So you want to start a business.

Or perhaps you’ve already started one, but you’re not yet sure you’ve done everything you can to protect yourself and your assets. Running a business is hard, so if you’re not all the way there yet, that’s okay. But answering the question of whether or not to incorporate is an important one, so you’ll want to tackle it sooner rather than later.

Incorporating is a legal process, which might sound kind of frightening, but it’s really not. It simply means when a business owner registers their side hustle or full-time biz with the state in which they operate, legally separating themselves from that business.

But wait, you’re thinking. If I “separate” myself from my business, does that mean I’m losing control over it? Um, no thank you.

Rest assured, the reality is quite the opposite. In actuality, it means that you are retaining a great deal of control over your business while having even more control over your personal life at the same time. As long as you’re at the right stage of your career, it’s a good idea.

The question is: Are you at that stage? We’re going to find out.

In this article, we will discuss what incorporation is and how to do it. You’ll learn about the types of corporations, business structures that act as corporations in some ways and not others, and how taxes factor in. We will also discuss the pros and cons of incorporating to help you decide whether it’s right for you. Lastly, we’ll take a step-by-step look at how to incorporate a business, then round out with some of the most pressing FAQs.

Get ready to know all you need to know. Read on.

- What is incorporation

- Types of corporations

- Pros and cons of a corporation

- When to consider incorporating

- Corporation requirements

- How to incorporate your business: step-by-step guide

- What to do after incorporation

- How much does it cost to incorporate a business

Incorporation 101: What is a corporation?

It’s always helpful to start with the definitions. Before we take our corporate deep dive, let’s consider a few of the most important terms and facets of incorporation.

For legal purposes, a corporation is a separate entity from the people who run it. That means it is treated by the law as though it has both rights and responsibilities. Therefore, it can enjoy the positives, such as borrowing money and owning assets.

On the other hand, being an entity has a few downsides as well. A corporation can also be sued and must pay its taxes.

More importantly, incorporating means removing your business from the sphere of your personal life and applying new structures to it—such as shareholders and boards of directors—that bring different benefits. Let’s take a look at a couple of those now.

Protection from liability

One of the main reasons to incorporate is protecting yourself from personal liability. Separating yourself from your business means that if something goes wrong, you personally are not the one who has to pay.

For instance, if you leak clients’ data unintentionally and they sue you, you have no protection as a sole proprietor—someone who runs their business as an arm of their personal life, both legally and tax-wise. You may have insurance (and you should), but as soon as it runs out, your personal bank account and assets are left holding the bag. This ruins small business owners all the time.

As a corporation, however, you have protection from liability. If the business gets sued, it gets sued, not you. That means when the corporation’s assets are exhausted, it may go belly up, but your home and car and retirement plan are still safe.

You can see the appeal.

Yes, running a sole proprietorship—a business that has not been incorporated—is a cozy way to go through life, and may seem simpler in the end. But as soon as something goes wrong, you’re going to wish you had incorporated.

On a final note, do note that liability is not the same thing as privacy. While you can avoid putting your personal address online if you use a registered agent for your business (more on that below), you still have to make your name public when incorporating. As most businesses operate publicly, though, this isn’t a huge issue.

Ability to issue stocks, raise money, and go public

Avoiding legal liability isn’t the only reason to incorporate, however. There are plenty of benefits that have nothing to do with steering clear of the courtroom.

For instance, corporations can raise money. While an enthusiastic friend or parent might invest in your sole proprietorship, no venture capitalist is going to give you money until you incorporate, because that’s the only way they’ll get a share in your company and one day see a healthy slice of the profits.

By the same token, incorporating also allows you to issue stocks to owners of the company. It also allows you to go public, which means letting people outside the company buy stock. This is an effective way of increasing the value of your business on a much larger scale.

Business structure versus business taxation

One final facet of incorporation is the concept that business structure and business taxation are not necessarily the same thing.

Limited liability corporations, more commonly known as LLCs, are the perfect example. An LLC is a corporation in the sense that it separates the business owner from their business and provides that layer of legal protection.

