In this post, you’re going to learn how to (actually) build a small business of your own step-by-step. Let’s get started.

Here are the steps to follow when starting a new business:

- Discover your idea

- Research your product/service and audience

- Create a business plan

- Choose a business structure

- Consider taxes

- Apply for state and federal licenses & permits

- Choose and register a business name

- Set up your business

- Develop a brand and marketing strategy

- Launch your business

Step 1: Discover your idea

All businesses, including yours, start from an idea. And the goal here is to take your idea and transform it into a thriving business (which will take some effort). When coming up with your idea, first and foremost, make sure it aligns with the type of business and lifestyle you want.

For example, there’s no point starting a dog walking business if you don’t like walking or dogs (you can see how that’ll be a problem). While it’s easy for money to fog your decision-making, it’s important you step back and think to yourself, “is this a business I can see myself doing everyday?” If the answer is no, then go back to the drawing board.

Next, think about how your idea is going to come to life. Are you going to offer it as a service? Create your own product? There are tons of ways to bring your idea to life depending on the industry you’re in.

Successful business ideas are born out of necessity. These are ideas that either fulfill a need, provide a solution, or offer value.

I’ll let Brian Chesky, founder of Airbnb, explain:

Chesky’s necessity was raising $150,000. His solution was selling three air mattresses to designers for $70 a night in his living room. The rest is history.

But what if you’re stuck for ideas? How do you determine what type of business to start?

Tips for finding ideas for a new business

Reddit: Check out Reddit, look at subjects that interest you, see what hot products or services people are talking about, and identify any pain points.

Marketplaces: Go where your buyers are, like Facebook marketplace, Amazon, or Etsy. Look at what they’re buying or what’s needed.

Top Seller Lists: Analyze the Amazon bestseller list, see what’s trending, and see how you can improve it.

Google Trends: Google offers a sneak peek into the level of interest in different topics over time. You can see if the level of interest rises or falls over time, to try and find products that are on the rise.

Get Inspired by Others: Inspired by a successful business model? Identify what you like and then determine how you can do it better.

Solve a Problem: What irks you or your friend probably does to most other people, too. Providing a solution to a common problem is the start to creating a great business idea.

Once you’ve found an idea, you need to confirm whether your business will be profitable.

Read more about finding great business ideas here.

Tips for validating your business idea

Market validation will determine if there is a real need for your product in your target market. Meaning, you’ve found something that consumers want and can sell at a profit. And that’s what makes a successful business.

Here are some of the questions that can help you validate your idea:

1. Is there a need? Sounds obvious, but statistics show that lack of market need is one of the main reasons small businesses fail.

2. Which direction is the market trending? Is the market growing, declining, or stagnant?

3. Who are your competitors? Is there room for another player?

4. Can you afford the initial investment fees? Drafting a business plan is the best way to estimate the cost of starting a business. The SBA’s startup costs worksheet is also very helpful. Some business ideas require little to no initial investment, so, depending on your goals, you may opt to start from a low investment business idea, first.

5. What are the regulations for new businesses? For example, the Internal Revenue Service (IRS) website contains business regulation information, such as tax matters.

Step 2: Research your product/service and audience

After you’ve chosen the type of business you want, it’s time to do some research. Now, it’s important we warn you: you’ll probably want to skip this step, but don’t. This is one of the most crucial steps for building a stable business.

Before you start building your business, you need to heavily research the industry and product/services you’d like to sell. You’ll need to look at the following:

- Your audience

- Your competition and overall industry

- How your product will fit in all of this

Audience research

Let’s focus on #1: Your audience. Doing audience research refers to researching a group of potential customers. By understanding the needs of your audience, you’ll be able to not only fulfill them, but make better decisions for your business.

To get started with audience research, you’ll want to create a buyer’s persona. What’s this? Well, think of it like creating a character of your ideal customer. You’ll want to ask questions like:

- Who are they?

- What do they love to do?

