your dream South Dakota business.

FAQ

The short answer is no. South Dakota is one of the few states in the country that does not have an income tax. This is beneficial to both employees and business owners.

South Dakota has no general business permit and has no corporate income tax and no inheritance or estate tax when a company is handed down to family. In addition, there is no property tax in the Mount Rushmore State.

While South Dakota has a large and popular tourism industry, it is also growing in other business sectors like agriculture, financial services and banking, healthcare, and technology.