However, according to the IRS, an LLC is not necessarily a corporation. Many small business owners choose to have the IRS treat their business as a disregarded entity, which means that it is taxed on your personal income tax return using a form known as a Schedule C. This is often the better approach financially for LLC owners, but your financial advisor or tax preparer is the best one to help you decide.

The point is that legal and tax structures are often different. This applies to different types of corporations in different ways. As such, your unique situation and the state in which you live will determine how you approach both.

For now, this brings us to the question: What types of corporations are there?

Types of corporations

While it might not be the most scintillating topic in the book, understanding the types of corporations is critical before you can choose which one will work for you.

The main types of corporations are the LLC, the S corporation or S Corp, and the C corporation or C Corp. Each has different requirements for incorporating, different pros and cons, and different appeals depending on what kind of business you run and what your future goals are.

Naturally, the unique aspects of each type of corporation could easily fill several books, and has. For our purposes, we will take a look at the major defining characteristics.

Limited liability corporation (LLC)

Limited liability corporations offer just that: limited liability. Owners’ personal assets are off-limits when it comes to the company’s lawsuits, debts, or other liabilities.

LLCs also benefit from flexible taxation, with the IRS treating them as “pass-through entities.” This means the LLC itself is not taxed; rather, the owner or owners are taxed on their personal income tax returns using a Schedule C (in the case of single members) or a K-1 (in the case of multiple members).

It’s easy to register an LLC, dissolve it, adjust to different management needs, and in the case of single-member LLC’s, they are taxed as disregarded entities, which may have financial benefits.

S corporation (S corp)

Like an LLC, an S Corp offers limited liability because it is a separate legal entity from its owner or owners. Also like an LLC, an S corp is a pass-through entity, where the tax burden falls to the owner or owners, rather than to the company.

Unlike an LLC, however, an S corp must have shareholders, directors, and officers. Shareholders own the corp, while the corp owns the business, with rules and regulations applying to all of these relationships. S corps offer additional layers of liability protection as compared to an LLC.

S corporations are also considered to have perpetual existence, which means that they live on even if ownership changes. This makes it a more stable entity for businesses that want to expand.

An S corp can also raise capital, issue stock, and go public. However, the rules applying to its stock are much more restrictive. Plenty of other regulations, such as those that pertain to taxation and financing, apply to S corps that do not apply to C corps.

C corporation (C corp)

In many ways, a C corp is similar to an S corp … but not in all ways.

One of the biggest items of note for a C corp is the fact that it is not a pass-through entity. That means the corporation is taxed, then the profits flow to the owners. At that point, they are taxed on those profits on their personal income return.

This is known as double taxation, and it’s kind of a bummer. This might make being a C corp seem unappealing, but there are some major benefits making up for it. These mostly involve the fact that regulations regarding investment and stock are looser, and it may be easier to access capital.

Unincorporated business structures

There are 2 general unincorporated business structures. The first is the sole proprietorship, in which one person alone provides goods or services. They don’t work with anyone else within their business; their only interactions are between themselves and their clients or customers.

The second structure is a partnership. This is when 2 or more people work together to run a business. Partnerships are complex, with the rules regarding their structure and taxation complex as a result.

Partnerships may exist as LLCs, S corps, or C corps, and in some cases may even be considered disregarded entities by the IRS. A number of rules regulate the latter situation. In the end, only a financial or tax advisor can help you make the best decision about which type of entity is right for you.

However, you as the small business owner have a right to examine the above types of corporations and decide whether one of them is right for you. Taking a look at a few pros and cons will help.

Benefits and disadvantages of incorporating a business

As with anything else in life, incorporating your business comes with significant advantages as well as disadvantages. In a vacuum, none of these is so compelling as to cause you to disregard the others; It’s more about what works for you, your customers and clients, and your unique goods and services.

Benefits of incorporating your business

Some of the benefits of incorporating your business include:

- Higher revenue stemming from altered workflows, the ability to raise more capital, and additional investment opportunities

- Better taxation in some cases, though not all, since corporate taxes offer more flexibility than what you might get through a sole proprietorship

- An additional layer of privacy that comes from appointing a registered agent so that you don’t have to keep your personal information on public record

- limited liability in order to protect your personal assets

Downsides of incorporating your business

Incorporation has its darker underbelly as well. Among the downsides of registering as an entity are:

- More paperwork to get set up and to remain in compliance with the state and federal governments

- More regulation of what you can do and how you can do it

- More costs relating to the increased paperwork requirements (as opposed to a sole proprietorship or single-member LLC)

- Double taxation (in the case of C corps)

- Less control over decision-making because you have to answer to a board of directors as well as shareholders (in the case of S corps and C corps)

So, is incorporation right for you? That depends. Next, let’s take a closer look at when you should make the jump.