- Where do they hang out online?

- What’s important to them?

With this information, you’ll get an idea of how you’ll connect with your customers.

Read this post to learn more about how to conduct audience research.

Competitor research

To get more information about your potential customers, analyze your competitors.

Competitor research will help you gain information about your customers as it’ll show you what they sell, who they sell to, and where you, as a business, can stand out.

Select 5-10 competitors and research their websites and social media profiles to collect as much information as possible on their products/services, and audience demographics.

With all this information, you can create a more accurate buyer’s persona and learn how to position your business to get the attention it needs. After this, you can start to create your business plan.

Step 3: Create a business plan

Before you can get to the fun part of building a business, you need to build the foundation (which usually means a lot of paperwork) #sorrynotsorry.

Having a business plan offers multiple benefits. Firstly, it outlines how your business will run, which will give you more clarity as a business owner. Secondly, it’ll help secure funding from a bank or other lender.

Elements of a good business plan

Your business plan should include the following:

- An overview of your business

- A detailed description of your business and why it exists

- Information about your industry and target market

- Products and services you offer

- Your marketing plan

- How your business will operate, including your equipment, shipping, and suppliers

- And your financial plan which will go over how much it’ll cost to start your business, where you’ll be getting the fund from, profit margins, etc.

Question to ask when creating a business plan

You can start by answering some questions:

- What problem does your business solve?

- How does your business solve the problem?

- How will you make money and what is the price customers will pay?

- Who are your customers? Who are your competitors?

- Which marketing strategies will you use and on what platforms?

- How will you fund your business? What’s your financial plan?

- When will you turn a profit?

Once you have all the information completed, you’ll be ready to start building your business.

For more details, read this post about creating a business plan.

Step 4: Choose a business structure

Finding the right type of business structure is an exciting time – your idea is now becoming a legal reality. Choosing the right structure can help pave the way for the success of your business later on.

Each business entity has its own legal requirements that directly influence your business. It will affect your setup costs, how you’ll run your business, which state laws apply, how you’ll file your taxes, and your level of legal liability.

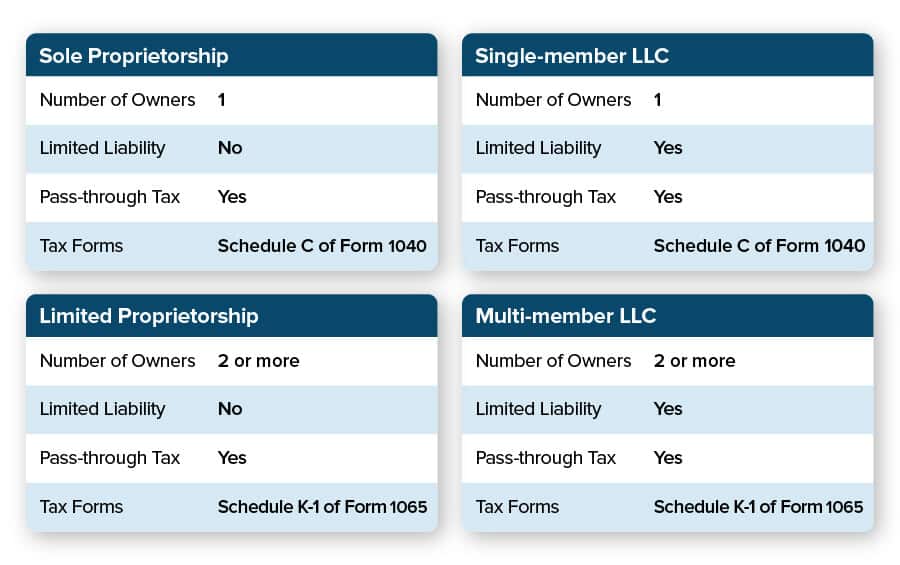

Small businesses generally use one of the following four business structures:

- Sole proprietorship

- General partnership

- Limited partnership

- Limited liability company (LLC)

Sole proprietorship is the default to starting a business. This means you are a one-woman (or man!) show. You can start immediately by using your own name and obtaining the required permits, licenses, and adequate insurance coverage. You’ll find what you need on your state’s website.

General partnerships are similar to sole proprietorships, except it has multiple business owners. Each person actively operates in the business, as well as shares the profits and losses of the business. If you open a partnership, you would most likely need an operating agreement.

Limited partnerships (LP) are a partnership between those running the business and a silent investor. Traditionally, silent investors have no day-to-day involvement in running the company. LPs are a good entity option for raising capital investment while retaining the simplified taxation of a general partnership.

But an LP is complicated to set up and requires state-by-state research. And any limited partners’ investments and shares are considered by the law as securities, subjecting them to state and federal security regulations.

NOTE: If you use one of the above structures and your business is sued, or you wind up in debt, you’re liable, and so are your personal assets.

Limited liability company (LLC) is one of the most common business structures for small businesses. Starting an LLC can be a good choice even for a one-man-show business as it can offer benefits.

Some of the benefits of an LLC include legal liability protection, as well as tax advantages.

It can be great if you’re trading in medium risk niches, such as construction or adventure activities, as you’re not personally liable for the business. However, the setup and running costs are a bit more expensive. You’ll need an accountant to register and file on your behalf (or just automate the process with us!)

Check out this video about how to form an LLC: a step by step guide.

Register your business

You’re almost there. Now, it’s time to register your business. Depending on where you do business, the rules may vary, so double check with your state.

However, if you’re US-based, then you’ll need to choose your business structure. Your business can be an LLC, sole proprietorship, partnership, etc. After you’ve selected your business structure, you may want to consider getting business insurance.

Some business structures have their own tax and registration requirements.

We’ll explain more in the part about taxes.

If you don’t have a business name yet, or if you’re unsure under which name to register your business, go ahead and read part #7.

Step 5: Consider taxes

Taxes are an important consideration when it comes to choosing a business entity.

Sole proprietorships are classified as a pass-through entity, meaning your business income is paid through your personal returns. You are also eligible for the 20% QBI (qualified income deduction).

General partnerships are treated the same as a sole proprietorship.

Limited partnerships are also pass-through entities, simplifying taxation and enabling you to claim the 20% QBI deduction. However, LP tax treatment varies from state to state, so check out your state website for more information.

Limited liability company (LLC) is typically treated as a pass-through entity for federal income tax purposes. However, members can choose for the LLC to be taxed as a corporation instead of a pass-through entity. The way you file and pay income taxes depends on whether your LLC has one owner or multiple owners. You can choose to be taxed as an S-corporation, learn more here.

Check out this post about filing taxes as an LLC.

Apply for an EIN (federal tax ID number)

The next thing you need to do is apply for an Employer Identification Number (EIN). You need an EIN to hire employees, open a bank account, pay federal taxes, and apply for any necessary business licenses and permits.

You can apply for an EIN online immediately after registering your business.

Apply for a state tax ID number

If you’re legally required to pay state taxes, you need a state tax ID number. You can find that out by researching your state’s income tax and employment tax laws on your state’s website. The process of applying for a state tax ID varies from state to state. Contact your state government directly.

Step 6: Apply for state and federal licenses and permits

State and federal licenses and permits are determined by what business you’re in and your location. State regulations generally cover a broader range of activities compared to federal regulations. For example, they regulate industries like construction, farming, dry cleaning, restaurants, and retail.

You only need a federal license or permit if your business activities are regulated by a federal agency. You can find out more on your state’s website and the gov SBA’s site.

So, have you given your business name much thought yet?

What about your registration and trademark?

If not, keep reading.

Step 7: Choose and register a business name

Naming your business is an exciting step. A good name reflects your business identity, is memorable, and engages your target audience.

Your business name will appear on your website, business cards, social media platforms, and more.

Here are some tips to get started.