When to consider incorporating

Remember, small businesses can operate as sole proprietorships for a long time (forever, really), so you don’t have to incorporate if you want to. However, there are certain situations when you really should. For instance, you should incorporate if you:

- Engage in work that could be considered risky, such as when you build houses or personal injury is a significant possibility, or if you manage other people’s money

- Want access to more funding and investment opportunities

- Have been told by financial advisors or tax professionals that incorporating—even just as a single-member LLC—is the best way for you to reduce your tax burden or otherwise gain tax benefits

- Are going to sign legal contracts as part of your work and should have that extra layer of liability protection

- Plan to hire employees, in which case you should know that you are responsible for their actions as a business, so again the liability is important

- Bring a partner on board, which just adds another person to the equation without adding any extra protection for your personal assets

- Simply want to look professional in front of clients and customers

Of course, some fields require you to be bonded and insured before you can get to work, even if you are a sole proprietor. (See: building houses.) However, even having insurance doesn’t protect you from an event in which your insurance coverage cannot handle the entire amount of the claim, at which point, your personal assets are on the line.

Corporation requirements

Let’s assume that you have decided to incorporate your business … so just what do you have to do to make the dream a reality?

As with the other sections in this post, please take all advice with a grain of salt. The rules of your state, laws that may govern your specific field, and other factors will all impact whether or not you should take certain steps. Always check with a professional before making a big business decision.

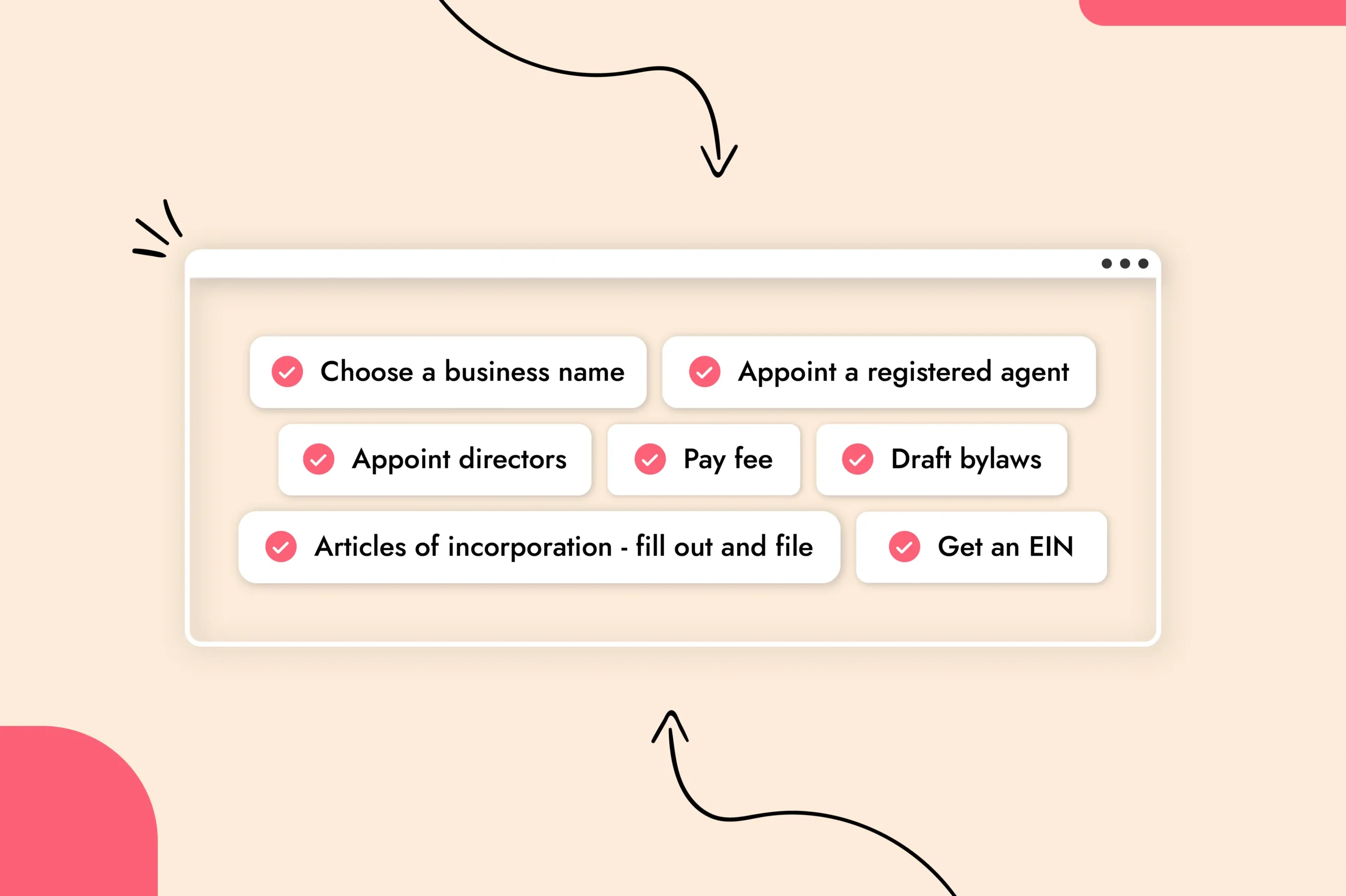

In general, you will need to fulfill several obligations in order to incorporate your business. You most likely will need the following:

- Business name

- Business structure

- Articles of incorporation

- Registered agent

- Bylaws

- Board of directors

- Shareholders

- EIN (Employer Identification Number)

- Business license

- Bank account

- Shareholder’s agreement

- Insurance

Depending on your exact situation, you may be able to skip some of these. Likewise, there may be additional requirements depending on your state and the type of business entity you choose.

In many cases, if not most, it really is a better idea to incorporate. That way, you get all the benefits and protections that come with being a business entity.

How to incorporate your business: a step-by-step guide

If you have decided you’re ready to take the plunge, here’s a step-by-step guide for what to do before and after incorporation.

Determine your business structure

As discussed at length above, your business’s chosen structure has a great deal of influence on its protection, freedoms, and potential lucrativeness. Choose the one that best fits your needs, ideally with the help of someone with a professional understanding of what’s at stake.

Choose a business name

Your business will need a name, of course. Make sure it’s unique, memorable, and easy to brand. You should also make sure that it can grow with your business—e.g. it won’t be too limited in scope if you add new services or product lines.

Lastly, make sure you conduct a search of existing corporations to make sure it’s available. While it’s not always illegal to have the same business name as someone else, trademark laws and marketing commonsense make it a bad idea.

Appoint a registered agent

A registered agent is a local person or entity who is available during regular business hours to accept mail and other paperwork on your behalf. For an individual, the person must be at least 18 years of age and reside in the state.

While you can be your own registered agent for your business, it is not required, and many people choose to assign the role to someone else to add an extra layer of privacy. When someone else fulfills the role of registered agent, it is their information that goes on public record, not yours. Whatever you decide, you will need to appoint a registered agent either way.

You must list your registered agent on the articles of incorporation. If you haven’t yet decided who it is, you can list yourself. However, remember that even in the interim, your information will become public record.

Appoint directors

If you incorporate as an LLC, you do not need a board of directors. However, for a C-corp or an S-corp, this is required. As with the registered agent, you will need to list your directors on your articles of incorporation, so you have to decide before filing with the state.

Issue stock

In order to form an S corp or a C corp, you are required to issue at least one stock share. The articles of corporation will also require details about the amount and type of the stock, so you must answer those questions and decide whom the shareholders will be before you file.

File articles of incorporation

Armed with the above information, it’s time to file your articles of incorporation. In some states, these are referred to as articles of organization. It’s simply a document showing your company exists and is allowed to do business in your state.