How to choose a business name

You can find the right business name with a dash of creativity and a deep-dive into market research.

First, decide on which style suits your business: Branded or generic? Do you need a keyword to describe what you do, or would a generic name be more appropriate?

For example:

If you’re selling artisan bags and hats through your eCommerce store, artisan bags and hats are relevant keywords. A generic name like ‘artisan bag and hat boutique’ would work well. However, if you plan on extending your range to include clothing and accessories, your name would no longer be applicable. Now a branded name like ‘Guanabana Handmade’ would suit your future vision.

Whichever you choose, keep it short and catchy, so it’s memorable and easy to spell. If you’re trading globally, ensure it’s available as a TLD (.com) domain or state if you’re local. If you plan to trade in a specific foreign market, It’s also important to make sure your business name does not mean something negative in that language.

You can use brand name generators that take your ideas and provide catchy, creative, and industry-relevant business name ideas.

Read more tips for choosing the perfect business name here.

Check that the business name is not already trademarked

Check that your chosen name is legally available to be sure you can use it.

Always run a trademark check to ensure your chosen name isn’t legally registered. If you’re in the US, research your name’s availability on the United States Patent and Trademark Office database.

Ensure it’s unique. Just because your business name isn’t trademarked doesn’t mean other businesses aren’t using it. This isn’t too big a problem unless they own the domain or are in close vicinity. Check your Secretary of State entity filings and DBA (doing business as) for other companies operating under the same name. Learn more on how to register your business name here.

You can start with a general internet search for similarly named businesses. Google will display any businesses online using the same or similar name. If your chosen name is overly popular, you need to go back to the drawing board.

Check your domain’s availability. A name’s not much use nowadays if you don’t own the domain. Check registrars like GoDaddy or Namecheap to confirm availability.

Once your business name is in the bag, it is time to protect it by registering it.

How to Register Your Business Name

Congratulations! You’ve found the perfect name for your business. One that reflects your brand, your product, and your mission. Now, how will you make sure that your business name is protected?

There are a few different ways to register your business name, each will offer you slightly different protections.

In short, an entity may give you partial name protection on the state level, a DBA won’t give you any name protection, and a trademark is the best way to protect your name on the state and federal level.

While not offering any official legal protections, a domain name for your business website’s URL, as well as social media handles, (assuming they are available) will be unique to you once you’ve registered them.

Here is a breakdown of the main ways you can register your business name:

Entity (e.g. LLC or Corporation)

While registering your business entity will give you some protection in the state you register it, it is not foolproof. For example, if you register an LLC in your state under the name ‘Happy Foods LLC’, no one else will be able to register the same name in the same state. However, they will be able to register this name in a different state. In addition, they will be able to register a very similar name, e.g. ‘My Happy Foods LLC’, or ‘Happy Fooding LLC’.

DBA (‘doing business as’)

A DBA, also known as ‘fictitious name’, ‘trade name’, ‘assumed name’, allows you to conduct businesses officially with a trade name different from your legal name. A DBA is required in some cases, and may offer benefits such as the ability to open a business bank account. A DBA won’t give you any name protection, as many businesses can go by the same DBA in the same state.

Trademark

A trademark is the best way to protect your business name. You can trademark your name, close variations to it, visual assets such as your logo, and more. Learn more about trademarking here.

Domain name

A domain name is like your personal address on the internet. Your domain will be shown in your website’s URL, if you opt to open a business website. In today’s digital first world, a website is usually a must. While a domain name on its own does not offer any legal name protection, once you’ve registered your domain name, no one else will be able to use it.

A website gives you complete control over your online presence, and allows you to showcase your products or services and connect with potential clients.

A domain name does not have to be identical to your entity name. For example, if your business name is ‘Happy Dog Hair Salon’, you can register a close domain name such as www.happydogsalon.com or www.happydog.com.