If you get in touch with your state’s Chamber of Commerce (or the related body depending on nomenclature), you will find the specific rules regarding filing as well as the paperwork you need to use and the fee structure.

Draft your bylaws

Bylaws are rules for how your corporation will be run. They set guidelines for how shareholders and directors must behave and for what rights accrue to them.

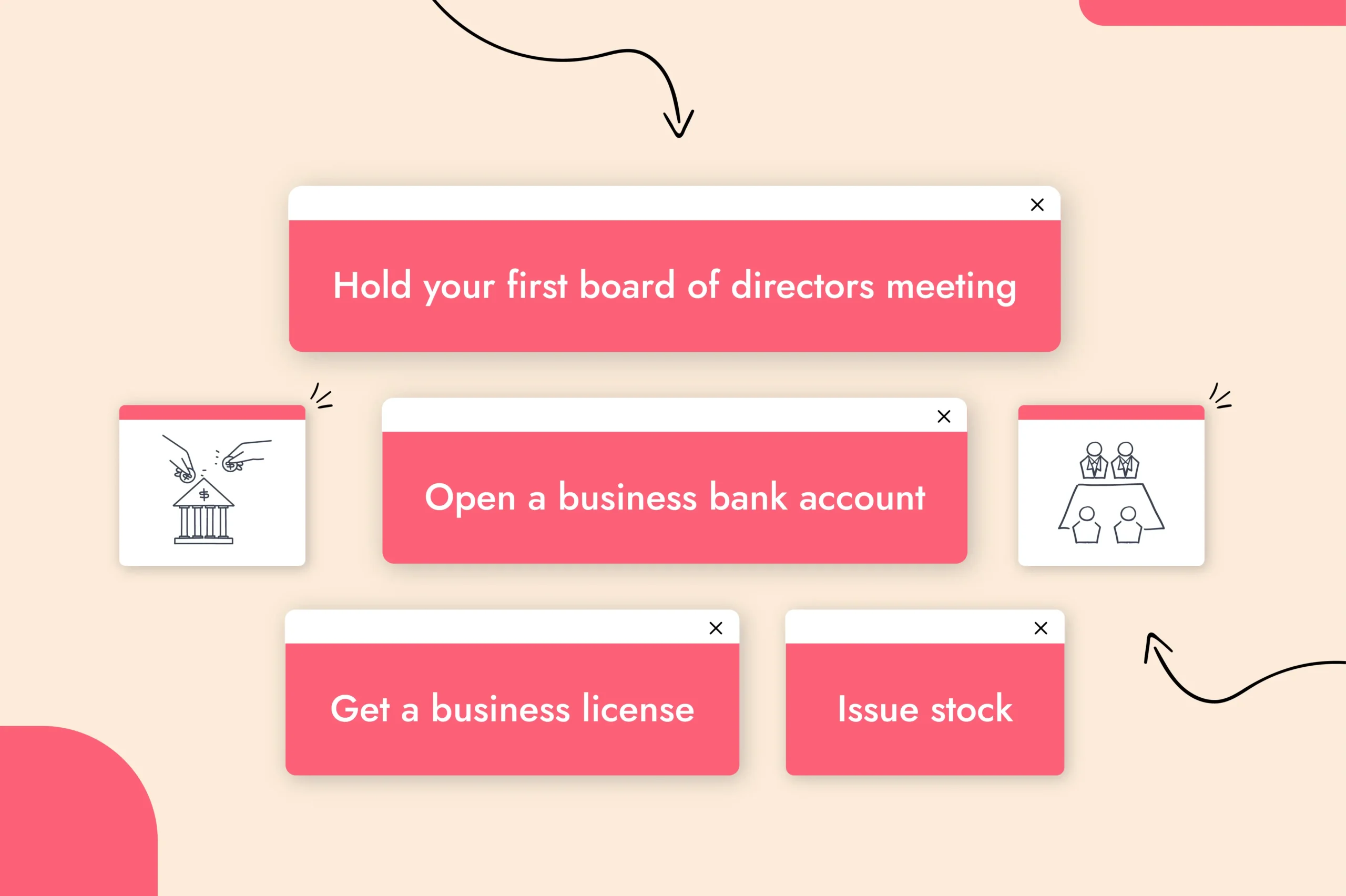

Things to do after you register a corporation

Hooray, you registered your business! Here’s what to do next.