Social media handles

To ensure your social media presence, registering your desired social media handles early on will be a good idea, (even if you are not yet active on all social media channels). Similarly to a domain name, once you’ve registered them, no one else will be able to use them but you. So what are you waiting for? 🙂

Step 8: Set up your business

Okay, now it’s time to set up your business—this is when it starts getting fun.

First thing, what are you selling? A product or service? Or maybe both?

Once you have that decided, you can do one of the following things:

#1 Create your own product or find a supplier and resell existing products in tandem with your services.

If you’re creating your own product or service, make sure you adhere to the legal requirements your product may have to follow.

If you’re selling an existing product, decide which business model is best for you – do you want to do dropshipping, print on demand, or wholesale?

Once you have that figured out, it’s time to deal with shipping. Research various shipping services and see what’s the best option for you.

Then, there’s option #2: provide your own service.

Whether you’re interested in opening a dog walking business or nail salon, you’re providing a service. If you’re choosing to become a service provider, then you’ll need to decide on your business model – will it be an online service or in-person service?

Depending on your business model, you’ll have to adhere to varying legal requirements (for example, if you have a nail salon, you’ll need to get a business license for your salon, etc.).

Set up shipping, payments, and bookings

Now it’s time to set things up. What does this mean? You need to set how customers are going to receive their product or service. Let’s break this down into 2 categories: selling a product vs selling a service.

Shipping

If you’re selling a product, then you’re going to need to set up shipping and a payment system. Thankfully, there are tons of shipping companies and apps that can help streamline the process.

Don’t forget to factor in shipping costs. You can either offer free shipping and include the cost in the retail price or have customers pay for shipping separately. Choose whichever you think is best for your business.

Payments

If you’re offering a service or selling a digital product, you don’t need to worry about shipping. But, setting up a website with a payment system is crucial regardless of your business model.

For payment systems, most website builders have a payment system built in, and WordPress also has plugins like woocommerce that will connect your website to a payment gateway (don’t worry, we have a blog on this in right here).

For more information, check out this blog post about getting paid online.

Bookings

As a service provider, you can start with a pen and paper to schedule appointments. As your business grows, your business, customers, (and sanity!) would benefit greatly from a booking system. So consider setting up a booking system—you can do this on your social media profiles as well as your website. That way, people can easily reach out to you and book an appointment. Read this post to learn more about how to use social media to gain bookings.

You have your foundation, you’ve figured out your business model, how customers will receive their products or services, and how you’ll get paid. Now what?

Step 9: Develop a brand and marketing strategy

Your brand is the reason why someone buys from you. It’s the emotional element of your business that encourages people to react emotionally. To build a brand that connects with customers, you’ll need to:

- Know who you are and what you sell

- Know what you stand for, which will be shown in the mission statement, brand values and promise

- Your unique value proposition (UVP), in other words, why customers should choose you

- Your brand story, the reason why you do what you do today

- Brand voice, the tone and language you’ll use to communicate to your customers

- And your visual brand identity, including your logo, brand name, and style guide

By completing these points, you’ll have a well-rounded understanding of your brand strategy. From there, you can continue onto step #8, launching your business.

Step 10: Launch your business

You have everything you need to bring your business to life. Now you’re at the final stage where you know what you want to sell, why you want to sell, and how you’re going to sell.

Your business may be physical or online, but either way, you’re going to use your brand strategy to help craft the perfect space for your business. Oh, and don’t forget, just because you have a physical business doesn’t mean you can skip out on having an online presence.

Now, you don’t necessarily need a website, although you should, but your business should have a Google business profile so you appear in Google’s search results.

If you’re launching a website, there are tons of eCommerce website builders, including Tailor Brand’s website builder, that will showcase your products and services.

Once you have everything up and running, you will start the exciting journey of managing and growing your business day by day.

Final thoughts

After you follow these steps (and we hope you do follow them!), you’ll have a legit business on its feet. Now, all you need to do is run it (easier said than done, but you can do it!).

For more support, check out this video here on how to set realistic business goals.