Register a DBA if needed

If for some reason you wish to do business under a different name than the legal one you put on your articles of incorporation, then you will need to register a DBA, or “doing business as” with your state.

Get an EIN

While you do not need an EIN (employment identification number) to officially incorporate, as it’s not required on your articles of incorporation, you will need one to hire employees, report your taxes, and go about your daily business tasks.

An EIN (Employer Identification Number) is not necessary in order to file your articles of incorporation, but it is necessary in order to pay your taxes. The exact process for getting an EIN from your state’s Chamber of Commerce will differ, but in all cases it is necessary.

Choose tax election

In some cases, your business structure and tax structure will be different. If so, you will need to make a tax election, preferably after consulting a professional.

Get licenses and permits

The required licenses and permits vary widely, depending on your industry, your location, and your state and local laws. Make sure you get the correct ones to remain in compliance.

Open a business bank account

Although it is not legally required in order to run a corporation, you may need to open a separate business bank account in order to get loans and receive investment money.

Hold an initial board of directors meeting

For the most part, electing a board of directors is done by the shell shareholders at least in the United States. However, in the case of smaller businesses, the shareholders may just be you alone or you and a few others. In that case, appointing board members is your task, but you must do it.

The laws of your state will determine how many board members you need. If you cannot find the information online, ask an expert.

Get insurance

Yes, corporations need insurance to protect their assets from financial risks. Insurance can help protect a corporation from lawsuits, natural disasters, and other unforeseen events. Without insurance, financial complications can quickly debilitate the business and even ruin its owners.

The exact type of insurance you need will vary according to your industry. It will also depend on whether you have employees and what services you provide.

Common types of insurance include disability, auto, liability, unemployment, workers’ comp, or liquor liability – and the list goes on.

In a nutshell, you will probably need insurance if your business operates dangerous equipment, has expensive assets, has employees, handles sensitive information (e.g. financial or medical), or offers one-time events (think weddings or helicopter trips). An insurance agent will help you think through the details.

Draft a shareholders’ agreement

Shareholders’ agreements are intended to tell you what to do in case of disagreement. They’re recommended in companies that have more than one shareholder, just as partnership agreements are important in corporations with more than one owner. Shareholder agreements help you:

- Balance power and create a pathway to making important decisions

- Protect minority shareholders by setting rules for selling stock

- Moderate discord between family and friends who go into business together

Ideally, you should create your shareholders’ agreement early in the process.

How much does it cost to incorporate a business?

The costs of incorporating a business vary wildly.

Most states charge a fee to file articles of incorporation online or by mail, usually around $50. Some don’t charge at all; some may charge in the hundreds of dollars range.

If you do not draft your articles of incorporation yourself, you will need to pay for help. Typically, this fee ranges between $50 and $300. Should you hire a legal firm, you can expect pricing to hover closer to $500 to $700. Documents such as bylaws, shareholders’ agreements, and so forth may also incur steep legal fees.

Other costs can include the drafting of bylaws if done by a professional, registered agent services (if you choose to hire a service), compensating director later on and more.

FAQ

Corporations are entities that have been legally separated from their owners. While they have rights and responsibilities, those are not the same as the rights and responsibilities of their owners.

An LLC is a limited liability corporation. Although it therefore technically counts as a corporation, the latter term more commonly refers to S corps and C corps.

The answer to this depends on your goals, your goods and services, your tax situation, and more.

S corps and C corps have much in common, but S corps are more restricted in terms of stock sales and investment considerations. C corps, on the other hand, suffer from double taxation, while S corps do not.

The cost of registering a business includes the filing fee charged by the state as well as how much you pay a third party to help you prepare your documents (which is optional).

C corps are the most common type of corporation in the United States, though that doesn’t necessarily reflect the needs and mindsets of small business owners.

A corporation’s bylaws lay out the rights and responsibilities of everyone at the company, from directors to officers to shareholders.

You are not legally required to have a shareholders’ agreement. However, it’s a good idea to have one at any company that has more than one person. That way, you have an impartial piece of documentation to help you resolve any difficulties.